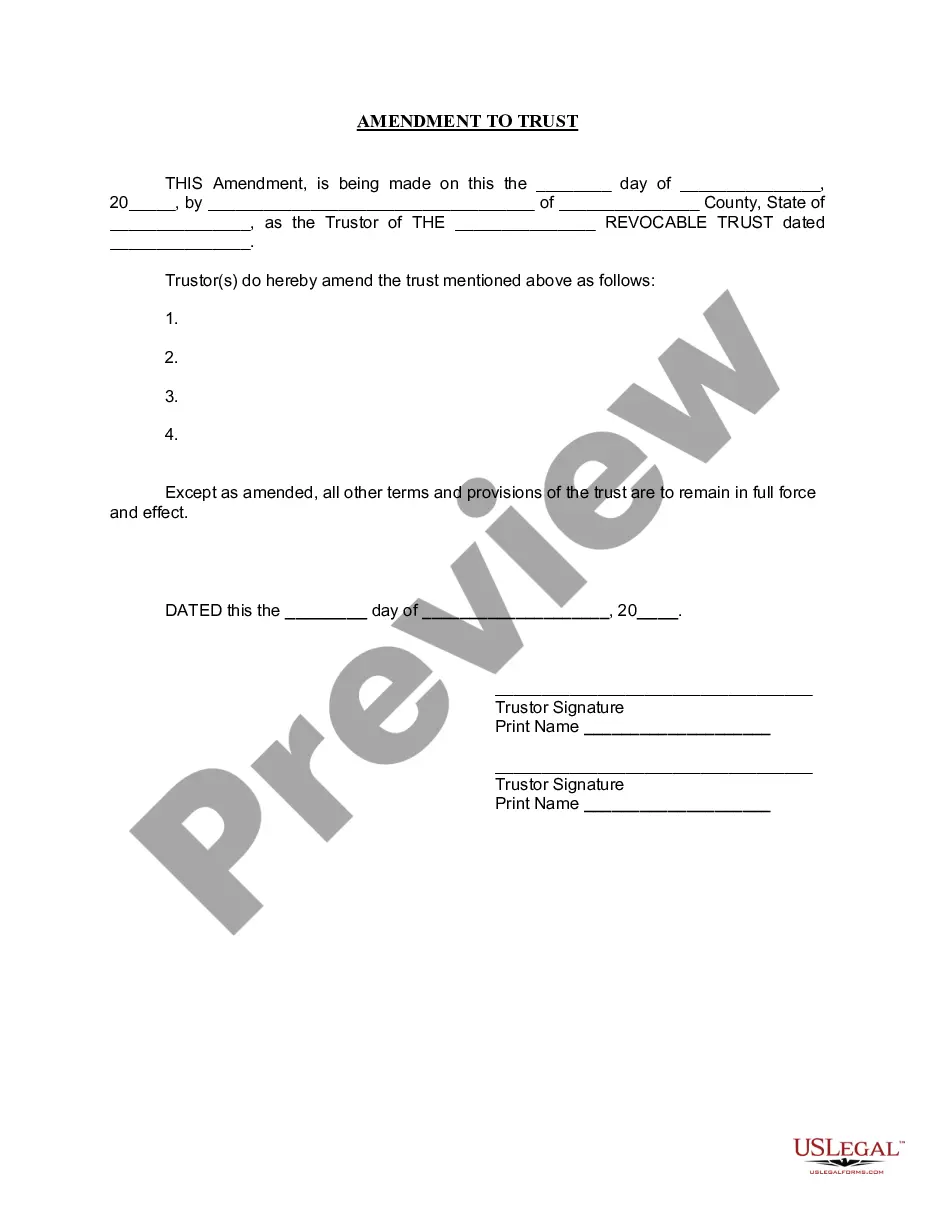

The Wayne Michigan Amendment to Living Trust is a legal instrument that allows individuals in Wayne County, Michigan, to make changes or modifications to their existing living trust. It is an essential document for those who have already established a living trust but wish to modify the terms, beneficiaries, or other provisions of the trust. There are various types of Wayne Michigan Amendment to Living Trust, and they are primarily categorized based on the specific modifications made. Some common types include: 1. Beneficiary Amendment: This type of amendment allows the granter (the person who created the trust) to change the beneficiaries or their respective shares mentioned in the original living trust. It is often used when individuals want to include new family members, remove certain beneficiaries, or revise the distribution of assets among beneficiaries. 2. Power of Appointment Amendment: With this amendment, individuals can alter or expand the powers of appointment granted to their appointed agents, beneficiaries, or trustees. It enables the granter to modify how the trust assets can be distributed among the beneficiaries or future generations. 3. Trustee Amendment: A Wayne Michigan Amendment to Living Trust can also be used to change the appointment of trustees or successor trustees mentioned in the original trust paperwork. This amendment allows granters to replace existing trustees, add co-trustees, or alter the order of successor trustees. 4. Specific Asset Amendment: In some cases, individuals may want to add or remove specific assets from their living trust. This type of amendment allows granters to include new properties, investments, or financial accounts, or exclude certain assets from the trust's coverage. 5. Administrative Amendment: An administrative amendment is used when minor administrative changes need to be made to the trust. These changes could include updates to contact information, addresses, or personal details of the granter or trustees. The Wayne Michigan Amendment to Living Trust is a powerful tool that ensures the flexibility of an individual's estate planning strategy. By allowing modifications to the original living trust, it enables the granter to align their estate plan with changing circumstances, desires, or preferences. Seeking legal advice from an attorney experienced in estate planning and trust law is crucial when considering or executing these amendments to guarantee compliance with Michigan state laws and secure the intended modifications to the living trust.

Wayne Michigan Amendment to Living Trust

Description

How to fill out Wayne Michigan Amendment To Living Trust?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, as a rule, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Wayne Michigan Amendment to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Wayne Michigan Amendment to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Wayne Michigan Amendment to Living Trust would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!