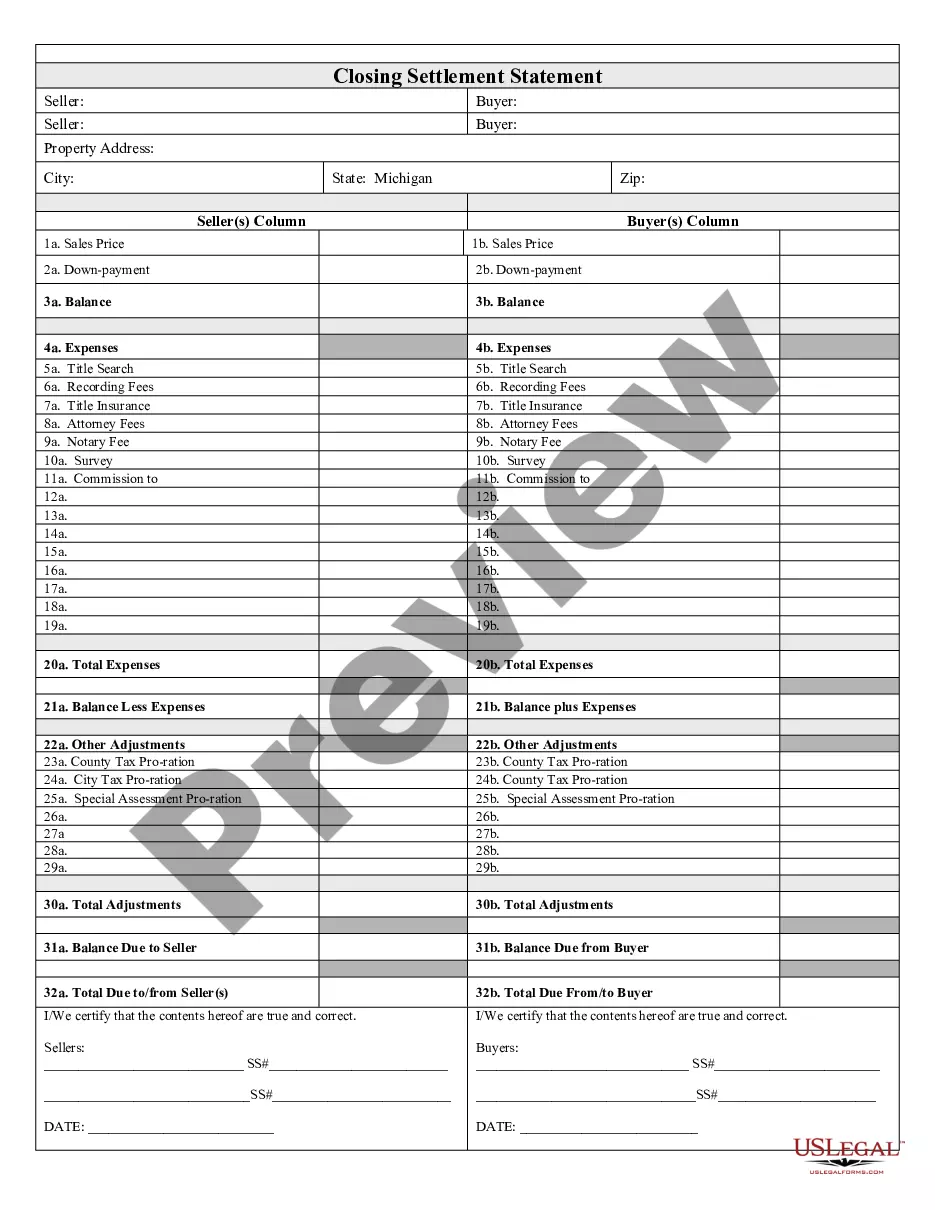

The Oakland Michigan Closing Statement is an important document typically used in real estate transactions in Oakland County, Michigan. This document serves as a final summary of the financial aspects, terms, and conditions of the transaction between the buyer and the seller. The purpose of the Oakland Michigan Closing Statement is to outline all the expenses and payments involved in the real estate deal, ensuring that both parties have a clear understanding of their financial obligations. It serves as a comprehensive record of the property's purchase price, the loan amount if applicable, and any additional costs such as property taxes, insurance, and fees associated with the closing process. The Oakland Michigan Closing Statement includes various crucial components such as: 1. Purchase Price: This section outlines the agreed-upon price at which the property is being sold. 2. Loan Amount: If the purchase is being financed with a mortgage, this section details the loan amount approved by the lender. 3. Prorated Expenses: Here, prorated expenses such as property taxes, utilities, and homeowner association fees, if applicable, are allocated between the buyer and the seller based on the closing date. 4. Closing Costs and Fees: This section lists all the fees associated with the closing process, including attorney fees, title insurance fees, appraisal fees, and any other expenses that need to be paid to complete the transaction. 5. Escrow Account: If an escrow account is involved, the statement will include details about any funds held in escrow, such as earnest money deposits or prepaid expenses. 6. Credits and Adjustments: Any agreed-upon credits or adjustments, such as repairs or improvements made by the seller, are detailed in this section. 7. Final Amount Due: The closing statement calculates the final amount due from the buyer and the amount to be received by the seller. It ensures that both parties are aware of their financial responsibilities and the exact amount needed to close the deal. Different types of Oakland Michigan Closing Statements may include variations based on the specific terms and conditions of each real estate transaction. These variations may arise due to factors such as the presence of multiple buyers or sellers, involvement of additional contingencies, inclusion of special provisions, or unique contractual agreements. Despite these potential differences, the core purpose and structure of the Oakland Michigan Closing Statement remain consistent.

Oakland Michigan Closing Statement

Description

How to fill out Oakland Michigan Closing Statement?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any legal background to create such papers cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Oakland Michigan Closing Statement or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Oakland Michigan Closing Statement in minutes employing our reliable platform. In case you are presently a subscriber, you can go on and log in to your account to download the needed form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Oakland Michigan Closing Statement:

- Ensure the template you have found is specific to your area because the regulations of one state or area do not work for another state or area.

- Review the form and go through a short description (if provided) of cases the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Oakland Michigan Closing Statement as soon as the payment is completed.

You’re all set! Now you can go on and print the form or fill it out online. If you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.