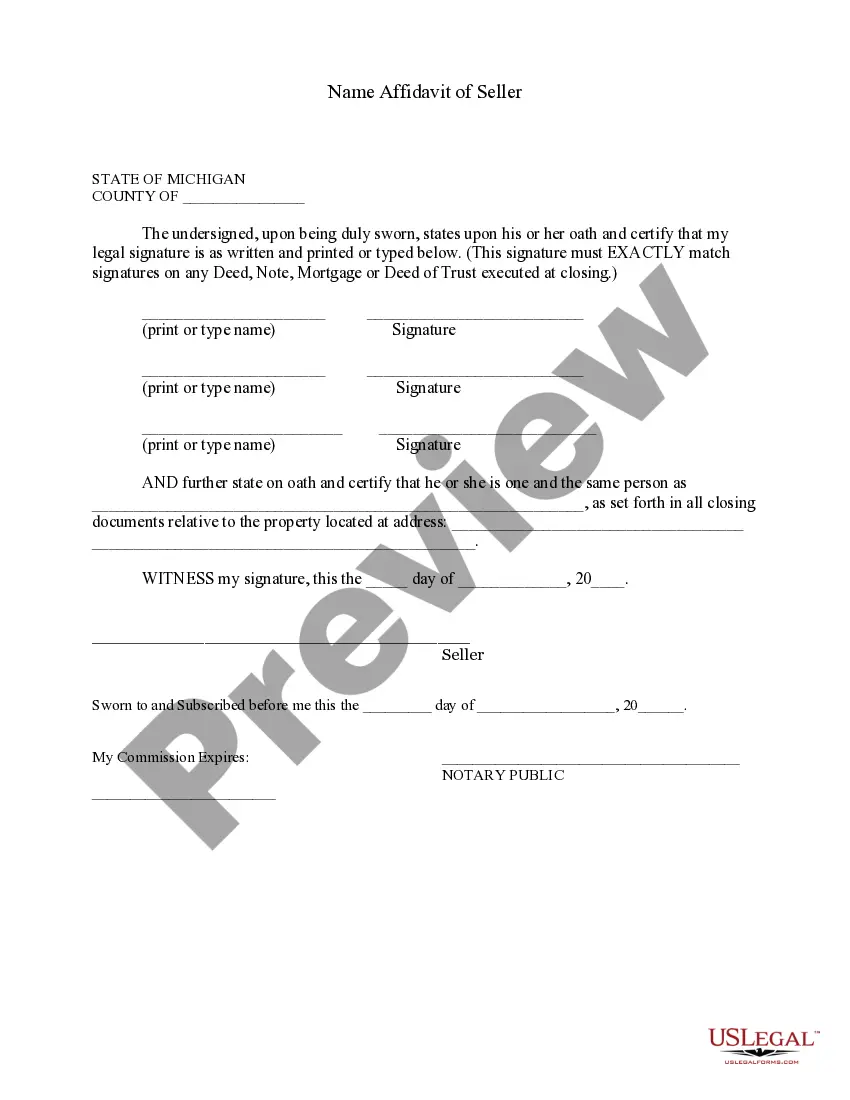

The Wayne Michigan Non-Foreign Affidavit Under IRC 1445 is a legal document used in real estate transactions to comply with the United States Internal Revenue Code (IRC) Section 1445 requirements. This affidavit is specifically required when a foreign person or entity sells or transfers real property located in Wayne, Michigan. The purpose of this affidavit is to ensure that the buyer withholds and pays the required amount of tax on the real estate transaction's gain to the Internal Revenue Service (IRS) for non-foreign sellers. By obtaining this affidavit, the buyer can confirm that the seller is not a foreign person, exempting them from withholding requirements. There are a few different types of Wayne Michigan Non-Foreign Affidavit Under IRC 1445 that may be relevant: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual sells or transfers real property located in Wayne, Michigan, and certifies that they are not a foreign person. 2. Entity Non-Foreign Affidavit: This affidavit applies to business entities, such as corporations, partnerships, or limited liability companies (LCS), that sell or transfer real property in Wayne, Michigan. It verifies that the entity is not considered a foreign person under IRC 1445. It's important to note that the Wayne Michigan Non-Foreign Affidavit Under IRC 1445 is a crucial document in real estate transactions involving non-foreign sellers. Failing to comply with these requirements can result in penalties or delayed closing processes. Therefore, it is imperative for both buyers and sellers to understand and fulfill their obligations under IRC 1445 to avoid any potential legal or financial issues.

Wayne Michigan Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Wayne Michigan Non-Foreign Affidavit Under IRC 1445?

Do you need a trustworthy and inexpensive legal forms provider to buy the Wayne Michigan Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to option.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Wayne Michigan Non-Foreign Affidavit Under IRC 1445 conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Wayne Michigan Non-Foreign Affidavit Under IRC 1445 in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.