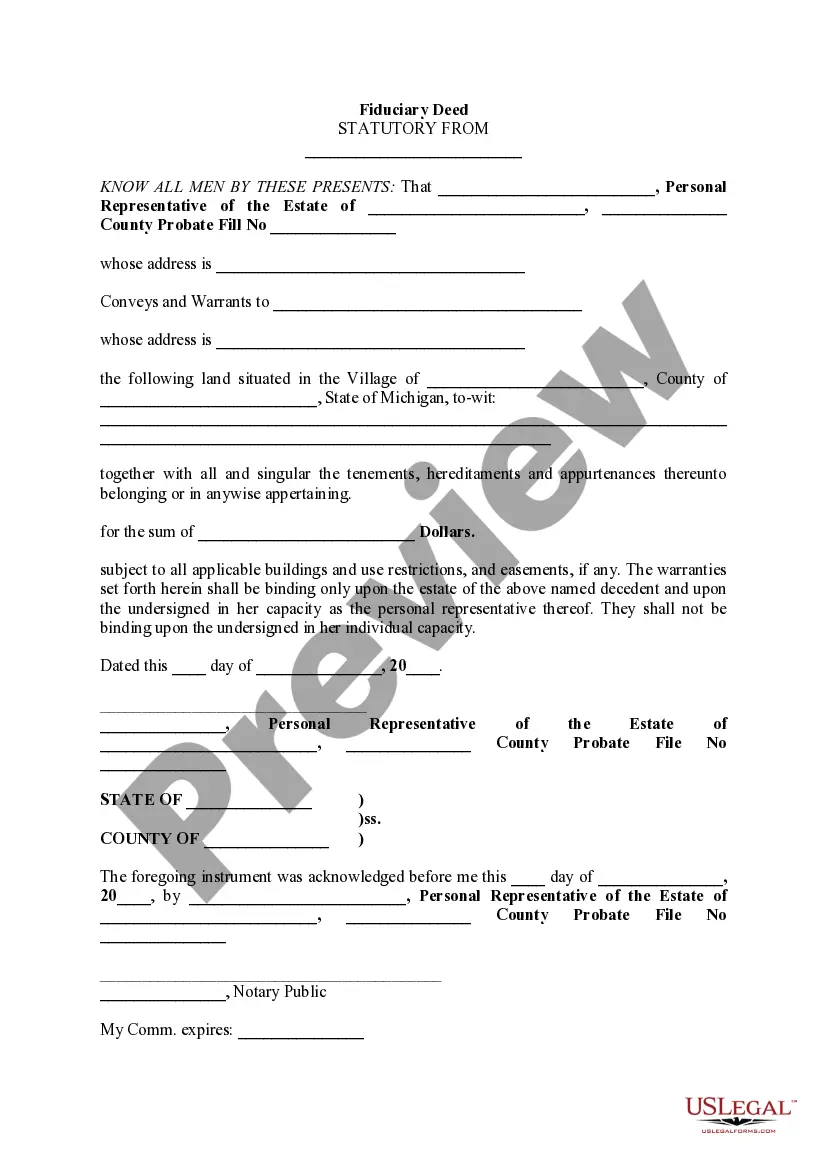

A Detroit Michigan Fiduciary Deed is a legal document used to transfer ownership of real estate from a fiduciary to a buyer. The fiduciary is typically someone who holds a position of trust, such as an executor of an estate or a trustee overseeing a trust. This type of deed is commonly used in situations where a property must be sold or transferred due to the death, incapacitation, or relocation of the original property owner. The fiduciary is responsible for carrying out the wishes of the property owner or fulfilling their legal obligations. The Detroit Michigan Fiduciary Deed is governed by state laws and must adhere to specific requirements to ensure a valid transfer of ownership. The deed must be properly executed, notarized, and recorded with the appropriate county office to establish legal ownership. There are different types of Detroit Michigan Fiduciary Deeds that may be used depending on the specific circumstances: 1. Personal Representative's Deed: This type of fiduciary deed is used when the fiduciary is the personal representative or executor of an estate. It allows them to transfer ownership of the property to a buyer as part of the estate administration process. 2. Trustee's Deed: If the fiduciary is a trustee overseeing a trust that includes the property, a trustee's deed may be used. This allows the trustee to transfer ownership of the property to a buyer while fulfilling their duty to manage the trust assets. 3. Guardian's Deed: In situations where a guardian has been appointed to manage the affairs of an incapacitated individual, a guardian's deed may be used to transfer ownership of the property. This ensures that the guardian can sell or transfer the property on behalf of the incapacitated person for their benefit. It is important to consult with a knowledgeable attorney or legal professional when dealing with a Detroit Michigan Fiduciary Deed to ensure compliance with state laws and to protect the interests of all parties involved.

Detroit Michigan Fiduciary Deed

Description

How to fill out Detroit Michigan Fiduciary Deed?

Finding confirmed templates that adhere to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are adequately organized by purpose and jurisdiction, making the search for the Detroit Michigan Fiduciary Deed as simple and quick as possible.

Maintaining documents orderly and compliant with legal standards is significantly important. Take advantage of the US Legal Forms library to always have essential document templates for any requirement readily available!

- Examine the Preview mode and form details.

- Ensure you’ve picked the appropriate one that aligns with your needs and fully matches your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one.

- If it satisfies you, proceed to the following step.

Form popularity

FAQ

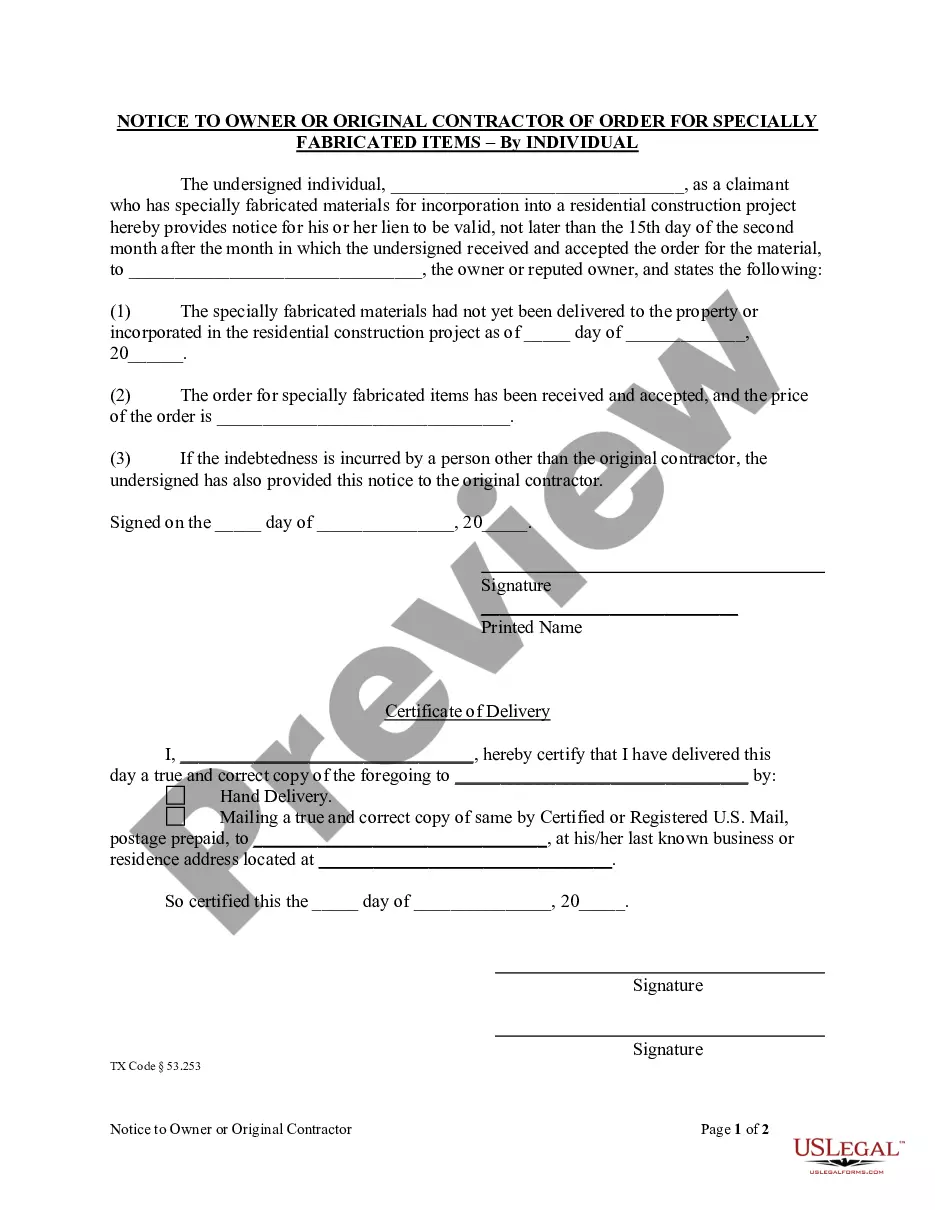

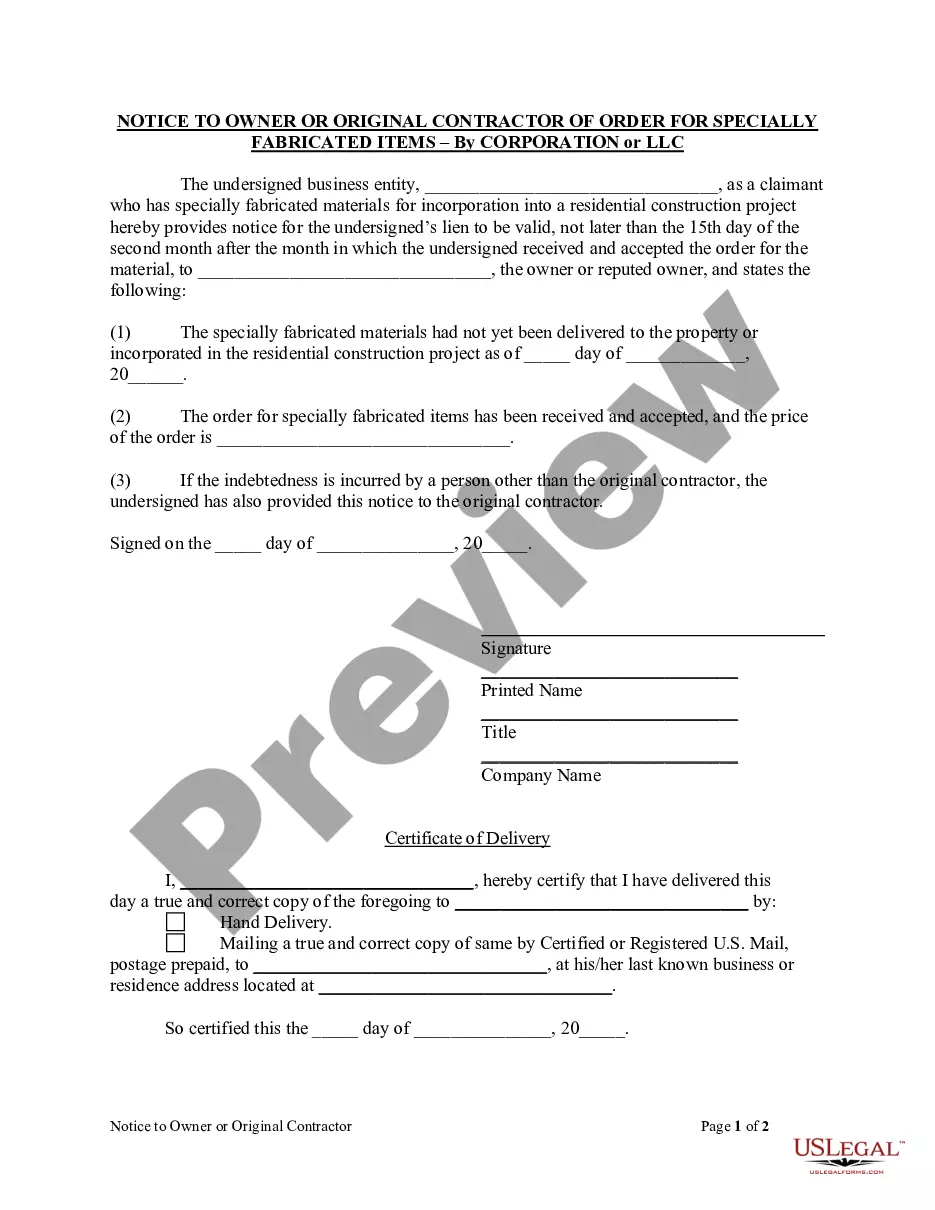

A fiduciary deed is typically a type of covenant deed given by a personal representative of an estate or a trustee of a trust. These financial representatives are called fiduciaries, hence the name fiduciary deed.

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.

If Title Deeds are mislaid or destroyed and the property or land is registered, a simple check with Land Registry will provide details of ownership. Often Land Registry will hold electronic versions of documents associated with the property which can be downloaded from their website for a small fee.

How can I get a copy of my deed? You should get your deed when you first purchase the property. If you do not have your deed, then you can get a certified copy of it at the Register of Deeds office; and a certified copy is just as good as the original.

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

To remove a deceased party from a Michigan real estate deed, submit a certified copy of the death certificate along with the new instrument of conveyance stating ?survivor of? in the grantor section, or show by liber and page or instrument number reference that the death certificate has been recorded in the Register of

You will have to file an application to the land registry. They will require evidence of death, i.e. death certificate or a will. You will have to go to the office of revenue officer and submit an application to transfer title in the surviving co-owners name or surviving heirs name.

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

Transfer on probate or administration of an estate on death When someone dies, removing his or her name from the property deed may be necessary in order to complete the probate process and distribute his or her estate to the beneficiaries.

Transferring ownership of an inherited property During probate the executors of the will need to transfer ownership of the property into the beneficiary's name. In order to do this they need to fill out forms with the Land Registry. You can find the property transfer forms on the Government website.