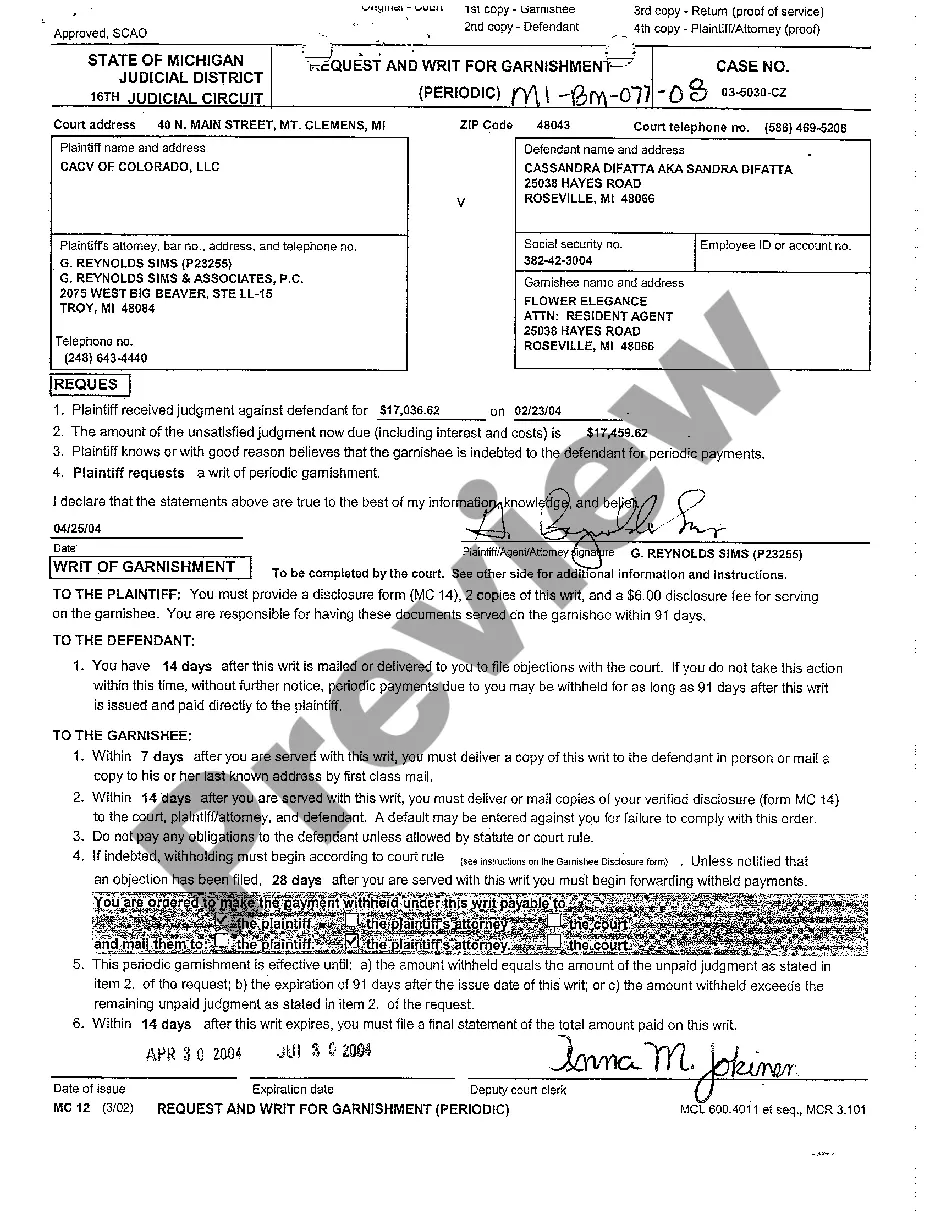

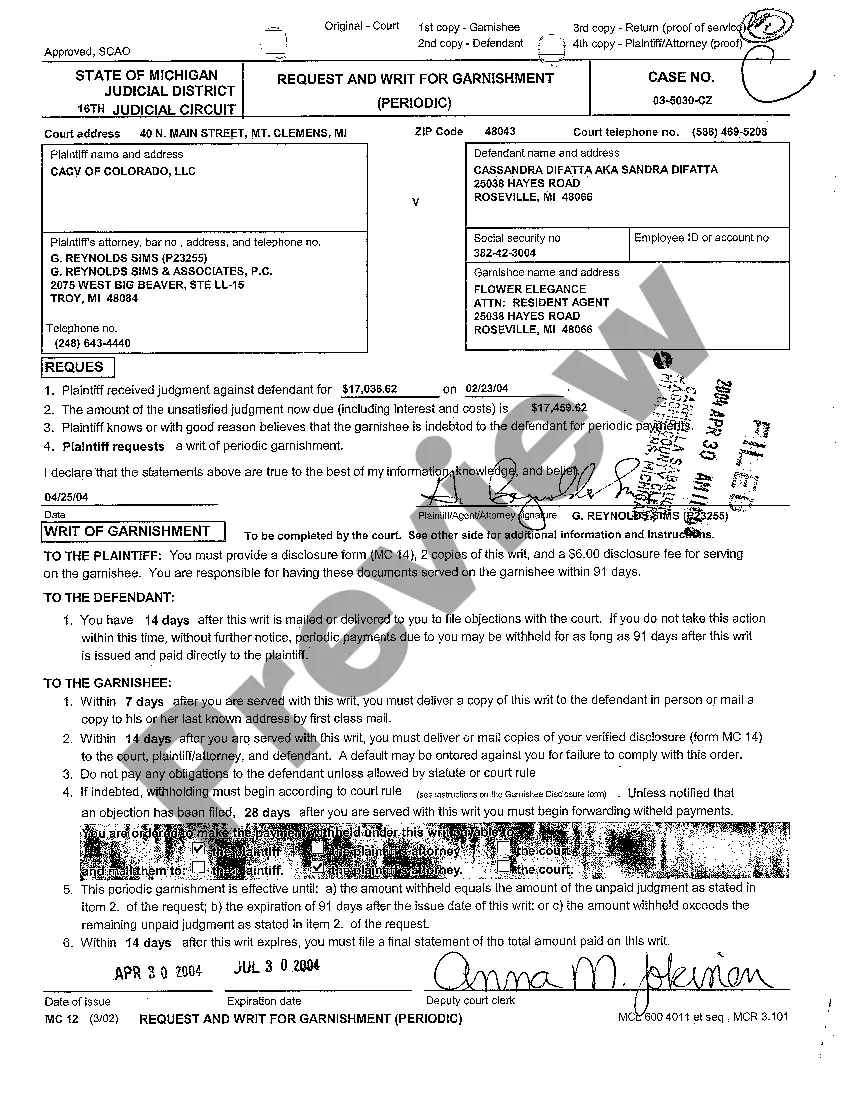

Oakland Michigan Request and Writ for Garnishment is a legal process used to collect unpaid debts from a debtor's wages or bank accounts. It involves obtaining a court order that allows a creditor to deduct a portion of the debtor's income or seize their assets until the debt is fully repaid. Here is a detailed description of the process: 1. Understanding Garnishment in Oakland County, Michigan: Garnishment is a legal tool available to creditors in Oakland County, Michigan, to recover outstanding debts. When all other attempts to collect a debt have failed, creditors can file a Request and Writ for Garnishment to initiate the garnishment process. 2. Filing the Request and Writ for Garnishment: To start the process, a creditor needs to file a Request and Writ for Garnishment with the appropriate court in Oakland County, Michigan. It's important to accurately complete all required forms and provide all necessary supporting documentation. This includes providing details about the debt, the debtor's information, and any other relevant information required by the court. 3. Serving the Request and Writ for Garnishment: Once filed, the court will issue the Writ of Garnishment, which must be served to the debtor's employer or bank. This notifies them of the court order requiring them to withhold part of the debtor's wages or freeze funds in the debtor's bank account to satisfy the debt. 4. Types of Garnishment in Oakland County, Michigan: In Oakland County, Michigan, there are several types of garnishment that can be initiated through the Request and Writ for Garnishment process. These include: — Wage Garnishment: This is the most common form of garnishment where a portion of the debtor's wages is withheld by the employer and sent directly to the creditor to pay off the debt. There are limits on the amount that can be garnished depending on the individual's income. — Bank Account Garnishment: This type of garnishment allows creditors to freeze funds in the debtor's bank account and collect the outstanding debt directly from the account. However, certain types of funds, such as Social Security or disability benefits, may be exempt from garnishment. 5. Disputing a Garnishment: Once a debtor receives a garnishment notice, they have the right to contest the garnishment in court. They can file a claim of exemption if they believe that their wages or assets are exempt from garnishment or if they have other valid reasons for disputing the debt. 6. Consequences of Garnishment: Garnishment can have significant consequences for debtors. It can lead to financial hardship and affect their ability to pay for necessities or meet other financial obligations. It is essential for debtors to seek legal advice and explore their options if facing garnishment. In summary, Oakland Michigan Request and Writ for Garnishment is a legal process used to collect outstanding debts from debtors. It involves filing the necessary paperwork with the court, serving the garnishment order to the employer or bank, and potentially garnishing wages or freezing bank accounts. There are various types of garnishment, including wage and bank account garnishment. Debtors have the right to dispute a garnishment and should seek legal advice to understand their options.

Oakland Michigan Request And Writ for Garnishment

Description

How to fill out Oakland Michigan Request And Writ For Garnishment?

Are you looking for a reliable and affordable legal forms provider to get the Oakland Michigan Request And Writ for Garnishment? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Oakland Michigan Request And Writ for Garnishment conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Oakland Michigan Request And Writ for Garnishment in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal paperwork online once and for all.