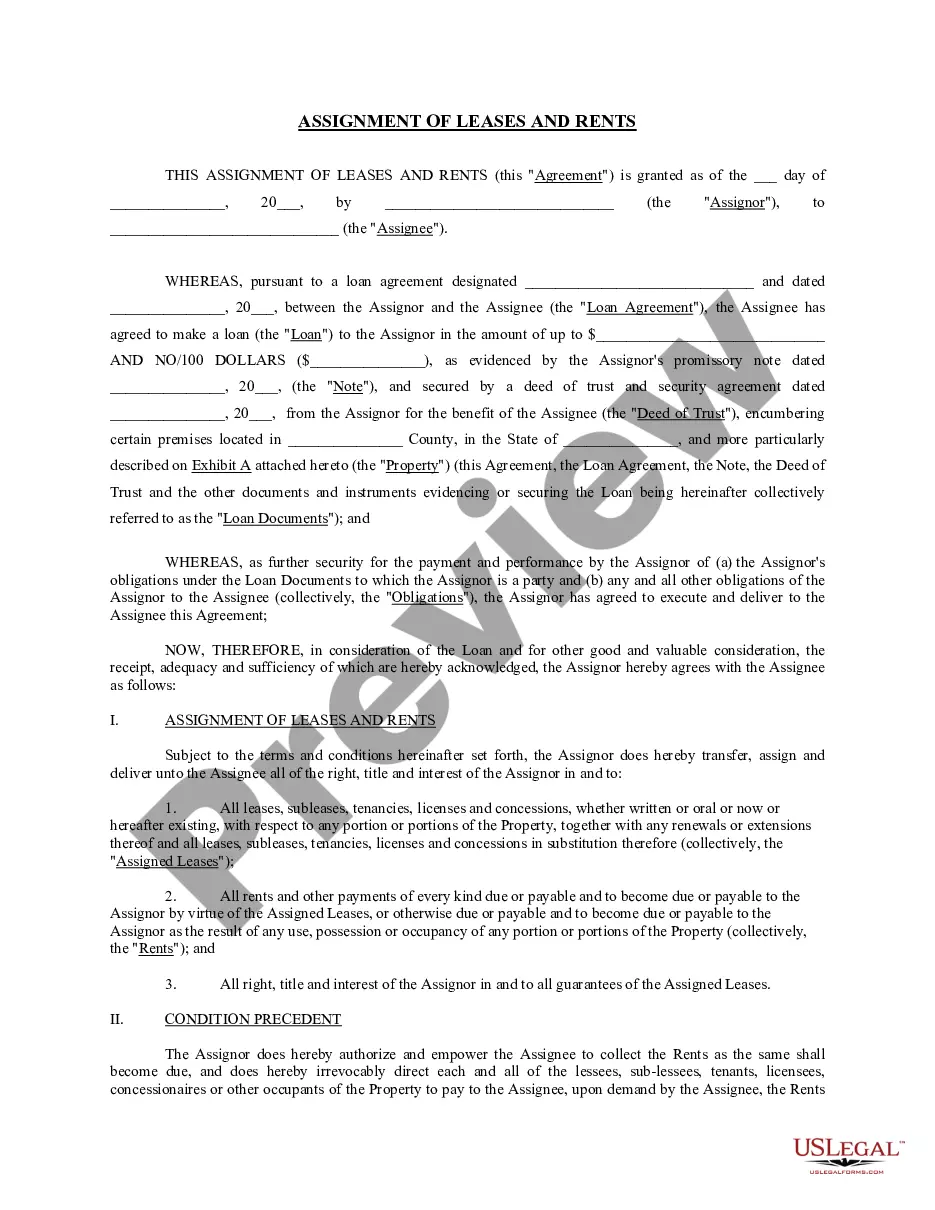

An assignment is the transfer of a property right or title to some particular person or entity under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. For example, the payee may assign his or her rights to collect the note payments to a bank. Lansing, Michigan Assignment of Lease and Rent from Borrower to Lender is a legal process that allows a borrower to transfer their lease agreement and rent payment obligations to a lender. This assignment typically occurs when the borrower has taken out a loan using their property as collateral and is unable to meet their financial obligations. By assigning their lease and rent payments to the lender, the borrower is able to address their debt and avoid defaulting on their loan. There are a few different types of Lansing Michigan Assignment of Lease and Rent from Borrower to Lender, each with its own implications and requirements. These include: 1. Voluntary Assignment: This occurs when the borrower willingly transfers their lease and rent payment obligations to the lender. It is often done as part of a debt restructuring or refinancing agreement. The borrower and lender negotiate and agree upon the terms of the assignment, including the transfer of rights and responsibilities. 2. Involuntary Assignment: In some cases, the lender may exercise their right to assign the lease and rent from the borrower without the borrower's consent. This typically happens when the borrower is in default on their loan and the lender takes action to protect their interests. The terms of involuntary assignment are usually outlined in the loan agreement or mortgage contract. 3. Temporary Assignment: Sometimes, a borrower may temporarily assign their lease and rent to the lender as a means of debt repayment. This arrangement allows the lender to collect the rent directly from the tenant until the borrower's financial situation improves. Once the debt is repaid, the assignment is lifted, and the borrower resumes their normal lease and rent payment responsibilities. Regardless of the type of assignment, it is essential to ensure that all parties involved are fully aware of their rights, obligations, and any additional terms agreed upon. Consulting with legal professionals experienced in Lansing, Michigan real estate and lending laws is highly recommended navigating the assignment process properly. Keywords: Lansing Michigan, Assignment of Lease, Rent, Borrower, Lender, Transfer, Property, Collateral, Financial Obligations, Default, Loan, Voluntary Assignment, Involuntary Assignment, Temporary Assignment, Debt Restructuring, Refinancing Agreement, Rights, Responsibilities, Consent, Default, Loan Agreement, Mortgage Contract, Temporary, Tenant, Repayment, Legal Professionals, Real Estate, Lending Laws.

Lansing, Michigan Assignment of Lease and Rent from Borrower to Lender is a legal process that allows a borrower to transfer their lease agreement and rent payment obligations to a lender. This assignment typically occurs when the borrower has taken out a loan using their property as collateral and is unable to meet their financial obligations. By assigning their lease and rent payments to the lender, the borrower is able to address their debt and avoid defaulting on their loan. There are a few different types of Lansing Michigan Assignment of Lease and Rent from Borrower to Lender, each with its own implications and requirements. These include: 1. Voluntary Assignment: This occurs when the borrower willingly transfers their lease and rent payment obligations to the lender. It is often done as part of a debt restructuring or refinancing agreement. The borrower and lender negotiate and agree upon the terms of the assignment, including the transfer of rights and responsibilities. 2. Involuntary Assignment: In some cases, the lender may exercise their right to assign the lease and rent from the borrower without the borrower's consent. This typically happens when the borrower is in default on their loan and the lender takes action to protect their interests. The terms of involuntary assignment are usually outlined in the loan agreement or mortgage contract. 3. Temporary Assignment: Sometimes, a borrower may temporarily assign their lease and rent to the lender as a means of debt repayment. This arrangement allows the lender to collect the rent directly from the tenant until the borrower's financial situation improves. Once the debt is repaid, the assignment is lifted, and the borrower resumes their normal lease and rent payment responsibilities. Regardless of the type of assignment, it is essential to ensure that all parties involved are fully aware of their rights, obligations, and any additional terms agreed upon. Consulting with legal professionals experienced in Lansing, Michigan real estate and lending laws is highly recommended navigating the assignment process properly. Keywords: Lansing Michigan, Assignment of Lease, Rent, Borrower, Lender, Transfer, Property, Collateral, Financial Obligations, Default, Loan, Voluntary Assignment, Involuntary Assignment, Temporary Assignment, Debt Restructuring, Refinancing Agreement, Rights, Responsibilities, Consent, Default, Loan Agreement, Mortgage Contract, Temporary, Tenant, Repayment, Legal Professionals, Real Estate, Lending Laws.