Oakland Michigan Living Trust for Husband and Wife with One Child offers a comprehensive estate planning solution that allows married couples in Oakland, Michigan to protect and manage their assets during their lifetime and efficiently transfer them to their child upon their passing. A living trust, also known as a revocable trust, is a legal document that holds ownership of assets while the creators of the trust are still alive. It offers numerous benefits, including avoiding probate, maintaining privacy, ensuring asset management in the event of incapacity, and minimizing estate taxes. In Oakland, Michigan, there are different types of living trusts that can be customized to meet the specific needs of a husband and wife with one child, such as: 1. Joint Revocable Living Trust: This type of living trust is established by both spouses together, allowing them to jointly manage and control their assets during their lifetime. It provides the flexibility to make changes, update beneficiaries, and modify terms in the trust agreement. Upon the passing of both spouses, the assets in the trust can be transferred to the child or held in trust for the child's benefit until a specified age or event. 2. A/B Living Trust: Also known as a "credit shelter trust" or "family trust," an A/B Living Trust divides assets into two separate trusts upon the death of the first spouse. The first spouse's trust, known as the "A trust" or "marital trust," provides income and use of assets to the surviving spouse while preserving the assets for the ultimate distribution to the child. The "B trust" or "bypass trust" shelters the assets from estate taxes and ensures they pass to the child or other designated beneficiaries upon the surviving spouse's death. 3. Testamentary Trust: A testamentary trust is created through a will and takes effect upon the death of the testator. In the case of a husband and wife with one child, they can establish a joint will where the surviving spouse's trust includes provisions for the child's future care, education, and distribution of assets. This type of trust provides more control over how the assets are managed and distributed while still avoiding probate. Overall, Oakland Michigan Living Trust for Husband and Wife with One Child offers flexible options for asset management, probate avoidance, and ensuring the secure transfer of assets to the child. Consulting with an experienced estate planning attorney is highly recommended assessing individual circumstances and determine the most suitable living trust structure.

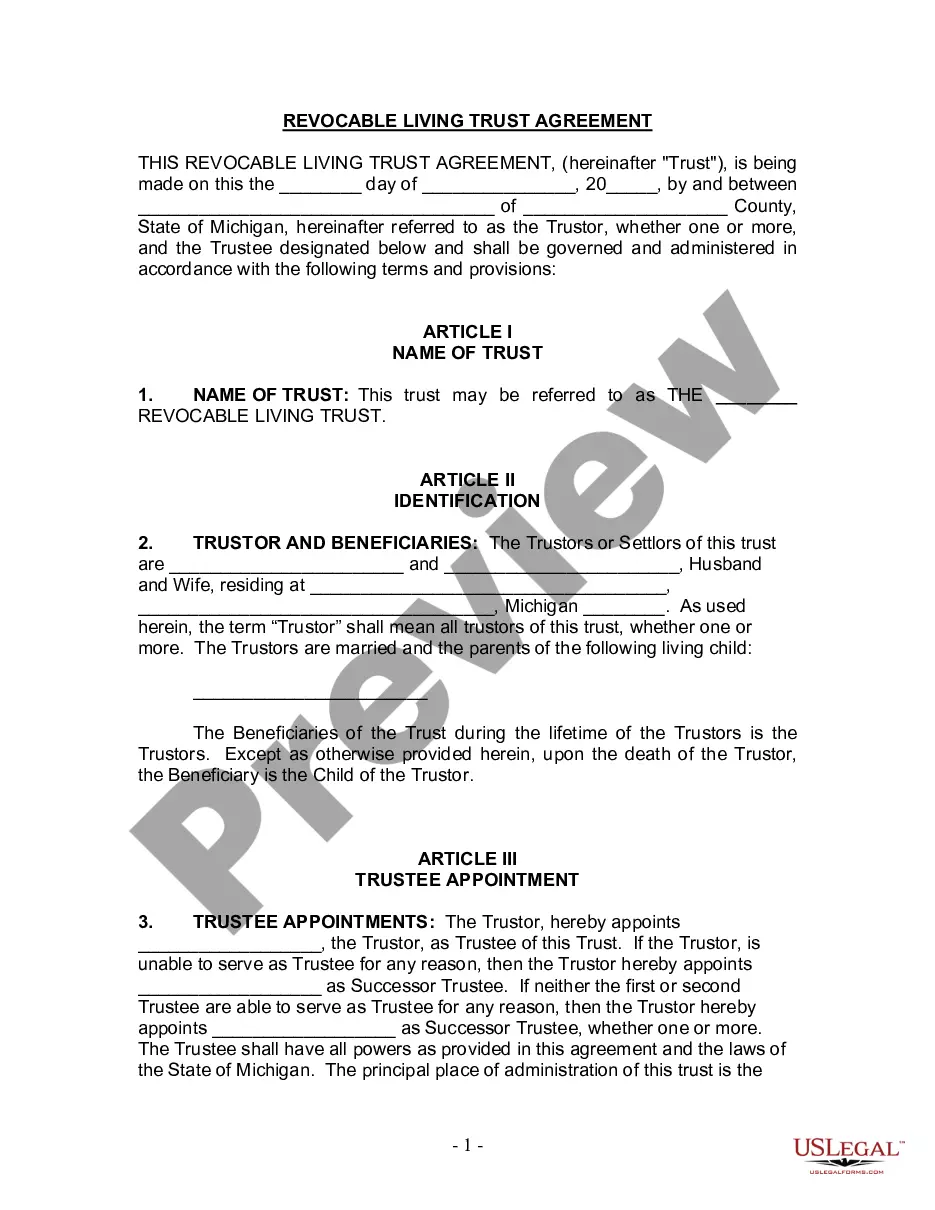

Oakland Michigan Living Trust for Husband and Wife with One Child

Description

How to fill out Oakland Michigan Living Trust For Husband And Wife With One Child?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Oakland Michigan Living Trust for Husband and Wife with One Child? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Oakland Michigan Living Trust for Husband and Wife with One Child conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Oakland Michigan Living Trust for Husband and Wife with One Child in any provided file format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online once and for all.