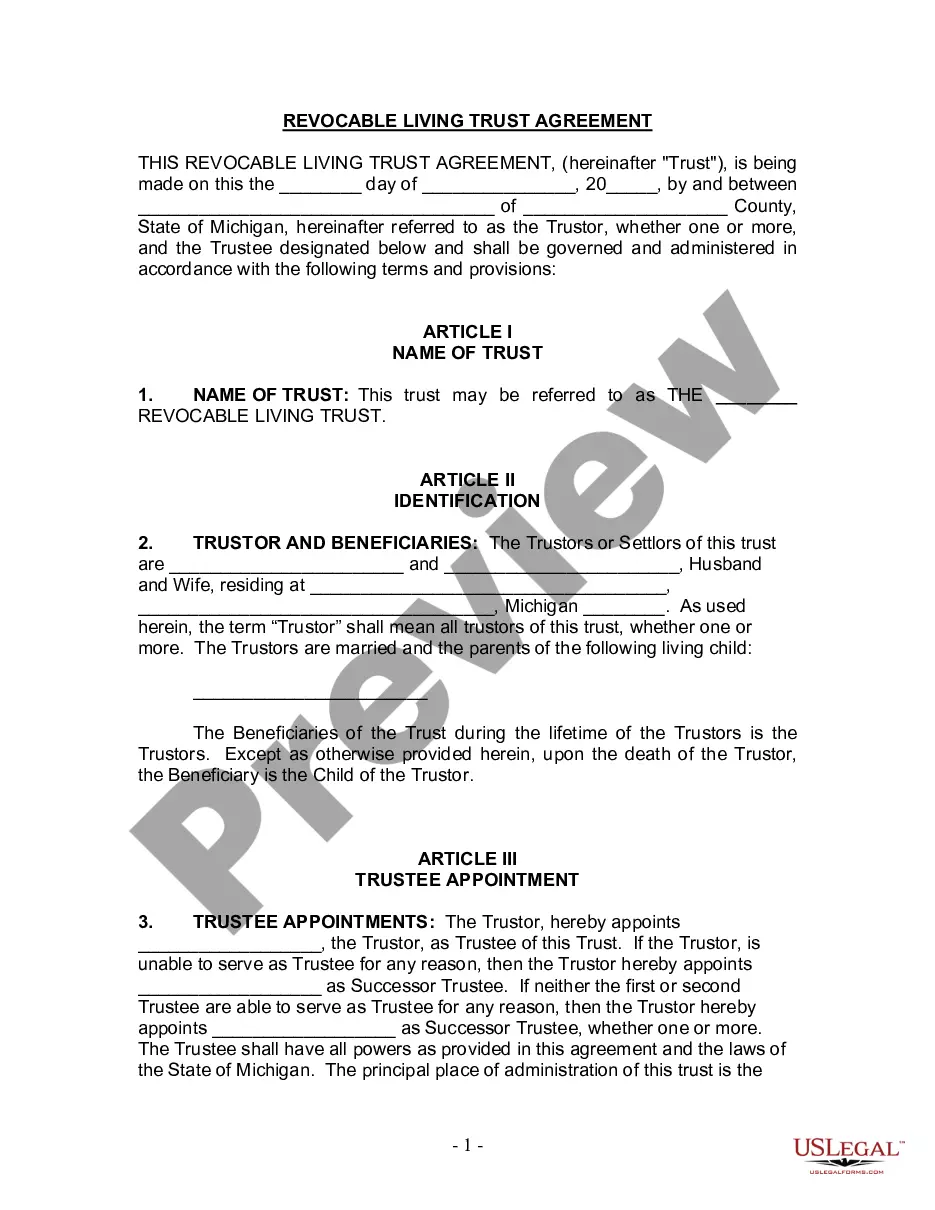

A Detroit Michigan Living Trust for Husband and Wife with One Child is a legal document that allows a married couple with one child to establish a trust to hold and manage their assets during their lifetime and provide for the distribution of those assets upon their death. This type of living trust is designed to protect and secure the interests of the husband, wife, and their child, ensuring that their assets are distributed according to their wishes. The main purpose of this living trust is to avoid probate, which is a legal process that occurs after someone's death to validate their will and administer their estate. By creating a living trust, the couple can transfer their assets into the trust and become the trustees, giving them full control over their assets and how they are managed and distributed during their lifetime. In a Detroit Michigan Living Trust for Husband and Wife with One Child, there are a few variations that can be considered based on specific circumstances and preferences. These variations include: 1. Revocable Living Trust: This type of trust allows the couple to make changes or revoke the trust at any time during their lifetime. It provides flexibility and control over the assets within the trust. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable living trust cannot be changed or revoked once it is established. It offers greater protection of assets from creditors and potential estate taxes. 3. Testamentary Trust: Unlike a revocable or irrevocable trust, a testamentary trust is created within a will and only takes effect upon the death of the person creating the will. It is commonly used when the couple wants to ensure that their child inherits the assets in a specific manner or over a specific period. 4. Supplemental Needs Trust: This type of trust is specifically designed to provide support and financial assistance to a child with special needs without jeopardizing their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI). 5. Discretionary Trust: A discretionary trust grants the trustee the authority to determine when and how the assets are distributed to the child, providing flexibility and protection for the assets within the trust. By consulting with an attorney experienced in estate planning, a Detroit Michigan Living Trust for Husband and Wife with One Child can be customized to fit the unique circumstances and goals of the couple, ensuring that their wishes for asset management and distribution are safeguarded.

Detroit Michigan Living Trust for Husband and Wife with One Child

Description

How to fill out Detroit Michigan Living Trust For Husband And Wife With One Child?

If you are searching for a relevant form template, it’s extremely hard to choose a better platform than the US Legal Forms website – probably the most considerable libraries on the web. Here you can find a large number of form samples for business and personal purposes by types and states, or key phrases. With the advanced search function, finding the most up-to-date Detroit Michigan Living Trust for Husband and Wife with One Child is as elementary as 1-2-3. Moreover, the relevance of each file is confirmed by a group of professional lawyers that regularly check the templates on our website and revise them in accordance with the latest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Detroit Michigan Living Trust for Husband and Wife with One Child is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the form you require. Check its description and use the Preview feature (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the proper file.

- Confirm your selection. Choose the Buy now button. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Detroit Michigan Living Trust for Husband and Wife with One Child.

Every single form you add to your user profile has no expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to receive an extra copy for modifying or printing, you may come back and save it once more at any time.

Make use of the US Legal Forms professional catalogue to get access to the Detroit Michigan Living Trust for Husband and Wife with One Child you were seeking and a large number of other professional and state-specific samples on one website!