Grand Rapids Michigan Amendment to Living Trust

Description

How to fill out Michigan Amendment To Living Trust?

Regardless of social or career position, completing legal-related documents is an unfortunate requirement in today’s business landscape.

Frequently, it’s nearly impossible for someone without legal education to generate such paperwork from scratch, primarily due to the complex terminology and legal intricacies they entail.

This is where US Legal Forms can be a lifesaver.

Ensure that the template you’ve found is suitable for your area because the laws of one state may not apply to another.

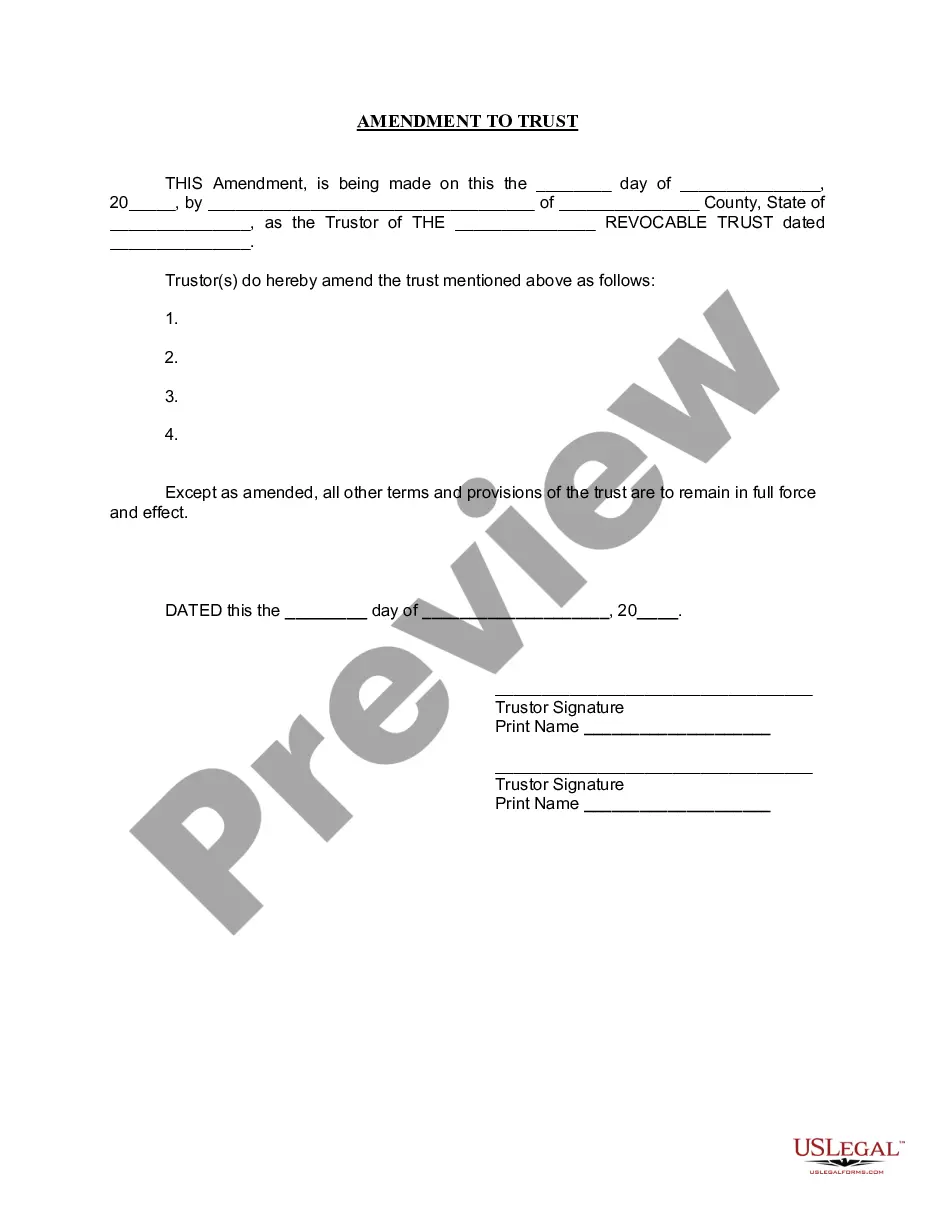

Preview the document and review a brief summary (if available) of situations the paper can be utilized for.

- Our service offers an extensive collection of over 85,000 state-specific forms that are suitable for nearly any legal situation.

- US Legal Forms also acts as an excellent resource for partners or legal advisors who wish to save time utilizing our DIY documents.

- Regardless of whether you need the Grand Rapids Michigan Amendment to Living Trust or other documents valid in your region, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Grand Rapids Michigan Amendment to Living Trust in moments using our reliable service.

- In case you are a returning customer, you can proceed and Log In to your account to access the correct form.

- However, if you are new to our library, make sure to follow these steps prior to downloading the Grand Rapids Michigan Amendment to Living Trust.

Form popularity

FAQ

In Michigan, a living trust does not need to be recorded like a will. Trust documents usually remain private and do not require filing with the state. This privacy can be beneficial for your beneficiaries, allowing them to manage assets without public scrutiny. If you are exploring options for a Grand Rapids Michigan Amendment to Living Trust, utilizing a non-recorded trust can offer added discretion for your estate.

Making changes to a revocable trust involves preparing a document that specifies the desired modifications. These changes can include adding or removing beneficiaries or altering asset distributions. A Grand Rapids Michigan Amendment to Living Trust helps ensure that your revisions are valid and enforceable. For added convenience and guidance during this process, consider exploring options available on USLegalForms, which can provide you with necessary templates and support.

To make changes to your revocable living trust, you typically need to draft an amendment that outlines the specific alterations. This document should be signed and dated as per state requirements, ensuring that it reflects your current wishes. Many find that utilizing a Grand Rapids Michigan Amendment to Living Trust provides clarity and adherence to the necessary legal standards. If you're looking for straightforward tools to assist with this process, USLegalForms can be a valuable resource.

In California, you can make handwritten changes to your trust, provided that these amendments comply with state laws. However, it is crucial to ensure that any modifications clearly state your intentions and meet the legal requirements. Utilizing a Grand Rapids Michigan Amendment to Living Trust can simplify the amendment process. If you're unsure, consider seeking assistance from a legal professional or using platforms like USLegalForms to ensure your changes are valid.

Trust documents do not necessarily have to be notarized to be legally binding in Michigan. However, notarization offers additional protection, making it easier to handle financial matters or dispute claims. When preparing a Grand Rapids Michigan Amendment to Living Trust, consider using US Legal Forms to navigate the documentation requirements efficiently.

In most cases, a trust in Michigan does not need to be notarized for its validity. However, having your trust notarized can help alleviate concerns that financial institutions may have in recognizing the trust. When devising a Grand Rapids Michigan Amendment to Living Trust, consider notarization to ease the fund's management and distribution processes.

One major mistake parents often make when setting up a trust fund is failing to update the trust after significant life events. Changes in family dynamics, such as births, deaths, or marriages, can affect your estate planning. It's crucial to ensure that a Grand Rapids Michigan Amendment to Living Trust reflects your current wishes and family structure to avoid complications later.

To amend a trust in Michigan, you can create a document that clearly states your intent to modify specific provisions. This amendment must be signed by you, the grantor, and may need to be notarized for extra assurance. Utilizing legal platforms like US Legal Forms can streamline the process of creating the necessary documentation for a Grand Rapids Michigan Amendment to Living Trust.

In Michigan, a living trust typically does not require notarization to be valid. However, while notarization is not mandated for the trust itself, it can be beneficial for ensuring acceptance by financial institutions or other entities. Thus, when considering a Grand Rapids Michigan Amendment to Living Trust, notarization may enhance trust and facilitate smoother transitions.

To ensure a trust is valid in Michigan, it must meet specific legal requirements. First, the trust must have a clear purpose and identify the beneficiaries. Additionally, the trust document should be properly executed, meaning it has been signed by the grantor and, in some cases, witnessed. This validity is essential for a Grand Rapids Michigan Amendment to Living Trust to function properly in managing your assets.