Grand Rapids Michigan Notice of Default is a legal document issued by a lender to a borrower who has failed to fulfill their mortgage or loan obligations. This notice serves as a formal notification to the borrower that they are in default and must take immediate action to rectify the situation. In Grand Rapids, Michigan, there are different types of Notice of Default depending on the nature of the default and the type of loan involved. The most common type of Grand Rapids Michigan Notice of Default is related to mortgage loans. When a homeowner fails to make timely mortgage payments or breaches the terms of their mortgage agreement, the lender has the right to initiate the foreclosure process. The Notice of Default sent in this case outlines the specific details of the default, including the amount owed, the consequences of non-payment, and the timeframe within which the borrower must respond. Another type of Grand Rapids Michigan Notice of Default may pertain to loans other than mortgages, such as personal or commercial loans. In such cases, the lender may issue a Notice of Default to inform the borrower of their non-compliance with the loan terms, which may include missed payments, late payments, or other breaches of the agreement. This notice typically grants the borrower a specific period to cure the default by making the necessary payments and rectifying the violation. It is important for borrowers in Grand Rapids, Michigan, to be aware of the consequences that follow a Notice of Default. Failure to respond or rectify the default within the given timeframe can lead to further legal actions, including foreclosure or the lender's pursuit of collection proceedings. It is advisable for borrowers to seek legal counsel or consult with a housing counselor to understand their rights and explore options for resolving the default. In summary, the Grand Rapids Michigan Notice of Default is a critical legal document that serves as a formal notification to borrowers who have defaulted on their mortgage or loan obligations. Different types of notices may exist depending on the loan type, and it is crucial for borrowers to promptly address and resolve the default to avoid severe consequences.

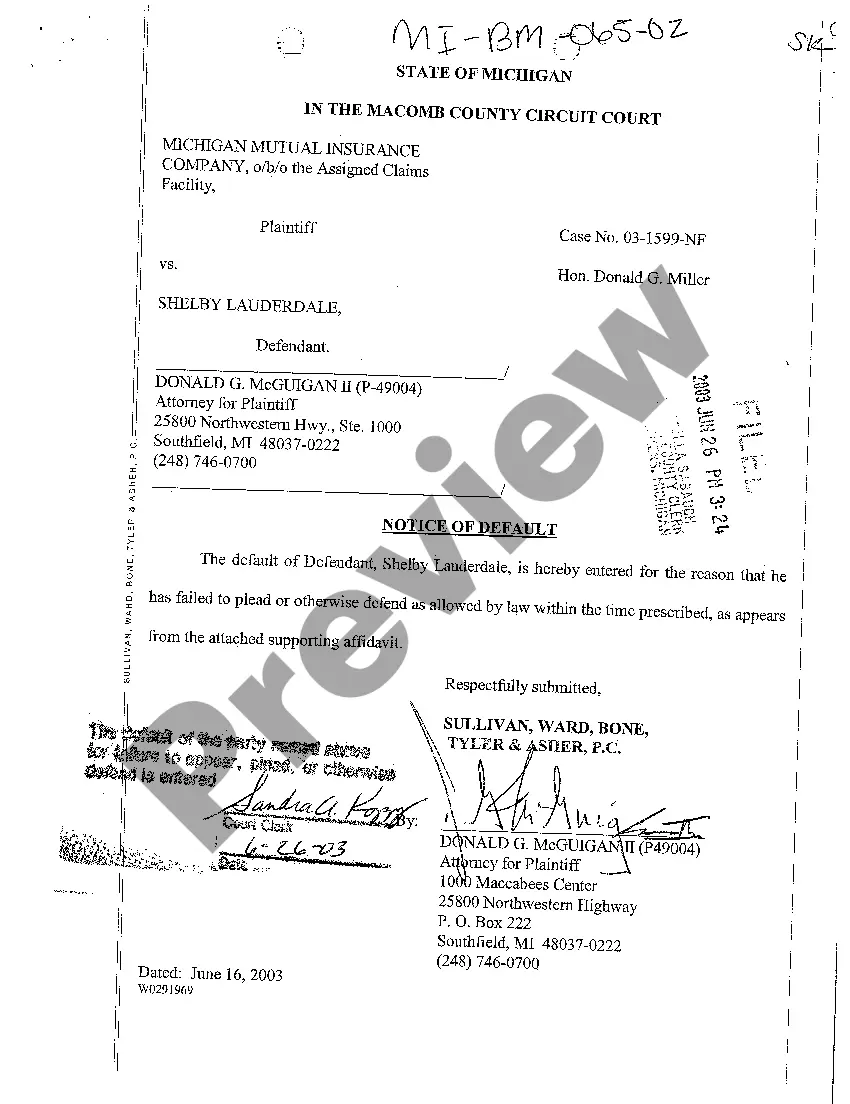

Grand Rapids Michigan Notice of Default

Description

How to fill out Grand Rapids Michigan Notice Of Default?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Grand Rapids Michigan Notice of Default gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Grand Rapids Michigan Notice of Default takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Grand Rapids Michigan Notice of Default. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!