Detroit Michigan Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Michigan Dissolution Package To Dissolve Limited Liability Company LLC?

Regardless of social or occupational standing, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual lacking legal knowledge to formulate this type of documentation from scratch, mainly due to the intricate language and legal subtleties they involve.

This is where US Legal Forms steps in to offer assistance.

Confirm that the document you have selected is appropriate for your area, as the rules of one state or county do not apply to another.

Preview the document and read a brief description (if available) of the situations the form can be utilized for.

- Our service features a vast array of over 85,000 ready-to-use state-specific documents that cater to nearly every legal circumstance.

- US Legal Forms also acts as a valuable tool for associates or legal advisors who wish to save time utilizing our DIY papers.

- Whether you require the Detroit Michigan Dissolution Package to Disband Limited Liability Company LLC or any other documentation that will be acceptable in your locality, with US Legal Forms, everything is within reach.

- Here’s how you can acquire the Detroit Michigan Dissolution Package to Disband Limited Liability Company LLC in a matter of minutes using our reliable service.

- If you are already a current customer, you can go ahead to Log In to your account to download the required document.

- On the other hand, if you are new to our collection, ensure you follow these steps before obtaining the Detroit Michigan Dissolution Package to Disband Limited Liability Company LLC.

Form popularity

FAQ

Domestic Limited Liability Company Name of Official DocumentForm #Paper FeeFranchise Tax Registration (use with LL-01)No FeeStatement of DissolutionLL-04$50.00Statement of Revocation of Dissolution for LLC$25.00Statement of Authority, Amendment, Cancellation or Denial for LLC$25.0016 more rows

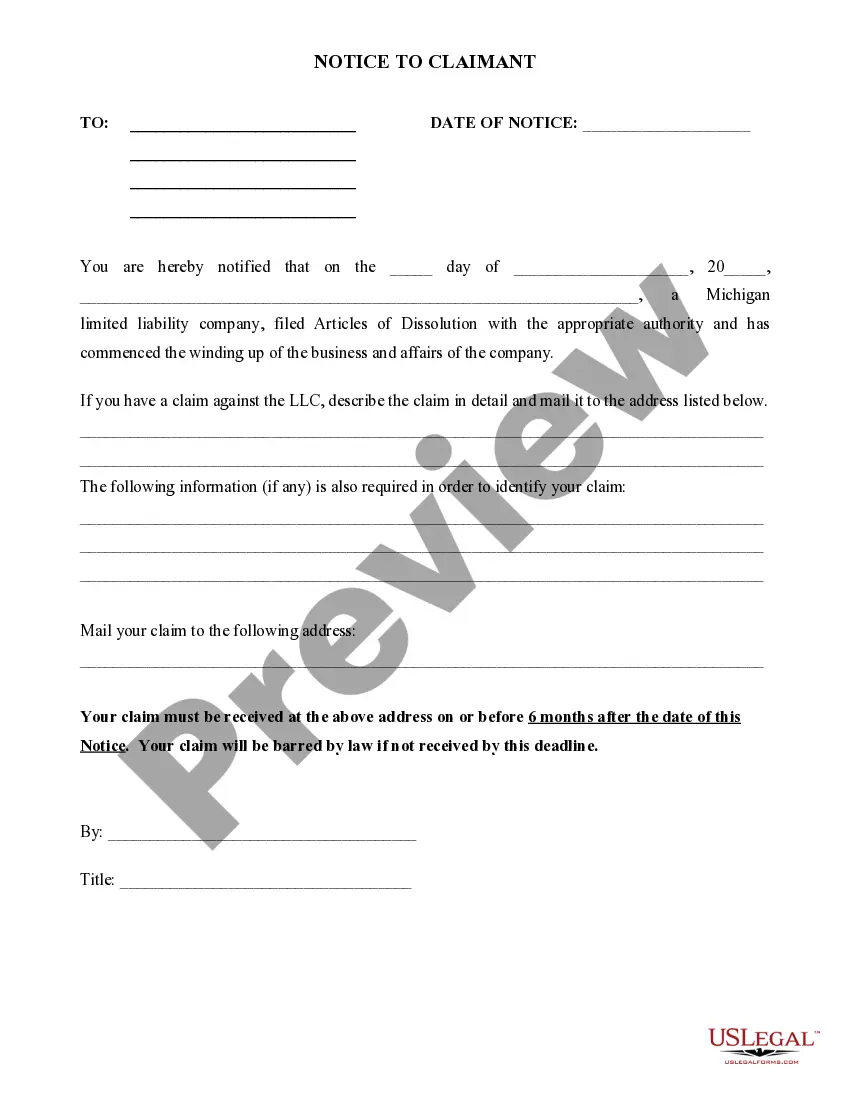

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

What is the Cost to Dissolve an LLC in Michigan. To dissolve an LLC in Michigan you need to file the Certificate of Dissolution with the Michigan Department of Licensing and Regulatory Affairs via mail or online for $10.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.