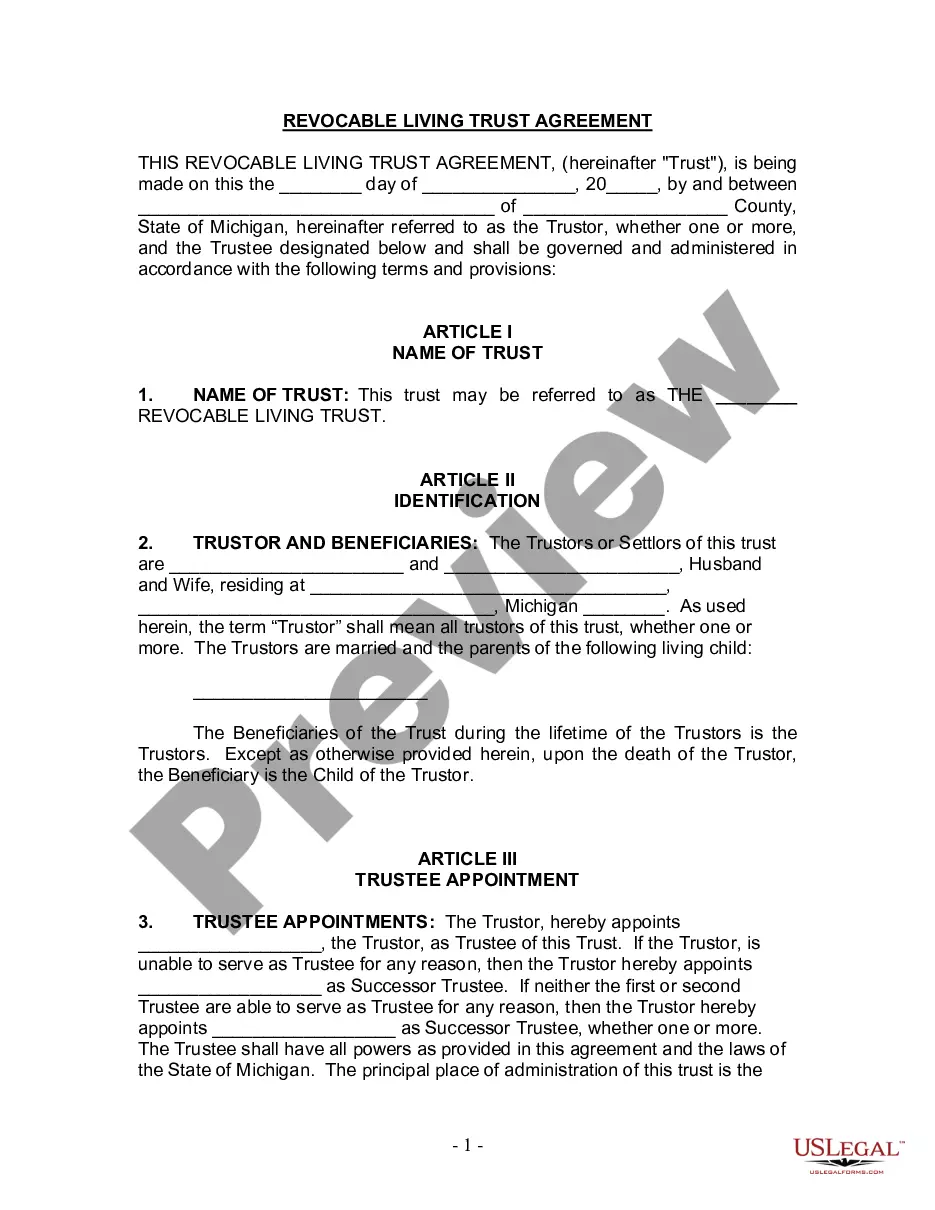

Wayne Michigan Living Trust for Husband and Wife with One Child is a legal arrangement designed to protect and manage assets and property for the benefit of a couple and their single child. This type of living trust ensures that the couple's estate is preserved and distributed according to their wishes while minimizing probate expenses and avoiding the need for court oversight. One common type of living trust is the revocable living trust. This trust allows the couple to maintain control and flexibility over their assets during their lifetime while ensuring a smooth transition of assets upon their passing. With a revocable living trust, the couple can amend or revoke the trust at any time as circumstances change. Another type of living trust is the irrevocable living trust. Unlike the revocable living trust, an irrevocable trust, once established, cannot be changed or revoked without the consent of all involved parties. This type of trust allows the couple to potentially reduce estate taxes and protect assets from creditors. Wayne Michigan Living Trust for Husband and Wife with One Child provides several key advantages. First and foremost, it allows the couple to designate a successor trustee to manage and distribute their assets according to their wishes, ensuring their child is adequately provided for. Additionally, this trust helps avoid the lengthy and costly probate process, which can delay asset distribution and result in substantial fees. By establishing a living trust, the couple can also maintain privacy as trust documents are not subject to public record, unlike wills. This ensures that the details of their estate plan remain confidential. Furthermore, a living trust allows for greater asset protection, shielding assets from potential creditors or legal claims. In summary, a Wayne Michigan Living Trust for Husband and Wife with One Child is a versatile and effective estate planning tool that provides numerous advantages. Whether choosing a revocable or irrevocable trust, couples can ensure their assets are managed, protected, and distributed according to their wishes for the benefit of their child.

Wayne Michigan Living Trust for Husband and Wife with One Child

Description

How to fill out Wayne Michigan Living Trust For Husband And Wife With One Child?

If you are searching for a valid form template, it’s difficult to choose a more convenient platform than the US Legal Forms site – one of the most extensive online libraries. With this library, you can get thousands of document samples for company and individual purposes by types and regions, or keywords. Using our advanced search function, finding the newest Wayne Michigan Living Trust for Husband and Wife with One Child is as easy as 1-2-3. In addition, the relevance of every record is proved by a group of expert attorneys that regularly check the templates on our website and update them according to the most recent state and county laws.

If you already know about our platform and have a registered account, all you should do to get the Wayne Michigan Living Trust for Husband and Wife with One Child is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you need. Look at its description and make use of the Preview function to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to discover the appropriate file.

- Affirm your choice. Click the Buy now option. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Wayne Michigan Living Trust for Husband and Wife with One Child.

Every single form you save in your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for enhancing or creating a hard copy, you can come back and save it once again whenever you want.

Make use of the US Legal Forms extensive catalogue to gain access to the Wayne Michigan Living Trust for Husband and Wife with One Child you were looking for and thousands of other professional and state-specific templates in a single place!