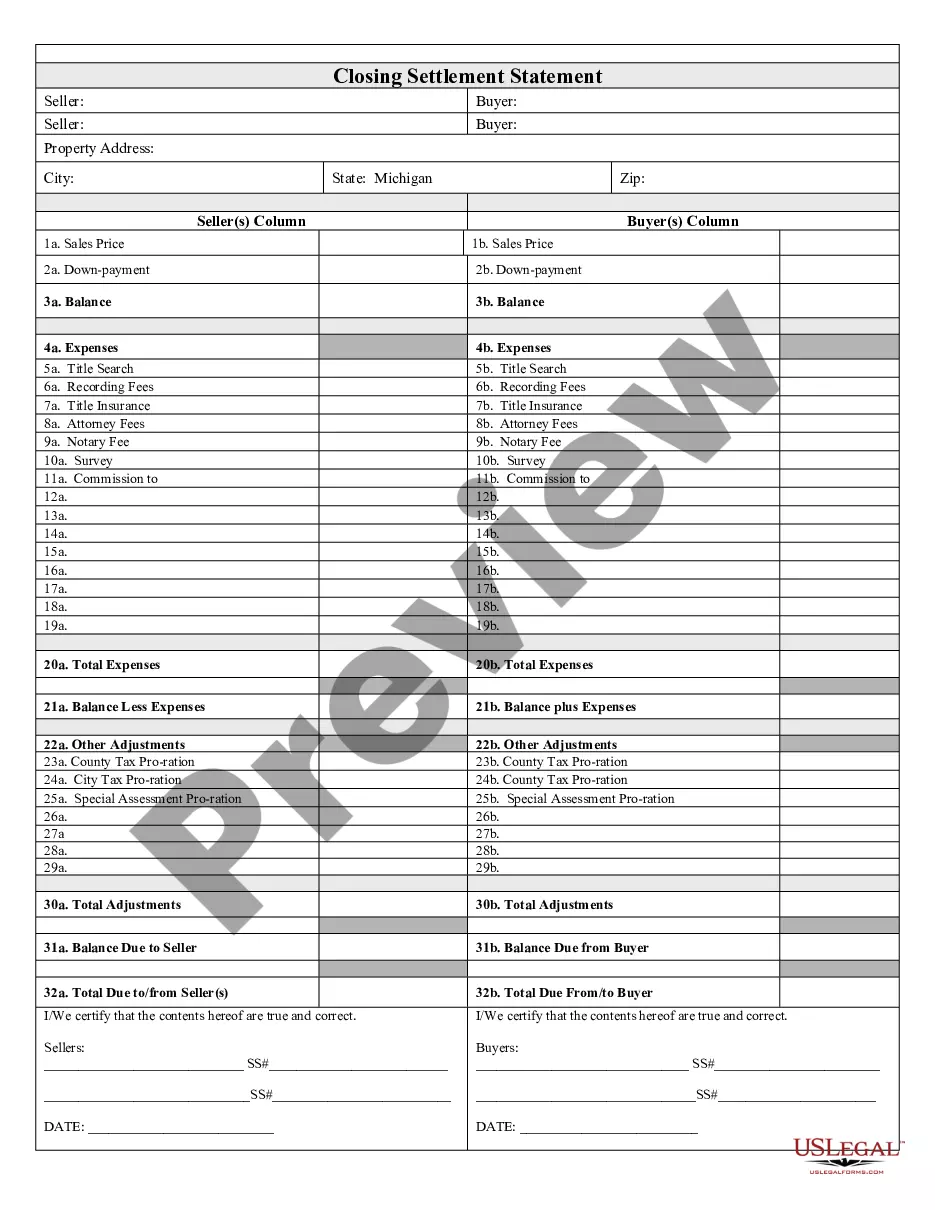

Lansing Michigan Closing Statement

Description

How to fill out Michigan Closing Statement?

Finding authentic templates related to your regional legislation can be difficult unless you access the US Legal Forms repository.

It’s a virtual compilation of over 85,000 legal documents catering to both personal and professional requirements along with various real-life scenarios.

All the forms are correctly classified by usage area and jurisdiction, so finding the Lansing Michigan Closing Statement becomes as straightforward as 1-2-3.

Maintaining organized documents that adhere to legal standards is of utmost significance. Take advantage of the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction stipulations.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the proper one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

To close an entity in Michigan, you must file dissolution documents with the Michigan Department of Licensing and Regulatory Affairs. Depending on the type of business entity, the required forms may vary. Additionally, settling your tax accounts before dissolution is critical, particularly when implementing a Lansing Michigan Closing Statement to ensure all financial matters are resolved.

To close your Michigan sales tax account, you need to submit a final sales tax return. This process involves reporting your final sales and providing payment for any outstanding taxes. Once the return is processed, the state will officially close your account, an important step prior to finalizing your Lansing Michigan Closing Statement.

Yes, in Michigan, a sales tax license does expire. Generally, the expiration is set to occur every three years. However, it’s crucial to note that failing to file your sales tax returns can lead to the revocation of your license. This means you should keep track of your compliance to ensure your sales tax license remains active, especially when preparing your Lansing Michigan Closing Statement.

Closing a business in Michigan requires several steps, starting with informing the Michigan Department of Licensing and Regulatory Affairs. You’ll need to file the appropriate dissolution forms and settle any outstanding taxes. Ensure every aspect is covered, including your Lansing Michigan Closing Statement, to avoid future liabilities. Uslegalforms can guide you through the necessary documentation and legal requirements.

In Michigan, city tax returns are typically required if you earn income within a city that imposes a local income tax. The specific cities have different rules, so it's essential to check where you're generating income. Your Lansing Michigan Closing Statement will support your understanding of any additional city taxes owed. Uslegalforms can help you navigate these local requirements effectively.

To close your Michigan withholding account, you need to submit a written request to the Michigan Department of Treasury. Make sure to include your account number and the reason for closure. Closing this account properly ensures your tax filings align with your Lansing Michigan Closing Statement. If you need guidance, uslegalforms provides templates and resources to assist you.

You must file a Michigan state tax return if you reside or earn income in Michigan. Even if your income is below certain thresholds, filing a return can be beneficial. Understanding the role of your Lansing Michigan Closing Statement in your overall tax filing can make this process clearer. For assistance, consider leveraging uslegalforms to simplify your filing experience.

To file Form 163 in Michigan, first download the form from the Michigan Department of Treasury website. After completing the form with accurate information, you can mail it to the appropriate address specified on the form. This form relates to reports on corporate income tax, which may affect your Lansing Michigan Closing Statement. Utilizing uslegalforms can streamline this process and ensure accuracy.

If you earn income from sources outside of Michigan while residing in Lansing, you may need to file an out-of-state tax return. Typically, this applies if you worked in another state. To ensure compliance, check the specific tax rules in the state where you generated income. Understanding the Lansing Michigan Closing Statement helps clarify your tax requirements.

The final closing statement is usually prepared by the closing agent, often associated with the title company or your lending institution. In Lansing Michigan, this professional is responsible for compiling all relevant financial details of the transaction. This ensures accuracy and adherence to regulations, providing you with a trustworthy record. Engaging with platforms like uslegalforms can help you streamline this process, ensuring your closing statement is accurate and comprehensive.