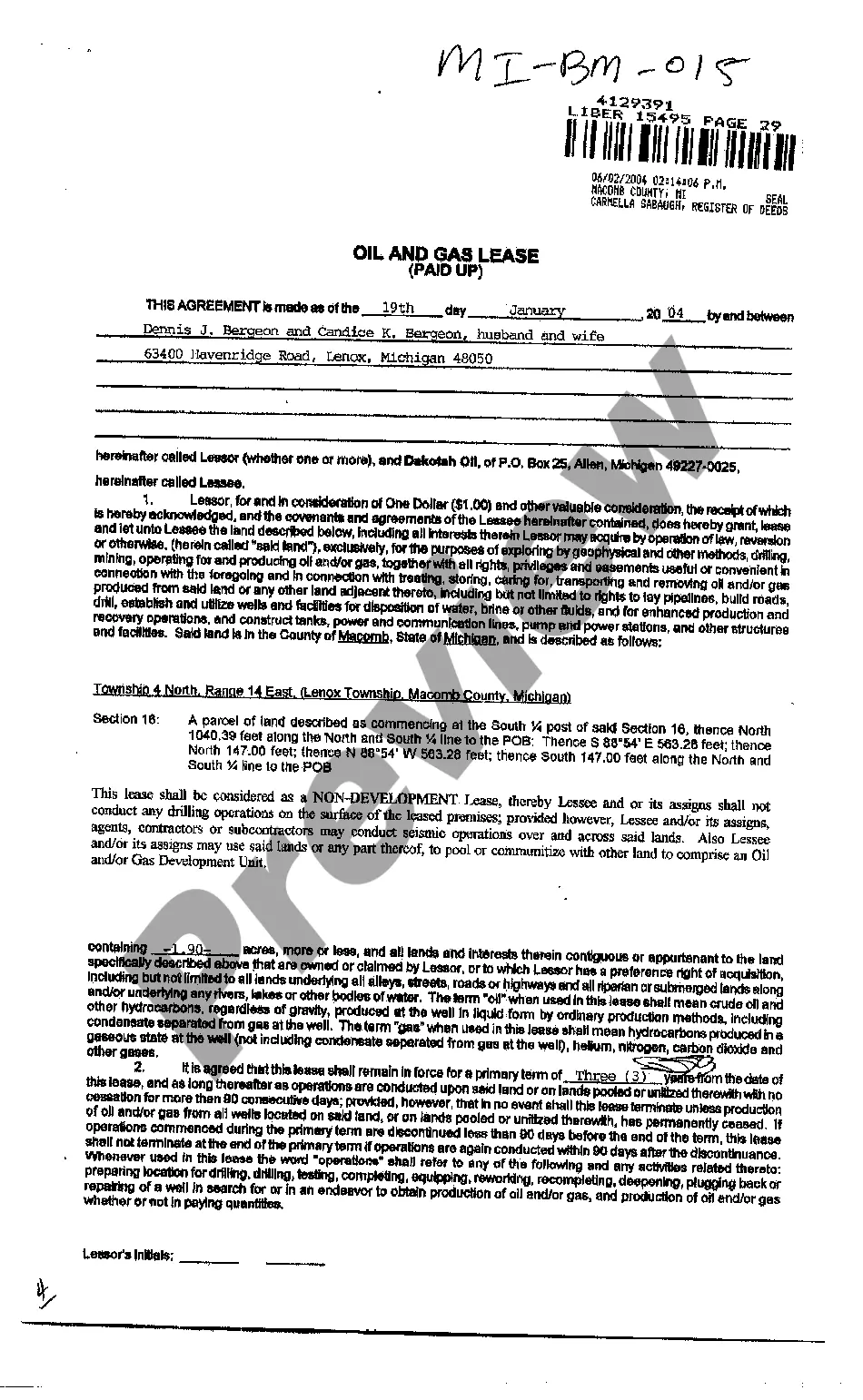

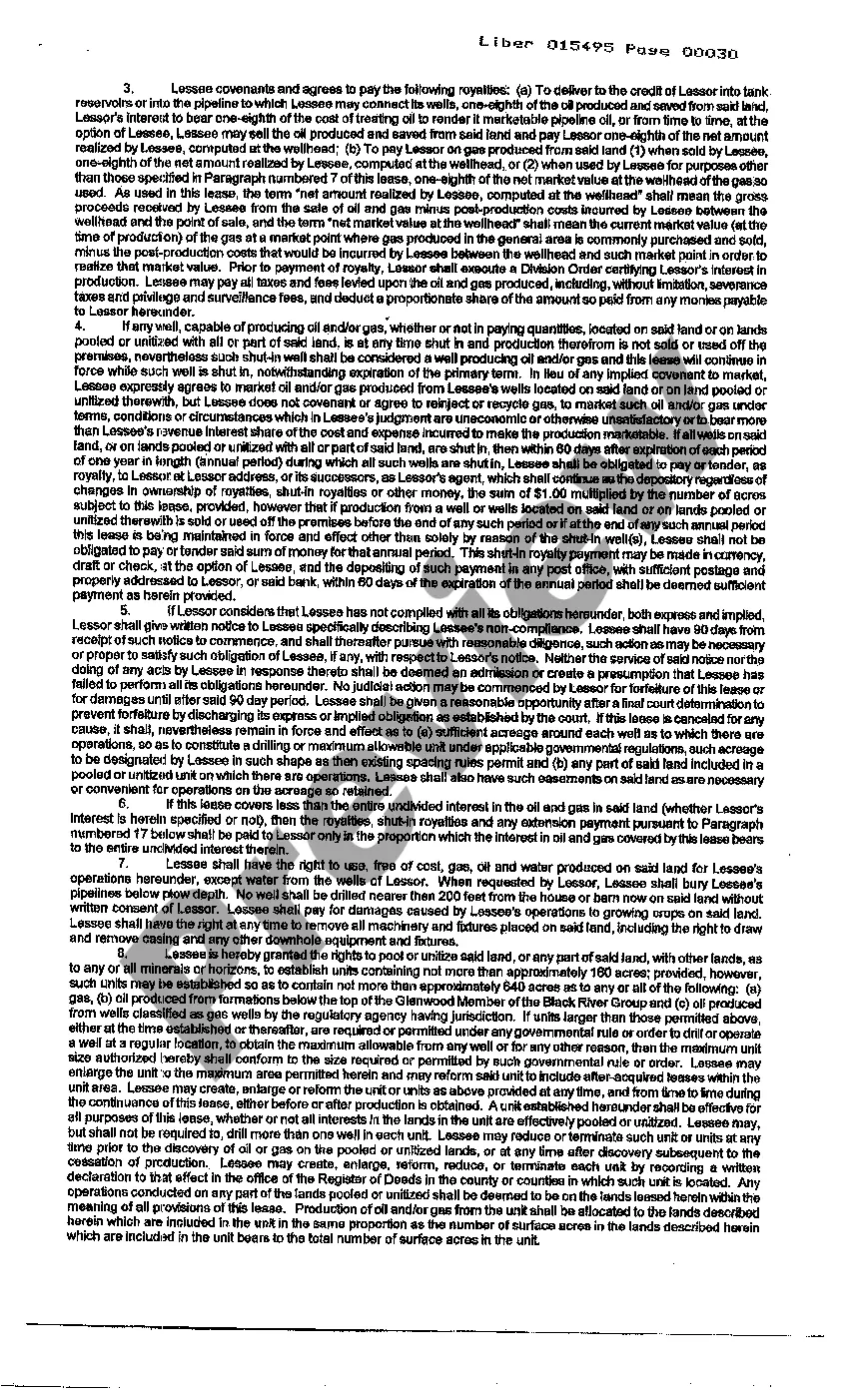

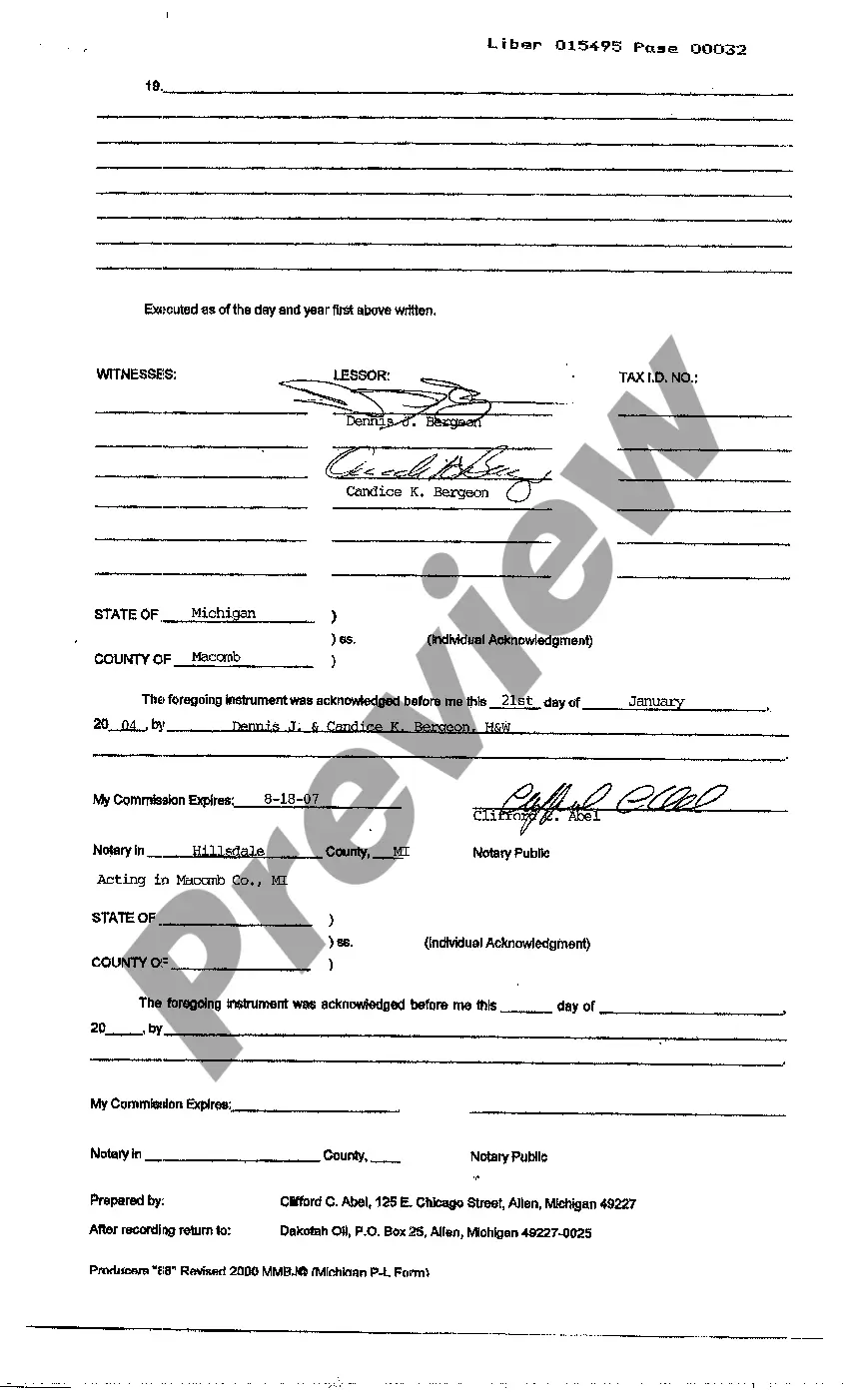

The Detroit Michigan Oil and Gas Lease is an agreement between the owner of a property in Detroit, Michigan and an oil and gas exploration or production company, granting the company the right to explore, drill, and extract oil and gas reserves from the property. It encompasses a wide range of legal terms and conditions, outlining the rights and responsibilities of both parties involved. This type of lease is integral to the energy industry, as it allows companies to access and utilize the valuable underground resources present in Detroit, Michigan. Within the lease, there are generally two main types of agreements: the primary term and the secondary term. 1. Primary Term: This refers to the initial period of the lease, during which the oil and gas company is granted the exclusive right to explore, drill, and develop the property for a specific duration. The duration can vary, but it is typically several years. The company pays a lease bonus or signing bonus to the property owner as compensation for granting the rights. During the primary term, the lessee (company) must commence drilling operations or meet specific conditions to fulfill the terms of the lease. 2. Secondary Term: If the lessee successfully discovers and produces oil or gas during the primary term, the lease will enter the secondary term. This term can continue as long as production is economically viable, typically extending for a longer period than the primary term. Additionally, if the primary term expires, but the company continues production, the lease will automatically transition to the secondary term. During this phase, the property owner receives royalty payments based on the value of the extracted oil and gas. Several key provisions are commonly included in a Detroit Michigan Oil and Gas Lease: a. Bonus Payment: The upfront payment made to the property owner upon signing the lease agreement. b. Royalty Clause: Specifies the percentage of revenue that will be paid to the property owner as royalties from oil and gas production. c. Surface Use Agreement: Defines the terms for the company's access to the surface of the property for drilling and operational activities. d. Drilling Obligations: Outlines the requirements and timeline for the commencement of drilling operations during the primary term. e. Shut-In Royalty: In the case where production becomes unprofitable, this clause allows the lessee to shut-in the well temporarily, while paying a reduced royalty to the property owner. f. Force Mature: Accounts for any unforeseen events or circumstances that may delay or interrupt the operations, temporarily suspending the lessee's obligations under the lease. g. Depth Clause: Determines the vertical and/or horizontal depth at which the lessee may explore and produce oil and gas. In essence, the Detroit Michigan Oil and Gas Lease is a legal instrument that enables oil and gas companies to explore, drill, and extract valuable resources from property owners' land in Detroit, Michigan. It establishes the terms, conditions, and financial arrangements that govern the relationship between the property owner and the energy company.

Detroit Michigan Oil And Gas Lease

Description

How to fill out Detroit Michigan Oil And Gas Lease?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

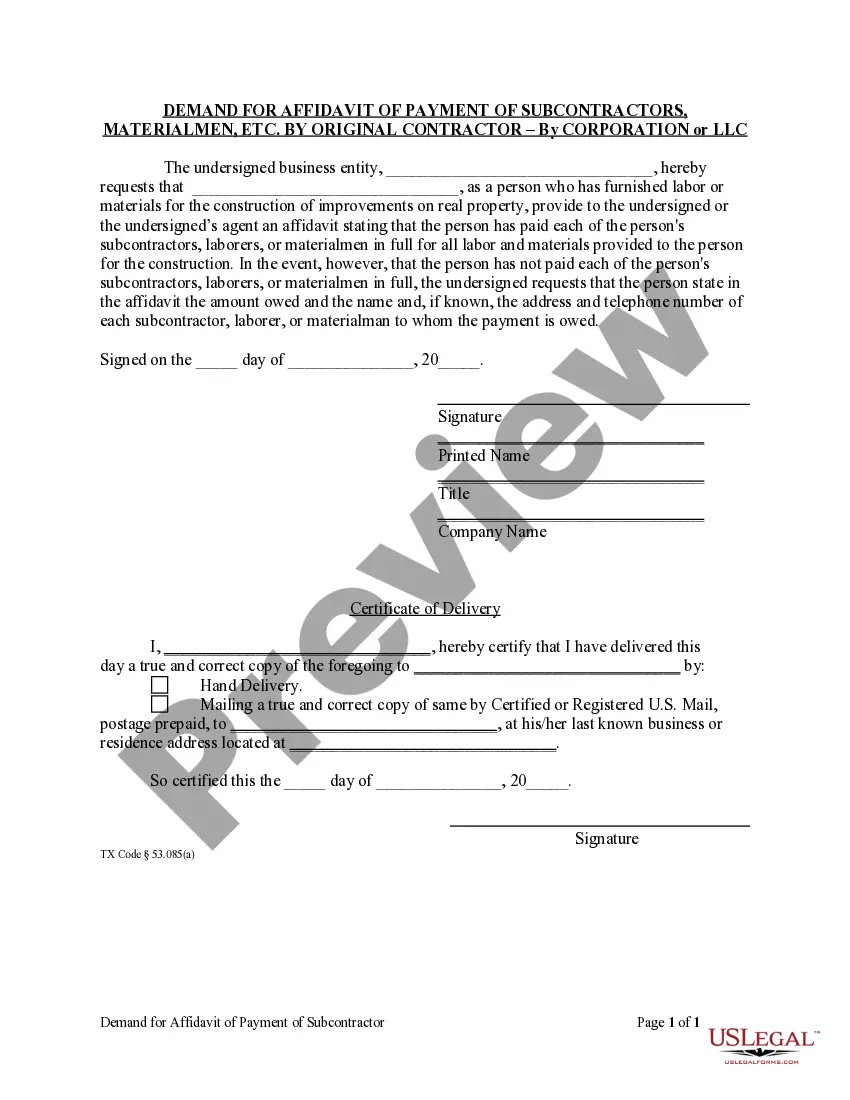

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Detroit Michigan Oil And Gas Lease or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Detroit Michigan Oil And Gas Lease adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Detroit Michigan Oil And Gas Lease is suitable for you, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!