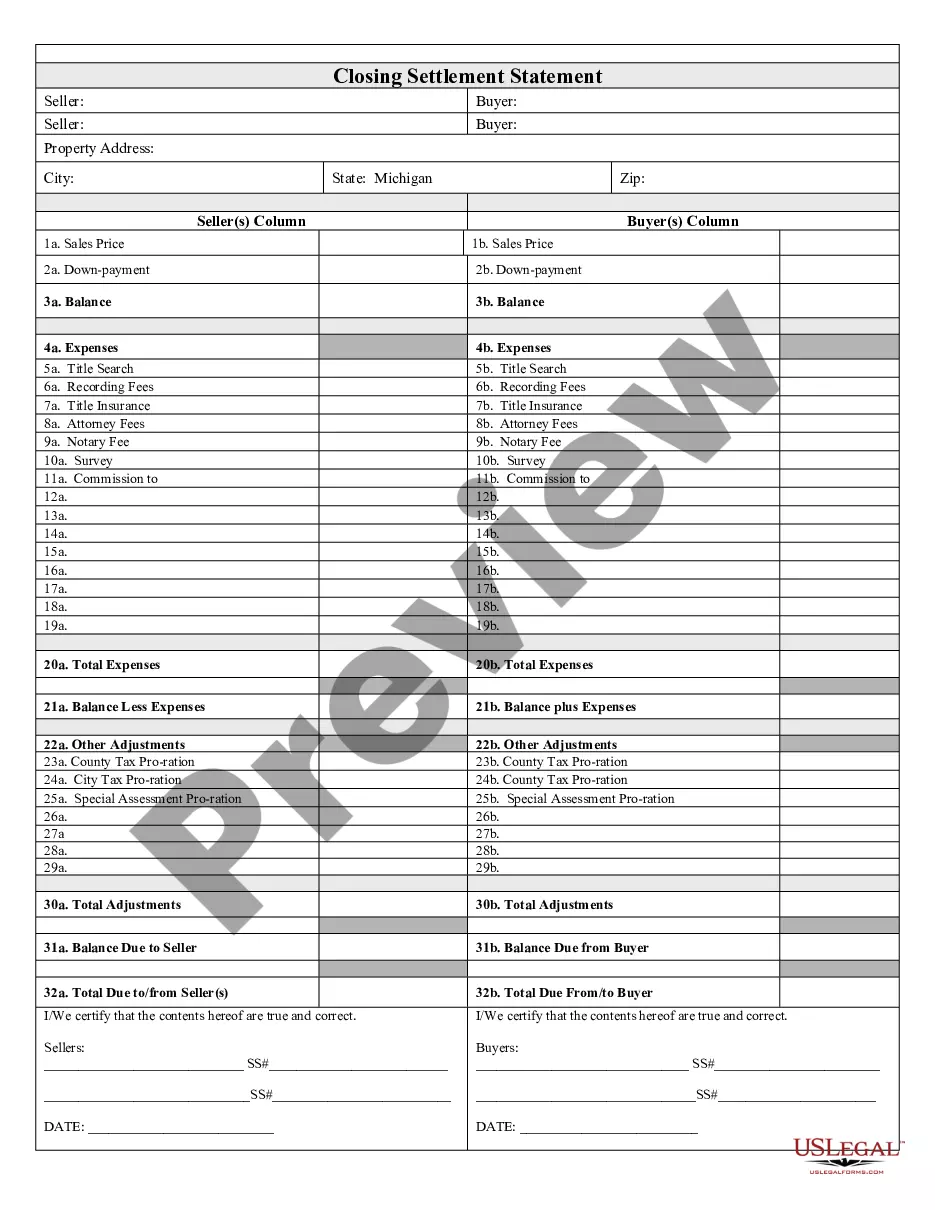

Grand Rapids Michigan Closing Statement

Description

How to fill out Michigan Closing Statement?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous website featuring thousands of document templates streamlines the process of locating and acquiring nearly any document template you seek.

You can quickly download, complete, and validate the Grand Rapids Michigan Closing Statement in a matter of minutes instead of spending hours online trying to find a suitable template.

Using our catalog is a fantastic method to enhance the security of your document submission.

The Download button will be available on all the documents you access. Furthermore, you can retrieve all previously saved files under the My documents section.

If you have not registered an account yet, follow the instructions below.

- Our expert attorneys routinely examine all the documents to ensure that the templates are suitable for a specific state and comply with updated laws and regulations.

- How can you acquire the Grand Rapids Michigan Closing Statement.

- If you possess a profile, simply Log In to your account.

Form popularity

FAQ

To become a real estate agent in Michigan, you must complete specific educational and licensing requirements. This includes completing a certain number of hours of approved real estate courses and passing the state exam. Once licensed, agents help individuals through the buying and selling process, guiding them in matters related to the Grand Rapids Michigan Closing Statement and providing essential advice.

Michigan operates as a title state, meaning that title companies typically handle the closing process and prepare the Grand Rapids Michigan Closing Statement. Real estate attorneys may not be necessary for the transaction, but their involvement can still add value, particularly if you face complicated legal hurdles. Understanding this distinction can help you choose the right professionals for your real estate journey.

While it is not required to hire a real estate attorney in Michigan, having one can simplify your transaction and ensure all documents related to your Grand Rapids Michigan Closing Statement are accurate. A real estate attorney can offer legal advice, review contracts, and represent you during closing. Their expertise helps prevent potential issues that may arise, making the process smoother for you.

To cancel your water service in Grand Rapids, Michigan, contact the Grand Rapids water department directly. You may need to provide your account details and confirm your request in writing. Completing this process ensures your final charges are reflected on your Grand Rapids Michigan Closing Statement, thus preventing you from getting billed after your cancellation. Make sure to follow up to ensure the cancellation is processed.

Filing proof of service in Michigan involves submitting documents to the court that confirm you have served legal papers to the necessary parties. You can use forms available through the Michigan state website or legal platforms like uslegalforms to simplify the process. Accurate filing helps ensure your Grand Rapids Michigan Closing Statement is valid and legally sound. Always keep copies of your proof for your records.

To submit overdue tax returns for the city of Grand Rapids, Michigan, mail them to the City Treasurer’s office. Ensure you include all necessary documentation with your return to avoid delays. Proper mailing helps ensure your Grand Rapids Michigan Closing Statement reflects your tax status accurately. Confirm the correct address on the official city website to avoid mistakes.

Yes, if you live or work in Grand Rapids, Michigan, you are required to file city taxes. The city assesses taxes based on income earned within its limits. Filing your taxes accurately impacts your Grand Rapids Michigan Closing Statement, ensuring it reflects your financial obligations correctly. Stay informed about deadlines and requirements to avoid penalties.

If you are mailing your IRS tax return from Michigan, the address varies based on whether you are including a payment. Generally, send it to IRS, P.O. Box 931100, Louisville, KY 40293-1100, if you are not enclose. Your Grand Rapids Michigan Closing Statement may offer guidelines on taxes owed or credits applicable, aiding you in accurate submissions.

The mailing address for your Michigan state tax return depends on whether you are sending a payment. For most taxpayers, the address is Michigan Department of Treasury, P.O. Box 30199, Lansing, MI 48909-7699. Verify your Grand Rapids Michigan Closing Statement to ensure you have the correct forms and address.

Yes, you can request Michigan tax forms to be mailed to you. Simply contact the Michigan Department of Treasury or visit their website to find more resources. Having the Grand Rapids Michigan Closing Statement on hand can simplify the process by providing context for your tax situation.