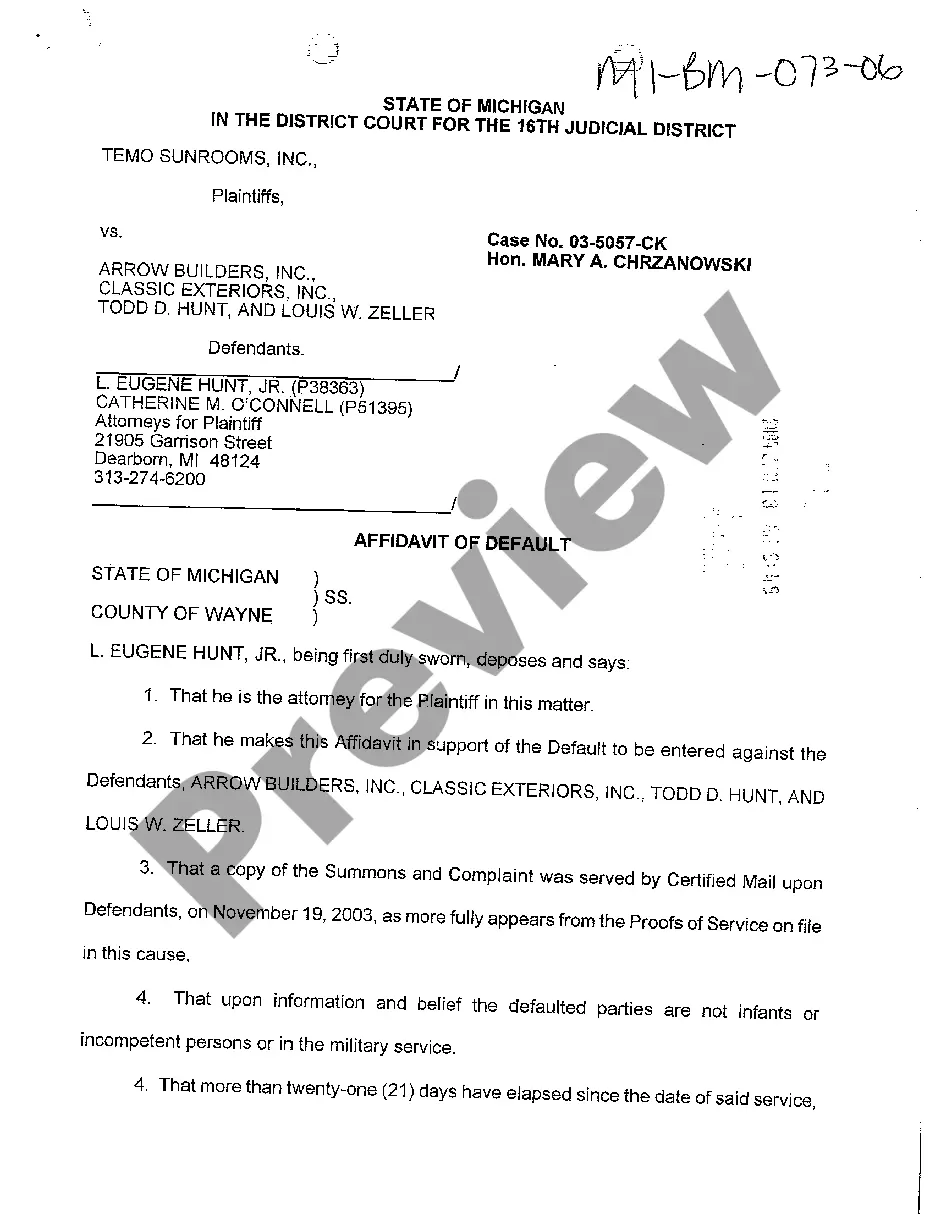

The Oakland Michigan Affidavit of Default is a legal document filed in Oakland County, Michigan, to initiate foreclosure proceedings on a property due to defaulting on a mortgage or loan. This affidavit is an important step in the foreclosure process, enabling the lender or mortgage holder to take legal action against the borrower. In order to understand the Oakland Michigan Affidavit of Default, it is crucial to grasp its purpose and the consequences it entails. When a borrower fails to make timely payments as outlined in their mortgage or loan agreement, they are considered to be in default. The lender can then file an Oakland Michigan Affidavit of Default to notify the borrower and begin the foreclosure process. This affidavit serves as evidence to the court that the borrower has defaulted on their mortgage or loan agreement. It must contain specific details, including the borrower's name, the property's location, the loan amount, the missed payment dates, and the total amount owed. Additionally, it must be signed by the lender or their authorized representative under penalty of perjury, asserting the authenticity and accuracy of the information provided. Once the Oakland Michigan Affidavit of Default is filed, it sets in motion a series of legal steps leading to a foreclosure sale. However, it is important to note that each foreclosure case is unique, and the specific stages and timelines may vary depending on multiple factors, such as state laws, court proceedings, and the borrower's response. While there is no explicit mention of different types of Oakland Michigan Affidavit of Default, it is worth highlighting that the process may differ slightly depending on whether it is a residential or commercial property, or if the loan is a first mortgage, second mortgage, or home equity loan. Each type of loan has its own specific regulations and requirements when it comes to filing an affidavit of default. In conclusion, the Oakland Michigan Affidavit of Default is a vital legal document utilized in the foreclosure process in Oakland County, Michigan. It signifies the lender's intention to initiate foreclosure proceedings due to the borrower's failure to make timely payments. Understanding the implications and the specific requirements of this affidavit is essential for both borrowers and lenders involved in the foreclosure process in Oakland County, Michigan.

Oakland Michigan Affidavit of Default

Description

How to fill out Oakland Michigan Affidavit Of Default?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Oakland Michigan Affidavit of Default? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and area.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Oakland Michigan Affidavit of Default conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Restart the search if the form isn’t good for your legal scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the Oakland Michigan Affidavit of Default in any provided format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online once and for all.