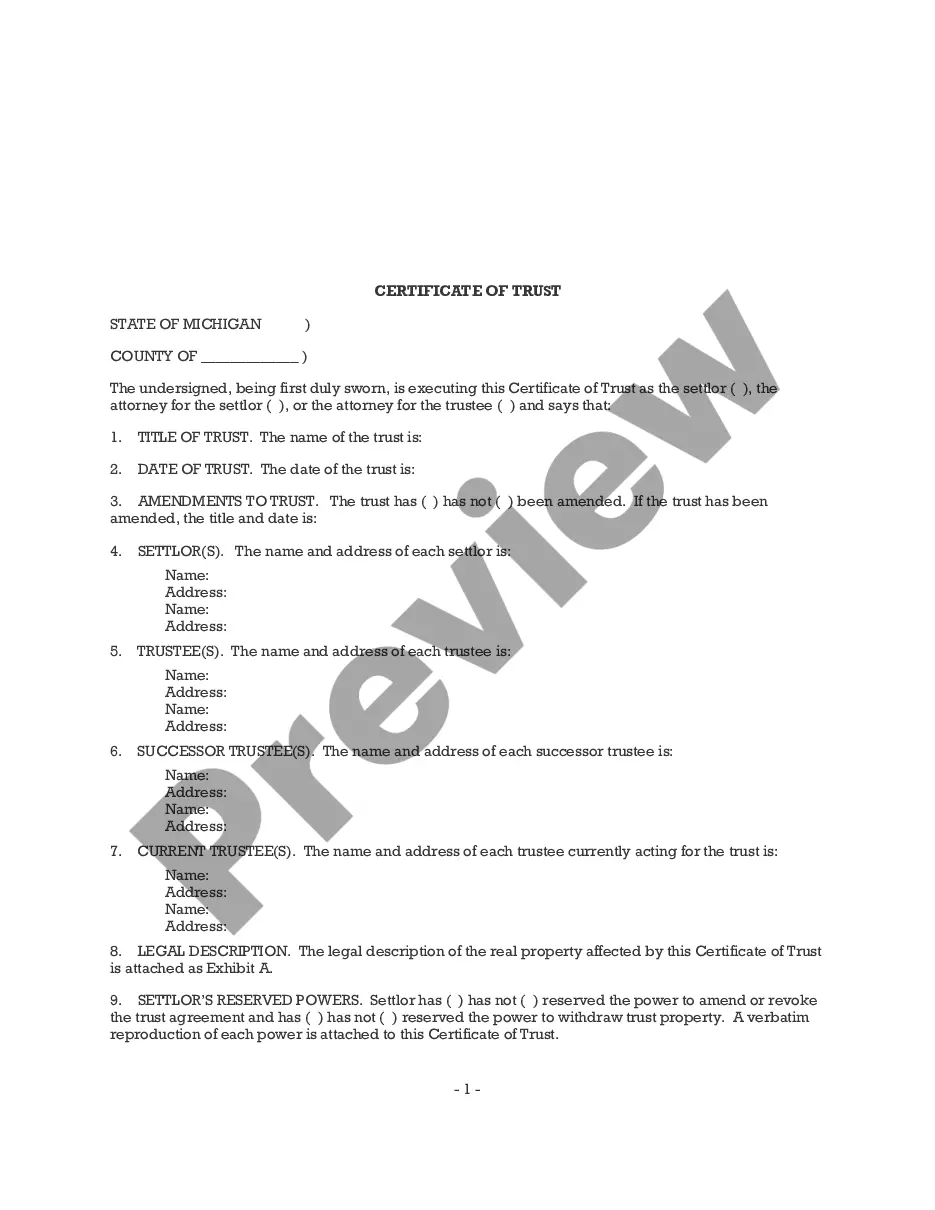

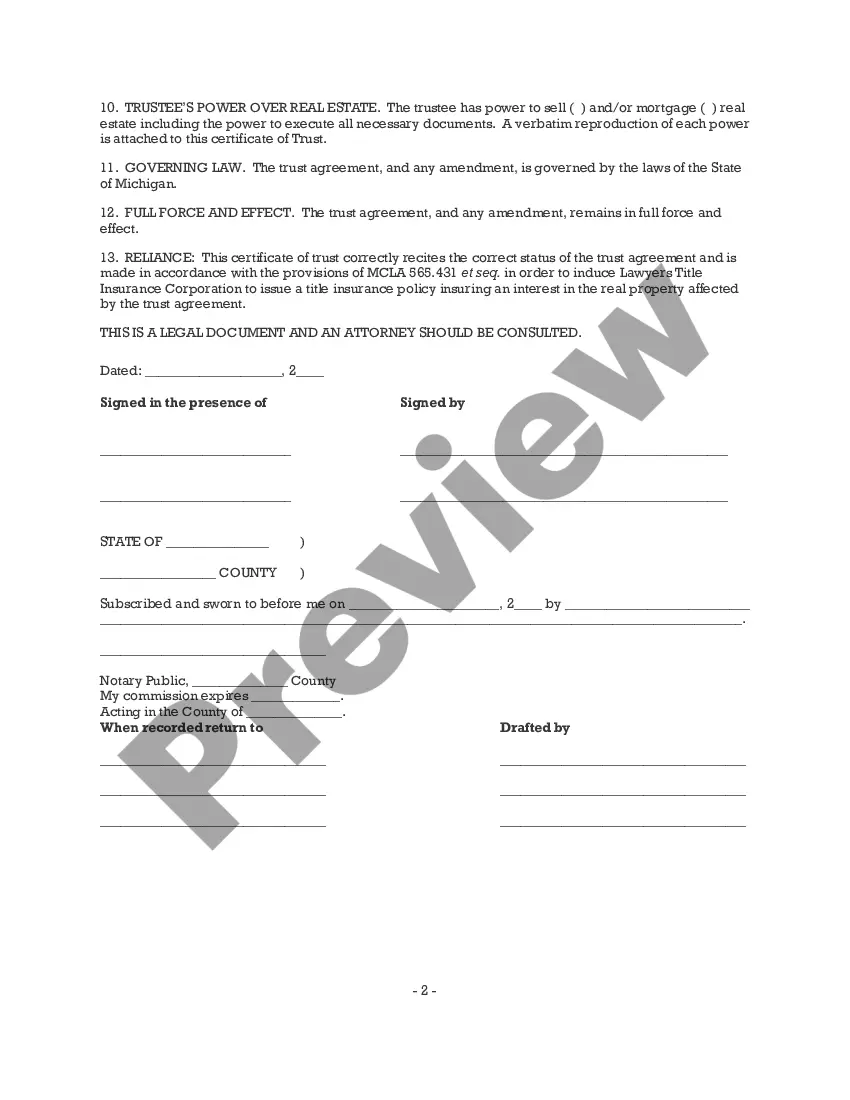

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

Wayne Michigan Certificate of Trust: A Comprehensive Overview The Wayne Michigan Certificate of Trust is a legal document that serves as crucial evidence of the existence and provisions contained within a trust. It is a detailed certification that verifies the trust's legitimacy and provides important information to relevant parties, such as financial institutions, real estate agents, and other professionals involved in trust-related transactions or decisions. Keywords: Wayne Michigan, Certificate of Trust, trust, legal document, legitimacy, provisions, evidence, financial institutions, real estate agents, professionals, transactions, decisions. There are different types of Wayne Michigan Certificates of Trust, each serving specific purposes and catering to diverse scenarios. Here are a few notable variations: 1. Irrevocable Trust Certificate: This type of Wayne Michigan Certificate of Trust indicates that the trust established by the granter (the person creating the trust) cannot be modified, amended, or revoked without the beneficiaries' consent. It is commonly used for estate planning purposes to ensure the preservation and distribution of assets according to the granter's wishes. 2. Revocable Trust Certificate: Unlike the irrevocable trust certificate, the revocable trust certificate allows the granter to modify or revoke the trust provisions during their lifetime. This type of certificate is popular for its flexibility, as it allows individuals to adapt their trust to changing circumstances or beneficiaries. 3. Special Needs Trust Certificate: This certificate is specifically designed for beneficiaries with disabilities or special needs. It establishes a trust that ensures individuals with disabilities can receive financial support without jeopardizing their eligibility for government benefits like Supplemental Security Income (SSI) or Medicaid. The Wayne Michigan Special Needs Trust Certificate outlines provisions that protect the beneficiary's interests and enhance their quality of life. 4. Family Trust Certificate: The Family Trust Certificate is commonly used to protect and manage family assets, providing a framework for asset distribution among family members. It ensures effective wealth management, minimizes estate taxes, and prevents unnecessary complications. This certificate identifies the designated trustees, beneficiaries, and outlines the guidelines for asset allocation. 5. Charitable Remainder Trust Certificate: This certificate aims to benefit both charitable causes and the granter's family. It allows the donor to contribute assets to a charitable trust, ensuring regular income for themselves or their designated beneficiaries while alive. Upon the donor's passing, the remaining trust assets are directed to charitable organizations or causes of their choosing. In summary, the Wayne Michigan Certificate of Trust is a crucial legal document that validates the existence and provisions of a trust. Its various types cater to different needs and circumstances, including irrevocable, revocable, special needs, family, and charitable remainder trusts. These certificates enable individuals to protect their assets, plan for their loved ones' financial security, and support philanthropic endeavors.Wayne Michigan Certificate of Trust: A Comprehensive Overview The Wayne Michigan Certificate of Trust is a legal document that serves as crucial evidence of the existence and provisions contained within a trust. It is a detailed certification that verifies the trust's legitimacy and provides important information to relevant parties, such as financial institutions, real estate agents, and other professionals involved in trust-related transactions or decisions. Keywords: Wayne Michigan, Certificate of Trust, trust, legal document, legitimacy, provisions, evidence, financial institutions, real estate agents, professionals, transactions, decisions. There are different types of Wayne Michigan Certificates of Trust, each serving specific purposes and catering to diverse scenarios. Here are a few notable variations: 1. Irrevocable Trust Certificate: This type of Wayne Michigan Certificate of Trust indicates that the trust established by the granter (the person creating the trust) cannot be modified, amended, or revoked without the beneficiaries' consent. It is commonly used for estate planning purposes to ensure the preservation and distribution of assets according to the granter's wishes. 2. Revocable Trust Certificate: Unlike the irrevocable trust certificate, the revocable trust certificate allows the granter to modify or revoke the trust provisions during their lifetime. This type of certificate is popular for its flexibility, as it allows individuals to adapt their trust to changing circumstances or beneficiaries. 3. Special Needs Trust Certificate: This certificate is specifically designed for beneficiaries with disabilities or special needs. It establishes a trust that ensures individuals with disabilities can receive financial support without jeopardizing their eligibility for government benefits like Supplemental Security Income (SSI) or Medicaid. The Wayne Michigan Special Needs Trust Certificate outlines provisions that protect the beneficiary's interests and enhance their quality of life. 4. Family Trust Certificate: The Family Trust Certificate is commonly used to protect and manage family assets, providing a framework for asset distribution among family members. It ensures effective wealth management, minimizes estate taxes, and prevents unnecessary complications. This certificate identifies the designated trustees, beneficiaries, and outlines the guidelines for asset allocation. 5. Charitable Remainder Trust Certificate: This certificate aims to benefit both charitable causes and the granter's family. It allows the donor to contribute assets to a charitable trust, ensuring regular income for themselves or their designated beneficiaries while alive. Upon the donor's passing, the remaining trust assets are directed to charitable organizations or causes of their choosing. In summary, the Wayne Michigan Certificate of Trust is a crucial legal document that validates the existence and provisions of a trust. Its various types cater to different needs and circumstances, including irrevocable, revocable, special needs, family, and charitable remainder trusts. These certificates enable individuals to protect their assets, plan for their loved ones' financial security, and support philanthropic endeavors.