Ann Arbor Michigan Living Trust for Husband and Wife with No Children: A Comprehensive Guide In Ann Arbor, Michigan, a living trust for a husband and wife with no children is an important estate planning tool that provides numerous benefits and ensures the smooth transfer and management of assets during their lifetime and after their passing. Let's delve into the details of what this type of trust entails, its advantages, and the different variations available. What is a Living Trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal document that allows individuals to place their assets into a trust during their lifetime. As the creators of the trust (known as granters), the husband and wife maintain full control over these assets and can amend or revoke the trust at any time. The trust serves as a vehicle to hold and distribute assets, both during their lifetime and upon their death. Benefits of a Living Trust in Ann Arbor, Michigan: 1. Avoidance of Probate: By creating a living trust, the assets placed within the trust do not pass through probate, a time-consuming and potentially expensive legal process. This ensures a smoother and quicker distribution of assets to beneficiaries. 2. Privacy: Probate records are public, while the administration of a living trust remains private, maintaining confidentiality for the married couple and their beneficiaries. 3. Disability Planning: A living trust allows the husband and wife to plan for possible incapacitation. In the event of a disability, a named successor trustee can seamlessly manage the trust's assets, eliminating the need for court-appointed conservatorship. 4. Control and Flexibility: The couple maintains complete control over the trust while they are alive, allowing them to make changes or revoke the trust if circumstances change. 5. Protection from Challenges: A properly structured living trust can provide protection against potential challenges to the distribution of assets, ensuring that the couple's wishes are upheld. Different Types of Living Trusts in Ann Arbor, Michigan: 1. Joint Living Trust: This type of trust is established by a married couple collectively and holds the assets of both spouses. It allows for the simultaneous management and distribution of assets held within the trust, ensuring a seamless transition of wealth. 2. Shared Living Trust with Separate Shares: In some cases, the couple might choose to maintain separate shares within a joint living trust. This allows each spouse to have control over their respective assets and specify different distribution instructions. 3. Single Living Trust: Although this guide specifically focuses on a living trust for a husband and wife, it's worth mentioning that unmarried individuals can also create a single living trust to manage their assets and ensure their wishes are followed. Consulting an Estate Planning Attorney in Ann Arbor, Michigan: Given the intricacies involved in creating a living trust for a husband and wife with no children, it is advisable to seek guidance from an experienced estate planning attorney in Ann Arbor, Michigan. They can provide personalized advice, draft the necessary legal documents, and ensure compliance with all applicable laws and regulations. In conclusion, a living trust for a husband and wife with no children in Ann Arbor, Michigan, offers numerous benefits, such as avoiding probate, ensuring privacy, disability planning, and maintaining control and flexibility. By consulting an estate planning attorney, individuals can make informed decisions and create a comprehensive trust that reflects their wishes and provides for a smooth transition of assets.

Ann Arbor Michigan Living Trust for Husband and Wife with No Children

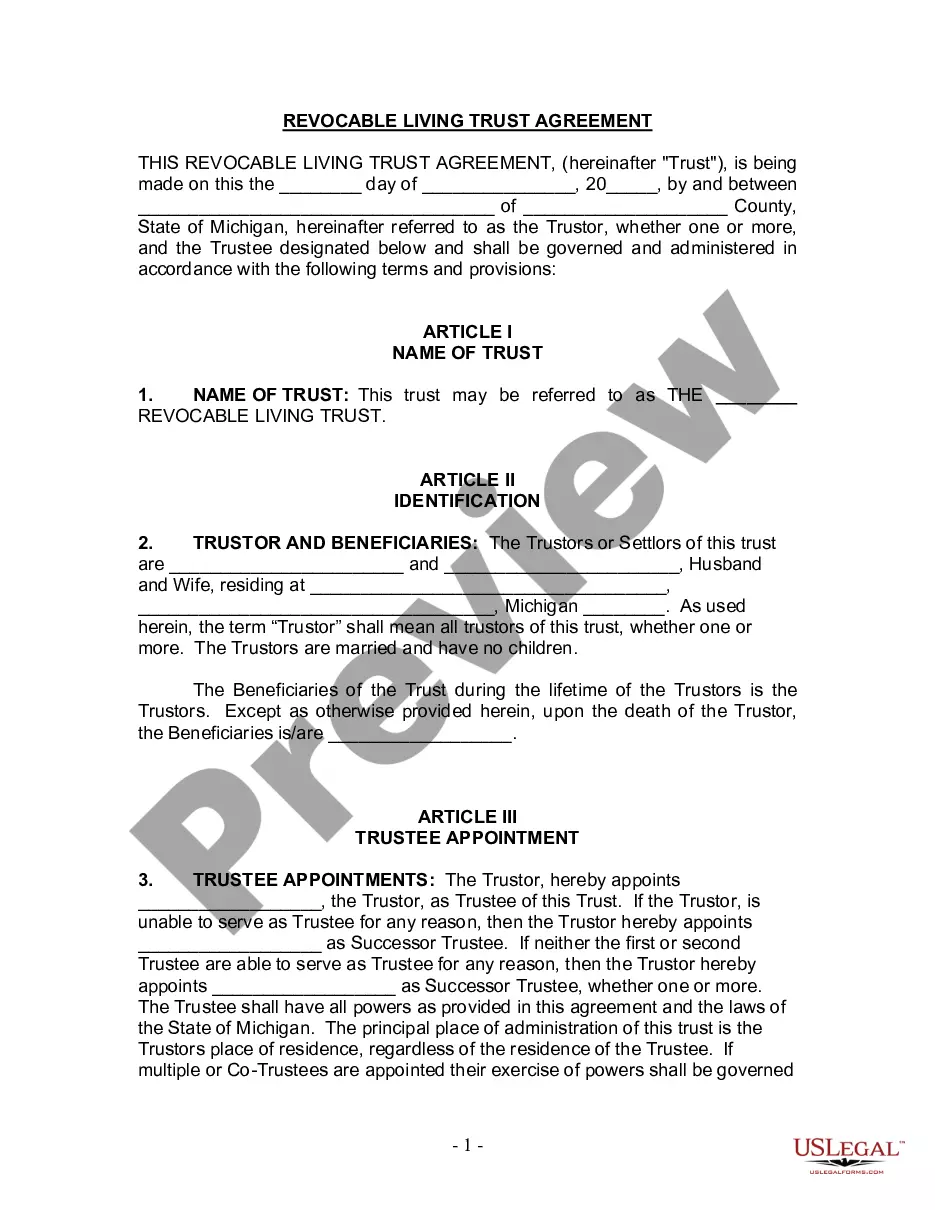

Description

How to fill out Ann Arbor Michigan Living Trust For Husband And Wife With No Children?

Make use of the US Legal Forms and get instant access to any form template you need. Our beneficial platform with thousands of document templates simplifies the way to find and get virtually any document sample you need. You can download, complete, and certify the Ann Arbor Michigan Living Trust for Husband and Wife with No Children in a couple of minutes instead of surfing the Net for several hours searching for an appropriate template.

Utilizing our collection is an excellent way to increase the safety of your record submissions. Our professional attorneys on a regular basis review all the documents to make certain that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Ann Arbor Michigan Living Trust for Husband and Wife with No Children? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Find the form you require. Make sure that it is the form you were hoping to find: examine its headline and description, and make use of the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the file. Select the format to get the Ann Arbor Michigan Living Trust for Husband and Wife with No Children and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the web. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Ann Arbor Michigan Living Trust for Husband and Wife with No Children.

Feel free to make the most of our service and make your document experience as efficient as possible!