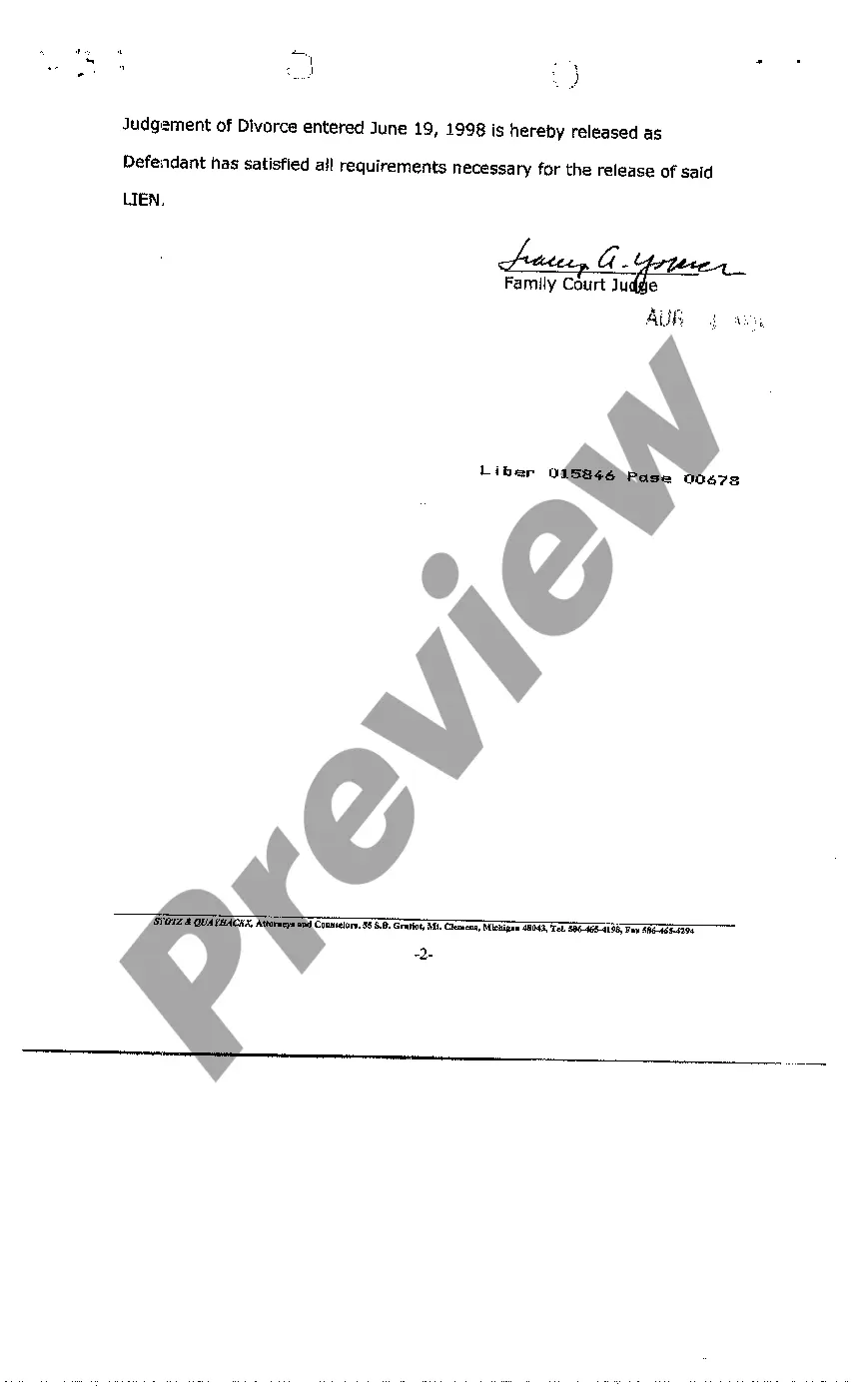

Keywords: Sterling Heights, Michigan, Order for Release of Lien, types Sterling Heights Michigan Orders for Release of Lien is a legal document used to formally cancel or release a previously filed lien on a property. Lien refers to a legal claim against a property placed by a creditor, typically as security for a debt owed by the property owner. The Order for Release of Lien is an essential step in the lien release process. It serves as an official declaration that the debt has been satisfied, settled, or otherwise resolved, thus releasing the property from any encumbrances. This document removes any cloud on the property title, ensuring the property owner's ability to freely transfer or sell the property. There are several types of Sterling Heights Michigan Orders for Release of Lien, depending on the specific circumstances and the type of lien being released. Some common types include: 1. Mortgage Lien Release: This type of lien release is commonly used when a property owner has fully paid off their mortgage loan. The Order for Release of Lien for Mortgage serves as a proof of payment and ensures the lender no longer holds any claim against the property. 2. Mechanic's Lien Release: Mechanic's liens are filed by contractors, suppliers, or laborers who haven't been paid for work done on a property. When the debt has been satisfied, a Mechanic's Lien Release Order is used to release the lien and clear any title concerns. 3. Property Tax Lien Release: When property taxes are not paid in full, the local taxing authority may file a tax lien against the property. Once the outstanding taxes, penalties, and interest have been paid, a Property Tax Lien Release Order is obtained to release the lien and ensure the property's clear title. 4. Judgment Lien Release: In cases where a court has issued a judgment against the property owner, such as an unpaid debt or a lawsuit settlement, a Judgment Lien Release Order is used to release the lien once the judgment has been satisfied or otherwise resolved. 5. IRS Lien Release: If the property owner has settled their outstanding tax debt with the Internal Revenue Service (IRS), an IRS Lien Release Order is necessary to remove the tax lien on the property. Regardless of the specific type of lien being released, it is crucial to follow the proper legal procedures in Sterling Heights, Michigan, to obtain and file the correct Order for Release of Lien. Consulting with a real estate attorney or an experienced professional knowledgeable in lien release processes can help ensure a smooth and legally compliant procedure.

Sterling Heights Michigan Order for Release of Lien

Description

How to fill out Sterling Heights Michigan Order For Release Of Lien?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no law education to create this sort of paperwork from scratch, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive collection with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Sterling Heights Michigan Order for Release of Lien or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Sterling Heights Michigan Order for Release of Lien quickly using our trusted service. In case you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

However, in case you are a novice to our library, make sure to follow these steps before downloading the Sterling Heights Michigan Order for Release of Lien:

- Ensure the form you have found is good for your area since the rules of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if available) of scenarios the paper can be used for.

- If the form you chosen doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Sterling Heights Michigan Order for Release of Lien as soon as the payment is done.

You’re good to go! Now you can proceed to print the form or fill it out online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.