Title: Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments: A Comprehensive Overview Keywords: Grand Rapids Michigan, supplemental objections, defendants' motion, installment payments, legal proceedings, court hearing, repayment plan, financial hardship Introduction: In Grand Rapids, Michigan, when faced with a defendant's motion for installment payments due to financial constraints, supplemental objections can be filed. These objections aim to address various concerns related to the proposed repayment plan. This detailed description provides an overview of Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments, highlighting different types of objections that may be relevant in such cases. 1. Objection: Inadequate Repayment Plan: — Defendants argue that the proposed installment payments fail to adequately address the plaintiff's financial hardship, thereby raising objections on the feasibility and fairness of the repayment plan. — Defendants may highlight specific financial constraints, such as unemployment, medical expenses, or other circumstances impacting their ability to meet the proposed payment schedule. 2. Objection: Prioritization of Debts: — This objection revolves around challenging the defendant's proposed payment arrangement in cases where multiple creditors are involved. — Defendants argue that implementing a debt prioritization system would allow them to allocate their limited resources more effectively, ensuring a fair distribution of payments among various obligations. 3. Objection: Disputed Liability or Damages: — Defendants might raise objections pertaining to the disputed liability or damages, claiming that the proposed installment payments should not be considered until the underlying disagreement is resolved. — This objection aims to protect defendants' interests by delaying or reconsidering the repayment plan until the court decides on the disputed matter. 4. Objection: Violation of Legal Procedures: — This type of objection pertains to defendants arguing that the application for installment payments fails to meet legal requirements or procedural obligations, making it invalid or insufficient in its current form. — Defendants may draw attention to specific legal statutes or court rules that should have been followed and request proper compliance. 5. Objection: Overreaching or Discriminatory Terms: — Defendants may argue that the proposed installment payments contain terms that unfairly burden or discriminate against them. — This objection can be raised when defendants believe the offered repayment plan breaches any legal provisions governing fair debt collection practices or promotes discriminatory practices. Conclusion: When defendants file a motion for installment payments in Grand Rapids, Michigan, supplemental objections provide a crucial avenue for raising concerns. Whether objecting to the adequacy of the proposed repayment plan, disputing liability or damages, challenging legal procedures, prioritization of debts, or discriminatory terms, these objections serve to protect the defendants' rights and ensure a fair and just resolution in court proceedings.

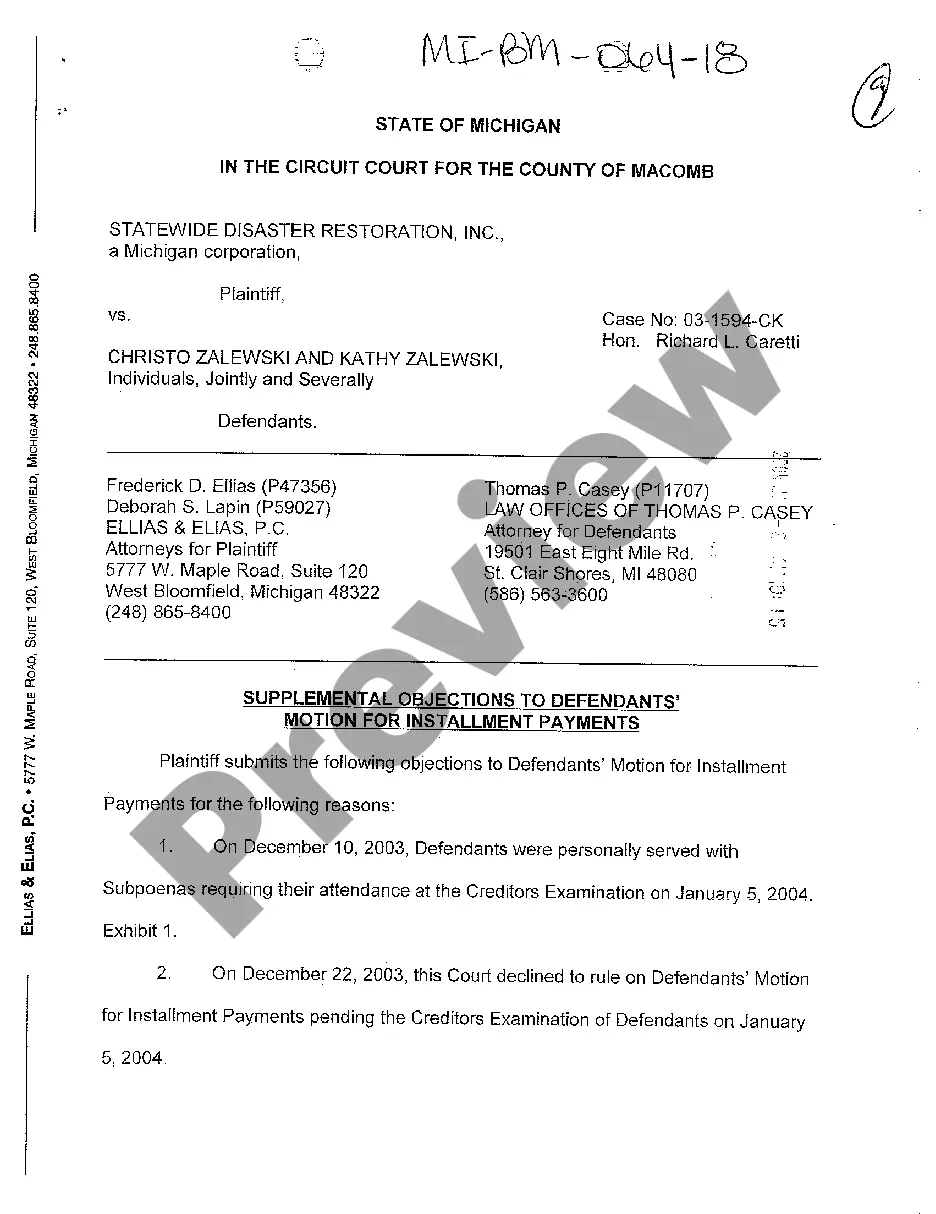

Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments

State:

Michigan

City:

Grand Rapids

Control #:

MI-BM-064-18

Format:

PDF

Instant download

This form is available by subscription

Description

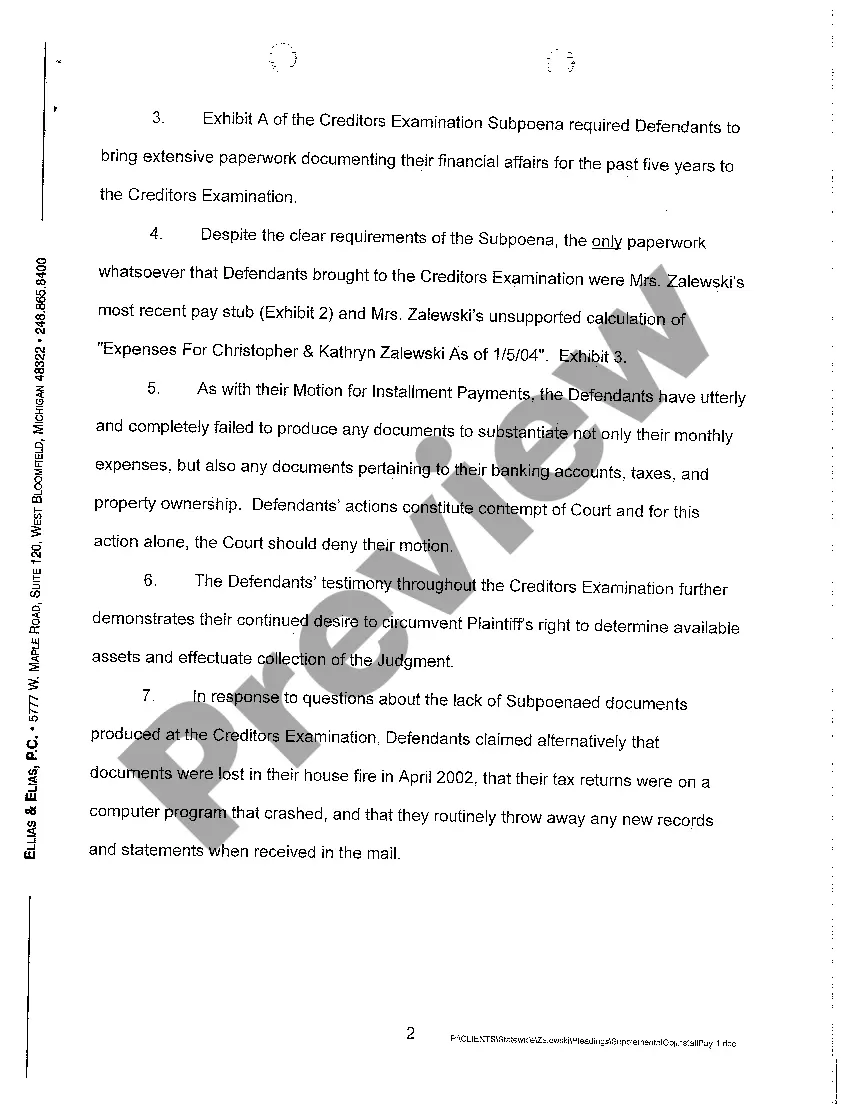

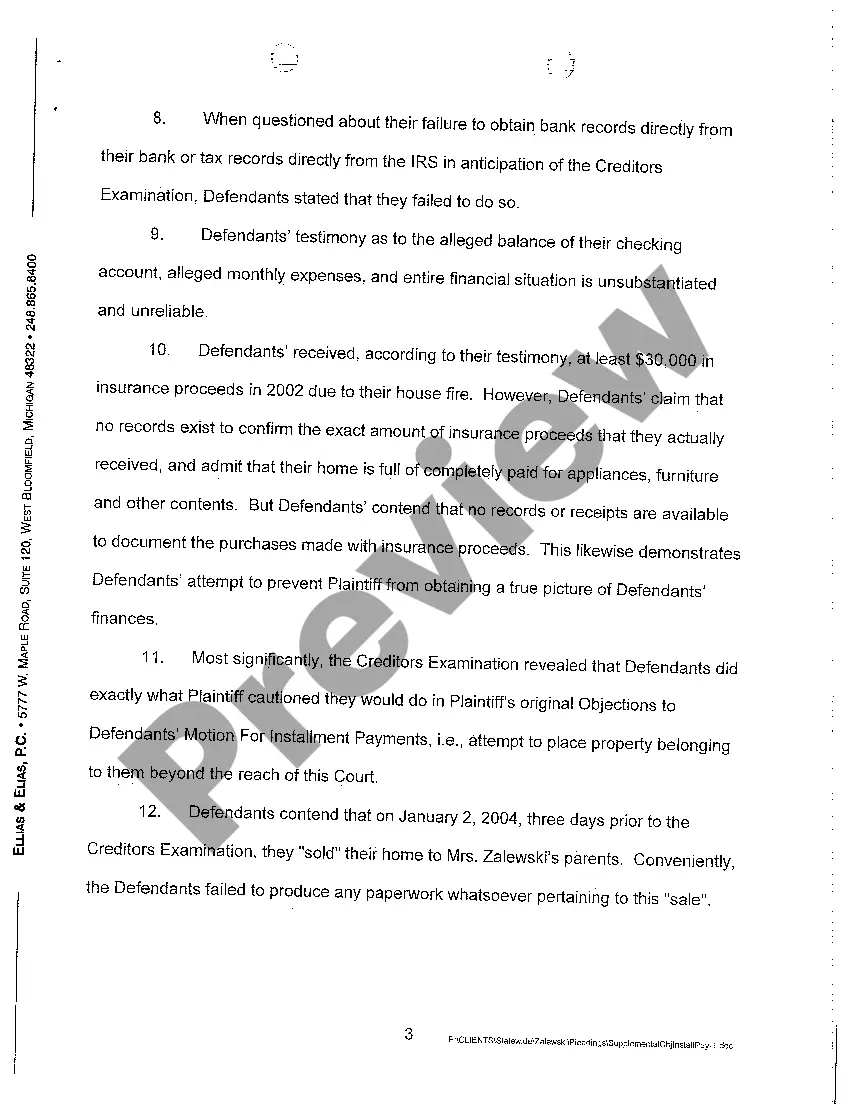

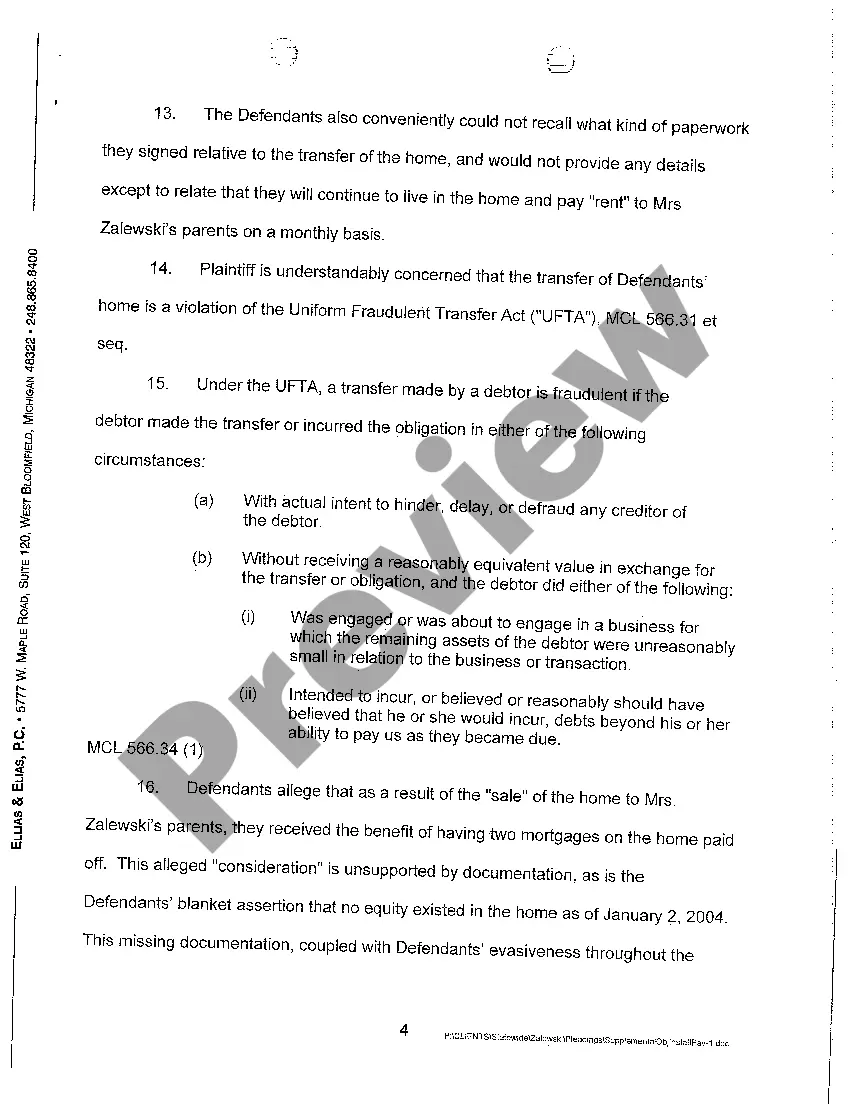

A15 Supplemental Objections to Defendants' Motion for Installment Payments

Title: Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments: A Comprehensive Overview Keywords: Grand Rapids Michigan, supplemental objections, defendants' motion, installment payments, legal proceedings, court hearing, repayment plan, financial hardship Introduction: In Grand Rapids, Michigan, when faced with a defendant's motion for installment payments due to financial constraints, supplemental objections can be filed. These objections aim to address various concerns related to the proposed repayment plan. This detailed description provides an overview of Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments, highlighting different types of objections that may be relevant in such cases. 1. Objection: Inadequate Repayment Plan: — Defendants argue that the proposed installment payments fail to adequately address the plaintiff's financial hardship, thereby raising objections on the feasibility and fairness of the repayment plan. — Defendants may highlight specific financial constraints, such as unemployment, medical expenses, or other circumstances impacting their ability to meet the proposed payment schedule. 2. Objection: Prioritization of Debts: — This objection revolves around challenging the defendant's proposed payment arrangement in cases where multiple creditors are involved. — Defendants argue that implementing a debt prioritization system would allow them to allocate their limited resources more effectively, ensuring a fair distribution of payments among various obligations. 3. Objection: Disputed Liability or Damages: — Defendants might raise objections pertaining to the disputed liability or damages, claiming that the proposed installment payments should not be considered until the underlying disagreement is resolved. — This objection aims to protect defendants' interests by delaying or reconsidering the repayment plan until the court decides on the disputed matter. 4. Objection: Violation of Legal Procedures: — This type of objection pertains to defendants arguing that the application for installment payments fails to meet legal requirements or procedural obligations, making it invalid or insufficient in its current form. — Defendants may draw attention to specific legal statutes or court rules that should have been followed and request proper compliance. 5. Objection: Overreaching or Discriminatory Terms: — Defendants may argue that the proposed installment payments contain terms that unfairly burden or discriminate against them. — This objection can be raised when defendants believe the offered repayment plan breaches any legal provisions governing fair debt collection practices or promotes discriminatory practices. Conclusion: When defendants file a motion for installment payments in Grand Rapids, Michigan, supplemental objections provide a crucial avenue for raising concerns. Whether objecting to the adequacy of the proposed repayment plan, disputing liability or damages, challenging legal procedures, prioritization of debts, or discriminatory terms, these objections serve to protect the defendants' rights and ensure a fair and just resolution in court proceedings.

Free preview

How to fill out Grand Rapids Michigan Supplemental Objections To Defendants' Motion For Installment Payments?

If you’ve already utilized our service before, log in to your account and download the Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Grand Rapids Michigan Supplemental Objections to Defendants' Motion for Installment Payments. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!