Sterling Heights, Michigan Notice of Default: A Comprehensive Overview In Sterling Heights, Michigan, a Notice of Default plays a crucial role in the foreclosure process. This legal document serves as an official notice to borrowers that they are in default on their mortgage payments and their lender has initiated the foreclosure process. With the inclusion of relevant keywords, let's explore the details of the Sterling Heights Notice of Default. 1. Definition of Notice of Default: A Notice of Default is an official communication that informs borrowers in Sterling Heights, Michigan, that they are in breach of their loan agreement by failing to make timely mortgage payments. It is the initial step taken by a lender to start the foreclosure process. 2. Purpose of Notice of Default: The primary objective of the Notice of Default is to provide borrowers with formal notification that they are in default on their mortgage. This document outlines the specific default amount and provides a timeline within which the borrower can rectify the issue to prevent foreclosure. 3. Types of Sterling Heights Notice of Default: While there might not be different types of Notice of Default specific to Sterling Heights, Michigan, variations can occur based on the specific circumstances of the borrower. Some potential variations may include: a. Residential Notice of Default: This type of Notice of Default is issued for residential properties, including single-family homes, townhouses, or condominiums. b. Commercial Notice of Default: For properties used for commercial purposes, such as office buildings, retail spaces, or industrial establishments, a commercial Notice of Default might be issued. c. Notice of Default with Loan Modification: In cases where borrowers are negotiating a loan modification with their lender, a Notice of Default may outline the terms and conditions of the proposed modification. These terms aim to help borrowers avoid foreclosure, provided they adhere to the modified agreement. d. Notice of Default with Intent to Accelerate: Should the lender decide to accelerate the foreclosure process, a Notice of Default with Intent to Accelerate may be issued. This notice informs the borrower that unless the default is cured within a specified timeframe, the entire loan balance will be due. 4. Consequences of Notice of Default: Once served with a Sterling Heights Notice of Default, borrowers must act promptly to avoid foreclosure. Unless the default is remedied or alternative solutions are explored, the lender can proceed to initiate foreclosure proceedings, potentially leading to the sale of the property at auction. In conclusion, the Sterling Heights, Michigan Notice of Default serves as a vital legal document in the foreclosure process, notifying borrowers of their default status and initiating necessary actions to rectify the situation. Understanding the various types and the potential consequences associated with this notice is crucial for borrowers to seek appropriate remedies and prevent the foreclosure of their property.

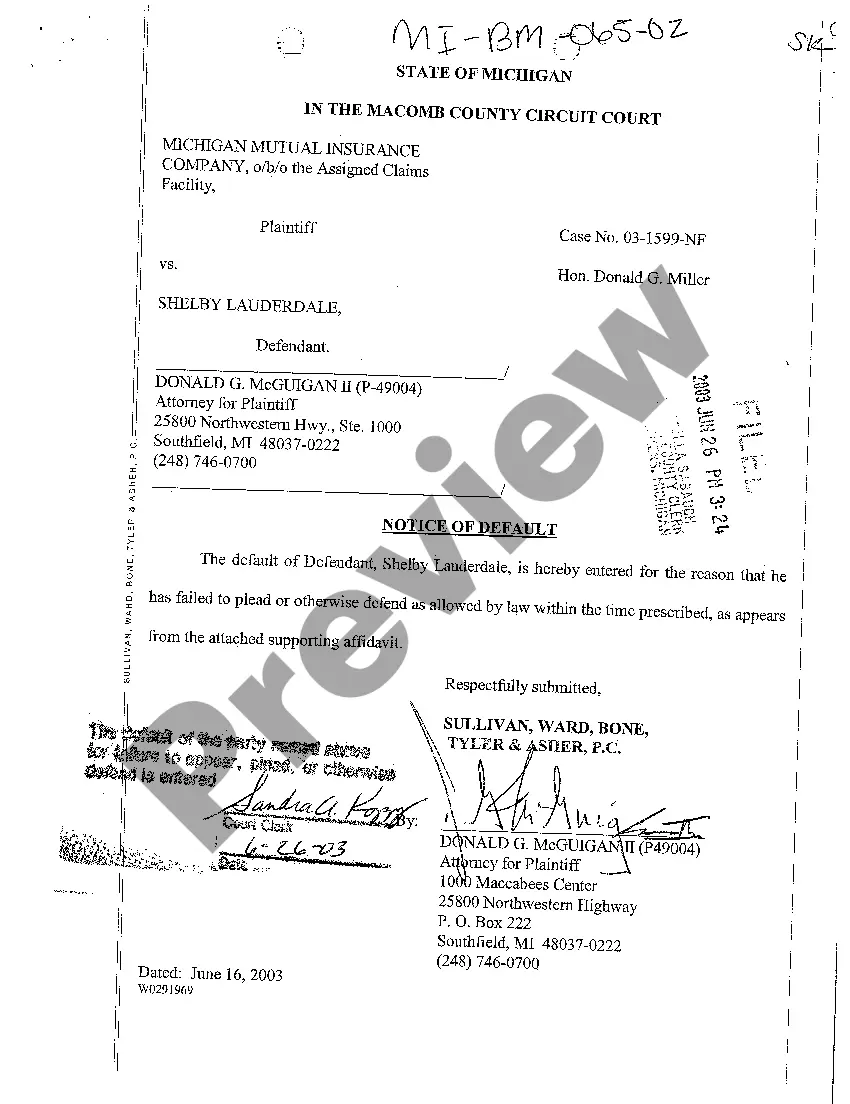

Sterling Heights Michigan Notice of Default

Description

How to fill out Sterling Heights Michigan Notice Of Default?

If you are searching for a relevant form template, it’s impossible to choose a better service than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can get a huge number of templates for organization and individual purposes by categories and states, or key phrases. Using our advanced search feature, getting the latest Sterling Heights Michigan Notice of Default is as elementary as 1-2-3. Furthermore, the relevance of each and every file is verified by a team of expert lawyers that on a regular basis review the templates on our platform and update them based on the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Sterling Heights Michigan Notice of Default is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you require. Check its information and utilize the Preview option to see its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the proper file.

- Affirm your choice. Select the Buy now button. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the file format and download it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Sterling Heights Michigan Notice of Default.

Every template you save in your user profile has no expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you need to receive an additional copy for editing or printing, you may come back and download it again at any moment.

Take advantage of the US Legal Forms professional library to get access to the Sterling Heights Michigan Notice of Default you were looking for and a huge number of other professional and state-specific templates in a single place!