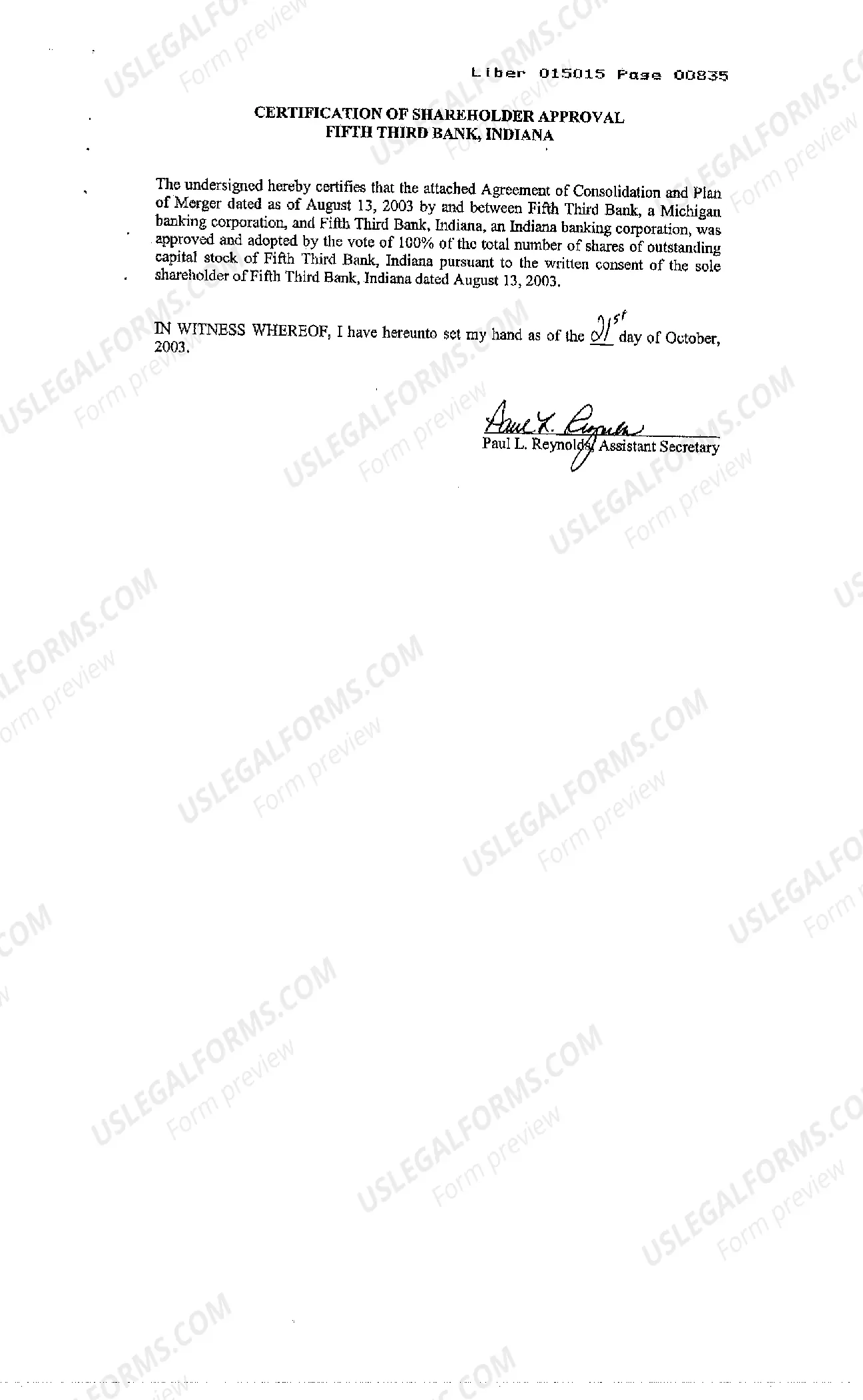

The Grand Rapids Michigan Agreement and Plan of Merger and Consolidation is a legally binding document that outlines the terms and conditions of the merger and consolidation of banks in the Grand Rapids, Michigan area. It serves as a comprehensive guideline for the parties involved, ensuring a smooth and transparent transition. This agreement typically covers various aspects, including the parties involved, the purpose of the merger or consolidation, the financial terms and considerations, and the overall structure of the new entity. It also addresses governance, decision-making procedures, and post-merger responsibilities. Keywords: Grand Rapids, Michigan, Agreement and Plan of Merger and Consolidation, banks, merger, consolidation, legally binding, terms and conditions, transition, parties involved, transparent, financial terms, new entity, governance, decision-making, post-merger responsibilities. Types of Grand Rapids Michigan Agreement and Plan of Merger and Consolidation Regarding Banks: 1. Merger Agreement: This type of agreement focuses on the merger process, which involves two or more separate banks combining their assets, liabilities, and operations to form a single entity. The agreement specifies the terms of the merger, such as the exchange ratio of shares, governance structure, and any special provisions related to the transaction. 2. Consolidation Agreement: In contrast to a merger, a consolidation involves the complete integration of two or more banks into a newly formed entity. The consolidation agreement outlines the terms and conditions for combining the banks' assets, liabilities, and operations. It may also address the establishment of a new corporate structure, governance framework, and the treatment of shareholders and employees. It's important to note that specific variations of the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation may exist depending on the unique circumstances and requirements of each bank merger or consolidation in the Grand Rapids area.

Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks

Description

How to fill out Grand Rapids Michigan Agreement And Plan Of Merger And Consolidation Regarding Banks?

Acquiring verified templates that adhere to your local regulations can be challenging unless you access the US Legal Forms library.

This is an online repository containing over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the files are systematically organized by usage areas and jurisdiction zones, making the retrieval of the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation related to banks as straightforward as pie.

Maintaining orderly paperwork that complies with legal standards is of utmost significance. Take advantage of the US Legal Forms library to always have crucial document templates conveniently at your fingertips!

- If you are already acquainted with our library and have previously used it, obtaining the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation related to banks requires only a few clicks.

- Simply Log In to your account, choose the document, and click Download to store it on your device.

- For new users, the process will involve just a bit more effort.

- Follow the instructions below to begin utilizing the most comprehensive online form library.

- Examine the Preview mode and form description. Ensure that you’ve selected the appropriate option that aligns with your requirements and fully satisfies your local jurisdiction criteria.

Form popularity

FAQ

Form F3 is used by Canadian issuers to register certain securities with the SEC. This form streamlines the process for short-form offerings and is particularly useful for companies involved in mergers, including the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks. This registration form simplifies compliance for companies looking to raise capital in the U.S. If you are navigating these requirements, consider using U.S. Legal Forms for detailed guidance.

SEC Form 4 is filed to report changes in ownership of securities by corporate insiders. Its purpose is to promote transparency in the financial markets, particularly during significant corporate events like mergers. For instance, in relation to the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks, insiders involved in the transaction must file this form to disclose their ownership changes. U.S. Legal Forms can assist with resources on submitting Form 4 correctly.

Form 20-F and 40-F serve as annual reports for foreign companies; however, they differ by jurisdiction. Specifically, Form 20-F applies to foreign companies under the SEC rules in the U.S., while Form 40-F is for Canadian companies. Understanding these differences is essential when dealing with international company mergers, including the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks. U.S. Legal Forms can provide further clarity and resources for these forms.

You can often find a merger agreement through financial institutions, legal databases, or consulting firms specializing in mergers. The Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks may be accessible through state regulatory websites or by contacting the involved banks directly. Additionally, U.S. Legal Forms offers templates and resources to assist you in drafting or locating a suitable merger agreement.

The SEC form DEF 14A, also known as the definitive proxy statement, is filed by companies to solicit shareholder votes for mergers, including the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks. This form contains important information regarding the merger proposals and the background of the transaction. It is essential for providing transparency and helping shareholders make informed decisions. If you need guidance on completing this form, consider checking out U.S. Legal Forms.

The SEC merger form, often referred to as Form S-4, is crucial for banks experiencing mergers and consolidations, including the Grand Rapids Michigan Agreement and Plan of Merger and Consolidation regarding banks. This form is required to register the securities offered in the merger. It provides essential details about the merging entities, the terms of the agreement, and financial information. Using U.S. Legal Forms can help you find and complete this form efficiently.

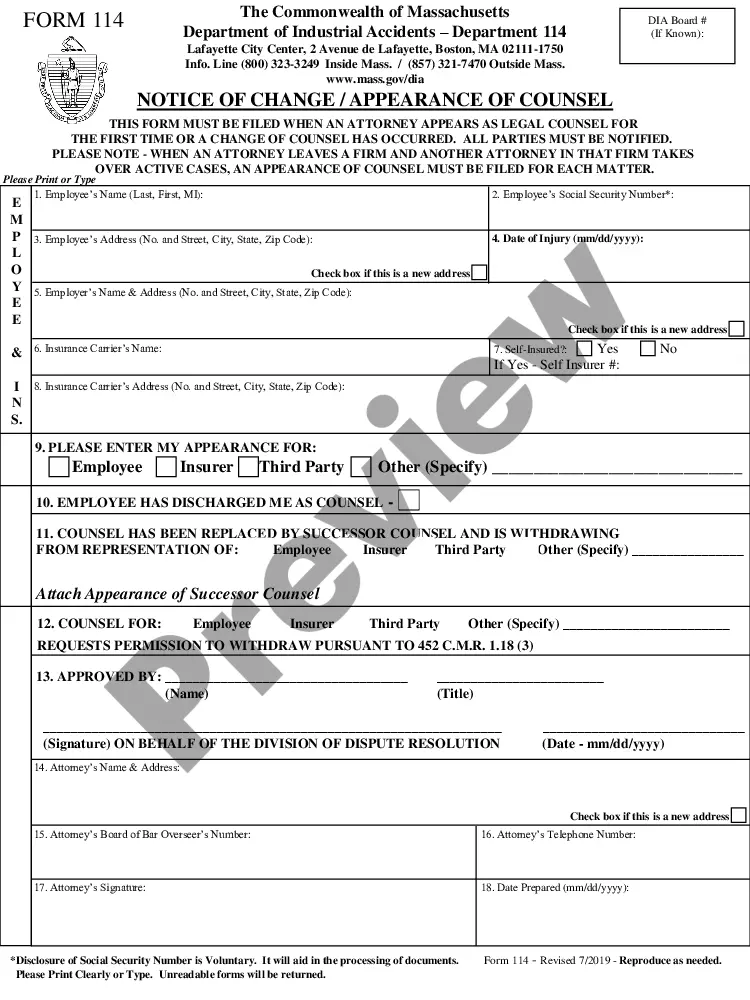

The federal banking agency (the Comptroller of the Currency, Federal Deposit Insurance Corp., or Federal Reserve) that is the primary regulator of the acquiring or surviving insured depository institution approves the merger under the Bank Merger Act.

Answer and Explanation: The federal reserve board has the authority to approve or disapprove mergers between banks and the formation of bank holding companies. Commercial banks are the oldest of all financial institutions.

Market estimates place a merger's timeframe for completion between six months to several years. In some instances, it may take only a few months to finalize the entire merger process. However, if there is a broad range of variables and approval hurdles, the merger process can be elongated to a much longer period.

For bank holding company applications, the Federal Reserve is required to take into account the likely effects of the acquisition on competition, the convenience and needs of the communities to be served, the financial and managerial resources and future prospects of the companies and banks involved, and the