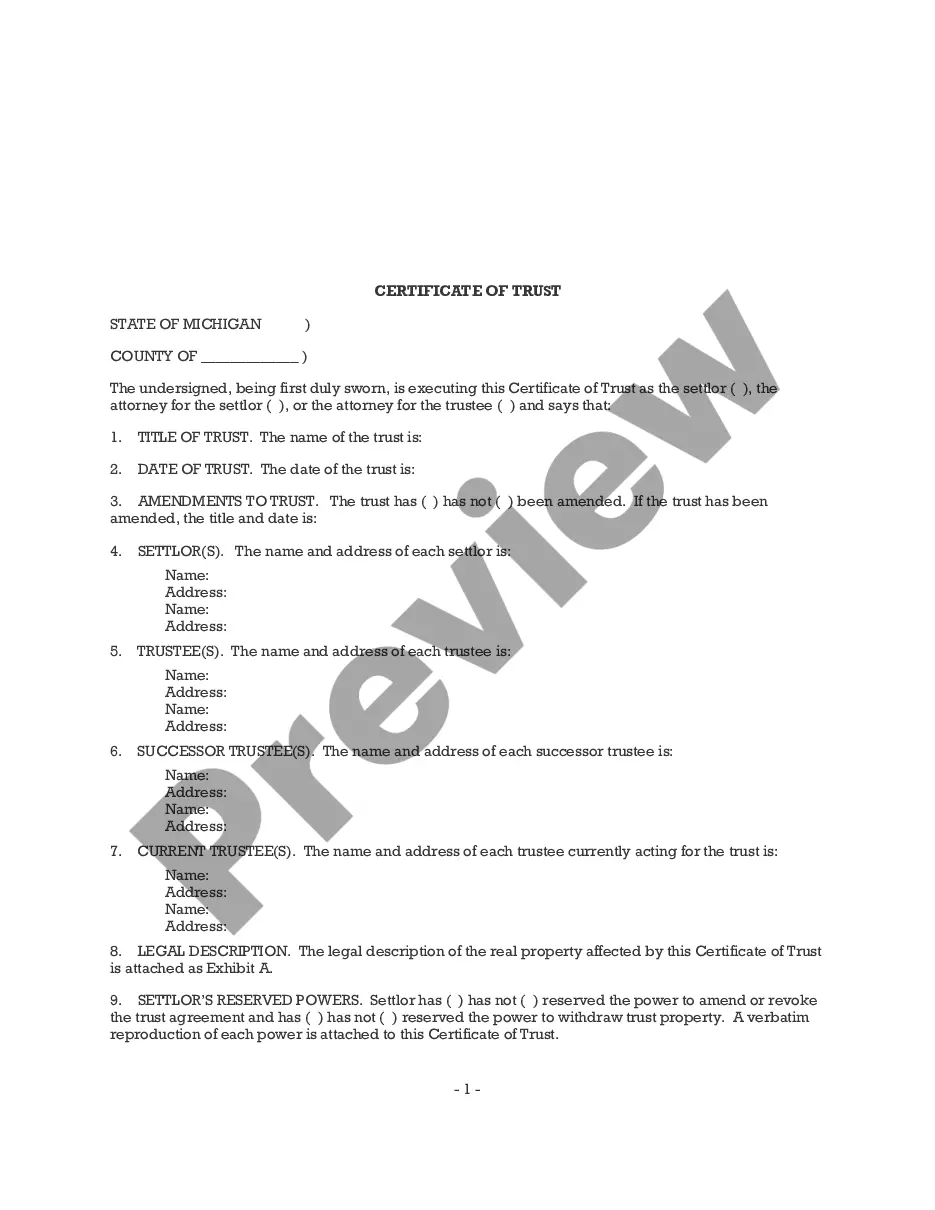

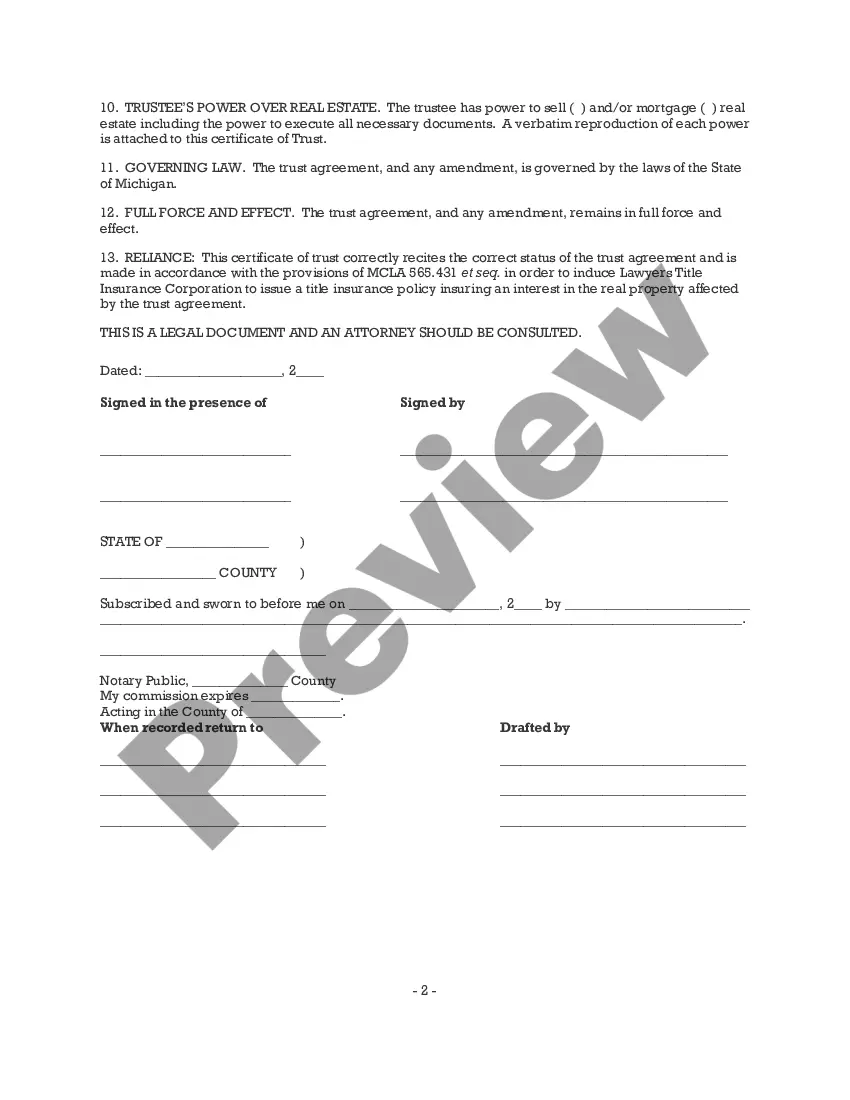

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

The Detroit Michigan Certificate of Trust is a legal document that certifies the existence and provisions of a trust established in the city of Detroit, Michigan. It acts as a condensed version of the trust agreement, which is the primary legal document governing the trust. The certificate of trust serves as evidence of the trust's existence, authenticity, and the trustee's authority to act on behalf of the trust. It enables the trustee to conduct trust-related business without having to divulge the entire trust agreement to third parties. This ensures privacy and prevents unnecessary disclosure of sensitive information contained in the trust agreement. The certificate of trust contains pertinent details about the trust, including the name of the trust, the date it was established, and the parties involved, such as the granter (the person who created the trust), the trustee (the person appointed to manage the trust assets), and the beneficiaries (the individuals who will benefit from the trust). Additionally, the certificate includes provisions outlining the powers and limitations of the trustee, such as investment powers, distribution guidelines, and any specific instructions or restrictions established by the granter. It may also specify the conditions under which the trust may be modified, terminated, or transferred. Different types of the Detroit Michigan Certificate of Trust may include: 1. Revocable Trust Certificate: This type of certificate is issued for a revocable trust, where the granter retains the right to modify or revoke the trust during their lifetime. It provides flexibility and allows the granter to maintain control over the trust assets. 2. Irrevocable Trust Certificate: This certificate is used for an irrevocable trust, which cannot be modified or revoked without the consent of all involved parties. It is often created for estate planning purposes, asset protection, or to reduce estate taxes. 3. Special Needs Trust Certificate: A special needs trust certificate is specific to trusts created for individuals with disabilities. It ensures the proper management of assets intended to supplement the individual's government benefits without affecting their eligibility. 4. Charitable Trust Certificate: This type of certificate is issued for trusts established for charitable purposes. It enables individuals or organizations to donate assets or money to a charity or foundation, ensuring the distributions align with the donor's intent. In summary, the Detroit Michigan Certificate of Trust is a crucial legal document that verifies and streamlines trust-related transactions in Detroit, Michigan. It encompasses key details regarding the trust's existence, participants, and provisions, facilitating efficient management and administration of trust assets while also safeguarding the granter's privacy.The Detroit Michigan Certificate of Trust is a legal document that certifies the existence and provisions of a trust established in the city of Detroit, Michigan. It acts as a condensed version of the trust agreement, which is the primary legal document governing the trust. The certificate of trust serves as evidence of the trust's existence, authenticity, and the trustee's authority to act on behalf of the trust. It enables the trustee to conduct trust-related business without having to divulge the entire trust agreement to third parties. This ensures privacy and prevents unnecessary disclosure of sensitive information contained in the trust agreement. The certificate of trust contains pertinent details about the trust, including the name of the trust, the date it was established, and the parties involved, such as the granter (the person who created the trust), the trustee (the person appointed to manage the trust assets), and the beneficiaries (the individuals who will benefit from the trust). Additionally, the certificate includes provisions outlining the powers and limitations of the trustee, such as investment powers, distribution guidelines, and any specific instructions or restrictions established by the granter. It may also specify the conditions under which the trust may be modified, terminated, or transferred. Different types of the Detroit Michigan Certificate of Trust may include: 1. Revocable Trust Certificate: This type of certificate is issued for a revocable trust, where the granter retains the right to modify or revoke the trust during their lifetime. It provides flexibility and allows the granter to maintain control over the trust assets. 2. Irrevocable Trust Certificate: This certificate is used for an irrevocable trust, which cannot be modified or revoked without the consent of all involved parties. It is often created for estate planning purposes, asset protection, or to reduce estate taxes. 3. Special Needs Trust Certificate: A special needs trust certificate is specific to trusts created for individuals with disabilities. It ensures the proper management of assets intended to supplement the individual's government benefits without affecting their eligibility. 4. Charitable Trust Certificate: This type of certificate is issued for trusts established for charitable purposes. It enables individuals or organizations to donate assets or money to a charity or foundation, ensuring the distributions align with the donor's intent. In summary, the Detroit Michigan Certificate of Trust is a crucial legal document that verifies and streamlines trust-related transactions in Detroit, Michigan. It encompasses key details regarding the trust's existence, participants, and provisions, facilitating efficient management and administration of trust assets while also safeguarding the granter's privacy.