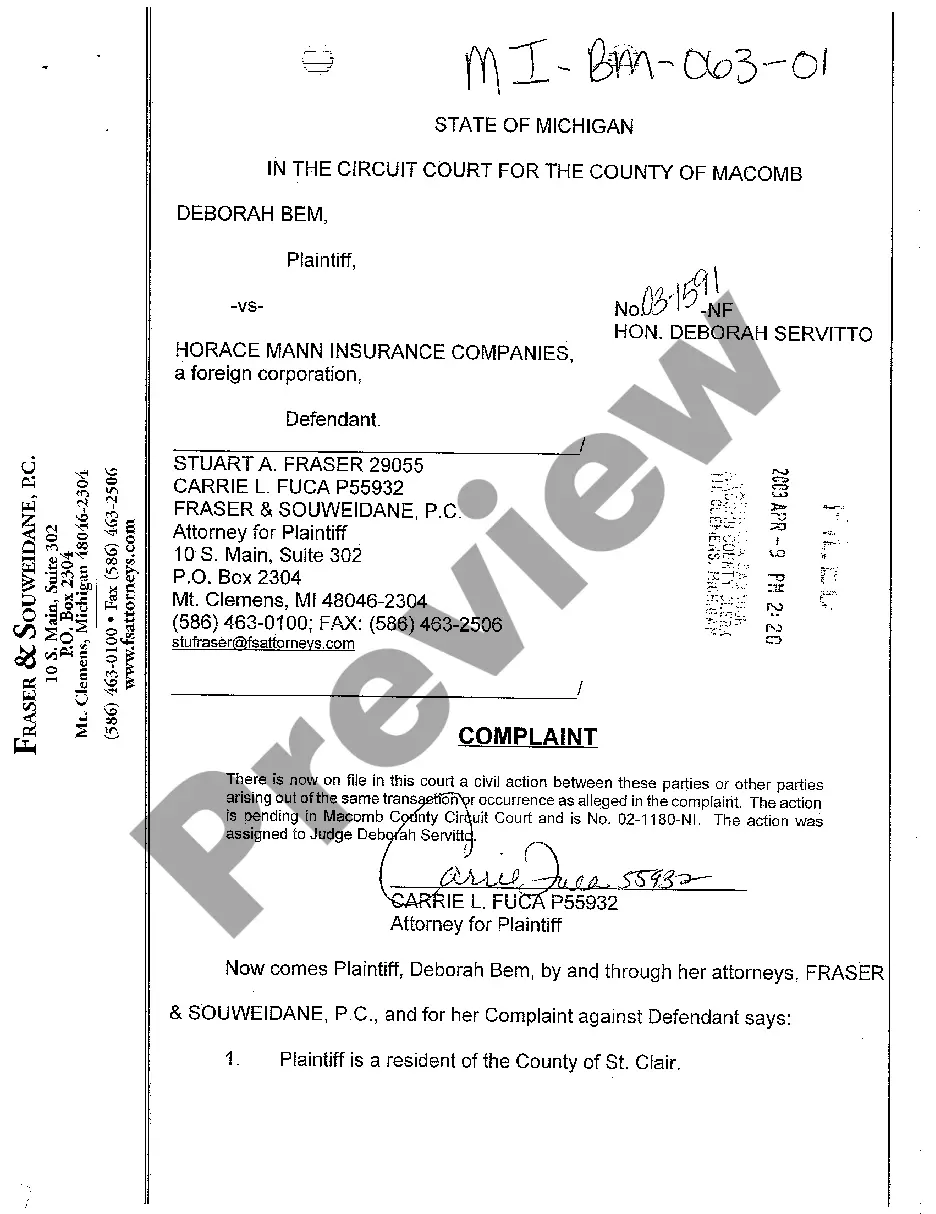

The Detroit Michigan Complaint Against Insurance Company for Nonpayment of Benefits refers to a legal action that residents of Detroit, Michigan can pursue when an insurance company fails to provide the benefits they are entitled to. This complaint addresses cases where insurance companies wrongfully deny or delay payment of benefits to policyholders. In Detroit, there are several types of complaints against insurance companies for nonpayment of benefits, including: 1. Health Insurance Complaints: These complaints arise when an insurer denies or delays payment for medical services, prescription drugs, or specialized treatments. Policyholders may face insurance companies' refusals based on preexisting conditions, lack of medical necessity, or other arbitrary reasons. 2. Auto Insurance Complaints: These complaints relate to nonpayment of benefits for auto accidents, including medical expenses, vehicle repairs, or lost wages. Insurers might argue that the accident was the policyholder's fault or attempt to minimize the amount paid for damages. 3. Homeowners Insurance Complaints: This category pertains to claims related to property damage, such as fire, theft, water damage, or natural disasters. Policyholders might encounter issues when insurers undervalue their losses or wrongfully refuse to cover the claimed damages. 4. Life Insurance Complaints: These complaints involve beneficiaries seeking payment under a life insurance policy after the policyholder's death. Insurance companies may contest the payout by claiming that the policy lapsed, the cause of death is not covered, or raising other grounds for denial. When pursuing a complaint against an insurance company in Detroit, it is crucial to gather relevant documentation, such as policy documents, claim forms, correspondence, medical records, and any other evidence supporting the validity of the claim. It is also advisable to consult an attorney who specializes in insurance law to ensure the process is conducted properly and to maximize the chances of success. Keywords: Detroit, Michigan, complaint against insurance company, nonpayment of benefits, health insurance, auto insurance, homeowners insurance, life insurance, denial of benefits, legal action.

Detroit Michigan Complaint Against Insurance Company for Nonpayment of Benefits

Description

How to fill out Detroit Michigan Complaint Against Insurance Company For Nonpayment Of Benefits?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

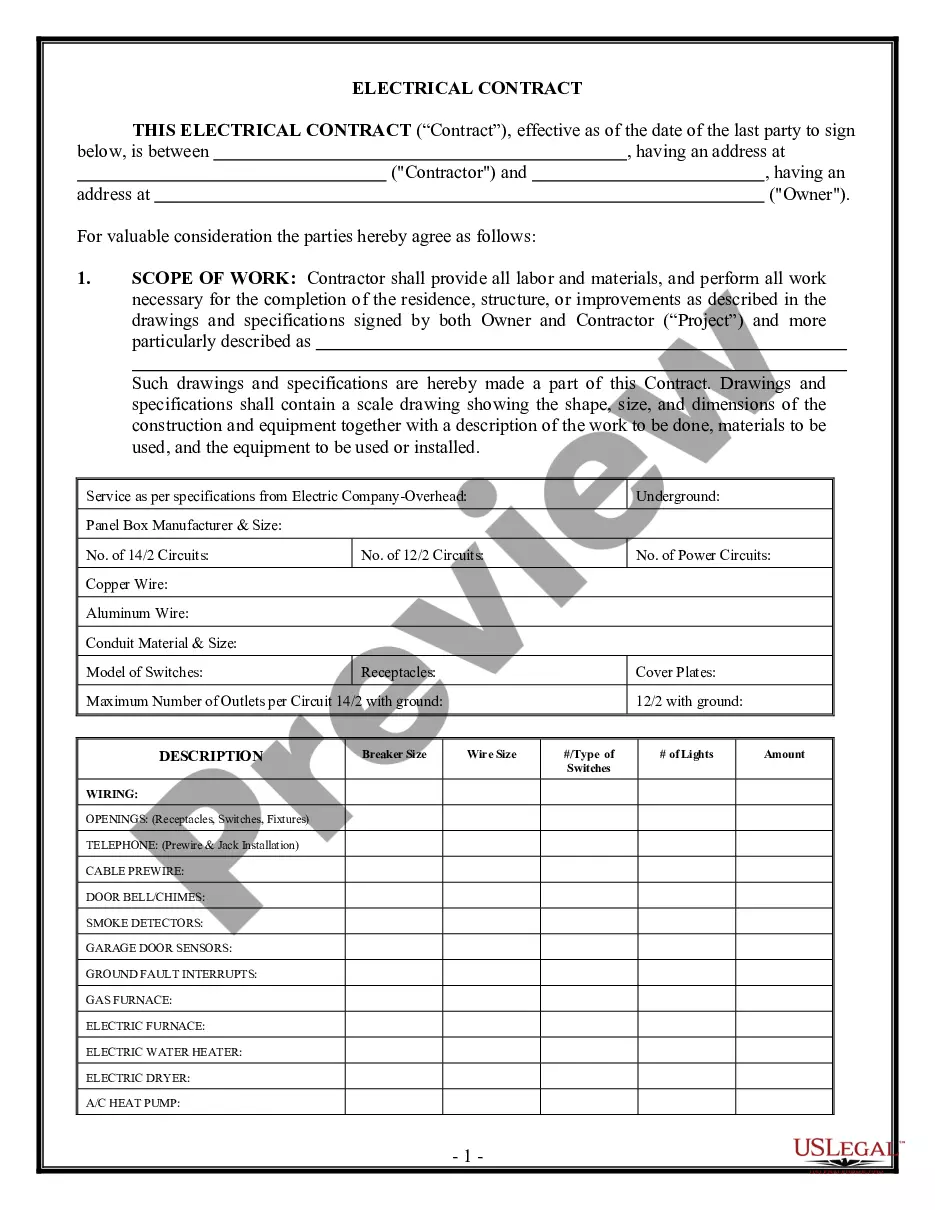

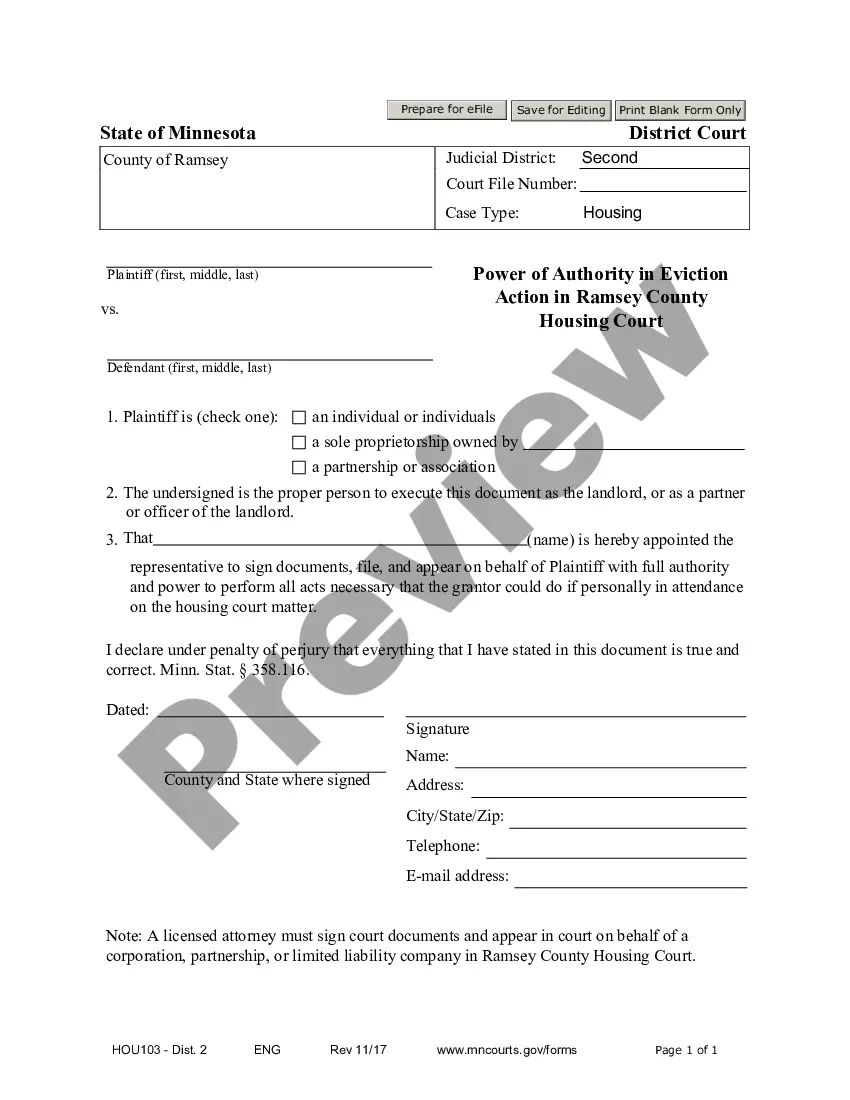

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Detroit Michigan Complaint Against Insurance Company for Nonpayment of Benefits or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Detroit Michigan Complaint Against Insurance Company for Nonpayment of Benefits complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Detroit Michigan Complaint Against Insurance Company for Nonpayment of Benefits is proper for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!