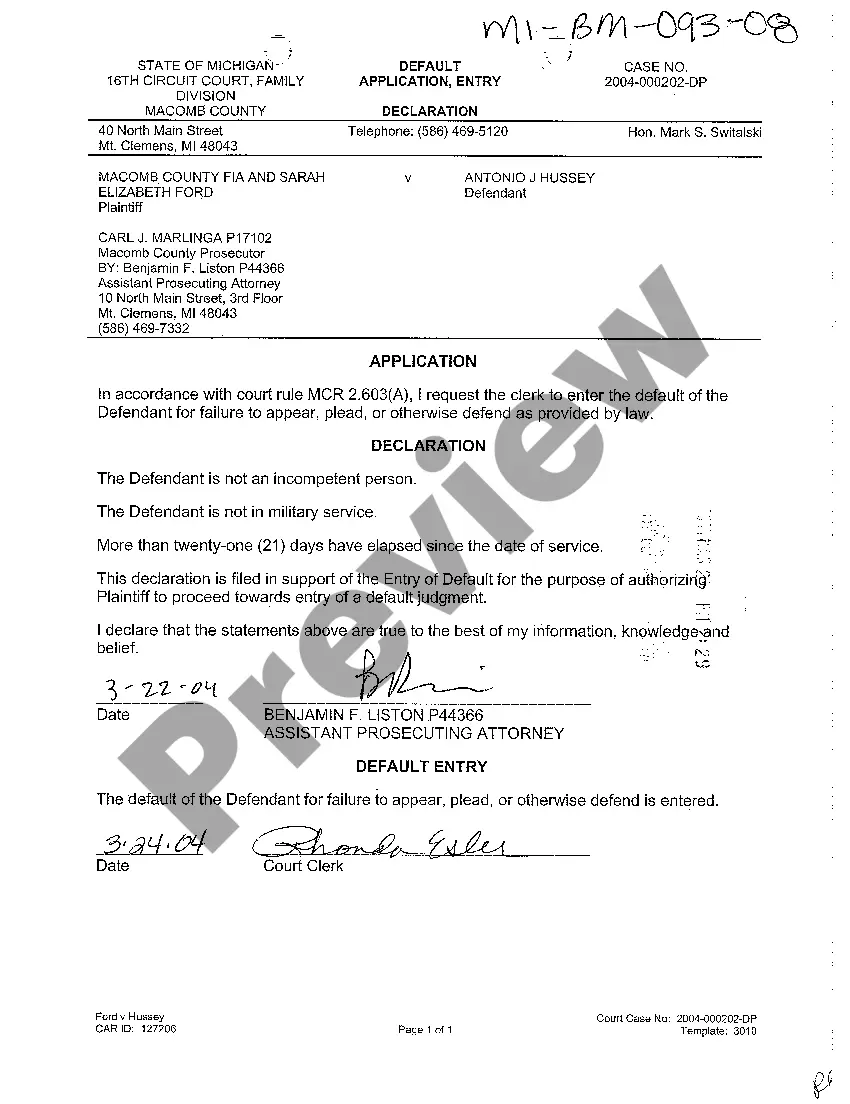

The Detroit Michigan Default Application, Entry is a standardized form used by individuals or entities in Detroit, Michigan, to initiate the process of defaulting on a loan or debt. It serves as an official request to the creditor or lender, notifying them of the debtor's inability to repay the borrowed funds as per the agreed terms. This application is an essential document when facing financial hardships and seeking debt relief. It provides detailed information about the debtor's financial situation, including income, expenses, assets, and liabilities. The debtor must accurately complete the form, disclosing all relevant financial information to ensure a fair evaluation of their financial circumstances. The Detroit Michigan Default Application, Entry helps creditor/lender understand the debtor's financial position and determine appropriate actions to be taken in response to the default. This may involve negotiating new repayment terms, restructuring the loan, offering a grace period, or entering into mediation or settlement discussions. There are various types of Detroit Michigan Default Application, Entry forms that may be used depending on the specific situation and the type of debt involved. For example: 1. Mortgage Default Application, Entry: Used when a borrower defaults on a mortgage loan, failing to make timely payments. The form helps assess the borrower's ability to meet future obligations and explore possible alternatives to foreclosure. 2. Student Loan Default Application, Entry: Specifically designed for individuals struggling with student loan repayment. It enables borrowers to apply for loan deferment, forbearance, or income-driven repayment plans to alleviate financial burden. 3. Credit Card Default Application, Entry: Used by individuals unable to make minimum monthly payments on their credit card debt. This form provides a detailed overview of the debtor's financial situation to negotiate new repayment terms, enroll in hardship programs or explore settlement options. 4. Personal Loan Default Application, Entry: Aims to address default situations relating to personal loans obtained from banks, credit unions, or other lending institutions. It assists in evaluating alternative repayment options and potential loan modifications. By using the appropriate Default Application, Entry form, debtors in Detroit, Michigan can formally communicate their financial distress to creditors or lenders and engage in a structured dialogue to resolve the default situation in the most suitable and mutually beneficial way possible.

Detroit Michigan Default Application, Entry

Description

How to fill out Detroit Michigan Default Application, Entry?

Do you need a trustworthy and affordable legal forms supplier to get the Detroit Michigan Default Application, Entry? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Detroit Michigan Default Application, Entry conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is intended for.

- Restart the search if the form isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Detroit Michigan Default Application, Entry in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online for good.