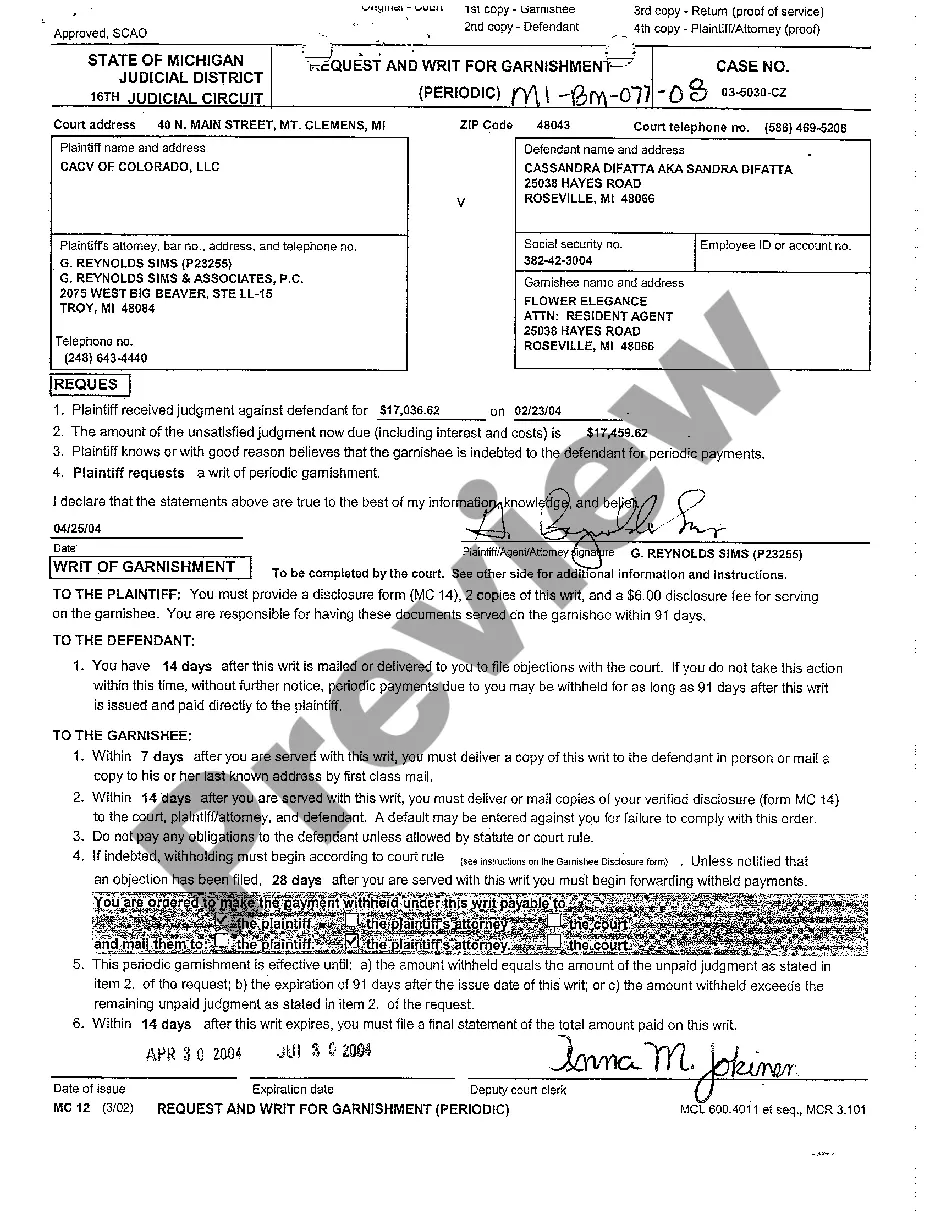

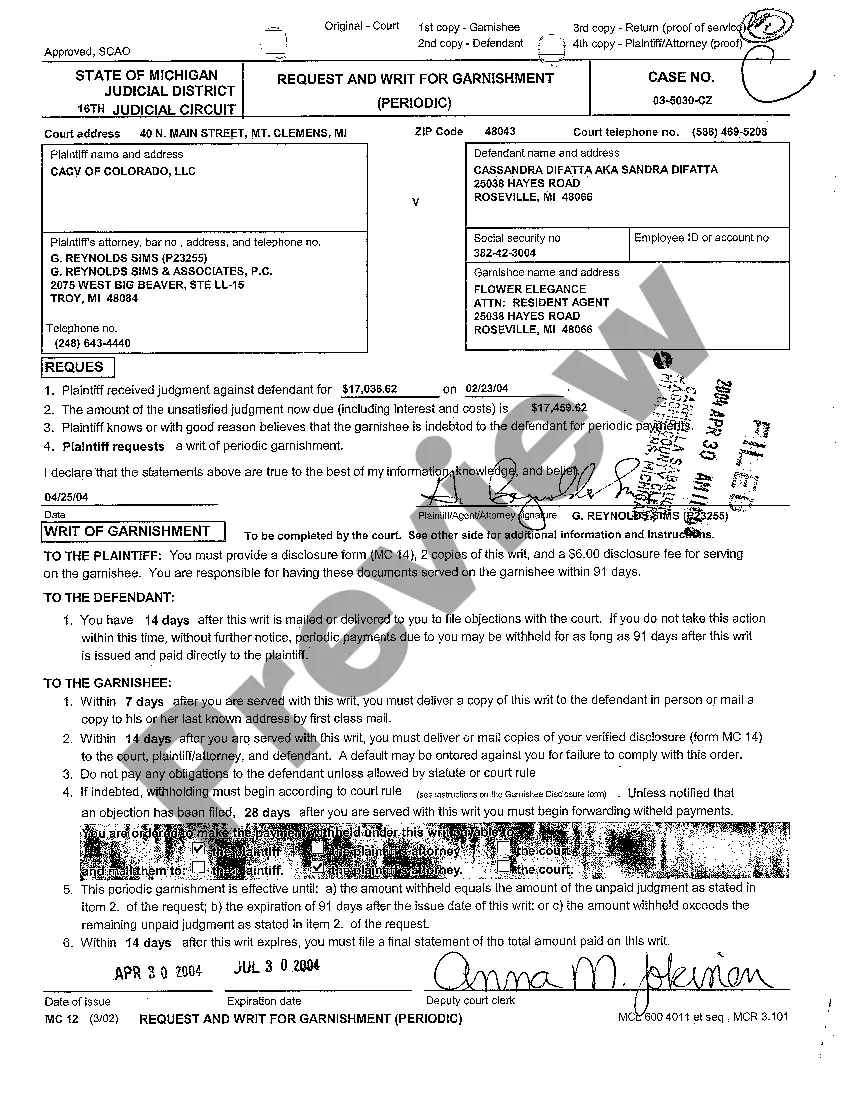

Keywords: Wayne Michigan, Request and Writ for Garnishment, types Introduction: The Wayne Michigan Request and Writ for Garnishment is a legal process that allows a creditor to collect outstanding debts from a debtor's income or assets. This court-authorized procedure can be initiated by creditors who have already obtained a judgment against the debtor. Understanding the different types of Wayne Michigan Request and Writ for Garnishment is essential for both creditors and debtors to navigate this legal framework effectively. Types of Wayne Michigan Request and Writ for Garnishment: 1. Earnings Garnishment: Earnings garnishment, also known as wage garnishment, involves collecting a portion of the debtor's income directly from their employer. Once a court approves the garnishment request, the employer is legally obligated to withhold the specified amount from the debtor's paycheck and remit it to the creditor, until the debt is fully satisfied. 2. Bank Account Garnishment: Bank account garnishment permits a creditor to collect debt directly from the debtor's bank account. Once a court grants the writ for garnishment, the creditor can freeze the debtor's bank account and withdraw the owed amount. It is essential for debtors to be aware of their rights regarding exempt funds, as certain funds may be protected from garnishment. 3. Property Garnishment: If a debtor does not have sufficient income or a bank account to garnish, creditors may opt for property garnishment. This type of garnishment involves seizing and liquidating the debtor's tangible assets, such as vehicles, real estate, or other valuable possessions, to satisfy the debt owed. 4. Tax Refund Garnishment: When a debtor is due to receive a tax refund, creditors can intercept the funds through tax refund garnishment. The state of Michigan applies this type of garnishment to collect unpaid debts, government fines, or child support obligations. It is important for debtors to address their outstanding debts promptly to avoid potential garnishment of their tax refund. 5. Student Loan Garnishment: For debtors who default on their federal student loans, the government has the right to initiate wage garnishment without a court order. The Department of Education can withhold a portion of the debtor's income or even their entire paycheck, making it crucial for individuals to explore alternative repayment options and avoid the default status. Conclusion: The Wayne Michigan Request and Writ for Garnishment is a crucial legal tool that allows creditors to collect outstanding debts. Understanding the various types of garnishment, including earnings, bank accounts, property, tax refunds, and student loans, is essential for both creditors and debtors to navigate the legal process effectively. Debtors should explore options to resolve their debts before facing potential garnishment, while creditors should follow legal procedures to ensure compliance and maximize debt recovery.

Wayne Michigan Request And Writ for Garnishment

State:

Michigan

County:

Wayne

Control #:

MI-BM-077-08

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Request And Writ for Garnishment

Keywords: Wayne Michigan, Request and Writ for Garnishment, types Introduction: The Wayne Michigan Request and Writ for Garnishment is a legal process that allows a creditor to collect outstanding debts from a debtor's income or assets. This court-authorized procedure can be initiated by creditors who have already obtained a judgment against the debtor. Understanding the different types of Wayne Michigan Request and Writ for Garnishment is essential for both creditors and debtors to navigate this legal framework effectively. Types of Wayne Michigan Request and Writ for Garnishment: 1. Earnings Garnishment: Earnings garnishment, also known as wage garnishment, involves collecting a portion of the debtor's income directly from their employer. Once a court approves the garnishment request, the employer is legally obligated to withhold the specified amount from the debtor's paycheck and remit it to the creditor, until the debt is fully satisfied. 2. Bank Account Garnishment: Bank account garnishment permits a creditor to collect debt directly from the debtor's bank account. Once a court grants the writ for garnishment, the creditor can freeze the debtor's bank account and withdraw the owed amount. It is essential for debtors to be aware of their rights regarding exempt funds, as certain funds may be protected from garnishment. 3. Property Garnishment: If a debtor does not have sufficient income or a bank account to garnish, creditors may opt for property garnishment. This type of garnishment involves seizing and liquidating the debtor's tangible assets, such as vehicles, real estate, or other valuable possessions, to satisfy the debt owed. 4. Tax Refund Garnishment: When a debtor is due to receive a tax refund, creditors can intercept the funds through tax refund garnishment. The state of Michigan applies this type of garnishment to collect unpaid debts, government fines, or child support obligations. It is important for debtors to address their outstanding debts promptly to avoid potential garnishment of their tax refund. 5. Student Loan Garnishment: For debtors who default on their federal student loans, the government has the right to initiate wage garnishment without a court order. The Department of Education can withhold a portion of the debtor's income or even their entire paycheck, making it crucial for individuals to explore alternative repayment options and avoid the default status. Conclusion: The Wayne Michigan Request and Writ for Garnishment is a crucial legal tool that allows creditors to collect outstanding debts. Understanding the various types of garnishment, including earnings, bank accounts, property, tax refunds, and student loans, is essential for both creditors and debtors to navigate the legal process effectively. Debtors should explore options to resolve their debts before facing potential garnishment, while creditors should follow legal procedures to ensure compliance and maximize debt recovery.

Free preview

How to fill out Wayne Michigan Request And Writ For Garnishment?

If you’ve already utilized our service before, log in to your account and save the Wayne Michigan Request And Writ for Garnishment on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Wayne Michigan Request And Writ for Garnishment. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!