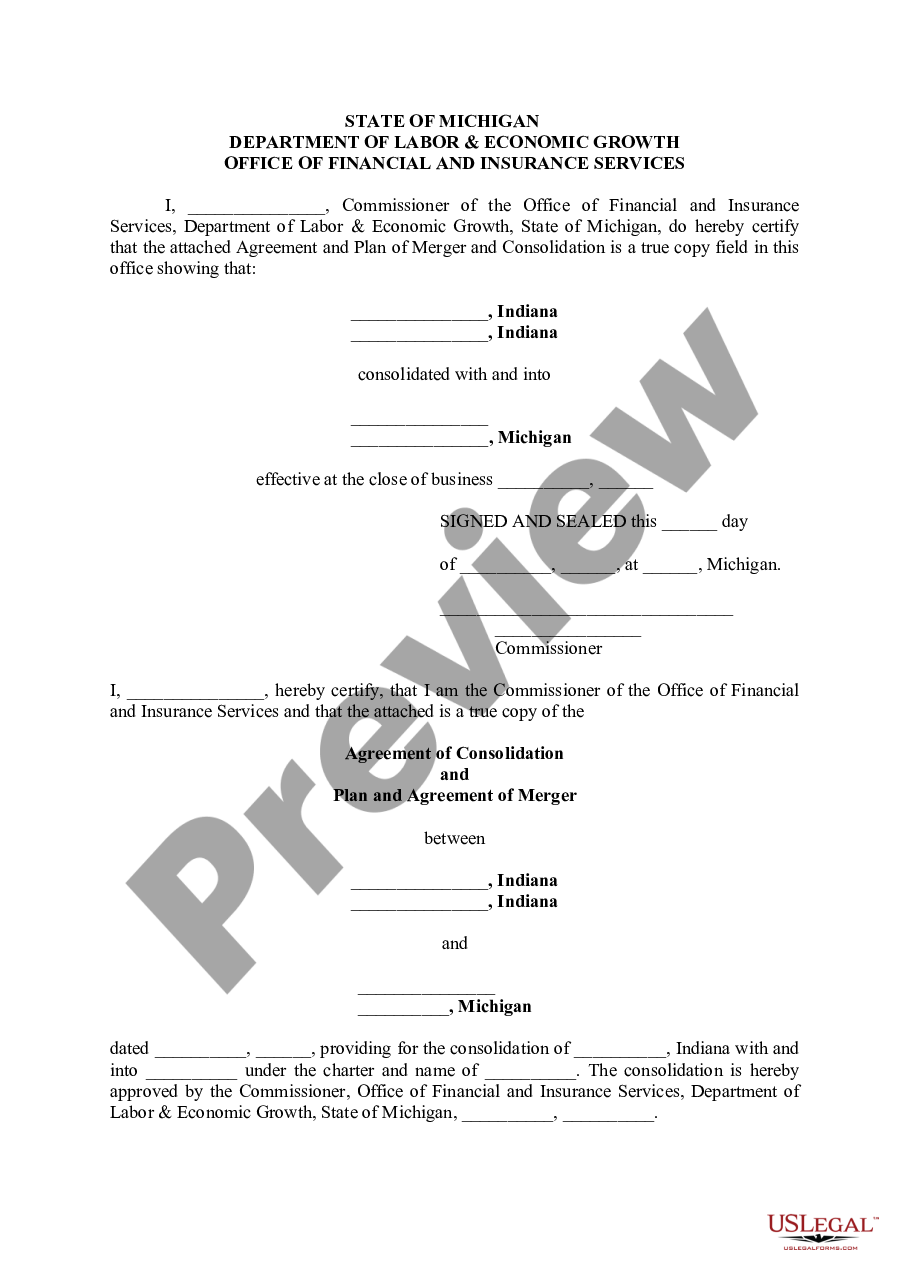

The Ann Arbor Michigan Agreement and Plan of Merger and Consolidation Regarding Banks refers to a legal document that outlines the terms and conditions for merging and consolidating banks in the city of Ann Arbor, Michigan. The agreement provides a comprehensive framework for banks to combine their resources and operations in order to enhance efficiency, competitiveness, and customer service. Keywords: Ann Arbor Michigan, Agreement and Plan of Merger, Consolidation Regarding Banks, legal document, merging, consolidating banks, resources, operations, efficiency, competitiveness, customer service. There are several types of Ann Arbor Michigan Agreement and Plan of Merger and Consolidation Regarding Banks, each catering to different scenarios: 1. Voluntary Merger: This type of agreement is entered into by two or more independent banks in Ann Arbor, Michigan, with the intention of combining their assets, liabilities, and operations voluntarily. The agreement outlines the process, rights, and obligations of each bank involved in the merger. 2. Forced Merger: In some cases, the state regulatory authority might mandate the merger of certain troubled banks for the purpose of stabilizing the banking sector in Ann Arbor, Michigan. The agreement clarifies the regulatory requirements, conversion of assets, and the post-merger operations of the banks. 3. Consolidation of Branches: This agreement applies to situations where two or more banks in Ann Arbor, Michigan, decide to consolidate their individual branches into one entity. It provides guidelines for closing redundant branches, transferring assets, and reallocating resources to ensure a smooth consolidation process. 4. Acquisition Merger: This type of agreement occurs when one bank in Ann Arbor, Michigan, acquires another bank and absorbs its operations and assets. The agreement specifies the terms of the acquisition, including the purchase price, the treatment of liabilities, and the integration of systems and procedures. 5. Cross-Border Merger: In some cases, a bank located outside of Ann Arbor, Michigan, may merge with a local bank, necessitating an agreement that complies with both federal and international regulations. This agreement specifies the legal requirements, the treatment of cross-border assets, and the governance structure of the merged entity. In conclusion, the Ann Arbor Michigan Agreement and Plan of Merger and Consolidation Regarding Banks is a legal framework that facilitates the merging and consolidating of banks in Ann Arbor, Michigan. It provides clarity on the rights, obligations, and processes involved, ensuring a smooth transition and integration of resources for the benefit of all stakeholders involved.

Ann Arbor Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks

Description

How to fill out Ann Arbor Michigan Agreement And Plan Of MergerAnd Consolidation Regarding Banks?

If you are looking for a relevant form, it’s impossible to choose a better platform than the US Legal Forms site – probably the most extensive libraries on the web. Here you can get a large number of form samples for business and individual purposes by types and states, or key phrases. With our advanced search function, getting the newest Ann Arbor Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks is as elementary as 1-2-3. Moreover, the relevance of every document is verified by a team of skilled attorneys that on a regular basis check the templates on our platform and revise them according to the newest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Ann Arbor Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the form you need. Check its information and make use of the Preview feature to check its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your decision. Choose the Buy now option. Next, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the obtained Ann Arbor Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks.

Each and every form you add to your account has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to receive an extra duplicate for modifying or creating a hard copy, you may return and download it once again whenever you want.

Take advantage of the US Legal Forms professional catalogue to gain access to the Ann Arbor Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks you were seeking and a large number of other professional and state-specific templates on a single website!