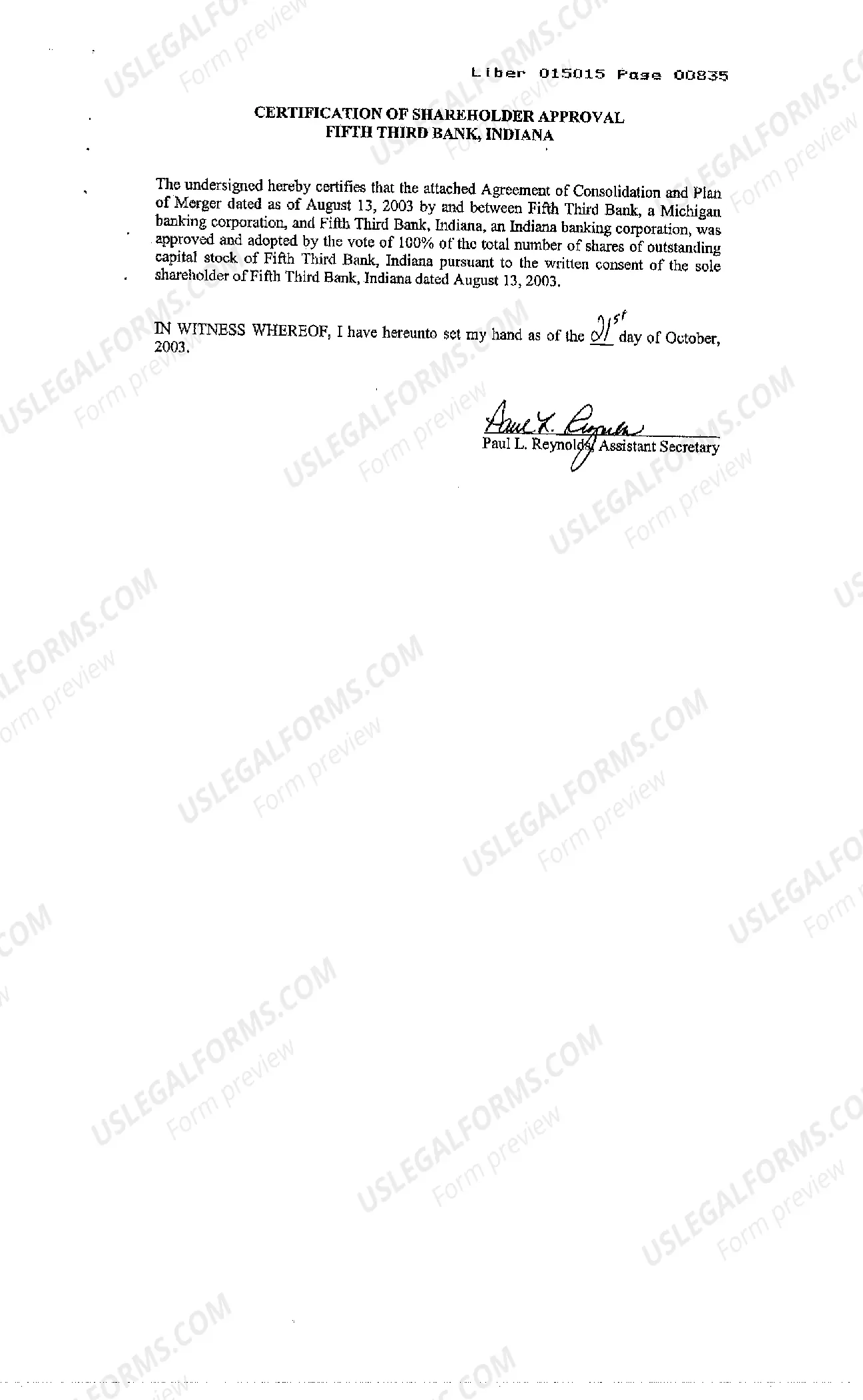

The Ann Arbor Michigan Agreement and Plan of Merger and Consolidation is a legal document that outlines the terms and conditions of merging or consolidating banks in the Ann Arbor, Michigan area. This agreement plays a crucial role in facilitating the combination of two or more financial institutions, ensuring a smooth transition and compliance with regulatory requirements. Keywords: Ann Arbor Michigan, Agreement and Plan of Merger, Agreement and Plan of Consolidation, banks, merging, consolidating, financial institutions, smooth transition, compliance, regulatory requirements. There are different types of Ann Arbor Michigan Agreement and Plan of Merger and Consolidation regarding banks, some of which are described below: 1. Ann Arbor Michigan Interbank Merger Agreement: This type of agreement is entered into by two or more banks within the Ann Arbor area. It typically outlines the terms and conditions to merge their operations, assets, and liabilities into a single entity. The agreement covers the allocation of shares, voting rights, management structure, and other essential aspects to ensure a successful merger. 2. Ann Arbor Michigan Bank Consolidation Agreement: In cases where multiple banks in Ann Arbor decide to consolidate their operations into a single entity, this agreement is used. It acts as a framework to combine the assets, liabilities, and operations of all participating banks into a unified organization. The consolidation agreement addresses issues like financial integration, organizational structure, employee transition, customer accounts, and legal considerations. 3. Ann Arbor Michigan Merger and Acquisition Agreement: This type of agreement comes into play when one bank acquires another in the Ann Arbor area. The agreement outlines the terms and conditions of the acquisition, including the purchase price, transfer of assets and liabilities, integration process, and regulatory compliance. It also covers matters like employee retention, management structure, and customer transition to ensure a seamless merging of the acquired bank with the acquiring entity. In conclusion, the Ann Arbor Michigan Agreement and Plan of Merger and Consolidation is a comprehensive legal document that governs the merging or consolidating of banks in the Ann Arbor area. The specific type of agreement depends on the nature of the transaction, whether it's a merger, consolidation, or acquisition.

Ann Arbor Michigan Agreement and Plan of Merger and Consolidation regarding banks

Description

How to fill out Ann Arbor Michigan Agreement And Plan Of Merger And Consolidation Regarding Banks?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Ann Arbor Michigan Agreement and Plan of Merger and Consolidation regarding banks or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Ann Arbor Michigan Agreement and Plan of Merger and Consolidation regarding banks adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Ann Arbor Michigan Agreement and Plan of Merger and Consolidation regarding banks is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!