Ann Arbor Michigan Living Trust for Husband and Wife with One Child is a legal arrangement that allows a couple to protect and manage their assets during their lifetime and ensure a smooth transfer of those assets to their child or children upon their death. This type of trust is specifically designed for married couples residing in Ann Arbor, Michigan, who wish to preserve their wealth, minimize estate taxes, and avoid the lengthy and costly probate process. There are several variations of the Ann Arbor Michigan Living Trust for Husband and Wife with One Child, depending on specific needs and preferences. Here are a few examples: 1. Revocable Living Trust: This type of trust is the most common choice for couples, as it allows them to retain control over their assets during their lifetime. They can modify or revoke the trust as they see fit, ensuring flexibility and adaptability. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked without the consent of all parties involved. This trust provides added protection against creditors and reduces estate tax liability. However, it comes with less flexibility compared to a revocable trust. 3. Testamentary Trust: A testamentary trust is established through a will and takes effect only upon the death of both spouses. This type of trust is often used when couples want to preserve their assets for the benefit of their child until they reach a certain age or achieve specific milestones. 4. Special Needs Trust: If the couple's child has special needs or disabilities, a special needs trust can be established within the Ann Arbor Michigan Living Trust. This trust ensures that the child's inheritance is managed properly and does not disrupt their eligibility for government benefits. 5. Charitable Remainder Trust: For couples who have philanthropic goals, a charitable remainder trust can be included in their living trust. This allows them to donate a portion of their assets to a charitable organization while retaining income from the trust during their lifetime. When creating an Ann Arbor Michigan Living Trust for Husband and Wife with One Child, it is essential to consult with an experienced estate planning attorney familiar with Michigan state laws. The attorney will guide the couple through the process, ensure that their wishes are accurately reflected in the trust, and assist in selecting the most appropriate type of trust to meet their unique needs.

Ann Arbor Michigan Living Trust for Husband and Wife with One Child

Category:

State:

Michigan

City:

Ann Arbor

Control #:

MI-E0177

Format:

Word;

Rich Text

Instant download

Description

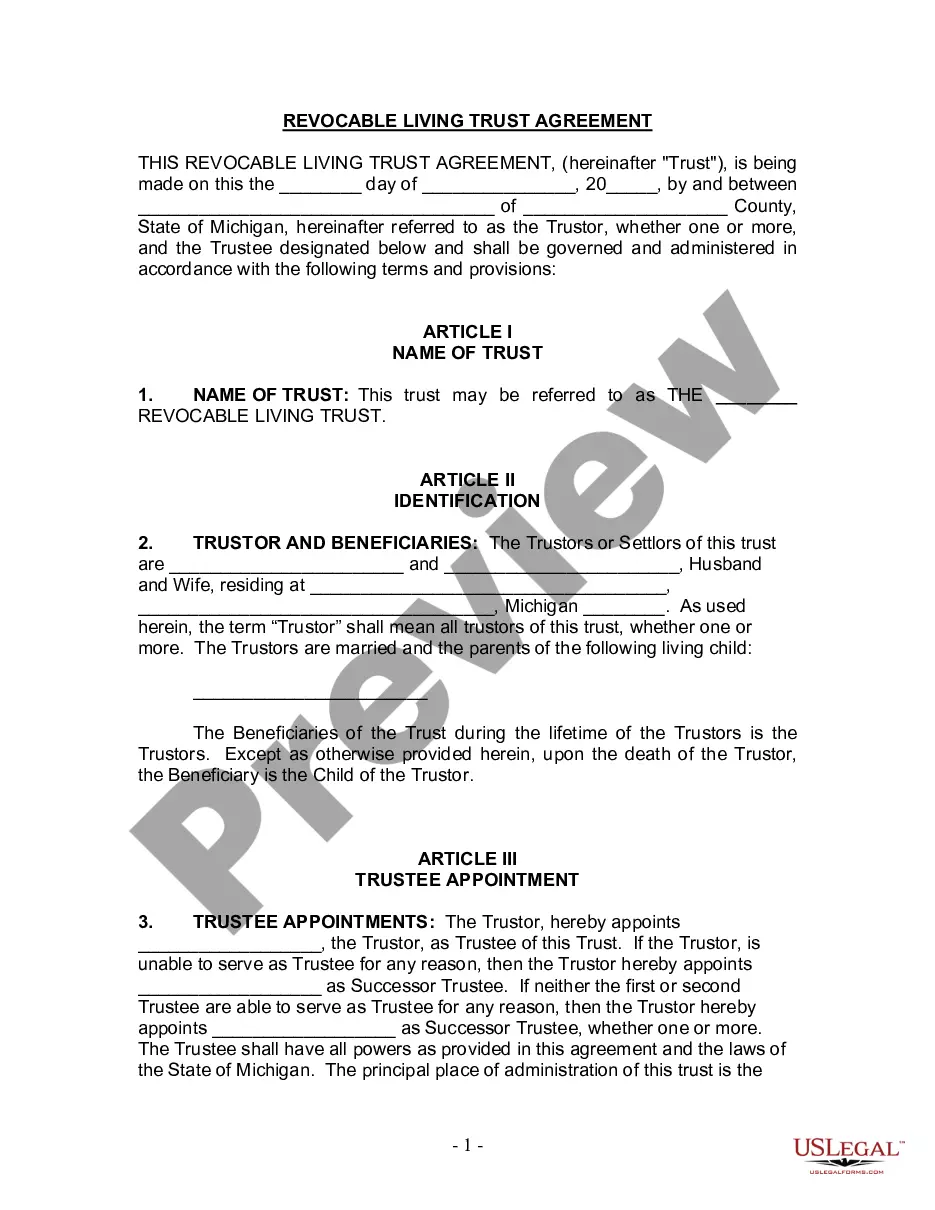

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Ann Arbor Michigan Living Trust for Husband and Wife with One Child is a legal arrangement that allows a couple to protect and manage their assets during their lifetime and ensure a smooth transfer of those assets to their child or children upon their death. This type of trust is specifically designed for married couples residing in Ann Arbor, Michigan, who wish to preserve their wealth, minimize estate taxes, and avoid the lengthy and costly probate process. There are several variations of the Ann Arbor Michigan Living Trust for Husband and Wife with One Child, depending on specific needs and preferences. Here are a few examples: 1. Revocable Living Trust: This type of trust is the most common choice for couples, as it allows them to retain control over their assets during their lifetime. They can modify or revoke the trust as they see fit, ensuring flexibility and adaptability. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked without the consent of all parties involved. This trust provides added protection against creditors and reduces estate tax liability. However, it comes with less flexibility compared to a revocable trust. 3. Testamentary Trust: A testamentary trust is established through a will and takes effect only upon the death of both spouses. This type of trust is often used when couples want to preserve their assets for the benefit of their child until they reach a certain age or achieve specific milestones. 4. Special Needs Trust: If the couple's child has special needs or disabilities, a special needs trust can be established within the Ann Arbor Michigan Living Trust. This trust ensures that the child's inheritance is managed properly and does not disrupt their eligibility for government benefits. 5. Charitable Remainder Trust: For couples who have philanthropic goals, a charitable remainder trust can be included in their living trust. This allows them to donate a portion of their assets to a charitable organization while retaining income from the trust during their lifetime. When creating an Ann Arbor Michigan Living Trust for Husband and Wife with One Child, it is essential to consult with an experienced estate planning attorney familiar with Michigan state laws. The attorney will guide the couple through the process, ensure that their wishes are accurately reflected in the trust, and assist in selecting the most appropriate type of trust to meet their unique needs.

Free preview

How to fill out Ann Arbor Michigan Living Trust For Husband And Wife With One Child?

If you’ve already utilized our service before, log in to your account and download the Ann Arbor Michigan Living Trust for Husband and Wife with One Child on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Ann Arbor Michigan Living Trust for Husband and Wife with One Child. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!