Title: Understanding Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller Introduction: In Sterling Heights, Michigan, businesses often engage in sales transactions with a Bill of Sale (BOS) that includes a warranty. A BOS provides legal documentation of the transfer of ownership from the corporate seller to the buyer. This article will delve into the details of the Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller, and explore any subcategories that might exist. Key Points: 1. Definition and Purpose: The Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller is a legally binding document that solidifies the transfer of ownership of assets from a corporate seller to the buyer. It serves as proof of the transaction and protects the rights and interests of both parties. 2. Content and Structure: The BOS with Warranty typically includes details such as the buyer and seller's names, addresses, and contact information. It also specifies the description of the asset being sold, the purchase price, payment terms, and any warranties or guarantees provided by the corporate seller. 3. Warranty Types for Corporate Seller: a. Full Warranty: This type of warranty ensures that the asset being sold is free from defects, and the corporate seller guarantees to repair or replace any covered issues within a specified period. b. Limited Warranty: This warranty provides coverage for specific aspects of the asset sold, typically excluding wear and tear or issues resulting from misuse by the buyer. c. As-Is: In some cases, the corporate seller might sell the asset "as-is," meaning that no warranties are provided, and the buyer accepts the asset in its current condition without any guarantee of functionality or quality. 4. Legal Considerations: An attorney or legal professional should draft the Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller to ensure it complies with state laws and protects the rights of both parties. Including specific language and provisions is crucial for a legally enforceable document. 5. Exception Cases: In certain circumstances, additional types of Bills of Sale might be required, such as: a. Vehicle Bill of Sale: Specifically used for the sale of automobiles or other motor vehicles, outlining details like VIN, model, year, and mileage. b. Real Estate Bill of Sale: Required for the sale of real estate, including land, buildings, or property. Conclusion: The Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller is an essential legal document used to facilitate the sale of assets between corporate sellers and buyers. It ensures the transfer of ownership while providing necessary warranties or guarantees. Understanding the different warranty types and consulting with legal experts can help both parties establish a fair and binding agreement.

Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller

State:

Michigan

City:

Sterling Heights

Control #:

MI-BILLSALE2

Format:

Word;

Rich Text

Instant download

Description

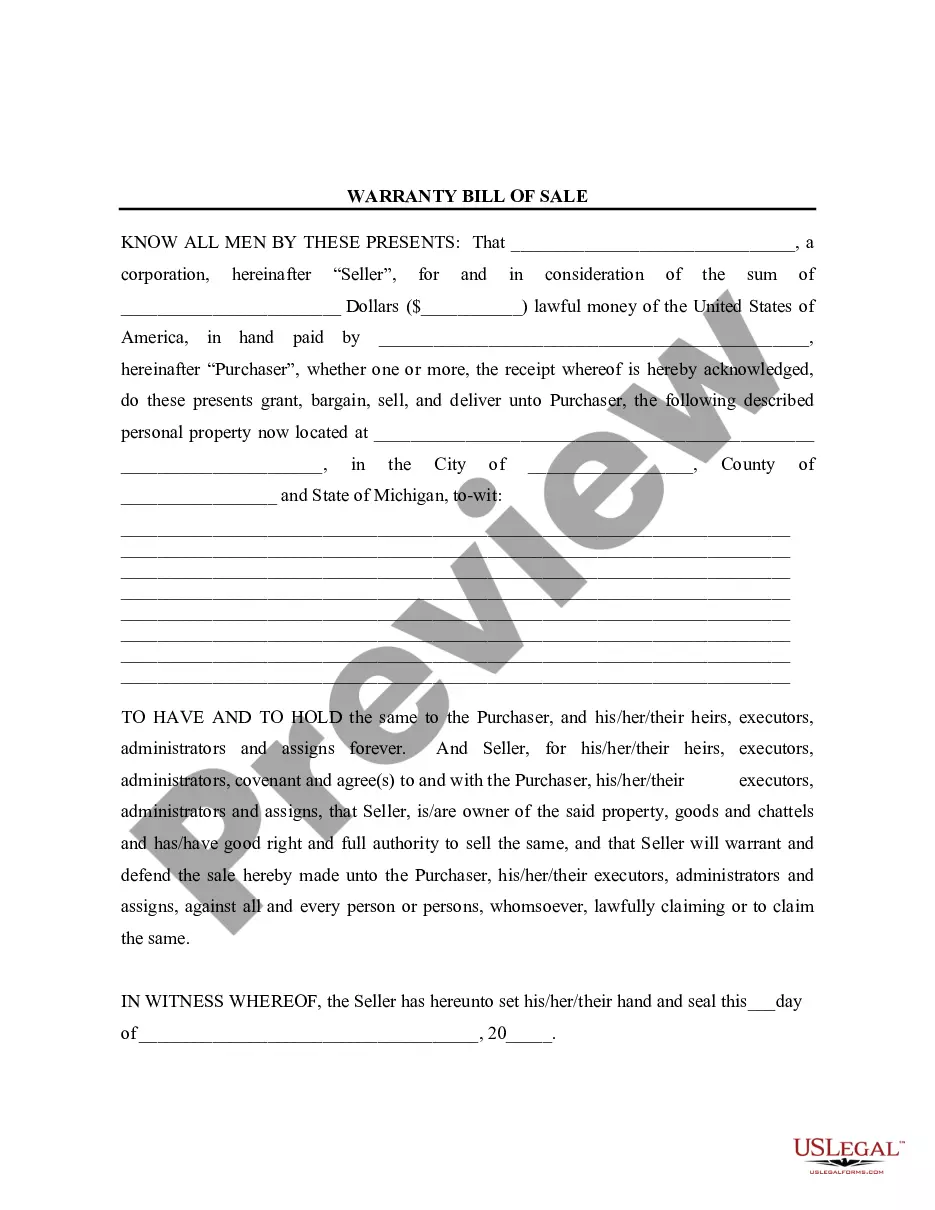

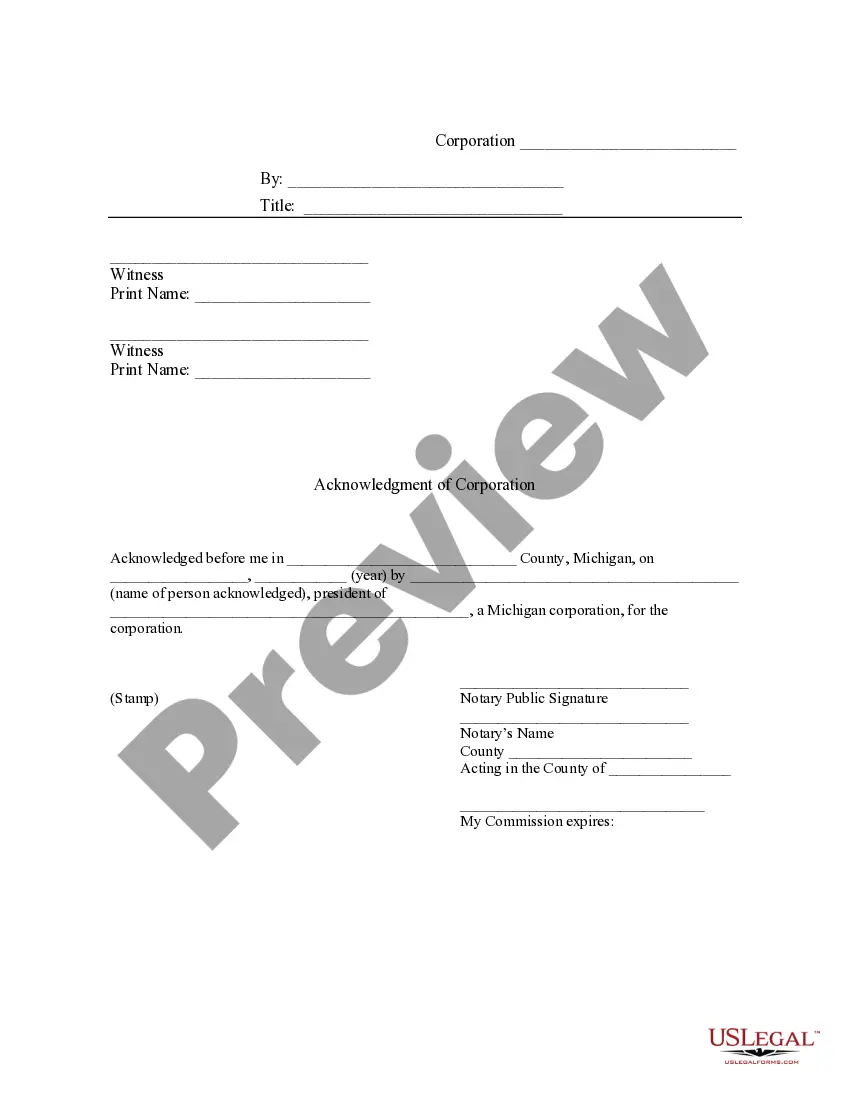

This Bill of Sale with Warranty for Corporate Seller is a Bill of Sale with an appropriate state specific Acknowledgment by Corporate Seller.This is a Warranty Conveyance as opposed to a Quitclaim Conveyance. This form complies with all applicable state statutory laws.

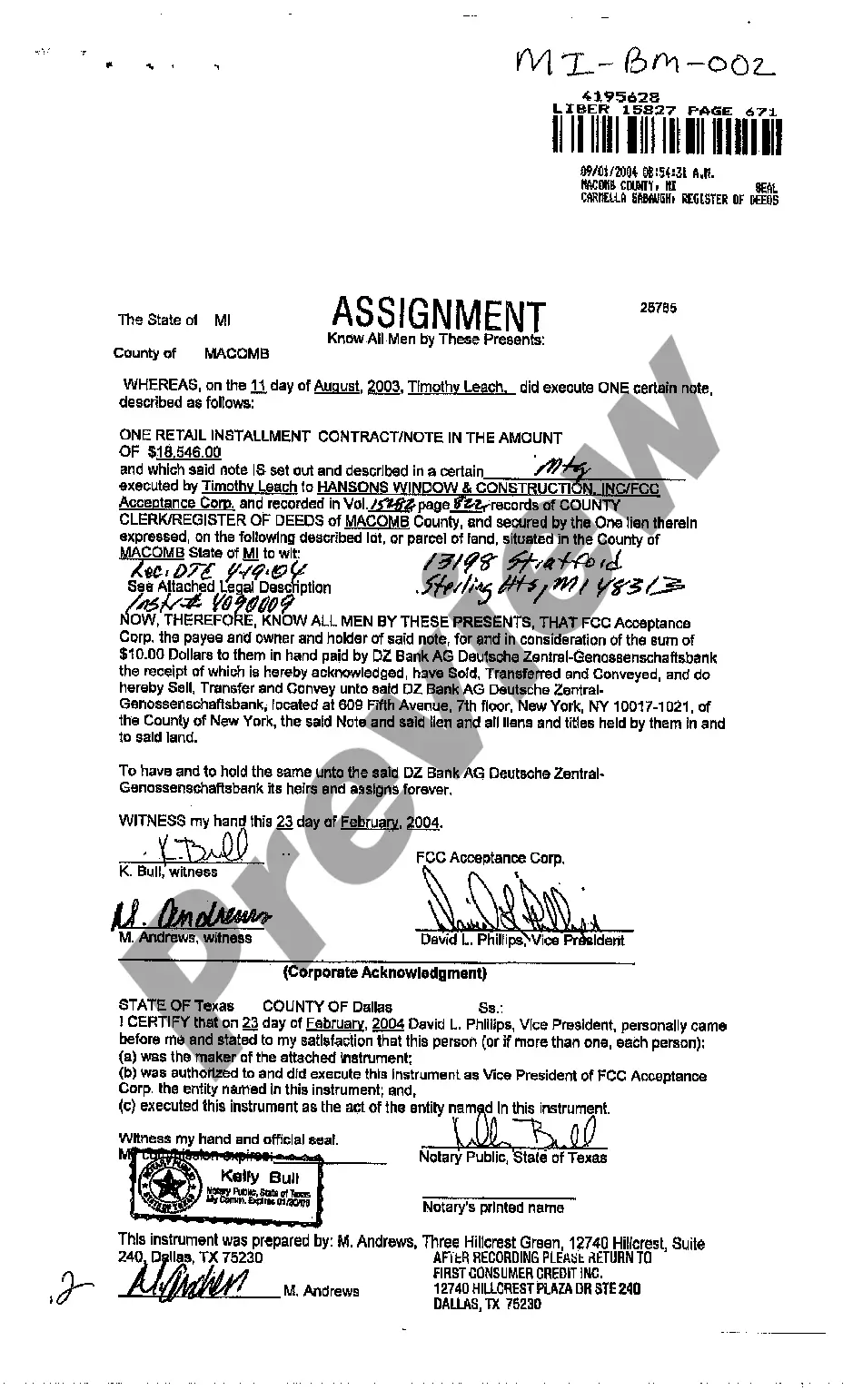

Title: Understanding Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller Introduction: In Sterling Heights, Michigan, businesses often engage in sales transactions with a Bill of Sale (BOS) that includes a warranty. A BOS provides legal documentation of the transfer of ownership from the corporate seller to the buyer. This article will delve into the details of the Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller, and explore any subcategories that might exist. Key Points: 1. Definition and Purpose: The Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller is a legally binding document that solidifies the transfer of ownership of assets from a corporate seller to the buyer. It serves as proof of the transaction and protects the rights and interests of both parties. 2. Content and Structure: The BOS with Warranty typically includes details such as the buyer and seller's names, addresses, and contact information. It also specifies the description of the asset being sold, the purchase price, payment terms, and any warranties or guarantees provided by the corporate seller. 3. Warranty Types for Corporate Seller: a. Full Warranty: This type of warranty ensures that the asset being sold is free from defects, and the corporate seller guarantees to repair or replace any covered issues within a specified period. b. Limited Warranty: This warranty provides coverage for specific aspects of the asset sold, typically excluding wear and tear or issues resulting from misuse by the buyer. c. As-Is: In some cases, the corporate seller might sell the asset "as-is," meaning that no warranties are provided, and the buyer accepts the asset in its current condition without any guarantee of functionality or quality. 4. Legal Considerations: An attorney or legal professional should draft the Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller to ensure it complies with state laws and protects the rights of both parties. Including specific language and provisions is crucial for a legally enforceable document. 5. Exception Cases: In certain circumstances, additional types of Bills of Sale might be required, such as: a. Vehicle Bill of Sale: Specifically used for the sale of automobiles or other motor vehicles, outlining details like VIN, model, year, and mileage. b. Real Estate Bill of Sale: Required for the sale of real estate, including land, buildings, or property. Conclusion: The Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller is an essential legal document used to facilitate the sale of assets between corporate sellers and buyers. It ensures the transfer of ownership while providing necessary warranties or guarantees. Understanding the different warranty types and consulting with legal experts can help both parties establish a fair and binding agreement.

Free preview

How to fill out Sterling Heights Michigan Bill Of Sale With Warranty For Corporate Seller?

If you’ve already utilized our service before, log in to your account and download the Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Sterling Heights Michigan Bill of Sale with Warranty for Corporate Seller. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!