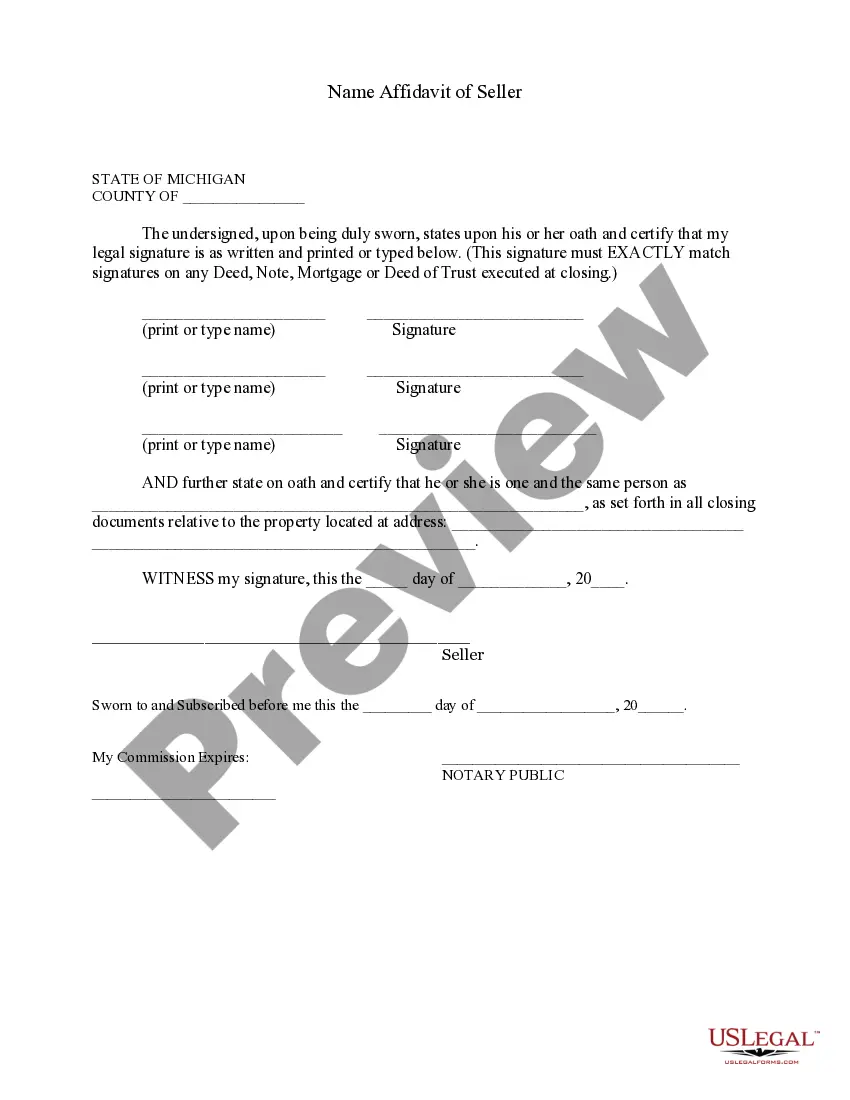

The Detroit Michigan Name Affidavit of Seller is a legal document that is commonly used during real estate transactions in the city of Detroit, Michigan. It serves as a declaration by the seller of the property, affirming their legal name and any alternate names or variations they may have used in the past. This affidavit is crucial as it helps ensure accurate and reliable documentation during the transfer of property ownership. It aims to prevent any confusion or disputes regarding the seller's identity and provides a level of transparency and accountability throughout the transaction process. Keywords: Detroit Michigan, Name Affidavit of Seller, real estate transactions, legal document, property ownership, seller's identity, transparency, accountability. There are typically no specific subtypes of Detroit Michigan Name Affidavit of Seller, as the document serves a singular purpose, i.e., verifying and confirming the seller's correct name. However, it is essential to note that different states or jurisdictions may have slight variations or requirements when it comes to name affidavits. Therefore, it is crucial to consult the specific legal guidelines and requirements of Detroit, Michigan, when preparing the Name Affidavit of Seller for a property transaction in the city.

Detroit Michigan Name Affidavit of Seller

Description

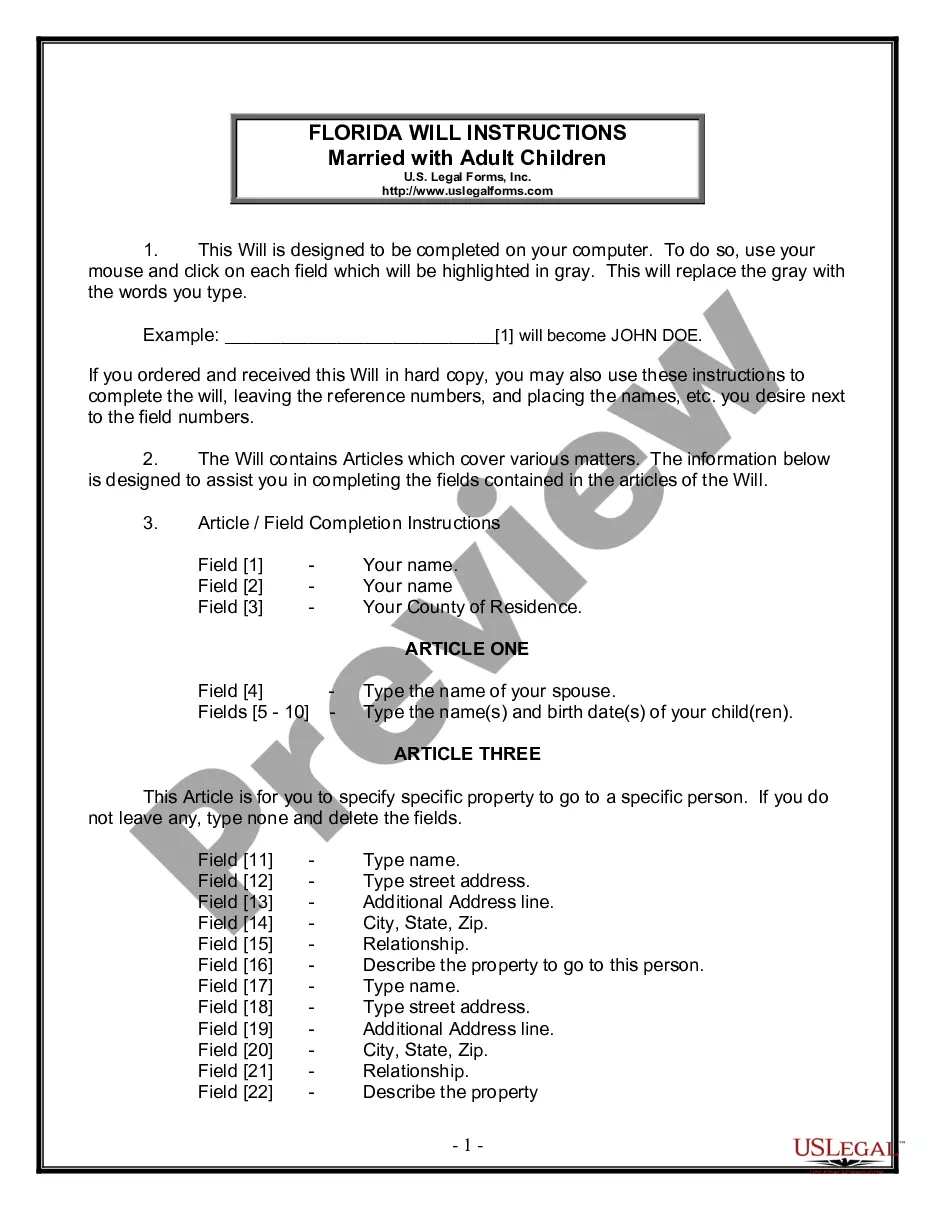

How to fill out Detroit Michigan Name Affidavit Of Seller?

If you have previously utilized our service, Log Into your account and download the Detroit Michigan Name Affidavit of Seller onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment schedule.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You enjoy continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you want to use it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or business needs!

- Make certain you’ve located a suitable document. Review the description and use the Preview option, if available, to verify if it aligns with your needs. If it does not fit, utilize the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Set up an account and complete the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Detroit Michigan Name Affidavit of Seller. Select the file format for your document and save it onto your device.

- Fill out your sample. Print it or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

Transfer Tax (Local Treasurer's Office): this tax is for the barter, sale, or any other method of ownership or title of real property transfer, at the maximum rate of 50% of 1%, or 75% of 1% in cities and municipalities within Metro Manila, of a property's worth.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

You can find out if transfer taxes will be due in the Do-It-Yourself Quitclaim Deed (after Divorce) tool. If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

MICHIGAN REAL ESTATE TRANSFER TAX The tax shall be upon the person who is the seller or the grantor. In the case of an exchange of two properties the deeds transferring title to each are subject to tax, and in each case shall be computed on the basis of the actual value of the property conveyed.

Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer.

Getting the name changed on your deeds is an easy process and you do not need to involve a solicitor. Generally there is no fee to pay either. You simply need to send a letter to the Land Registry office requesting the name change, together with either the original or a certified copy of your marriage certificate.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.