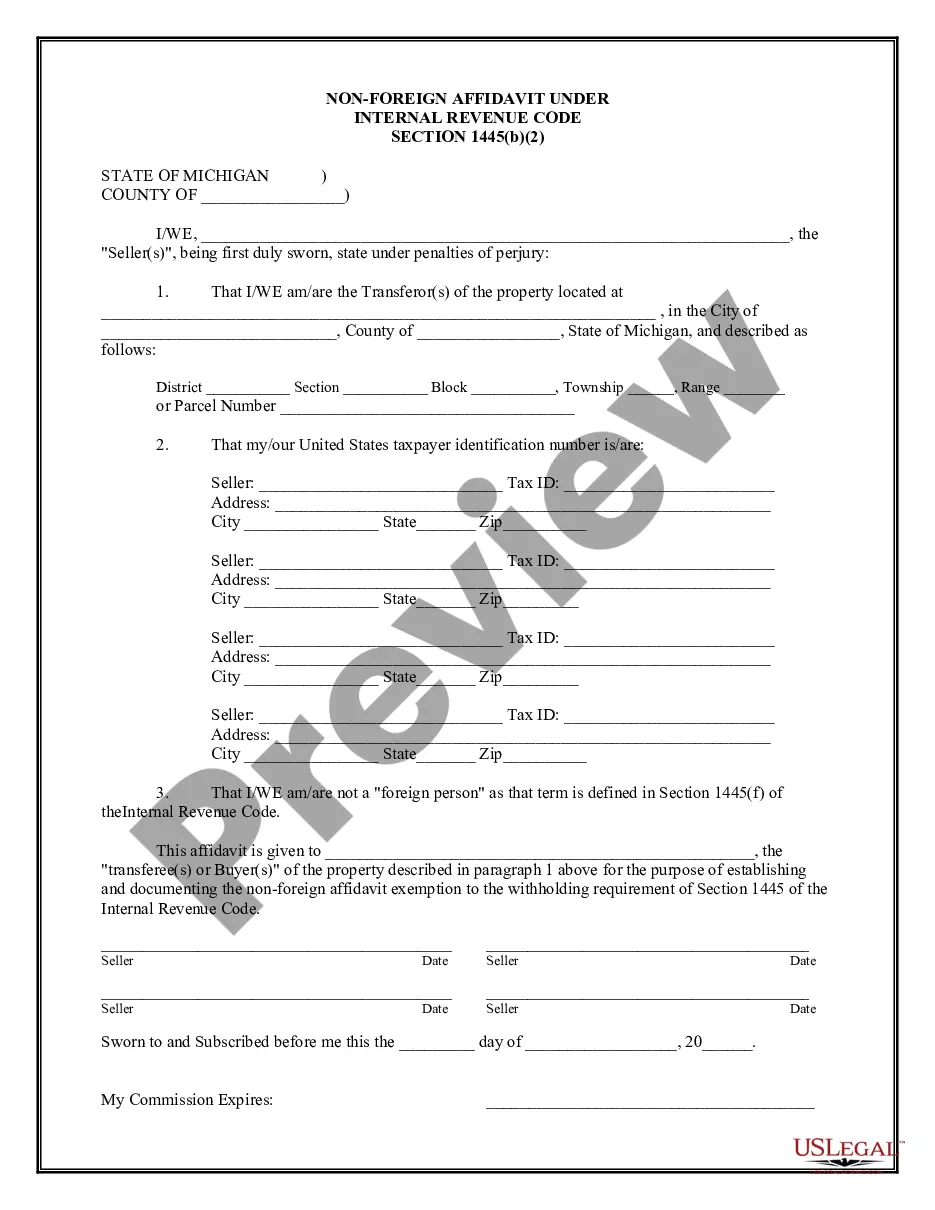

A Lansing Michigan Non-Foreign Affidavit Under IRC 1445 is a legal document that confirms an individual's non-foreign status regarding the sale or transfer of real property in the United States. This affidavit is required under the Internal Revenue Code (IRC) section 1445, which mandates withholding tax on the disposition of a U.S. real property interest in a foreign person. The Lansing Michigan Non-Foreign Affidavit Under IRC 1445 is specifically applicable to individuals involved in real estate transactions in Lansing, Michigan. It serves as an assurance to the Internal Revenue Service (IRS) that the seller or transferee is not a foreign person, thus exempting them from the withholding tax requirement. Keywords: Lansing Michigan, Non-Foreign Affidavit, IRC 1445, real property, United States, legal document, sale, transfer, non-foreign status, Internal Revenue Code, withholding tax, real estate transactions, Internal Revenue Service, seller, transferee. In Lansing, Michigan, there may be different types of Non-Foreign Affidavits under IRC 1445, depending on the specific transaction or circumstances. Some possible variations could include: 1. Individual Non-Foreign Affidavit: This type of affidavit is completed by an individual who is selling or transferring real property in Lansing, Michigan, to declare their non-foreign status. The affidavit affirms their U.S. residency or non-foreign status per IRC 1445 requirements. 2. Trust or Estate Non-Foreign Affidavit: In cases where a trust or estate entity is involved in a real estate transaction in Lansing, Michigan, this affidavit is completed by the trustee or executor representing the trust or estate. It ensures compliance with IRC 1445 regulations by confirming the non-foreign status of the trust or estate. 3. Partnership or Corporation Non-Foreign Affidavit: When a partnership or corporation participates in a real property sale or transfer in Lansing, Michigan, the designated representative completes this affidavit. It verifies the non-foreign status of the partnership or corporation, as required by IRC 1445. 4. Foreign Person Affidavit: Although not directly related to the "Non-Foreign Affidavit under IRC 1445," it is worth mentioning that a foreign person involved in a Lansing, Michigan, real estate transaction may be required to complete a specific affidavit for tax purposes. This affidavit aims to determine the correct amount of withholding tax to be imposed on the transaction. Please note that the availability and specific requirements of these affidavits may vary depending on local regulations and the individual circumstances of the real estate transaction in Lansing, Michigan. It is advisable to consult legal professionals or tax experts to ensure compliance with all applicable laws and regulations.

Lansing Michigan Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Lansing Michigan Non-Foreign Affidavit Under IRC 1445?

If you are searching for a valid form template, it’s impossible to find a more convenient place than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can get a huge number of templates for organization and personal purposes by categories and states, or keywords. Using our high-quality search option, getting the most up-to-date Lansing Michigan Non-Foreign Affidavit Under IRC 1445 is as elementary as 1-2-3. Additionally, the relevance of each record is proved by a group of professional attorneys that regularly review the templates on our website and revise them in accordance with the most recent state and county regulations.

If you already know about our system and have a registered account, all you need to get the Lansing Michigan Non-Foreign Affidavit Under IRC 1445 is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the sample you want. Look at its description and utilize the Preview feature (if available) to explore its content. If it doesn’t meet your needs, use the Search field at the top of the screen to get the proper file.

- Affirm your selection. Select the Buy now option. Next, pick your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the obtained Lansing Michigan Non-Foreign Affidavit Under IRC 1445.

Each and every template you save in your profile has no expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an additional duplicate for enhancing or printing, feel free to come back and download it once more whenever you want.

Make use of the US Legal Forms professional collection to gain access to the Lansing Michigan Non-Foreign Affidavit Under IRC 1445 you were seeking and a huge number of other professional and state-specific templates on one platform!