Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Michigan Dissolution Package To Dissolve Limited Liability Company LLC?

Leverage the US Legal Forms and gain instant access to any form template you desire.

Our practical platform with a vast collection of templates streamlines the process of locating and acquiring virtually any document sample you require.

You can export, fill out, and validate the Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC in a matter of minutes instead of spending countless hours browsing the internet for a suitable template.

Utilizing our catalog is a superb way to enhance the security of your document filing.

Locate the form you require. Verify that it is the template you were aiming to find: examine its title and description, and make use of the Preview feature when it is accessible. Otherwise, utilize the Search bar to find the correct one.

Initiate the downloading process. Click Buy Now and select the pricing plan you wish to choose. Then, create an account and complete your order payment using a credit card or PayPal.

- Our knowledgeable legal experts routinely assess all the documents to verify that the templates are suitable for a specific area and comply with updated laws and regulations.

- How can you obtain the Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC.

- If you already hold a subscription, simply sign in to your account. The Download button will be visible on all the samples you review.

- In addition, you can access all your previously saved documents in the My documents section.

- If you haven't set up a profile yet, follow the instructions below.

Form popularity

FAQ

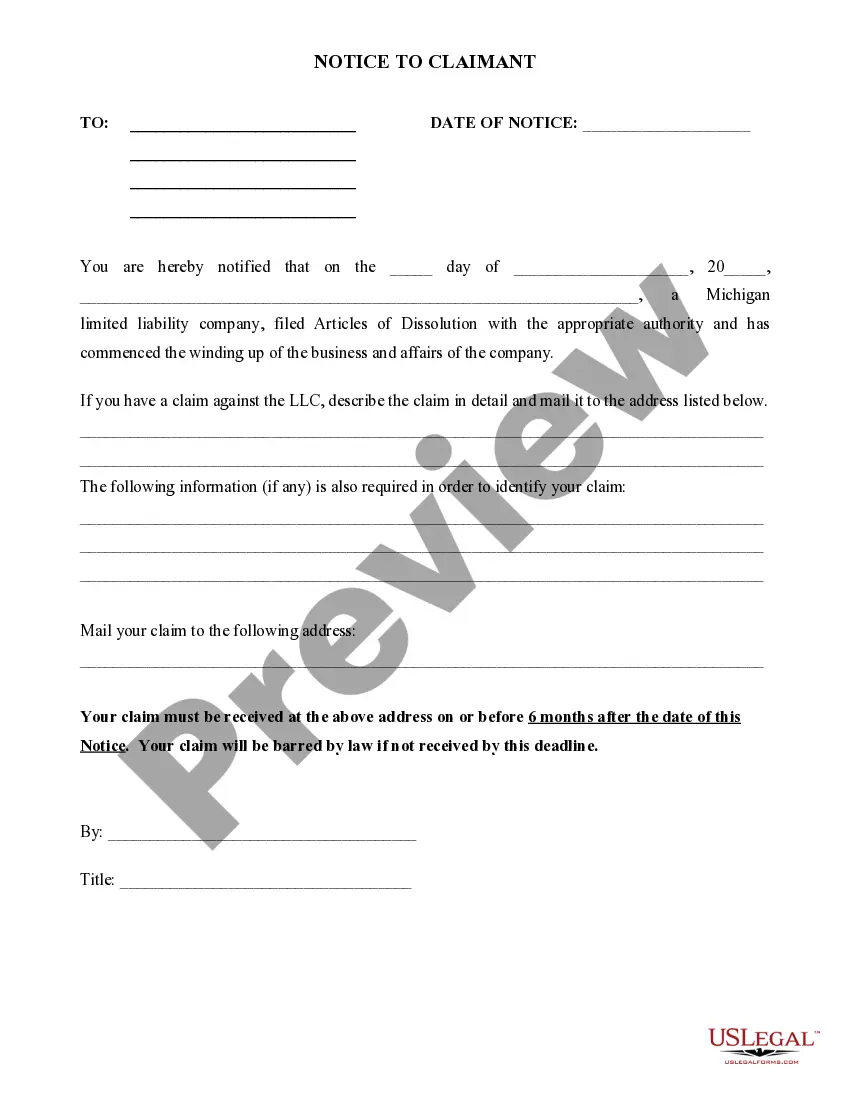

Before you move forward with the Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC, it's essential to settle any outstanding debts and obligations your LLC may have. Notify your creditors and ensure that all necessary financial records are in order. Additionally, review your operating agreement or articles of organization to understand the specific steps required for dissolution. Once you’ve completed these prior steps, you can confidently proceed with using the dissolution package to ensure everything is handled correctly.

To officially close an LLC, you must first hold a meeting with all members to vote on the dissolution. Following this decision, file the Articles of Dissolution with the state of Michigan. Additionally, settle any outstanding debts and distribute remaining assets according to your operating agreement. The Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC can guide you through these steps and simplify this important process.

To file a dissolution of your LLC in Michigan, you will need to complete the appropriate forms provided by the Michigan Department of Licensing and Regulatory Affairs. Begin by filling out the Articles of Dissolution, which can be obtained online. Once completed, submit the form along with the required fees. Utilizing the Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC makes this process easier and helps ensure compliance with state regulations.

Dissolving an LLC is straightforward, but it does involve specific steps. While it may seem daunting, using the Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC makes the process easier. This package offers clear instructions and help you avoid common pitfalls, ensuring that you can complete the dissolution without unnecessary stress.

When you dissolve your LLC, it’s important to understand the tax implications. Generally, any income generated up to the date of dissolution must be reported. You could also face potential taxes on the distribution of the LLC's remaining assets. The Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC can help you navigate these issues and ensure compliance with tax regulations.

To dissolve your LLC in Michigan, start by filing the appropriate documents with the Michigan Department of Licensing and Regulatory Affairs. You'll need to submit the Articles of Dissolution, which officially signals your intent to close the business. The Sterling Heights Michigan Dissolution Package to Dissolve Limited Liability Company LLC simplifies this process by providing all necessary forms and guidance. Once filed, ensure that remaining debts are settled and tax obligations are addressed.

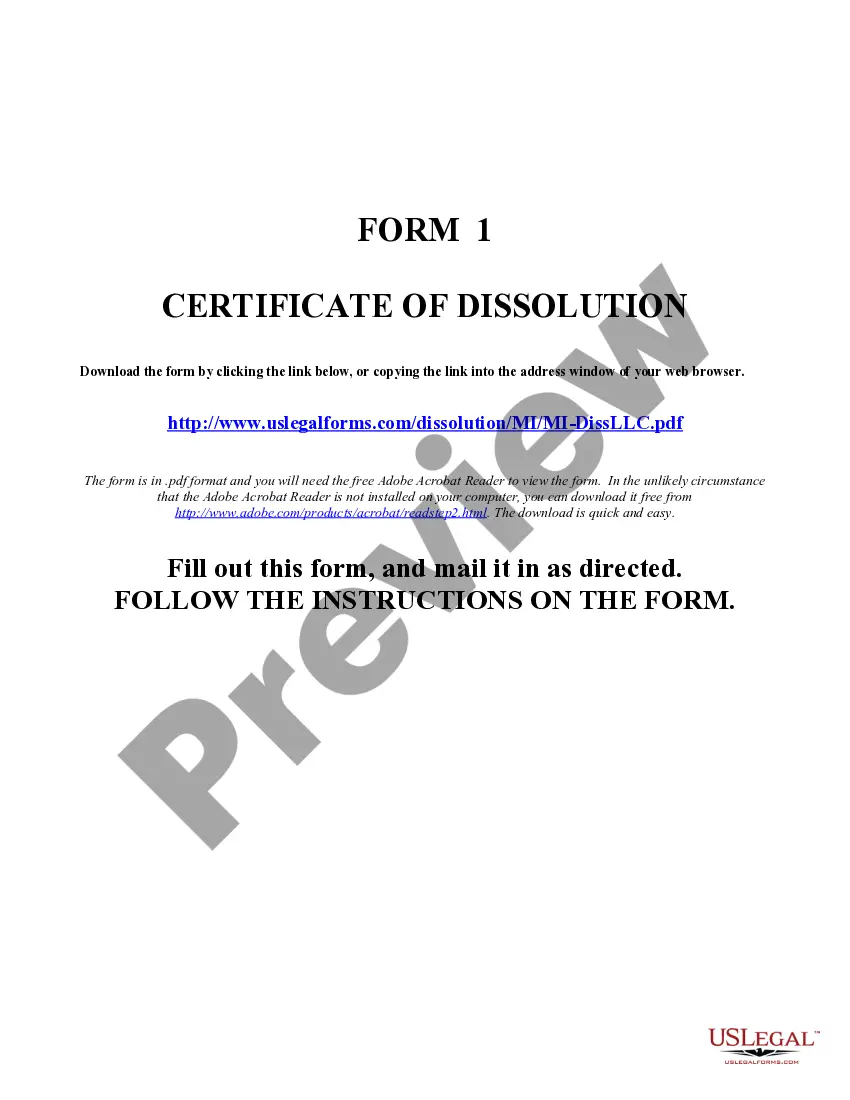

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

Steps to Cancel a Delaware LLC Consult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.