The Lansing Michigan Agreement and Plan of Merger and Consolidation is a legal document that outlines the terms and conditions surrounding the merger and consolidation process for banks in Lansing, Michigan. This agreement serves as a blueprint for the transaction, ensuring that both parties involved fully understand their rights, obligations, and responsibilities throughout the merger process. Keywords: Lansing Michigan, Agreement and Plan of Merger, Consolidation, banks, legal document, terms and conditions, merger process, rights, obligations, responsibilities. There are various types of Lansing Michigan Agreement and Plan of Merger and Consolidation that may be specific to different scenarios in the banking industry. Some of these specialized agreements include: 1. Bank Merger Agreement: This type of agreement is specifically designed for the merger of two or more banks in Lansing, Michigan. It details the terms of the merger, such as the exchange ratio of shares, the composition of the new board of directors, and operational changes post-merger. 2. Financial Consolidation Agreement: This agreement focuses on consolidating the financial resources and operations of multiple banks in Lansing, Michigan. It includes provisions for combining balance sheets, consolidation of assets and liabilities, and the formation of a unified financial entity. 3. Regional Bank Consolidation Agreement: In the event that multiple regional banks in Lansing, Michigan decide to merge and consolidate their operations, this agreement sets forth the terms to establish a new regional bank. It covers aspects like the geographic coverage, branch network integration, and rebranding strategies. 4. Merger and Acquisition Agreement: This type of agreement is broader and encompasses mergers and acquisitions of banks in Lansing, Michigan. It outlines the terms and conditions for the acquisition of one bank by another, addressing factors such as purchase price, due diligence, regulatory approvals, and integration plans. 5. Merger Integration Agreement: This agreement focuses on the integration process post-merger and consolidation. It outlines the steps, timelines, and responsibilities for merging the systems, processes, and employees of the banks involved. This agreement ensures a smooth transition and maximizes the synergies between the merging entities. In conclusion, the Lansing Michigan Agreement and Plan of Merger and Consolidation is a crucial legal document that facilitates the merger and consolidation of banks in Lansing, Michigan. Different types of agreements may exist based on specific circumstances, covering various aspects such as financial consolidation, regional bank consolidation, and merger integration.

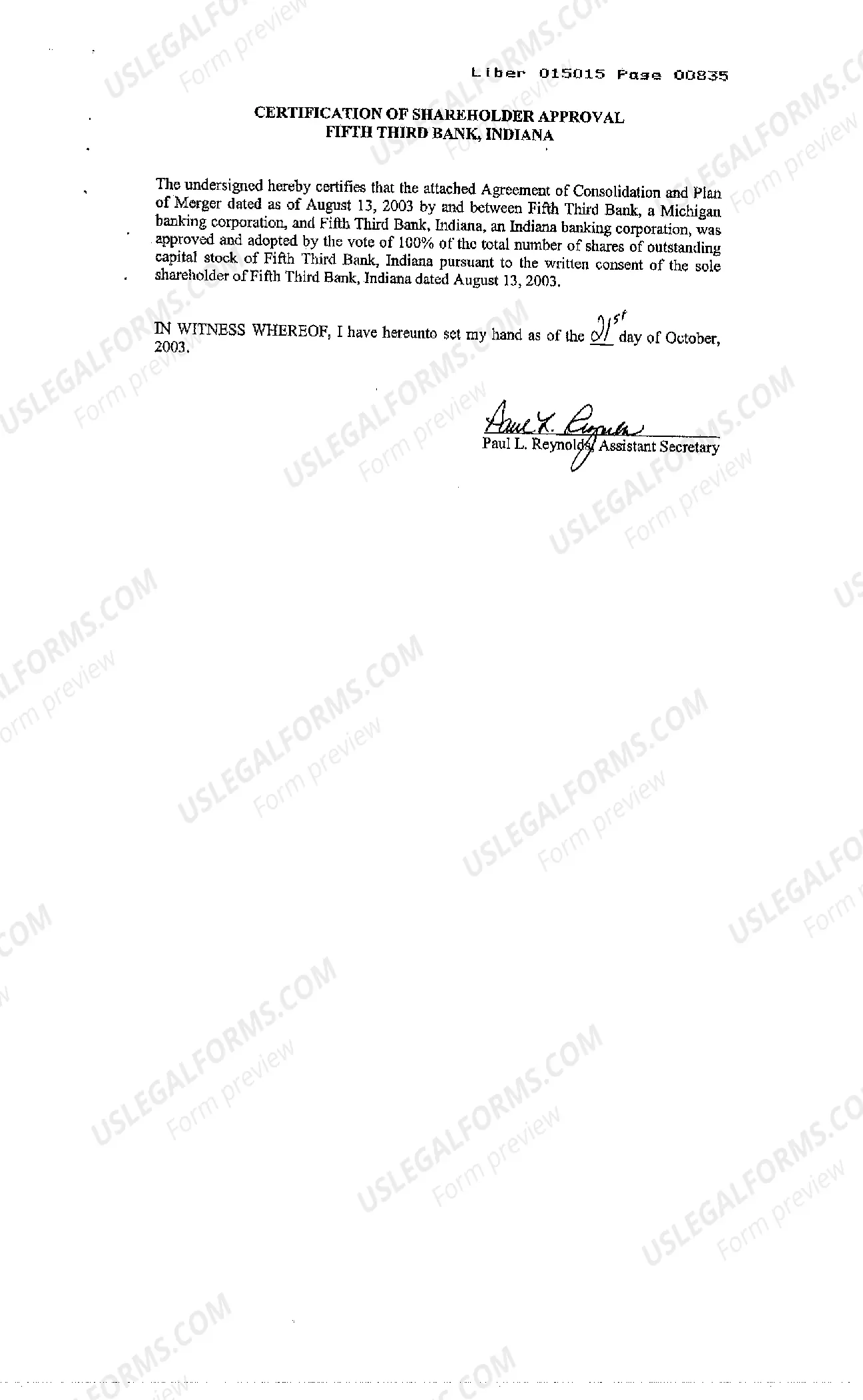

Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks

Description

How to fill out Lansing Michigan Agreement And Plan Of Merger And Consolidation Regarding Banks?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any law education to draft this sort of papers from scratch, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service offers a massive collection with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks in minutes employing our reliable service. If you are already an existing customer, you can proceed to log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps prior to downloading the Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks:

- Ensure the template you have chosen is specific to your location considering that the rules of one state or area do not work for another state or area.

- Review the form and go through a short outline (if available) of scenarios the document can be used for.

- If the form you picked doesn’t suit your needs, you can start over and look for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Lansing Michigan Agreement and Plan of Merger and Consolidation regarding banks once the payment is completed.

You’re good to go! Now you can proceed to print out the form or complete it online. If you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.