Grand Rapids Michigan Oil And Gas Lease is a legal agreement that grants the right to extract and produce oil and gas resources within the Grand Rapids formation located in the state of Michigan. This lease is primarily entered into between a landowner, often referred to as the lessor, and an oil or gas company, known as the lessee, interested in exploring and extracting the natural resources present in the area. The Grand Rapids formation is a significant geological formation that spans several counties in Michigan, including Kent, Ottawa, Montcalm, and Muskegon. It is known for its vast reserves of oil and natural gas, making it an attractive prospect for energy companies seeking to capitalize on these valuable resources. A Grand Rapids Michigan Oil And Gas Lease typically includes various terms and conditions that govern the exploration, drilling, production, and related activities within the leased area. Some essential components covered in the lease agreement are: 1. Primary Term: This signifies the initial period for which the lease is valid, during which the lessee has the right to explore and develop the leased premises. 2. Royalty Percentage: The lease often specifies the percentage of the revenue generated from the sale of oil and gas that will be paid to the lessor as a royalty. 3. Bonus Consideration: This refers to the upfront payment made by the lessee to the lessor as a consideration for granting the lease rights. The amount may vary depending on factors such as market conditions and the potential yield of the oil and gas reserves. 4. Drilling Obligations: The lease may outline the lessee's obligations regarding the drilling of wells on the leased premises. This can include the number of wells to be drilled and the timeline for their completion. 5. Shut-In Royalty: A shut-in royalty clause allows the lessee to temporarily suspend production from a well without terminating the lease. In such cases, the lessee pays a shut-in royalty to the lessor as compensation for the temporary cessation of production. 6. Depth Limitations: The lease may impose limitations on the depths at which the lessee can explore or produce oil and gas resources. Different types of Grand Rapids Michigan Oil And Gas Leases may include variations in the terms mentioned above, specific addendums for environmental protection, surface usage agreements, and financial provisions. Additionally, leases can differ based on their duration, with options for renewal or termination, and specific provisions related to pooling or unitization agreements for efficient resource extraction. Understanding the terms and types of Grand Rapids Michigan Oil And Gas Leases is crucial for both landowners and energy companies to ensure transparent and mutually beneficial agreements.

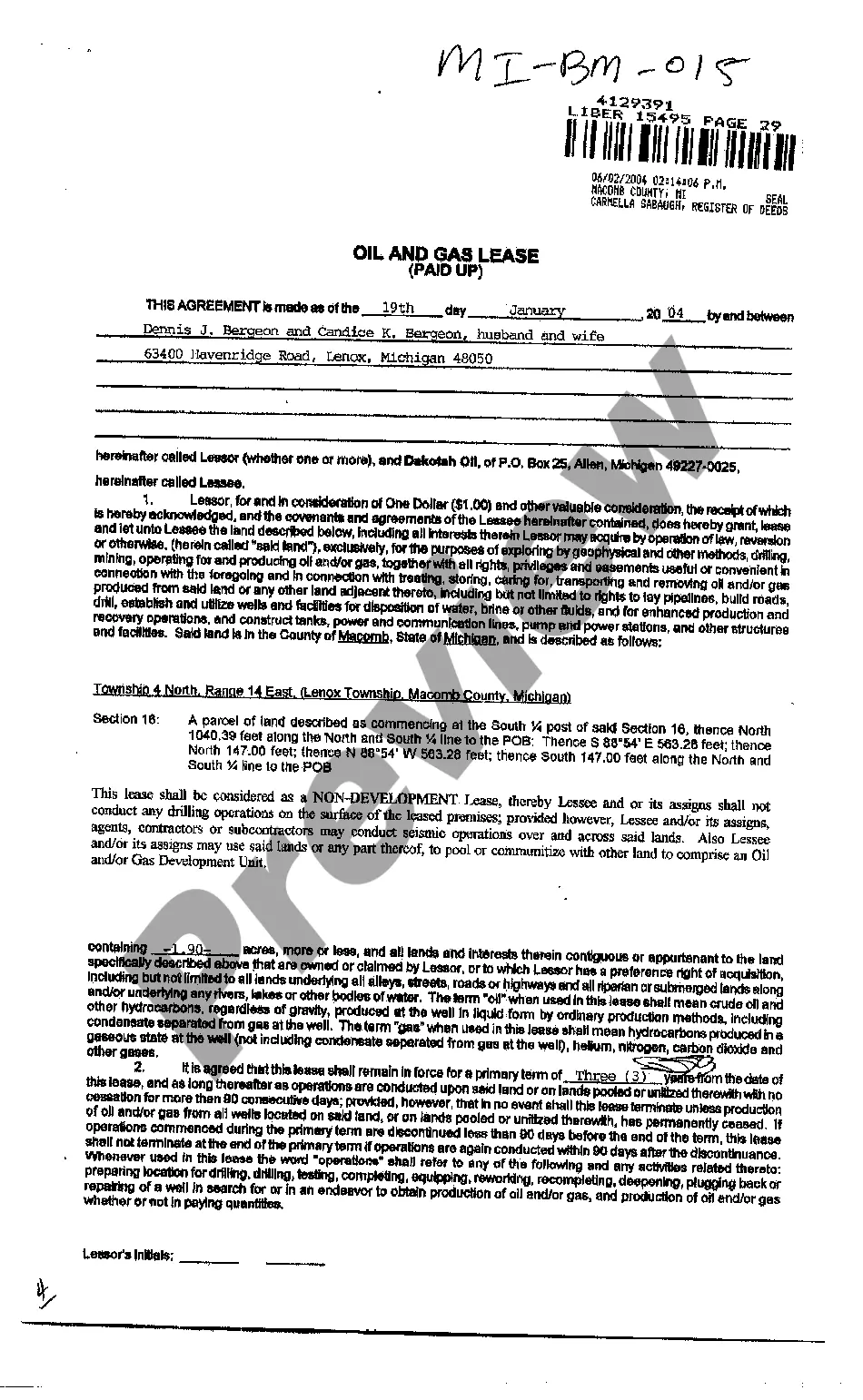

Grand Rapids Michigan Oil And Gas Lease

State:

Michigan

City:

Grand Rapids

Control #:

MI-BM-015

Format:

PDF

Instant download

This form is available by subscription

Description

Oil And Gas Lease

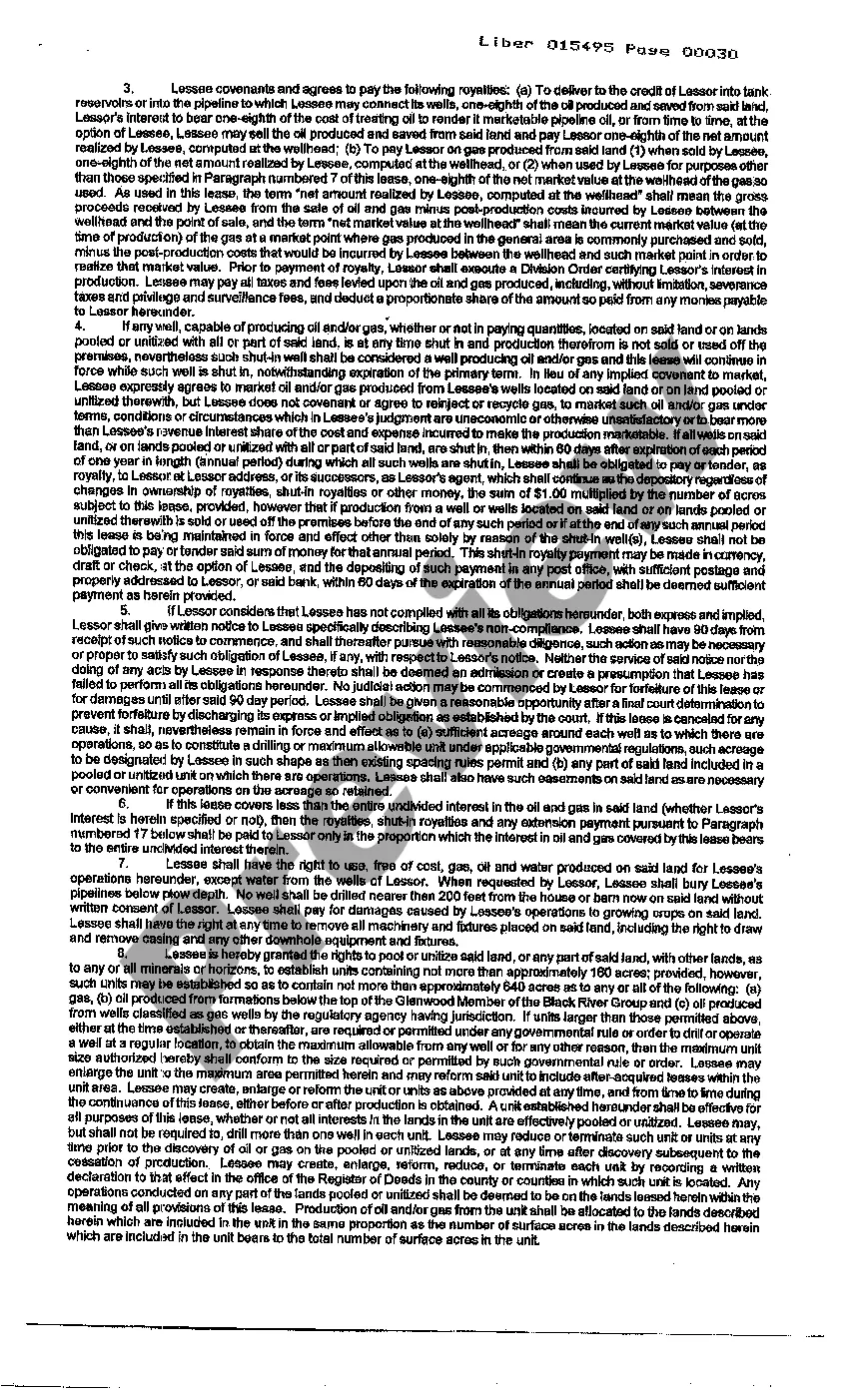

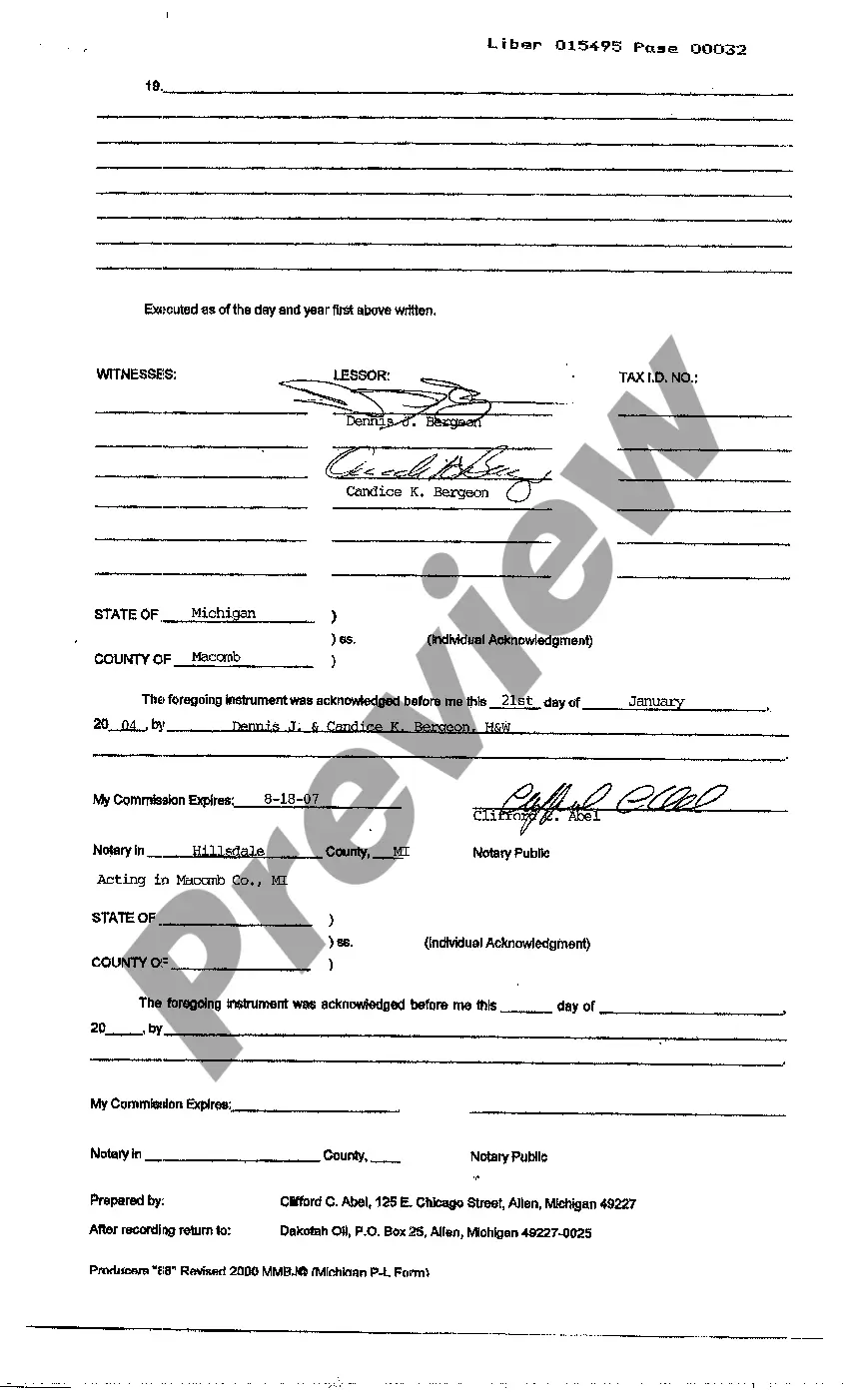

Grand Rapids Michigan Oil And Gas Lease is a legal agreement that grants the right to extract and produce oil and gas resources within the Grand Rapids formation located in the state of Michigan. This lease is primarily entered into between a landowner, often referred to as the lessor, and an oil or gas company, known as the lessee, interested in exploring and extracting the natural resources present in the area. The Grand Rapids formation is a significant geological formation that spans several counties in Michigan, including Kent, Ottawa, Montcalm, and Muskegon. It is known for its vast reserves of oil and natural gas, making it an attractive prospect for energy companies seeking to capitalize on these valuable resources. A Grand Rapids Michigan Oil And Gas Lease typically includes various terms and conditions that govern the exploration, drilling, production, and related activities within the leased area. Some essential components covered in the lease agreement are: 1. Primary Term: This signifies the initial period for which the lease is valid, during which the lessee has the right to explore and develop the leased premises. 2. Royalty Percentage: The lease often specifies the percentage of the revenue generated from the sale of oil and gas that will be paid to the lessor as a royalty. 3. Bonus Consideration: This refers to the upfront payment made by the lessee to the lessor as a consideration for granting the lease rights. The amount may vary depending on factors such as market conditions and the potential yield of the oil and gas reserves. 4. Drilling Obligations: The lease may outline the lessee's obligations regarding the drilling of wells on the leased premises. This can include the number of wells to be drilled and the timeline for their completion. 5. Shut-In Royalty: A shut-in royalty clause allows the lessee to temporarily suspend production from a well without terminating the lease. In such cases, the lessee pays a shut-in royalty to the lessor as compensation for the temporary cessation of production. 6. Depth Limitations: The lease may impose limitations on the depths at which the lessee can explore or produce oil and gas resources. Different types of Grand Rapids Michigan Oil And Gas Leases may include variations in the terms mentioned above, specific addendums for environmental protection, surface usage agreements, and financial provisions. Additionally, leases can differ based on their duration, with options for renewal or termination, and specific provisions related to pooling or unitization agreements for efficient resource extraction. Understanding the terms and types of Grand Rapids Michigan Oil And Gas Leases is crucial for both landowners and energy companies to ensure transparent and mutually beneficial agreements.

Free preview

How to fill out Grand Rapids Michigan Oil And Gas Lease?

If you’ve already utilized our service before, log in to your account and download the Grand Rapids Michigan Oil And Gas Lease on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Grand Rapids Michigan Oil And Gas Lease. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!