Keywords: Grand Rapids Michigan, Dissolution Package, Dissolve Corporation Description: If you are looking to dissolve your corporation in Grand Rapids, Michigan, you can avail yourself of the Grand Rapids Michigan Dissolution Package. This package provides comprehensive assistance and necessary documentation required to successfully dissolve your corporation within the state. The Grand Rapids Michigan Dissolution Package helps streamline the dissolution process, ensuring legal compliance and a hassle-free experience. It is designed to meet the specific requirements of dissolving a corporation in Michigan, providing a step-by-step guide and essential resources. The package includes various forms and templates essential for dissolving a corporation, such as the Articles of Dissolution, Certificate of Dissolution, Notice of Dissolution, and more. These documents are carefully prepared and tailored to meet the legal requirements of the state of Michigan. Additionally, the Dissolution Package provides guidance on fulfilling any outstanding obligations of the corporation, including compliance with tax obligations, settling debts, and notifying creditors. This ensures that all necessary steps are taken to wind up the affairs of your corporation in an organized and orderly manner. If you own a different type of corporation, such as a Limited Liability Company (LLC), there are specific Grand Rapids Michigan Dissolution Packages available for those entities as well. For instance, you can find the Grand Rapids Michigan LLC Dissolution Package, designed to assist in the dissolution process for LCS operating in Grand Rapids, Michigan. The LLC Dissolution Package includes state-specific forms and instructions catering to the unique requirements of dissolving an LLC in the state of Michigan. In summary, the Grand Rapids Michigan Dissolution Package offers a comprehensive solution to dissolve corporations in Grand Rapids, Michigan. By providing the necessary forms, instructions, and guidance, the package ensures a smooth and proper dissolution process. Whether you own a corporation or an LLC, there is a suitable dissolution package available to meet your specific needs.

Grand Rapids Michigan Dissolution Package to Dissolve Corporation

Category:

State:

Michigan

City:

Grand Rapids

Control #:

MI-DP-0001

Format:

Word;

Rich Text

Instant download

Description

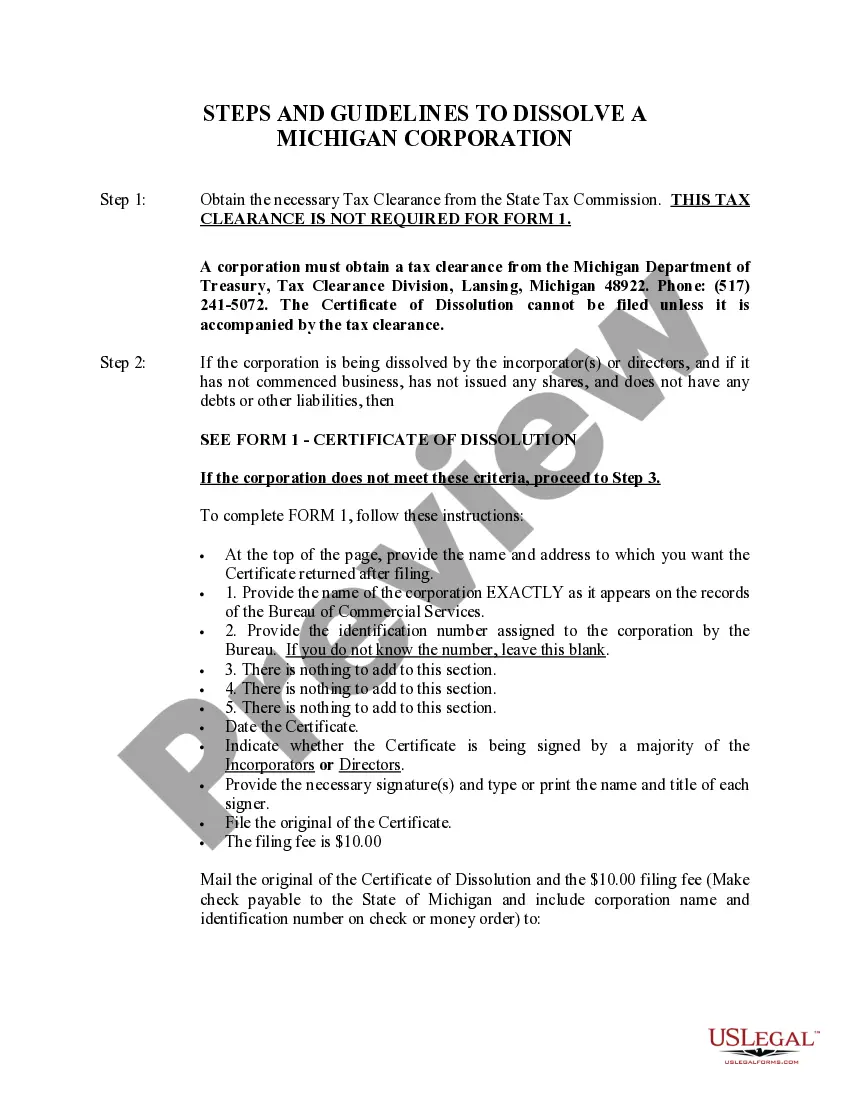

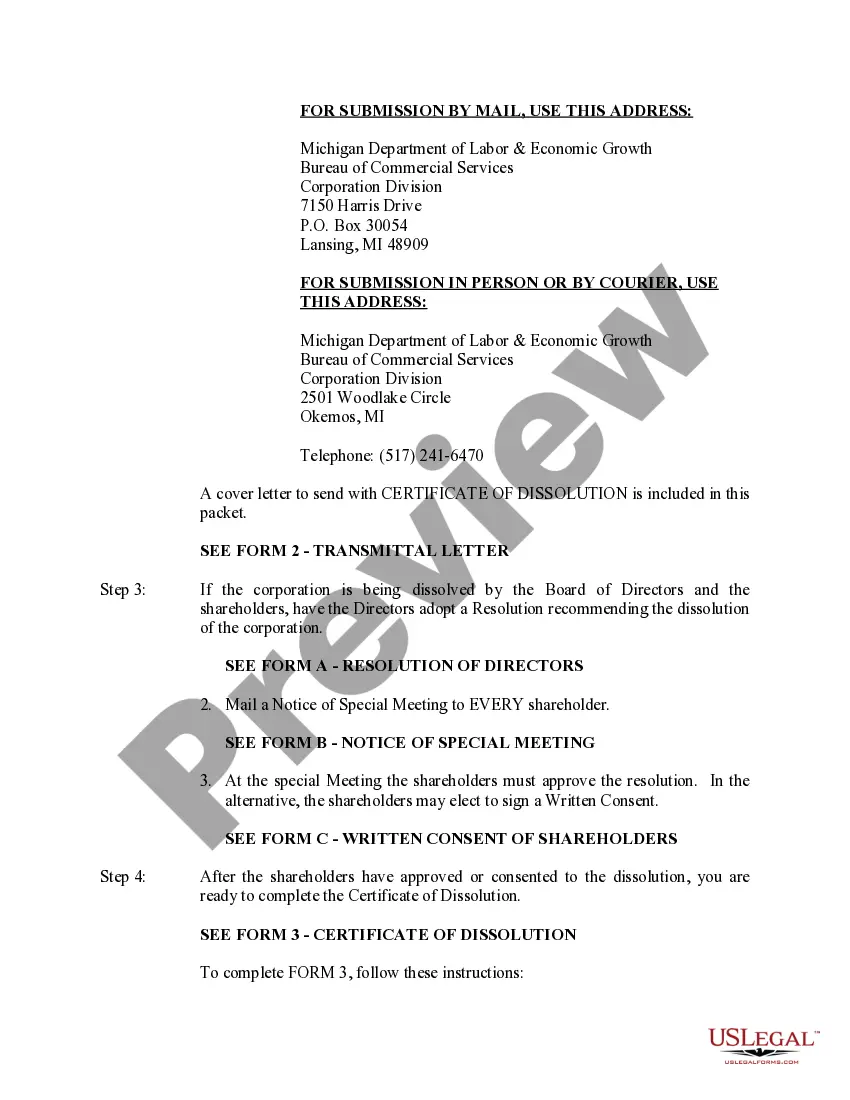

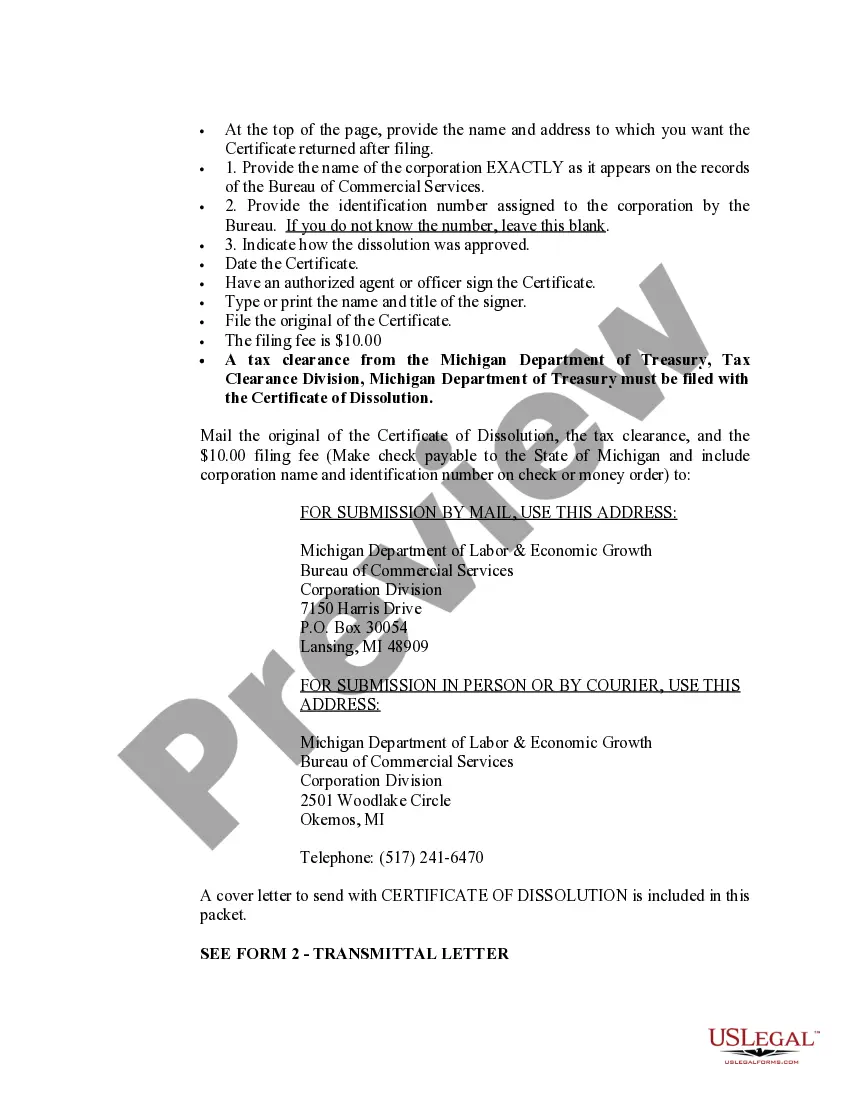

The dissolution of a corporation package contains all forms to dissolve a corporation in Michigan, step by step instructions, addresses, transmittal letters, and other information.

Keywords: Grand Rapids Michigan, Dissolution Package, Dissolve Corporation Description: If you are looking to dissolve your corporation in Grand Rapids, Michigan, you can avail yourself of the Grand Rapids Michigan Dissolution Package. This package provides comprehensive assistance and necessary documentation required to successfully dissolve your corporation within the state. The Grand Rapids Michigan Dissolution Package helps streamline the dissolution process, ensuring legal compliance and a hassle-free experience. It is designed to meet the specific requirements of dissolving a corporation in Michigan, providing a step-by-step guide and essential resources. The package includes various forms and templates essential for dissolving a corporation, such as the Articles of Dissolution, Certificate of Dissolution, Notice of Dissolution, and more. These documents are carefully prepared and tailored to meet the legal requirements of the state of Michigan. Additionally, the Dissolution Package provides guidance on fulfilling any outstanding obligations of the corporation, including compliance with tax obligations, settling debts, and notifying creditors. This ensures that all necessary steps are taken to wind up the affairs of your corporation in an organized and orderly manner. If you own a different type of corporation, such as a Limited Liability Company (LLC), there are specific Grand Rapids Michigan Dissolution Packages available for those entities as well. For instance, you can find the Grand Rapids Michigan LLC Dissolution Package, designed to assist in the dissolution process for LCS operating in Grand Rapids, Michigan. The LLC Dissolution Package includes state-specific forms and instructions catering to the unique requirements of dissolving an LLC in the state of Michigan. In summary, the Grand Rapids Michigan Dissolution Package offers a comprehensive solution to dissolve corporations in Grand Rapids, Michigan. By providing the necessary forms, instructions, and guidance, the package ensures a smooth and proper dissolution process. Whether you own a corporation or an LLC, there is a suitable dissolution package available to meet your specific needs.

Free preview

How to fill out Grand Rapids Michigan Dissolution Package To Dissolve Corporation?

If you’ve already utilized our service before, log in to your account and save the Grand Rapids Michigan Dissolution Package to Dissolve Corporation on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Grand Rapids Michigan Dissolution Package to Dissolve Corporation. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!