Detroit Michigan Living Trust for Husband and Wife with Minor and or Adult Children

Description

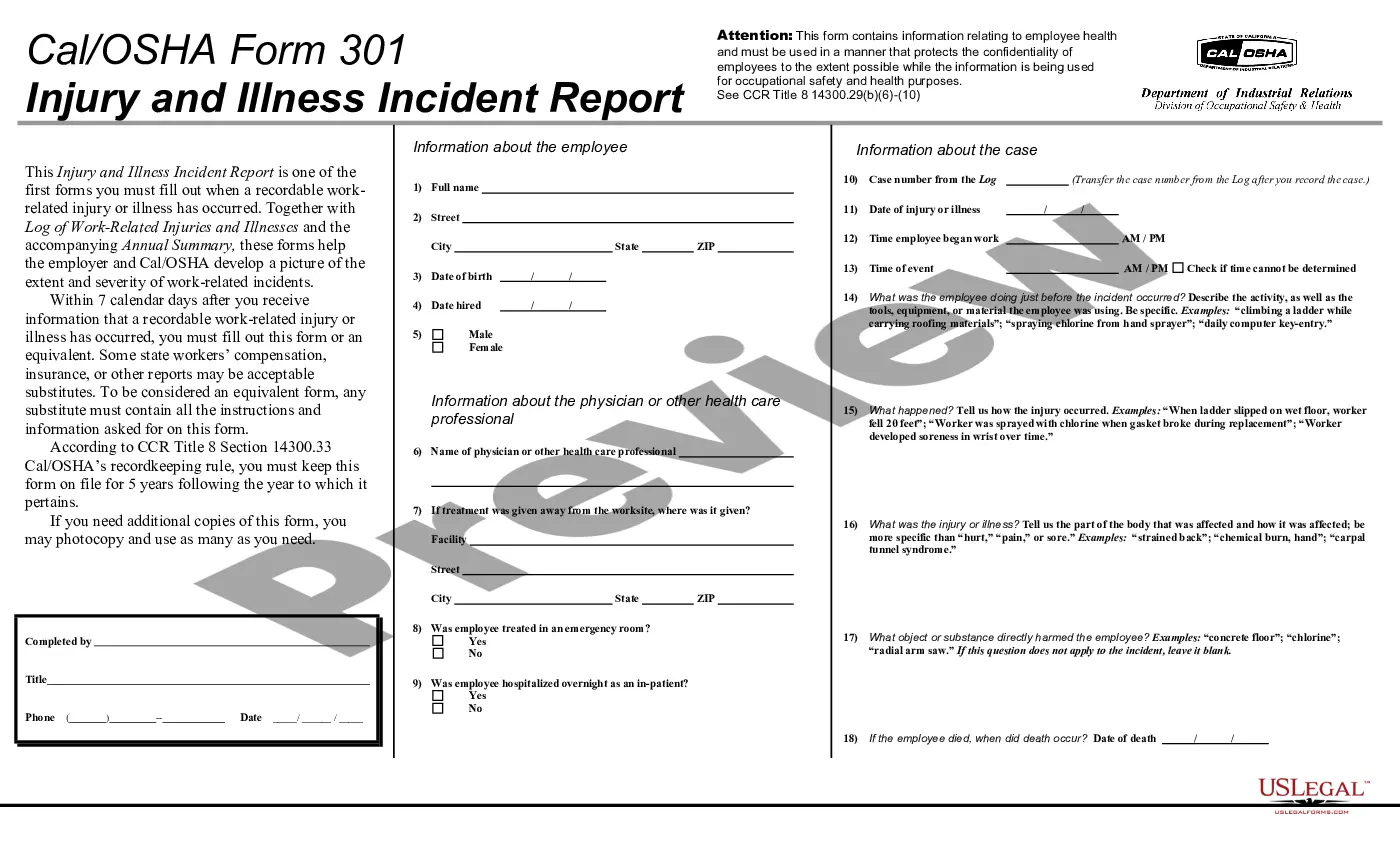

How to fill out Michigan Living Trust For Husband And Wife With Minor And Or Adult Children?

If you have previously utilized our service, Log In to your account and download the Detroit Michigan Living Trust for Husband and Wife with Minor and/or Adult Children onto your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your first time using our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and use the Preview feature, if available, to verify if it suits your needs. If it does not meet your criteria, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and pick a monthly or annual subscription option.

- Create an account and make a payment. Enter your credit card information or choose the PayPal option to finalize the purchase.

- Obtain your Detroit Michigan Living Trust for Husband and Wife with Minor and/or Adult Children. Select the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A trust can be a useful estate-planning tool for lots of people. But given the expenses associated with opening one, it's probably not worth it unless you have a certain amount of assets.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

A Living Trust can help you avoid Probate in Michigan, but a Will cannot. A Living Trust is a private document which does not require any court intervention. Most Living Trust transfers take place in the privacy of your attorney's office shortly after a death.

Professionals usually charge an annual fee of between 1 percent to 2 percent of assets in the trust.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

The cost of forming a living trust in Michigan will depend on how you go about creating it. One option is to make it yourself using an online service. You could pay less than $100 or as much as $300 if you opt for this method. The other option is to draw up the trust document with the help an attorney.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.