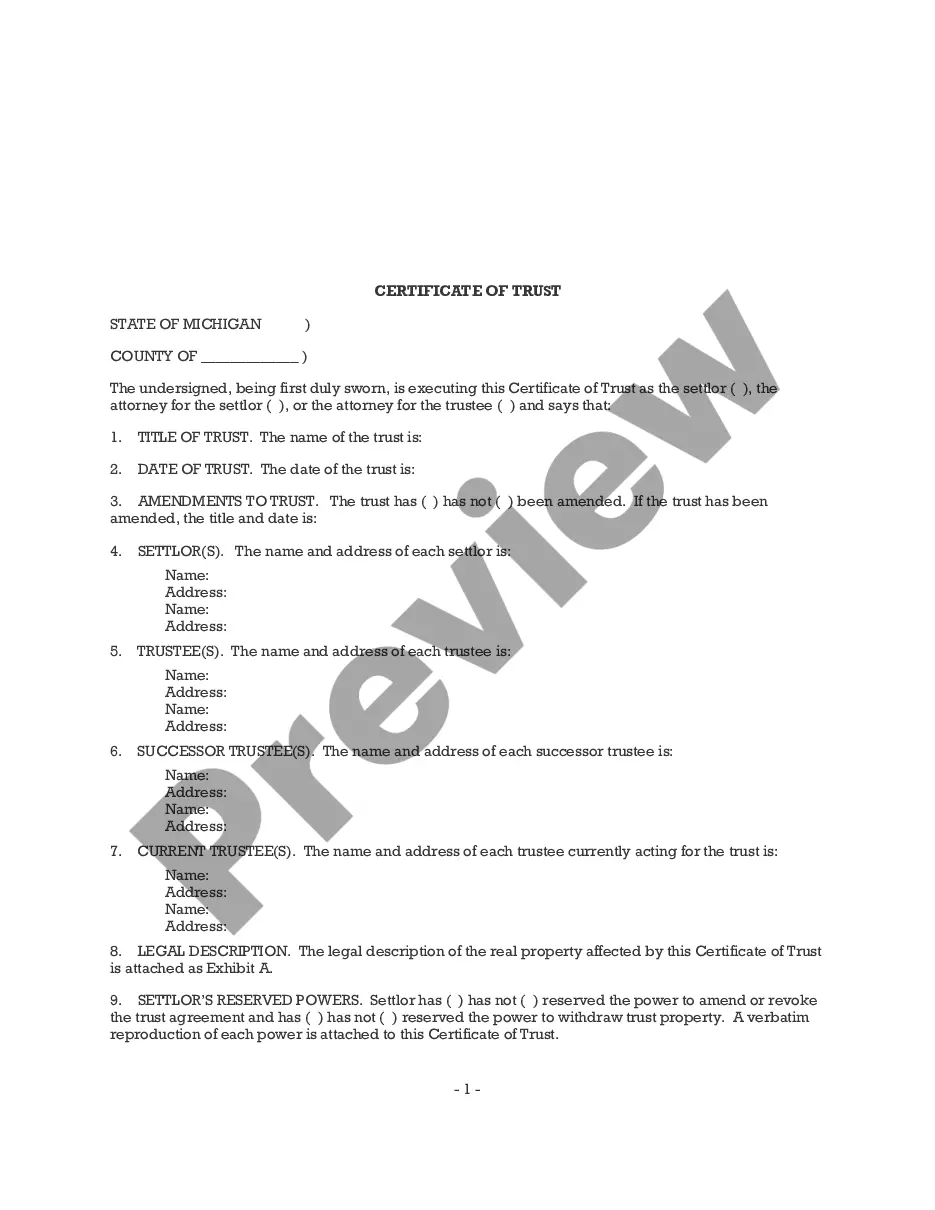

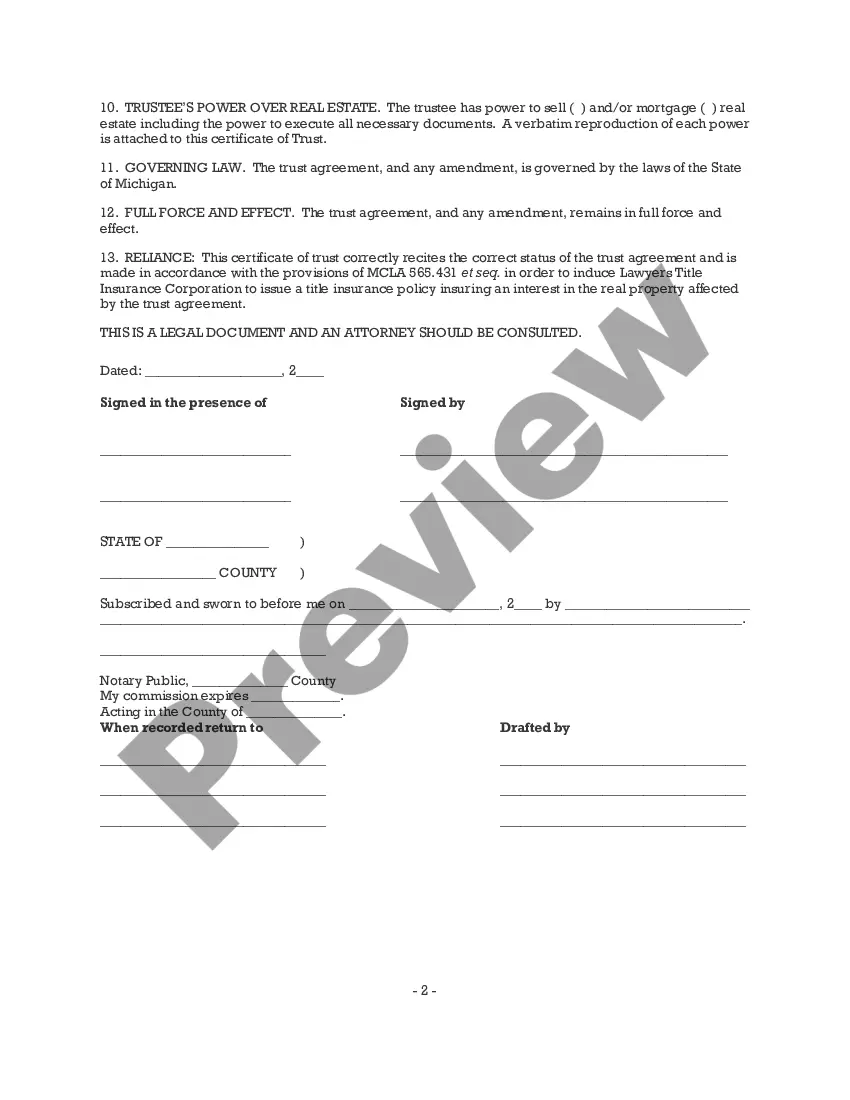

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

Ann Arbor Michigan Certificate of Trust is a legal document that provides proof of the existence and terms of a trust established in Ann Arbor, Michigan. It serves as evidence that a trust has been legally established and outlines the rights and responsibilities of the involved parties. The Ann Arbor Michigan Certificate of Trust contains essential information such as the name of the trust, the date it was created, and the parties involved, including the trust or (the person who establishes the trust), the trustee (the person responsible for managing the trust assets), and the beneficiaries (those who will benefit from the trust). It also specifies the terms and conditions of the trust, including how the trust assets are to be managed, distributed, and protected. There are different types of Ann Arbor Michigan Certificate of Trust, designed to meet specific needs and requirements. Some common types include: 1. Revocable Living Trust Certificate: This certificate of trust is created during the lifetime of the trust or and enables them to retain control over the trust assets. It allows the trust or to modify or revoke the trust at any time. 2. Irrevocable Trust Certificate: This type of certificate indicates that the trust cannot be modified or terminated by the trust or once it is established. It often provides protection from estate taxes and creditors. 3. Special Needs Trust Certificate: This certificate of trust is designed to provide financial support for a beneficiary with special needs while ensuring that they do not lose eligibility for government assistance programs. 4. Charitable Remainder Trust Certificate: This certificate establishes a trust where the trust or can donate assets to a charitable organization while retaining an income stream from those assets during their lifetime or for a specified period. 5. Testamentary Trust Certificate: This type of certificate is created under a will and becomes effective upon the death of the trust or. It ensures that the assets are managed and distributed according to the trust or's wishes. In summary, the Ann Arbor Michigan Certificate of Trust is a crucial legal document that confirms the existence and terms of a trust established in Ann Arbor, Michigan. Various types of certificates cater to different needs, including revocable living trusts, irrevocable trusts, special needs trusts, charitable remainder trusts, and testamentary trusts.Ann Arbor Michigan Certificate of Trust is a legal document that provides proof of the existence and terms of a trust established in Ann Arbor, Michigan. It serves as evidence that a trust has been legally established and outlines the rights and responsibilities of the involved parties. The Ann Arbor Michigan Certificate of Trust contains essential information such as the name of the trust, the date it was created, and the parties involved, including the trust or (the person who establishes the trust), the trustee (the person responsible for managing the trust assets), and the beneficiaries (those who will benefit from the trust). It also specifies the terms and conditions of the trust, including how the trust assets are to be managed, distributed, and protected. There are different types of Ann Arbor Michigan Certificate of Trust, designed to meet specific needs and requirements. Some common types include: 1. Revocable Living Trust Certificate: This certificate of trust is created during the lifetime of the trust or and enables them to retain control over the trust assets. It allows the trust or to modify or revoke the trust at any time. 2. Irrevocable Trust Certificate: This type of certificate indicates that the trust cannot be modified or terminated by the trust or once it is established. It often provides protection from estate taxes and creditors. 3. Special Needs Trust Certificate: This certificate of trust is designed to provide financial support for a beneficiary with special needs while ensuring that they do not lose eligibility for government assistance programs. 4. Charitable Remainder Trust Certificate: This certificate establishes a trust where the trust or can donate assets to a charitable organization while retaining an income stream from those assets during their lifetime or for a specified period. 5. Testamentary Trust Certificate: This type of certificate is created under a will and becomes effective upon the death of the trust or. It ensures that the assets are managed and distributed according to the trust or's wishes. In summary, the Ann Arbor Michigan Certificate of Trust is a crucial legal document that confirms the existence and terms of a trust established in Ann Arbor, Michigan. Various types of certificates cater to different needs, including revocable living trusts, irrevocable trusts, special needs trusts, charitable remainder trusts, and testamentary trusts.