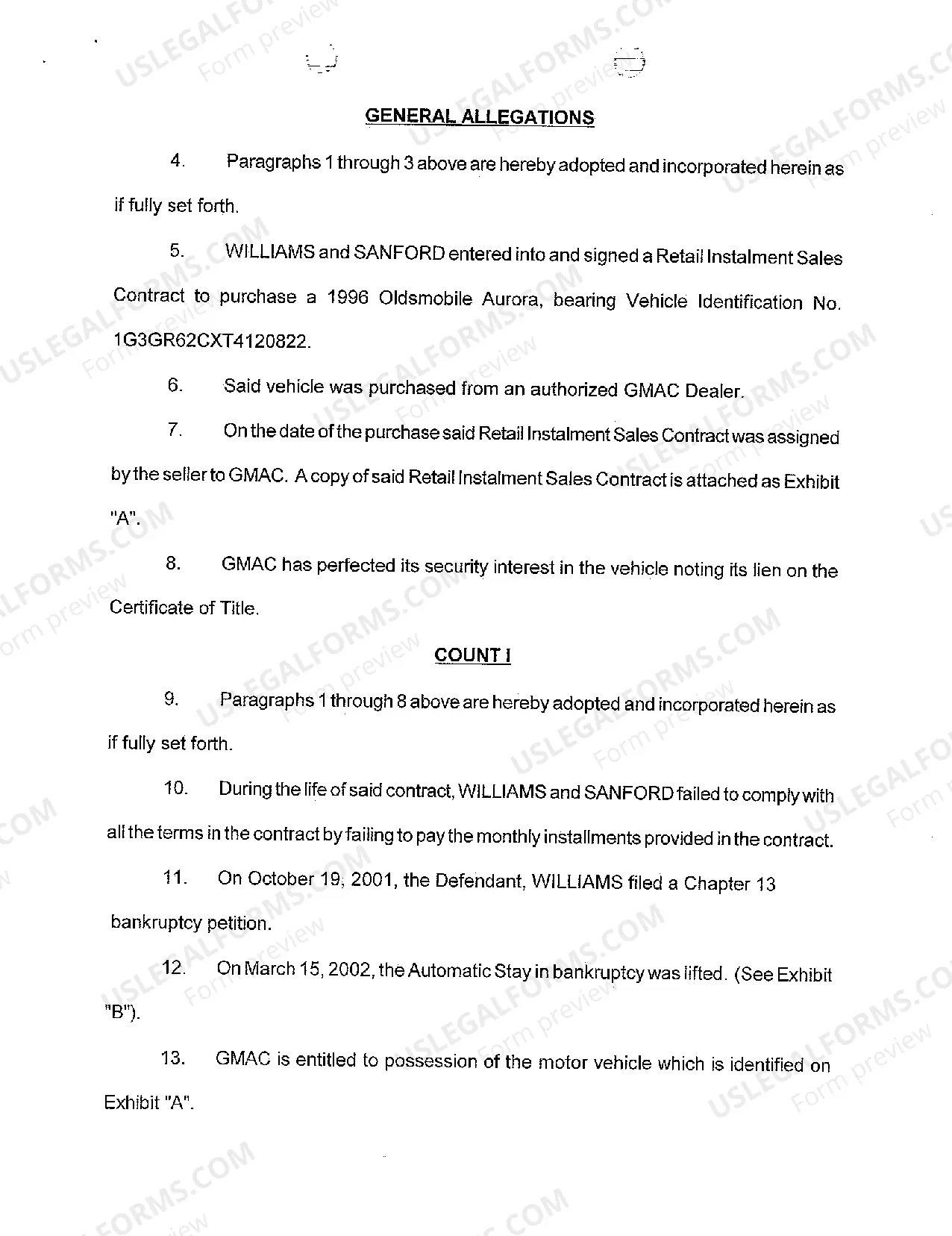

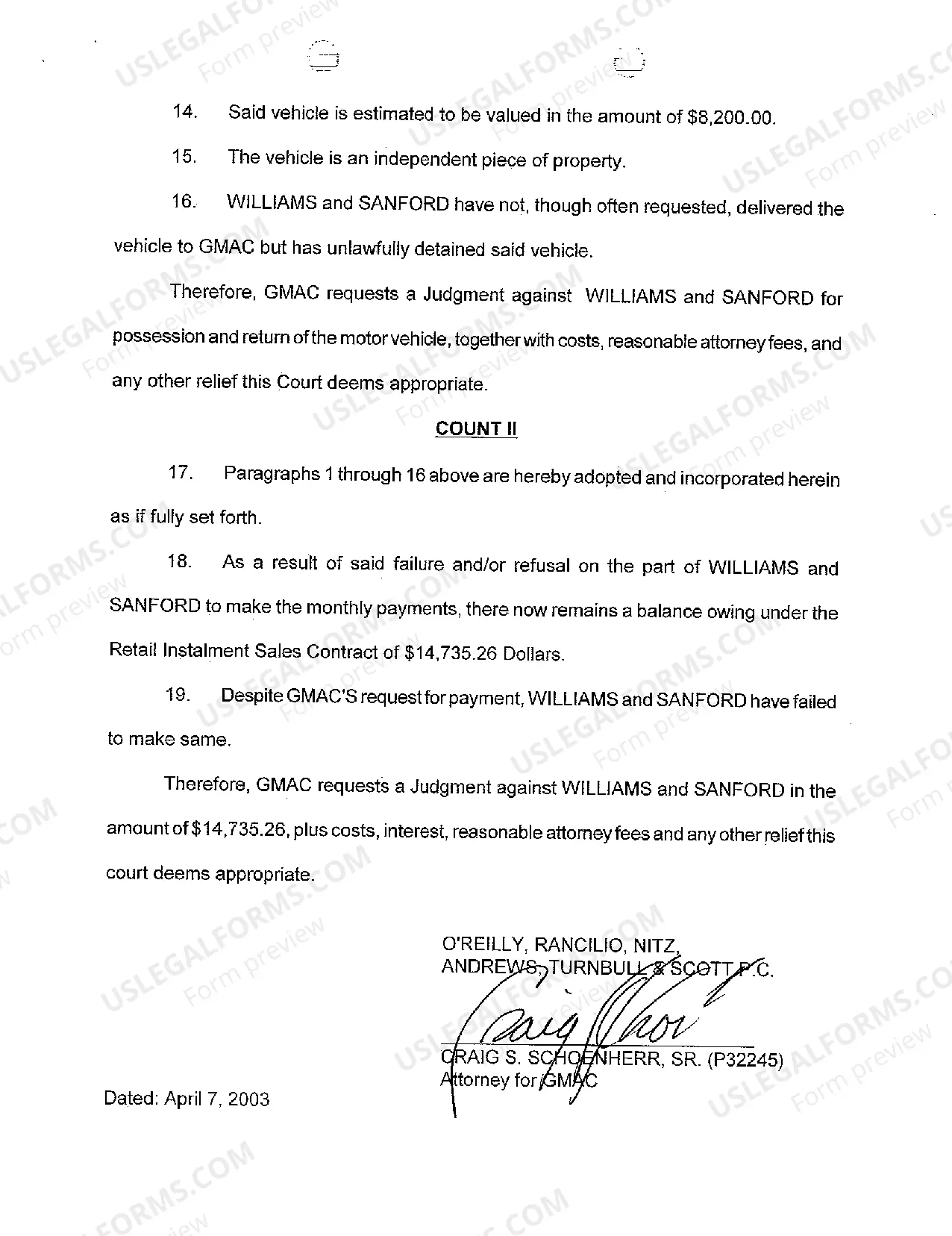

Title: Understanding Grand Rapids Michigan's Complaint for Possession of Vehicle after Default on Installment Sales Contract Keywords: Grand Rapids Michigan Complaint for Possession of Vehicle, Vehicle Repossession Laws, Installment Sales Contract Default, Step-by-Step Process, Legal Consequences Description: In Grand Rapids, Michigan, a Complaint for Possession of Vehicle after Default on an Installment Sales Contract is a legal action taken by a creditor to repossess a vehicle in the event of a default on payments by the buyer. This article provides an in-depth overview of the process, relevant keywords, and possible consequences for the defaulter. Types of Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract: 1. Voluntary Repossession: This occurs when the buyer willingly surrenders the vehicle due to financial hardships and an inability to make repayments on the installment sales contract. 2. Involuntary Repossession: In this type, the creditor takes legal action to repossess the vehicle after the buyer defaults on the terms of the installment sales contract. Usually, this involves missed payments or failure to fulfill contractual obligations. Step-by-Step Process: 1. Default on Installment Sales Contract: When a buyer fails to make timely payments or honor the terms of the installment sales contract, they are considered in default. 2. Notice of Default: The creditor is required to send a written notice of default to the buyer, stating the violation(s) and providing an opportunity to cure the default within a specific period. 3. Notice of Intent to Repossess: If the buyer fails to cure the default, the creditor sends a written notice of intent to repossess the vehicle. This notice states the creditor's intent to seize the vehicle after a certain date if the default is not resolved. 4. Repossession: If the buyer does not cure the default within the specified period, the creditor may legally repossess the vehicle. However, they must do so peacefully and without breaching the peace. 5. Notice of Sale: After the repossession, the creditor may send a written notice of the intent to sell the repossessed vehicle. This notice includes details about the upcoming sale, giving the buyer a final opportunity to reclaim the vehicle before it goes to auction. 6. Sale of Repossessed Vehicle: If the buyer fails to reclaim the vehicle or make payment arrangements, the creditor can sell the repossessed vehicle. However, they must follow specific legal requirements, such as providing notice of the public sale. Legal Consequences: Defaulting on an installment sales contract and facing a Complaint for Possession of Vehicle in Grand Rapids, Michigan, can have severe legal consequences, including: — Negative impacrediscoveredor— - Potential deficiency balance liability — Loss of the vehicle and any accumulated equity — Potential legal fees and costs associated with the repossession process — Difficulty obtaining credit or securing financing in the future It is crucial for buyers in Grand Rapids, Michigan, to carefully read and understand their installment sales contracts to avoid defaulting and facing potential repossession actions.

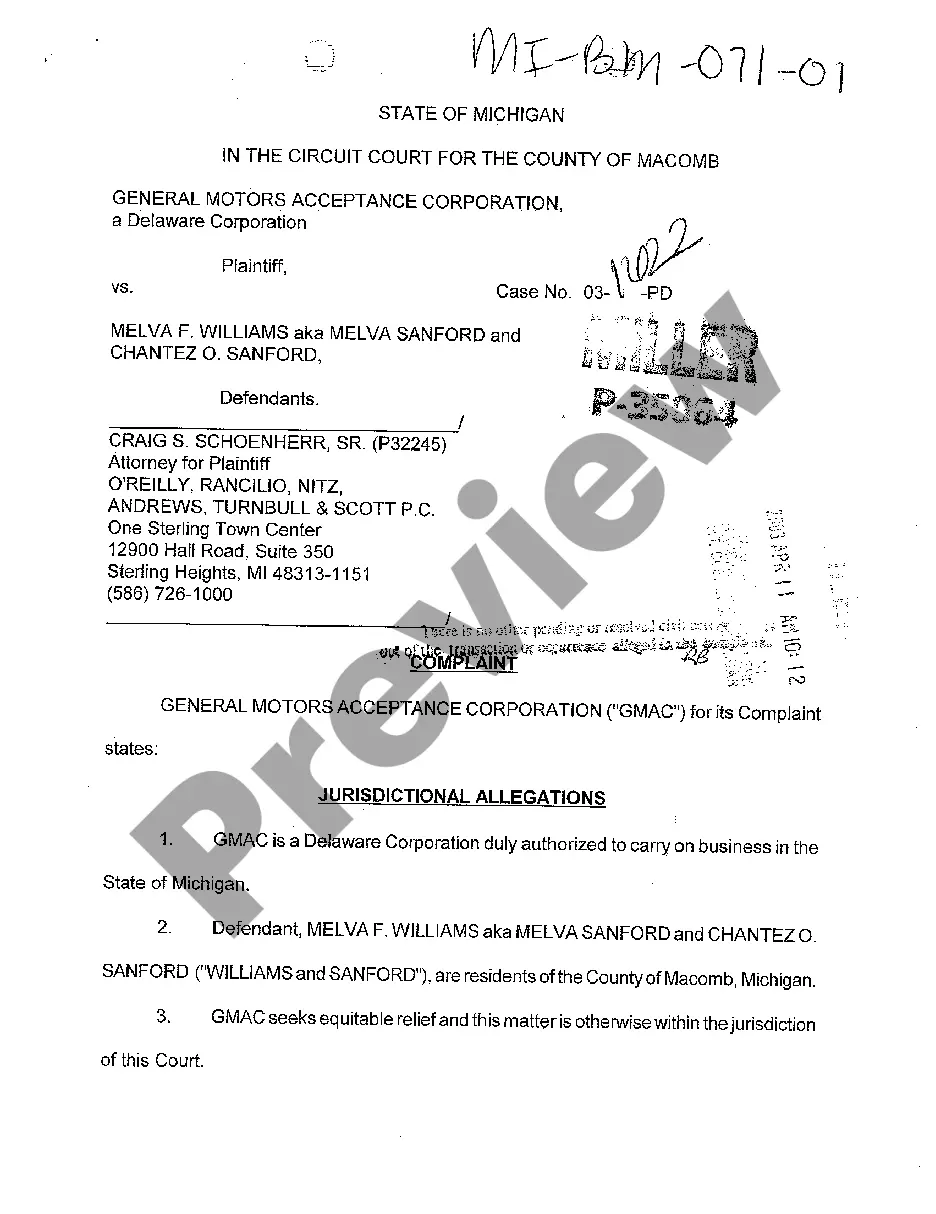

Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract

Description

How to fill out Grand Rapids Michigan Complaint For Possession Of Vehicle After Default On Installment Sales Contract?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no law education to create such papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract quickly using our trustworthy service. If you are already an existing customer, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract:

- Ensure the form you have found is specific to your area because the rules of one state or county do not work for another state or county.

- Preview the form and read a short description (if available) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- Log in to your account login information or create one from scratch.

- Pick the payment method and proceed to download the Grand Rapids Michigan Complaint for Possession of Vehicle after Default on Installment Sales Contract as soon as the payment is completed.

You’re good to go! Now you can go on and print out the form or fill it out online. Should you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.