Title: Understanding Sterling Heights Michigan Notice of Dishonored Check — Civil Introduction: In Sterling Heights, Michigan, the legal repercussions associated with writing a bad check or a bounced check are outlined through a Notice of Dishonored Check — Civil. This legal instrument serves as a formal notice to the check issuer, informing them of the consequences of their actions. In this article, we will explore the different types and implications of a Notice of Dishonored Check, using relevant keywords such as bad check and bounced check. Types of Sterling Heights Michigan Notice of Dishonored Check — Civil: 1. Bad Check: A bad check is a term commonly used to describe a check that is dishonored due to insufficient funds in the issuer's bank account. When a check bounces or is returned unpaid, it is often considered a bad check. These can result from unintentional errors, financial strain, or even deliberate attempts to deceive. 2. Bounced Check: Similar to a bad check, a bounced check refers to a check that cannot be honored by the bank. This could be due to various reasons, including insufficient funds, a closed account, or an irregularity with the check itself. A bounced check can result in financial penalties and legal consequences for the check issuer. Implications of Sterling Heights Michigan Notice of Dishonored Check — Civil: 1. Legal Consequences: A Notice of Dishonored Check — Civil represents the initiation of legal action against the check issuer. This notice informs them that they are liable for the payment of the check amount, any related fees, and potentially additional penalties. Failure to address the issue may result in further legal actions, including a lawsuit. 2. Financial Penalties: In Sterling Heights, Michigan, a dishonored check can result in various financial penalties. These penalties may include bank charges for the returned check, penalties imposed by the payee, and potential attorney fees if legal action is pursued. The check issuer may be legally obligated to reimburse the full amount of the check, along with any resulting expenses. 3. Damage to Credit Score: Writing bad checks or having checks bounce can have a negative impact on one's credit score. Banks and financial institutions often report these incidents to credit bureaus, potentially leading to a decrease in creditworthiness. A damaged credit score can make it challenging to secure loans, credit cards, or even certain employment opportunities. 4. Potential Criminal Charges: In some cases, writing bad checks with fraudulent intent may result in criminal charges. While this may not be the immediate outcome of receiving a Notice of Dishonored Check, repeated offenses or significant amounts owed can escalate the situation to a criminal offense, leading to fines and possible imprisonment. Conclusion: Understanding the significance and implications of a Sterling Heights Michigan Notice of Dishonored Check — Civil is crucial. Writing a bad check or having a check bounce can have severe financial and legal consequences for the check issuer. It is essential to promptly address and rectify such situations to avoid further complications.

Sterling Heights Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

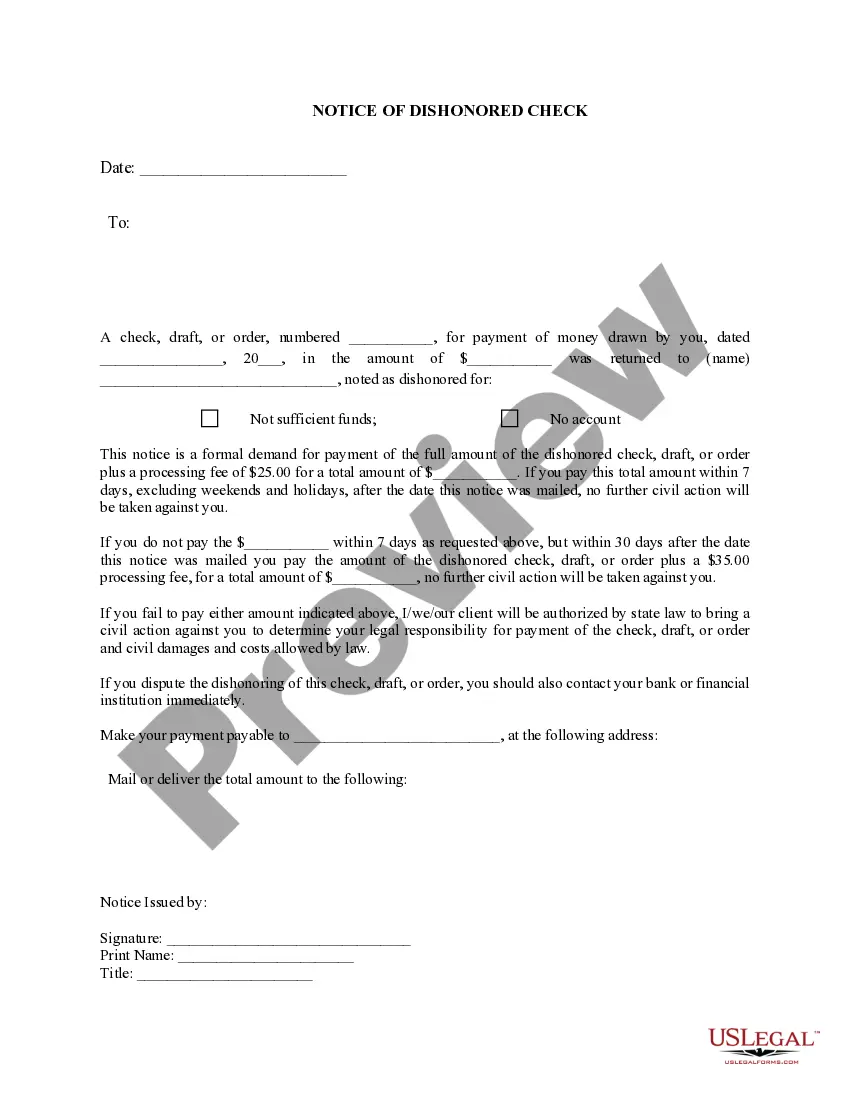

Description

How to fill out Sterling Heights Michigan Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Sterling Heights Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Sterling Heights Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Sterling Heights Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check would work for you, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!