Title: Exploring the Lansing Michigan Agreement and Plan of Merger and Consolidation Regarding Banks Introduction: In Lansing, Michigan, agreements and plans of merger and consolidation regarding banks play a crucial role in shaping the financial landscape. This comprehensive guide aims to provide a detailed description of the Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks, highlighting its significance, key components, and potential variations. Keywords: Lansing Michigan, agreement, plan of merger, consolidation, banks 1. Understanding the Lansing Michigan Agreement and Plan of Merger and Consolidation: — In Lansing, Michigan, the Agreement and Plan of Merger and Consolidation is a legal contract signed between two or more banks or financial institutions. — It outlines the terms and conditions under which the participating banks agree to merge or consolidate their operations, assets, and liabilities. — This agreement is a complex document that guides the process of merging or consolidating banks, ensuring a smooth transition and legal compliance. 2. Key Components of the Agreement and Plan of Merger and Consolidation: — Identification of parties involved: The agreement specifies the names, legal entities, and locations of the banks entering into the merger or consolidation. — Objectives and purpose: It outlines the goals and motivations behind the merger or consolidation, such as expanding market reach, leveraging resources, or increasing operational efficiency. — Terms and conditions: This section elucidates the terms, rights, and obligations of all parties involved, including share exchange ratios, voting rights, board composition, and operational frameworks. — Regulatory compliance: The agreement ensures compliance with local and federal banking regulations, including obtaining necessary approvals from relevant regulatory bodies such as the Michigan Department of Insurance and Financial Services or the Federal Reserve System. — Integration process: It provides a step-by-step plan for integrating the banks, covering aspects like customer data transfer, IT system integration, employee retention, and branch consolidation. 3. Types of Lansing Michigan Agreement and Plan of Merger and Consolidation: — Horizontal Merger: Refers to the merging of two or more banks operating in the same market or geographic location to strengthen their market share. — Vertical Merger: Occurs when banks operating in different stages of the financial industry, such as retail banking and investment banking, merge to streamline services and expand their service offerings. — Conglomerate Merger: Involves the merger of banks with unrelated business activities to diversify their portfolios and mitigate risks. — Interstate Merger: Describes a merger between banks based in different states, which requires compliance with both state and federal regulations. Conclusion: The Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks is a vital legal instrument that governs the process of merging or consolidating financial institutions. It plays a pivotal role in shaping the banking landscape of Lansing, Michigan, by establishing guidelines for banks to combine forces while maintaining regulatory compliance. Understanding the key components and various types of agreements provides a comprehensive view of how these mergers and consolidations contribute to the growth and stability of the banking sector. Keywords: Lansing Michigan, agreement, plan of merger, consolidation, banks, horizontal merger, vertical merger, conglomerate merger, interstate merger.

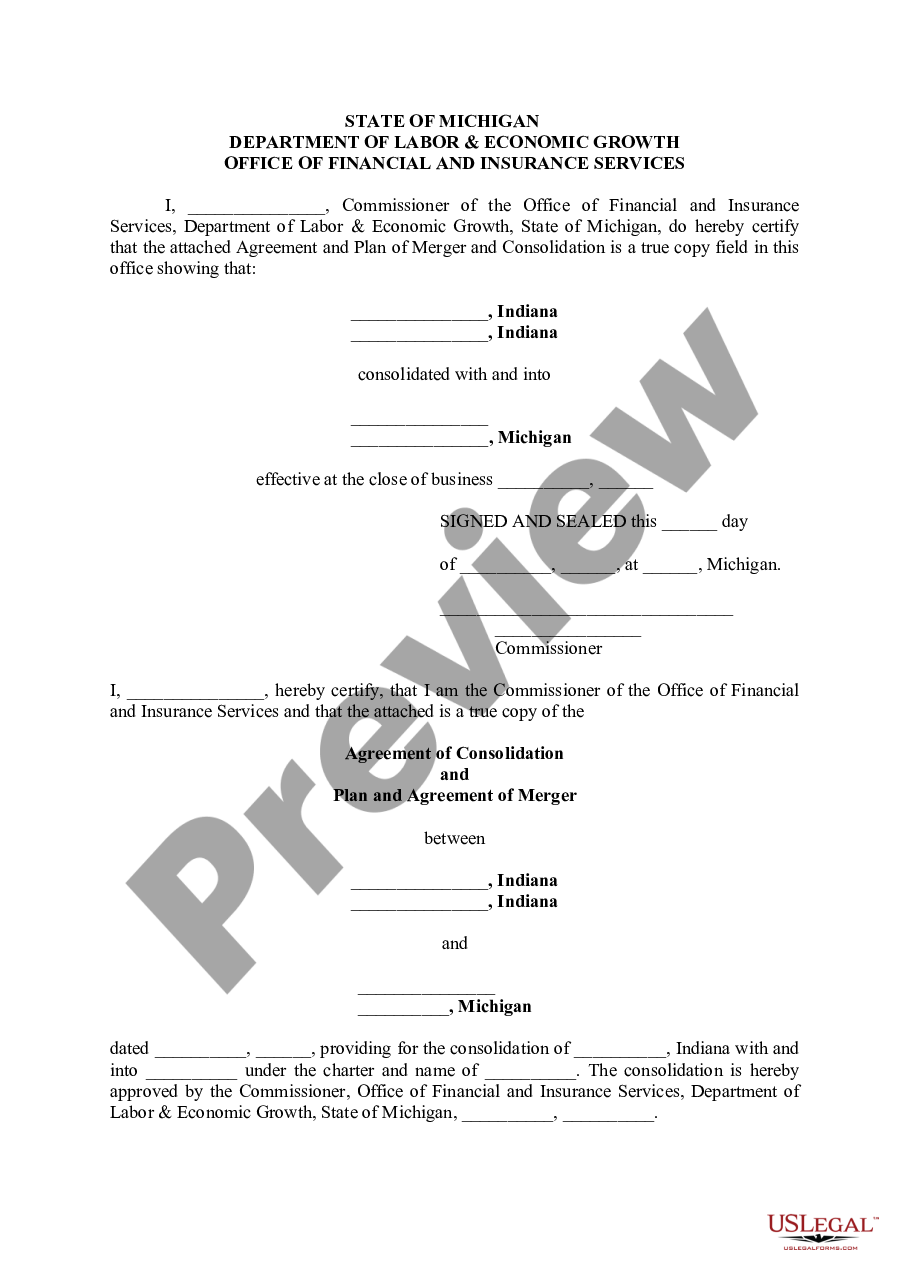

Lansing Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks

Description

How to fill out Lansing Michigan Agreement And Plan Of MergerAnd Consolidation Regarding Banks?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any law education to draft such papers from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Lansing Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Lansing Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks quickly employing our trustworthy platform. In case you are already a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before downloading the Lansing Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks:

- Be sure the template you have found is specific to your area because the rules of one state or area do not work for another state or area.

- Review the form and read a short description (if available) of scenarios the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Lansing Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks once the payment is done.

You’re good to go! Now you can go on and print the form or complete it online. If you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.