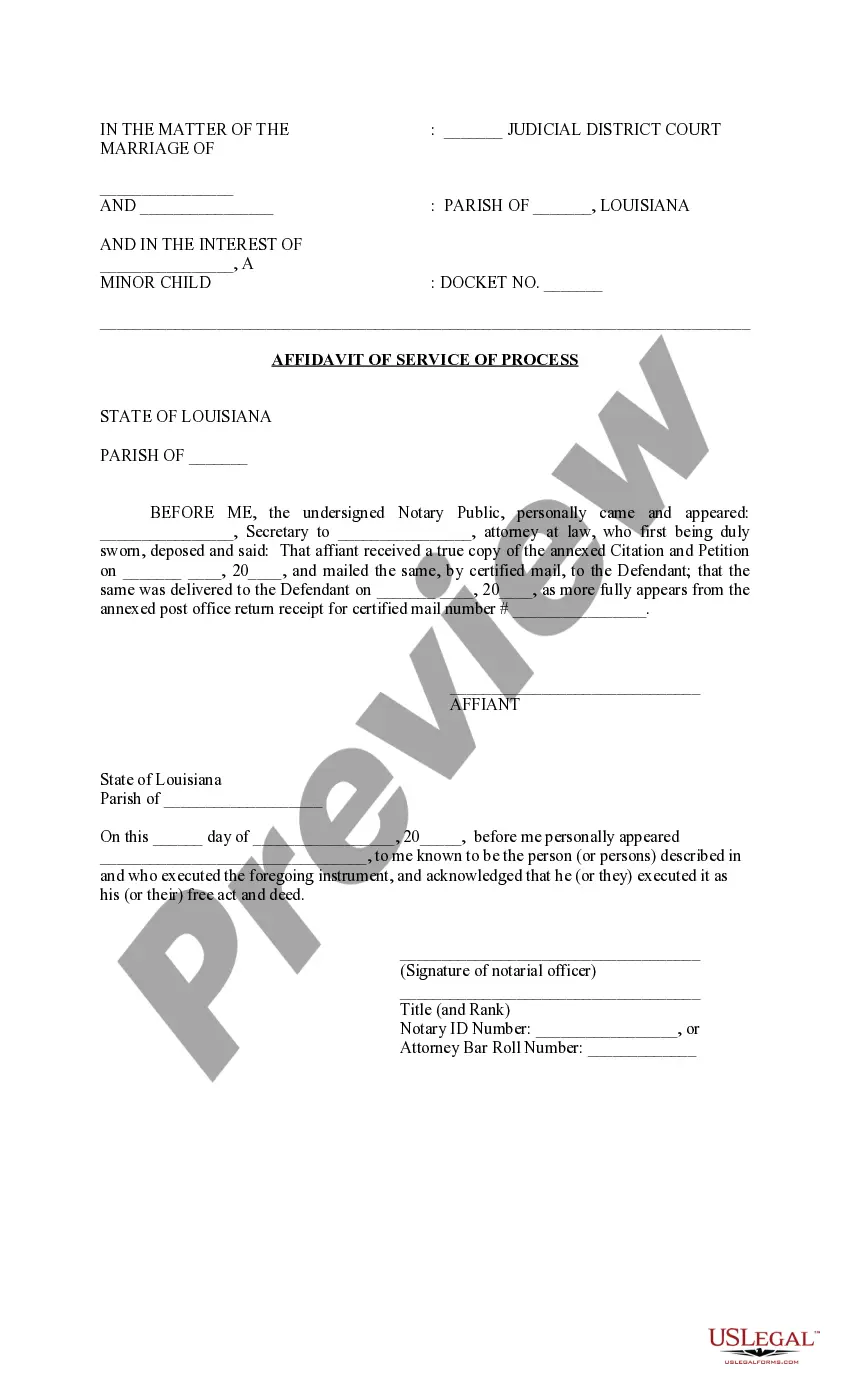

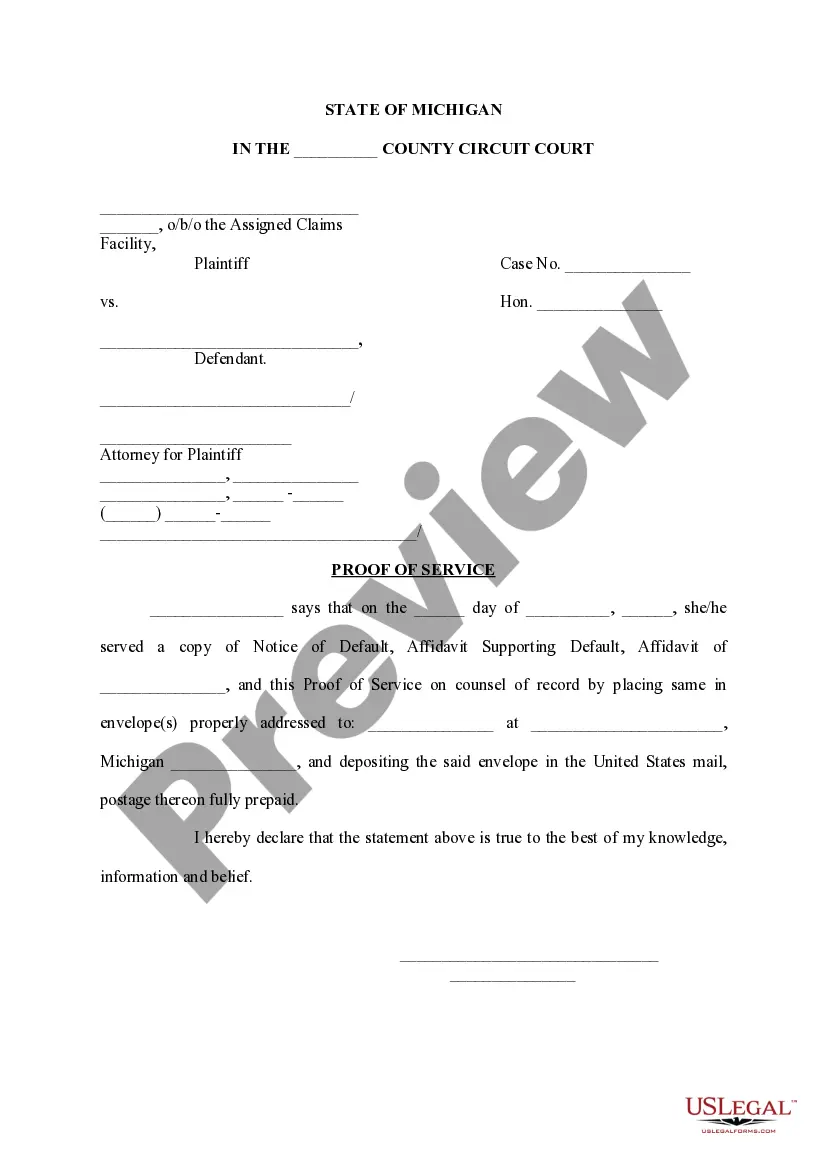

Oakland Michigan Proof of Service — Notice of Default is a legal document used to notify the appropriate parties involved in a foreclosure process in Oakland County, Michigan. It provides proof that the borrower or homeowner was properly served with a Notice of Default, which is a formal notice indicating that they have defaulted on their mortgage or loan obligations. The Notice of Default initiates the foreclosure process and is typically sent by the lender or their representative, such as a mortgage service or an attorney. It serves as a warning to the homeowner that legal action will be taken if they fail to rectify the default within a specified period. The Oakland Michigan Proof of Service — Notice of Default must adhere to the specific legal requirements outlined by the Michigan state statutes and local court rules. It generally includes the following information: 1. Identification of the parties: The document contains the names and addresses of the borrower and lender or their representatives involved in the foreclosure process. 2. Property information: It provides a detailed description of the property subject to foreclosure, including the address, legal description, and any other relevant identifying information. 3. Default details: The Notice of Default specifies the specific default-related information, such as the amount owed, the due date for payment, and any other contractual violations that led to the default. 4. Cure period: It states the duration within which the borrower can rectify the default, typically giving them a chance to catch up on missed payments or fulfill other obligations to avoid foreclosure. This period allows homeowners an opportunity to negotiate with their lender or explore alternative options, such as loan modifications or repayment plans. 5. Service of Notice: The Proof of Service section of the document demonstrates that the Notice of Default was served properly to the borrower or homeowner. Service can be performed through various methods, including personal delivery, certified mail, or through a court-appointed process server. The document must include the date, time, and method of service as proofs. Different types of Oakland Michigan Proof of Service — Notice of Default can be distinguished by the party serving the notice. For instance, if the lender themselves sent the notice, it would be referred to as the Oakland Michigan Lender's Proof of Service — Notice of Default. Alternatively, if a third-party representative, such as an attorney or a mortgage service, served the notice on behalf of the lender, it would be named the Oakland Michigan Representative's Proof of Service — Notice of Default. In conclusion, the Oakland Michigan Proof of Service — Notice of Default is a critical document required in the foreclosure process. It ensures that proper notice is given to the borrower, outlining the default and the necessary actions to avoid foreclosure. Adherence to the specific legal requirements is crucial to maintain the integrity of the foreclosure process.

Oakland Michigan Proof of Service - Notice of Default

Description

How to fill out Oakland Michigan Proof Of Service - Notice Of Default?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any legal background to create such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Oakland Michigan Proof of Service – Notice of Default or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Oakland Michigan Proof of Service – Notice of Default quickly using our trustworthy service. If you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

However, if you are a novice to our platform, ensure that you follow these steps prior to obtaining the Oakland Michigan Proof of Service – Notice of Default:

- Be sure the form you have chosen is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the document and go through a brief outline (if available) of cases the document can be used for.

- In case the one you picked doesn’t suit your needs, you can start over and search for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Oakland Michigan Proof of Service – Notice of Default once the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. If you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.