Wayne Michigan Living Trust for Husband and Wife with No Children

Description

How to fill out Michigan Living Trust For Husband And Wife With No Children?

If you are looking for a legitimate form template, it’s difficult to find a more user-friendly platform than the US Legal Forms site – one of the most comprehensive collections online.

With this collection, you can discover numerous form examples for business and personal use categorized by types and regions, or search terms.

Utilizing our premium search feature, obtaining the latest Wayne Michigan Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Every template you store in your profile has no expiration date and belongs to you permanently.

You can access them through the My documents menu, so if you wish to receive another version for editing or printing, you can return and download it again anytime.

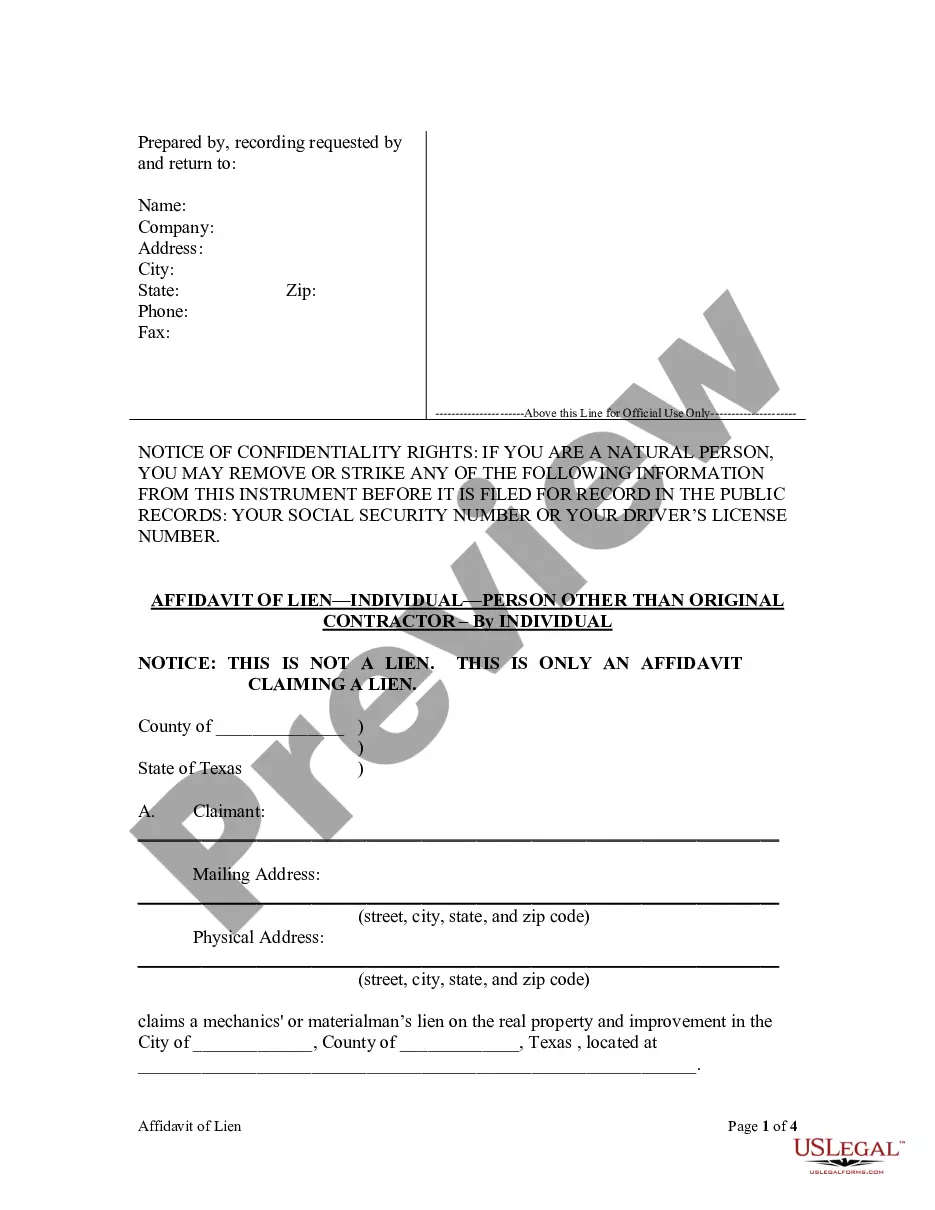

- Confirm you have selected the template you require.

- Examine its details and use the Preview feature to review its content. If it doesn’t fit your requirements, apply the Search option at the top of the page to locate the desired document.

- Validate your choice. Click the Buy now button. Then, select your preferred payment plan and provide your details to register for an account.

- Complete the purchase. Utilize your credit card or PayPal to finish the registration process.

- Obtain the template. Choose the format and save it on your device.

- Modify as needed. Fill in, alter, print, and sign the acquired Wayne Michigan Living Trust for Husband and Wife with No Children.

Form popularity

FAQ

A Wayne Michigan Living Trust for Husband and Wife with No Children has some shortcomings to consider. One downside is that it often requires more upfront costs and effort compared to a simple will, which can deter some couples. Additionally, if all assets are not properly transferred into the trust, it may lead to complications during administration after your passing. However, despite these challenges, many couples find the benefits of a living trust far outweigh the downsides, especially in maintaining control over their assets.

One of the most common mistakes is failing to clearly outline the distribution of assets. Parents often underestimate the importance of specifying terms and conditions. With a Wayne Michigan Living Trust for Husband and Wife with No Children, you can avoid these pitfalls by establishing clear guidelines for asset management and distribution.

Yes, you can create your own living trust in Michigan. Many individuals find it empowering to take control of their estate planning. However, a professionally crafted Wayne Michigan Living Trust for Husband and Wife with No Children can provide tailored guidance, ensuring compliance with state laws and better protecting your assets.

Having separate living trusts can offer distinct advantages. For instance, it may allow for more personalized management of assets and ease the transfer of property upon death. However, a Wayne Michigan Living Trust for Husband and Wife with No Children can simplify the estate planning process, ensuring that both partners’ wishes are honored without unnecessary complexity.

A single person with no children may still benefit from a Wayne Michigan Living Trust for Husband and Wife with No Children. Establishing a trust provides clarity on asset distribution and can simplify the process for heirs or beneficiaries. Additionally, a trust can manage your assets during periods of incapacity, ensuring that your wishes are followed. Consider using platforms like USLegalForms to create a trust that fits your unique situation.

Suze Orman advocates for the use of trusts as part of effective estate planning. She emphasizes that a living trust can help protect your assets and ensure they are distributed according to your preferences. Specifically, a Wayne Michigan Living Trust for Husband and Wife with No Children allows couples to have complete control over their estate, which aligns with Orman's advice to remain proactive in financial planning.

Yes, a married couple should consider having a living trust, especially if they want to facilitate the transfer of assets after death. A living trust simplifies estate management and can help avoid probate, making it easier for your loved ones. With a Wayne Michigan Living Trust for Husband and Wife with No Children, couples can efficiently manage their assets while ensuring their wishes are honored.

A husband and wife may choose separate trusts for several reasons. Having individual trusts allows each partner to tailor their estate plan according to their specific wishes and needs. This flexibility is particularly useful when considering different assets or beneficiaries. A separate Wayne Michigan Living Trust for Husband and Wife with No Children can also protect individual assets from potential creditors.