The Detroit Michigan Non-Foreign Affidavit Under IRC 1445 is a legal document that serves to identify the seller's tax status in relation to the sale of real property located in Detroit, Michigan. This affidavit is required under the Internal Revenue Code (IRC) Section 1445, which pertains to withholding tax on dispositions of U.S. real property interests by foreign persons. The purpose of this affidavit is to certify that the seller of the property is not a foreign person or entity, aiming to relieve the buyer or the withholding agent responsible for ensuring compliance with the IRS withholding requirements from the obligation of withholding a portion of the sale proceeds as tax. The affidavit must be completed accurately and truthfully, as any false statements can lead to severe penalties. There are different types of Detroit Michigan Non-Foreign Affidavit Under IRC 1445 based on the seller's individual circumstances. These types might include: 1. Individual Non-Foreign Affidavit: Used when the seller is an individual and not a foreign person as defined by the IRC. 2. Corporate Non-Foreign Affidavit: Applicable when the seller is a corporation or a business entity not considered a foreign person under IRC standards. 3. Partnership Non-Foreign Affidavit: Utilized when the seller is a partnership and meets the criteria for non-foreign status. 4. Trust Non-Foreign Affidavit: Pertinent if the seller is a trust and qualifies as non-foreign per the IRC regulations. Each type of affidavit will require specific information relevant to the particular seller's circumstances to establish their non-foreign status. This may include the seller's name, address, taxpayer identification number (TIN), and a declaration regarding their U.S. residency or non-foreign status. Additionally, supporting documentation, such as copies of passports, residency cards, or tax returns, may be required to substantiate the seller's claim. The completed affidavit should be signed and notarized by the seller, acknowledging that the information provided is accurate. Subsequently, the buyer or the withholding agent will retain this affidavit as documentation to demonstrate the seller's non-foreign status, relieving them of the withholding obligations outlined in IRC Section 1445. It is crucial to consult with legal professionals or tax experts to ensure compliance with the relevant laws and regulations governing real estate transactions and to ascertain the correct type of non-foreign affidavit required for a particular situation in Detroit, Michigan.

Detroit Michigan Non-Foreign Affidavit Under IRC 1445

Description

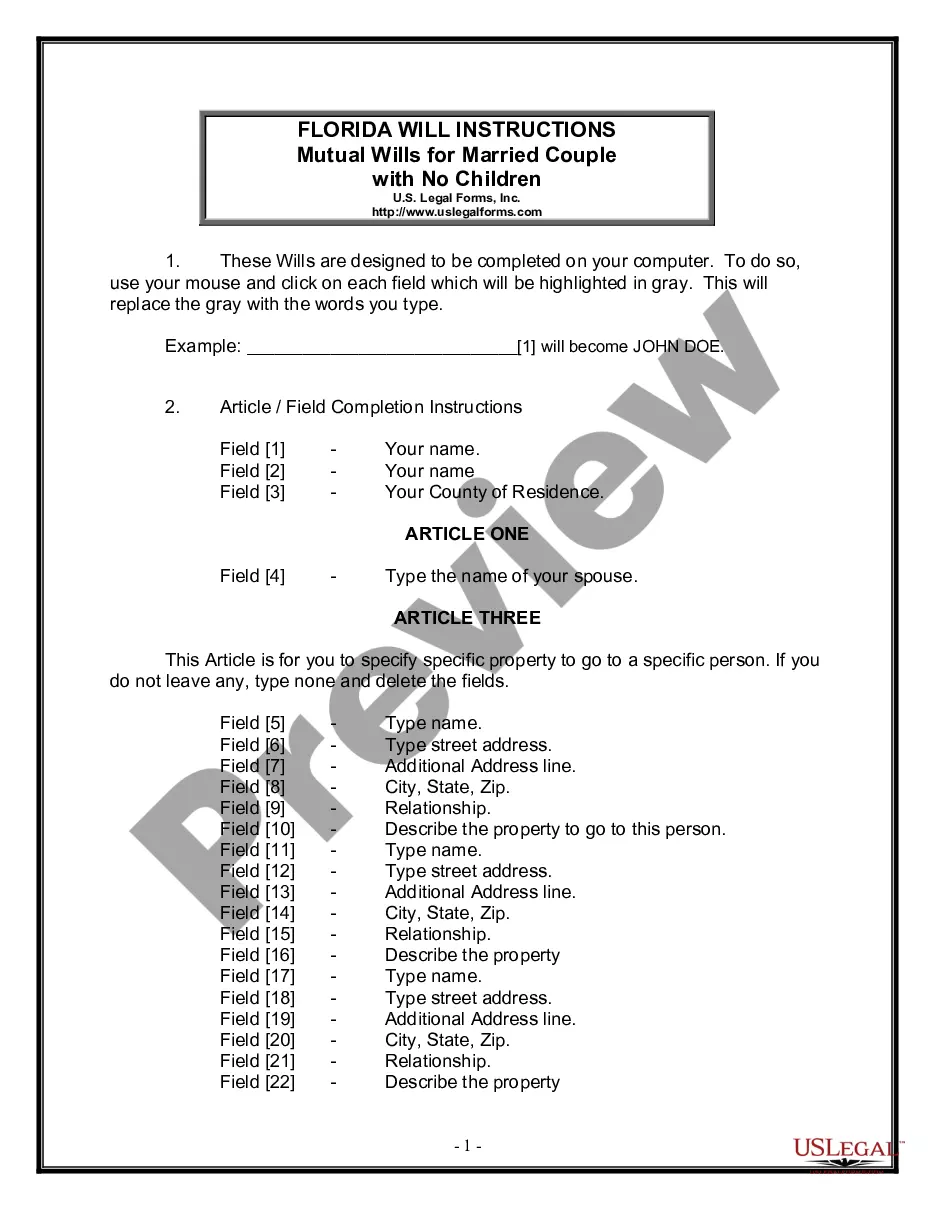

How to fill out Detroit Michigan Non-Foreign Affidavit Under IRC 1445?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Detroit Michigan Non-Foreign Affidavit Under IRC 1445 becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Detroit Michigan Non-Foreign Affidavit Under IRC 1445 takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Detroit Michigan Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!