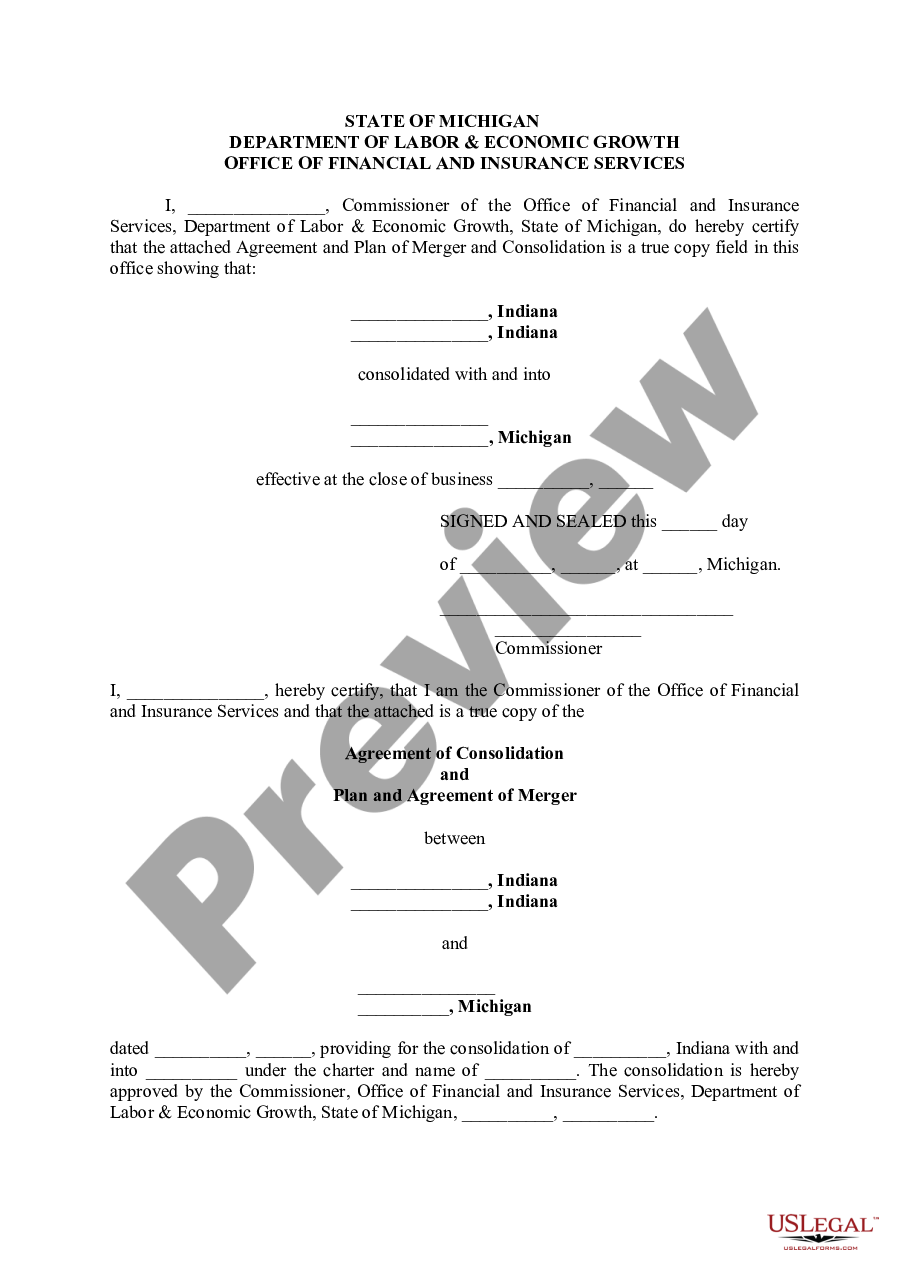

The Sterling Heights Michigan Agreement and Plan of Merger and Consolidation Regarding Banks refers to a legal document that outlines the merger and consolidation process between two or more banks operating in Sterling Heights, Michigan. This agreement is essential for banks intending to merge their operations in order to streamline services, increase operational efficiency, and potentially expand their market presence. Keywords: Sterling Heights Michigan, agreement, plan of merger, consolidation, banks. Different types of Sterling Heights Michigan Agreement and Plan of Merger and Consolidation Regarding Banks may include: 1. Merger Agreement: This type of agreement outlines the specific terms and conditions agreed upon by the merging banks, such as the exchange ratio of shares, board composition, and the new organizational structure. It also addresses the legal and regulatory requirements that need to be fulfilled for the merger to take place successfully. 2. Consolidation Plan: This document focuses on the operational aspects of the merger and consolidation process. It details how the combining banks will integrate their systems, processes, and employees to ensure a seamless transition. The plan also addresses potential challenges, risks, and the strategies to mitigate them during the consolidation process. 3. Shareholders Agreement: This agreement is crucial when the merger or consolidation involves publically traded banks. It outlines the rights, privileges, and obligations of the shareholders of both banks. It also specifies the mechanisms for voting and decision-making within the new entity. 4. Regulatory Compliance Agreement: This agreement addresses the necessary steps to comply with the legal and regulatory framework governing banks in Sterling Heights, Michigan. It ensures that the merged entity follows all necessary guidelines, licenses, and permits required by regulatory authorities. 5. Employee Transition Agreement: In a merger or consolidation, employees from both banks may be affected. This agreement outlines the terms and conditions regarding the transition of employees, such as severance packages, potential layoffs, employee benefits, and continuation of contracts. 6. Intellectual Property Agreement: If the merging banks have proprietary technologies or intellectual property rights, this agreement defines how these assets will be shared, protected, and utilized post-merger. It ensures that both parties are in agreement regarding the ownership and use of valuable intellectual property. 7. Financial Agreement: This agreement addresses the financial aspects of the merger and consolidation, such as the allocation of assets and liabilities, integration of financial reporting systems, and the management of customer accounts. It also covers details about the potential issuance of new shares, debt reorganization, or capital structure adjustments. Overall, the Sterling Heights Michigan Agreement and Plan of Merger and Consolidation Regarding Banks represents a comprehensive legal framework that facilitates the harmonious integration of banks operating in Sterling Heights, Michigan, ensuring a smooth transition and enhanced banking services for customers.

Sterling Heights Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks

Description

How to fill out Sterling Heights Michigan Agreement And Plan Of MergerAnd Consolidation Regarding Banks?

If you are looking for a valid form template, it’s impossible to find a more convenient service than the US Legal Forms site – one of the most extensive libraries on the internet. With this library, you can get a huge number of form samples for business and personal purposes by types and states, or key phrases. Using our high-quality search function, discovering the newest Sterling Heights Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks is as easy as 1-2-3. Moreover, the relevance of every record is confirmed by a team of skilled lawyers that on a regular basis review the templates on our website and update them in accordance with the newest state and county laws.

If you already know about our system and have an account, all you need to receive the Sterling Heights Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you need. Check its description and utilize the Preview feature (if available) to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the needed file.

- Affirm your decision. Click the Buy now button. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the received Sterling Heights Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks.

Every single form you save in your account has no expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to get an extra copy for enhancing or creating a hard copy, you can return and save it once again at any time.

Make use of the US Legal Forms professional library to gain access to the Sterling Heights Michigan Agreement and Plan of MergerAnd Consolidation Regarding Banks you were looking for and a huge number of other professional and state-specific templates in a single place!