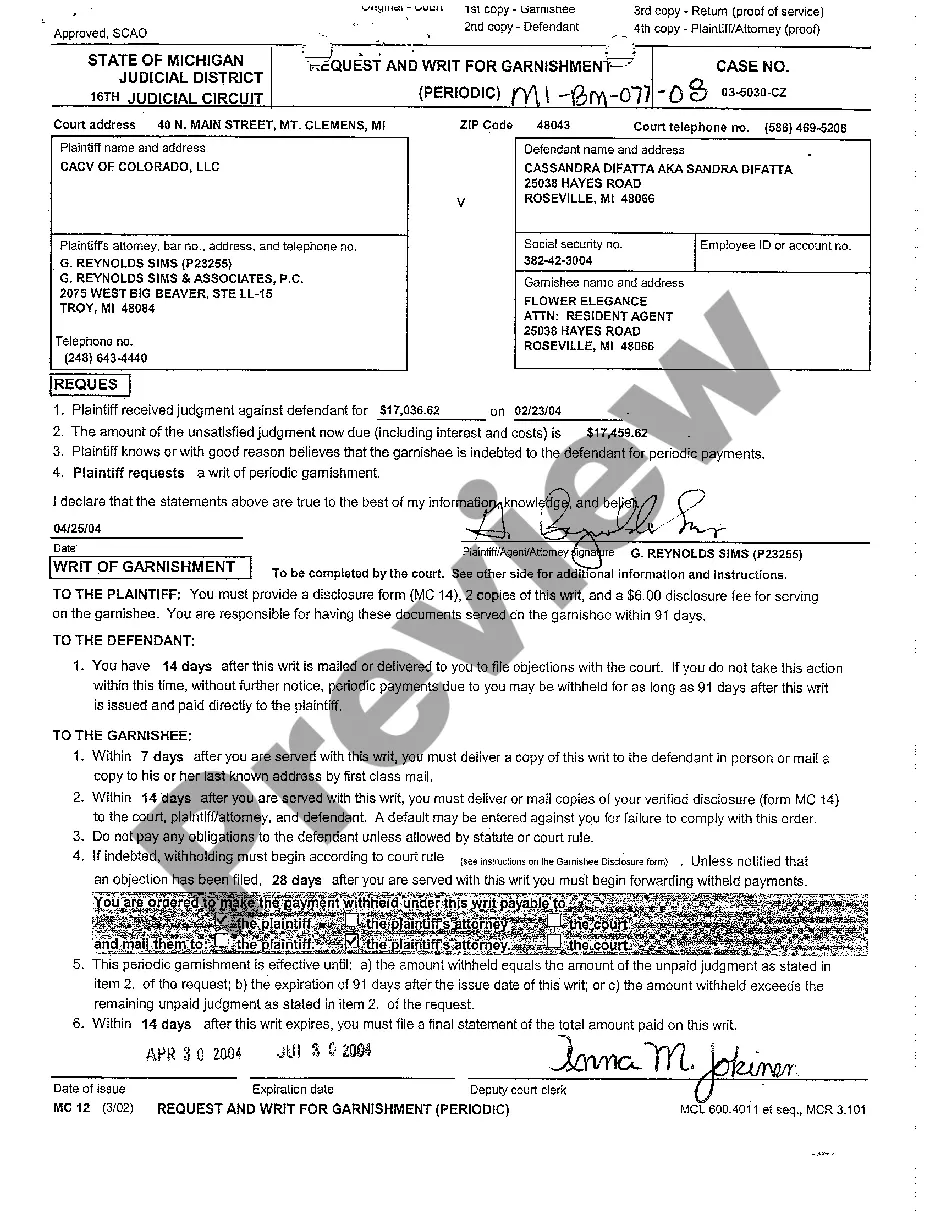

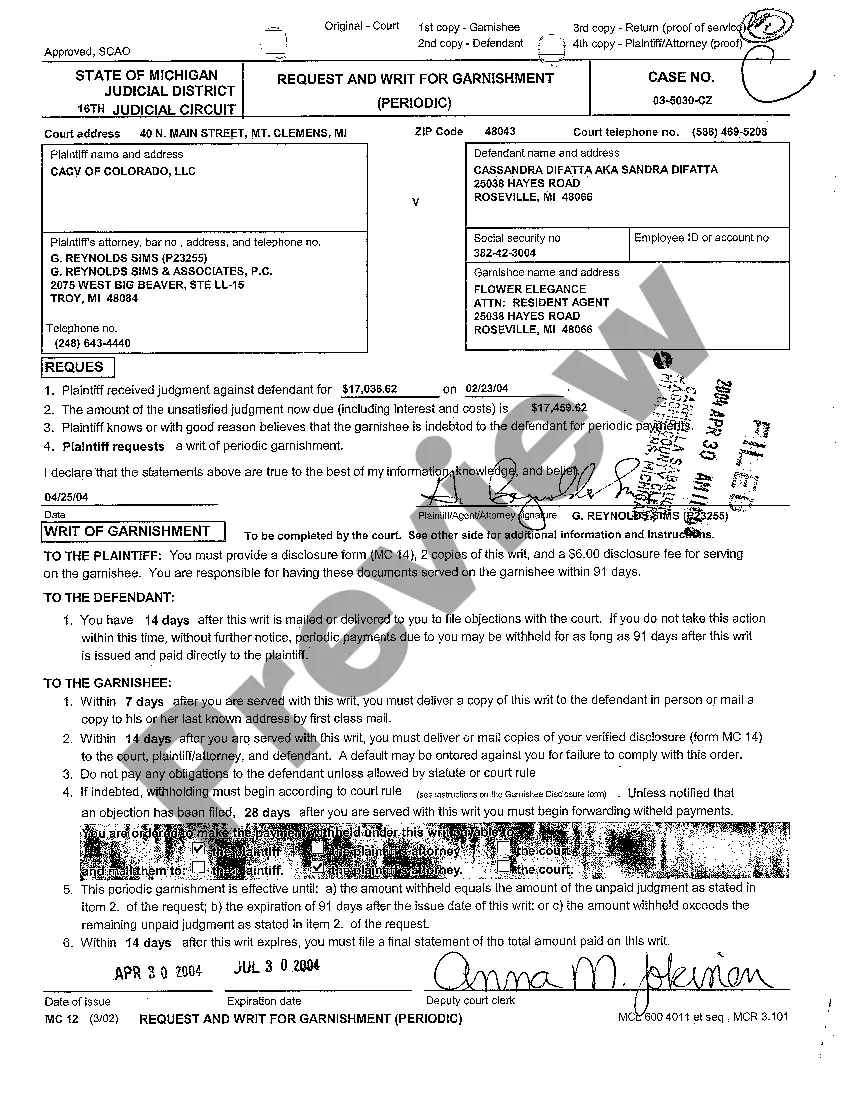

Ann Arbor, Michigan Request and Writ for Garnishment is a legal procedure that allows creditors to collect their debts from a debtor's wages or assets, ensuring the repayment of owed amounts. It is important to understand the requirements and procedures involved in this process to effectively navigate through the legal system. In Ann Arbor, Michigan, there are two types of Request and Writ for Garnishment: 1. Wage Garnishment: Wage garnishment is the most common type of garnishment. It allows creditors to collect a certain percentage of a debtor's income directly from their paycheck until the debt is fully satisfied. The creditor must obtain a court order for wage garnishment, which is then served to the debtor's employer. The employer deducts the specified amount from the debtor's wages and pays it directly to the creditor. 2. Non-Wage Garnishment: Non-wage garnishment is a broader category that encompasses garnishing a debtor's assets other than their wages. This includes bank accounts, tax refunds, rental income, or any other income sources. Similar to wage garnishment, a court order is necessary to initiate non-wage garnishment. The court order allows the creditor to freeze or collect funds directly from the debtor's accounts. It is important to note that garnishment procedures follow specific rules and limits set by both federal and state laws. In Ann Arbor, Michigan, the garnishment process is governed by the Michigan Court Rules and the Federal Consumer Credit Protection Act (CCPA), which outlines the maximum amount of wages that can be garnished. To initiate a Request and Writ for Garnishment in Ann Arbor, Michigan, creditors must follow these steps: 1. Obtain a judgment against the debtor: Before garnishment, the creditor must have a court judgment against the debtor, confirming the debt's validity. 2. File a Request and Writ for Garnishment: The creditor files a Request and Writ for Garnishment with the appropriate court in Ann Arbor, Michigan. This document includes details about the debtor, their employer or financial institution, and the amount to be garnished. 3. Serve the garnishment order: Once the court approves the garnishment request, the creditor must serve the garnishment order to the debtor's employer or financial institution. This notification outlines the amount to be deducted and the responsibilities of the garnishee. 4. Collect the garnished funds: The employer or financial institution deducts the specified amount from the debtor's wages or freezes the debtor's account and sends the funds directly to the creditor. The garnishment continues until the debt is satisfied or a court order terminates it. It is essential for both creditors and debtors in Ann Arbor, Michigan, to understand their rights and responsibilities regarding garnishment. Debtors have the right to challenge garnishment orders if they believe them to be invalid or if they are facing financial hardship. Creditors must adhere to legal procedures and limitations to ensure fair debt collection. Navigating the Ann Arbor, Michigan Request and Writ for Garnishment process can be complex. It is advisable to consult with a legal professional specializing in debt collection or seek free legal aid services to ensure proper compliance with the applicable laws and regulations.

Ann Arbor Michigan Request And Writ for Garnishment

Description

How to fill out Ann Arbor Michigan Request And Writ For Garnishment?

Take advantage of the US Legal Forms and gain instant accessibility to any form template you desire.

Our user-friendly website featuring a vast array of document samples makes it easy to locate and acquire nearly any form template you require.

You can download, complete, and sign the Ann Arbor Michigan Request And Writ for Garnishment within minutes rather than spending hours online searching for the correct template.

Using our library is an excellent way to enhance the security of your form submissions. Our skilled legal experts frequently evaluate all documents to ensure that the templates are suitable for a specific region and comply with current laws and regulations.

Initiate the download process. Click Buy Now and choose your preferred pricing plan. Next, register an account and complete your payment using a credit card or PayPal.

Save the document. Specify the format to receive the Ann Arbor Michigan Request And Writ for Garnishment and modify and complete, or sign it according to your specifications.

- How can you obtain the Ann Arbor Michigan Request And Writ for Garnishment.

- If you possess an account, simply Log In to your account. The Download option will be available on all the samples you view.

- Furthermore, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow these steps.

- Access the page with the form you require. Ensure it is the correct form: review its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find your desired form.

Form popularity

FAQ

Negotiating a garnishment settlement involves discussing your financial situation with the creditor to reach an agreement that works for both parties. Start by presenting your financial information honestly and proposing a reasonable amount or payment plan. In Ann Arbor, Michigan, utilizing resources like US Legal Forms can provide you with templates and advice to enhance your negotiation strategy.

Filling out a wage garnishment exemption requires you to identify your exempt income and any relevant financial circumstances. In Ann Arbor, Michigan, this may include certain benefits, such as social security or disability payments. Ensure that you attach the necessary documentation to support your claim and submit it to the court as instructed to protect your rights.

To write an objection letter for wage garnishment, clearly state your reasons for disputing the garnishment and provide any supporting documentation. In Ann Arbor, Michigan, ensure your letter is professional and addressed to the appropriate court or creditor. Use a confident and assertive tone to present your case effectively, and consider using US Legal Forms for templates and guidelines.

Answering a writ of garnishment involves understanding the specific instructions provided in the writ itself. In Ann Arbor, Michigan, you typically need to respond within a certain period, outlining why the garnishment should not proceed. Consulting with a legal professional or using resources like US Legal Forms can facilitate this process and ensure you cover all necessary points.

To fill out a challenge to garnishment form, start by gathering all relevant information related to the garnishment in Ann Arbor, Michigan. You will need to include your personal details, the details of the creditor, and the grounds for your challenge. Once completed, ensure you submit the form to the appropriate court and keep a copy for your records to track the status of your case.

Yes, you can challenge a garnishment. In Ann Arbor, Michigan, filing a request and writ for garnishment can provide a formal way to contest the garnishment. It's vital to understand your rights and the grounds for your challenge, which may include errors in the garnishment process or claiming exemptions. Seeking legal advice can help you navigate this process effectively.

Stopping wage garnishment quickly requires immediate action. You can file an Ann Arbor Michigan Request And Writ for Garnishment to challenge the garnishment or negotiate directly with the creditor for a settlement. Additionally, consider filing a motion to exempt certain funds or apply for a hardship claim if applicable. Using platforms like uslegalforms can streamline this process, providing you with the necessary forms and guidance to address garnishments effectively.

To file a motion to stop wage garnishment in Michigan, start by gathering all necessary documentation related to the garnishment case. You will need to submit an Ann Arbor Michigan Request And Writ for Garnishment form to the court, along with your motion and any supporting evidence. This motion typically argues the grounds on which you seek to halt the garnishment, such as financial hardship or errors in the garnishment process. Seeking legal advice may be beneficial to navigate this complex situation successfully.

A writ in Michigan is a court order that directs a third party to take action, such as seizing a debtor's assets or funds. When you file an Ann Arbor Michigan Request And Writ for Garnishment, the court will authorize the garnishment, allowing creditors to collect the owed amount from your wages or bank accounts. The process begins with a judgment in favor of the creditor, ensuring that the writ is legally enforceable. Therefore, understanding this process is essential to navigate financial obligations effectively.

Writing a letter to stop garnishment involves clearly stating your situation and providing any relevant documentation. Be sure to include your contact information, details about the original debt, and your reason for requesting the stop. With the help of uslegalforms, you can find templates and guidance for crafting an effective letter related to the Ann Arbor Michigan Request And Writ for Garnishment.