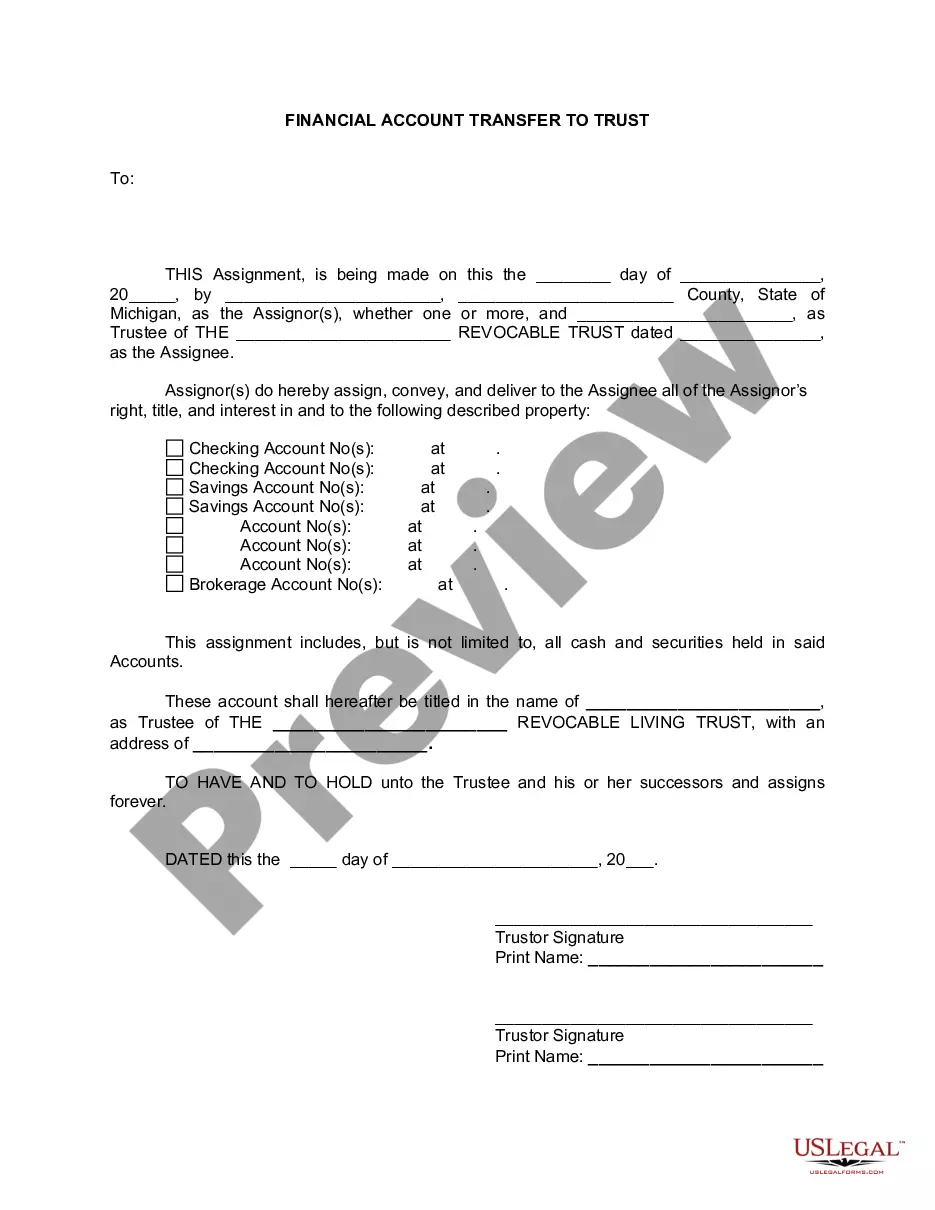

Detroit Michigan Financial Account Transfer to Living Trust is a legal process that involves the transfer of financial accounts to a living trust in the city of Detroit, located in the state of Michigan. This process allows individuals to ensure a smooth and efficient transfer of their financial assets upon their death or incapacitation. A living trust, also known as a revocable trust, is a legal document that holds ownership of assets during an individual's lifetime and allows for the distribution of those assets after their passing. By transferring financial accounts to a living trust, individuals can avoid probate, a court-supervised process that validates and administers a person's will, making the distribution of assets a lengthy and potentially costly affair. There are several types of transfers to living trusts available in Detroit, Michigan's financial account transfer process. The most common types include: 1. Detroit Michigan Financial Account Transfer to Living Trust — Traditional Method: In this method, individuals transfer their financial accounts, including bank accounts, investment accounts, retirement accounts, and brokerage accounts, to their living trust by formally changing the account ownership to the name of the trust. This involves notifying the financial institution where the accounts are held and providing them with the necessary documentation to effectuate the transfer. 2. Detroit Michigan Financial Account Transfer to Living Trust — Payable on Death (POD) or Transfer on Death (TOD) Designation: With this method, individuals can avoid the transfer process entirely by designating their living trust as the beneficiary of their financial accounts. Upon their death, the funds or assets held in these accounts are automatically transferred to the trust without going through probate. This method simplifies the transfer process and does not require formal ownership changes during an individual's lifetime. 3. Detroit Michigan Financial Account Transfer to Living Trust — Special Considerations: Depending on the specific financial accounts involved, there might be additional steps or considerations in the transfer process. For example, certain retirement accounts, such as 401(k) or IRA (Individual Retirement Account), may have specific IRS regulations that need to be followed. Consulting with a qualified attorney or financial advisor specializing in estate planning and trust administration can provide valuable guidance in navigating these complexities. Overall, the Detroit Michigan Financial Account Transfer to Living Trust is a crucial step in estate planning, allowing individuals to ensure the efficient and private transfer of their financial assets to their chosen beneficiaries. It provides the peace of mind that their assets will be distributed as per their wishes, while minimizing the time, costs, and potential complications associated with probate.

Detroit Michigan Financial Account Transfer to Living Trust

Description

How to fill out Detroit Michigan Financial Account Transfer To Living Trust?

Do you require a dependable and affordable legal forms provider to obtain the Detroit Michigan Financial Account Transfer to Living Trust? US Legal Forms is your preferred option.

Whether you need a simple arrangement to establish guidelines for cohabiting with your partner or a collection of forms to advance your divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are tailored based on the regulations of specific states and regions.

To download the document, you must Log In to your account, locate the necessary form, and click the Download button next to it. Kindly note that you can access your previously acquired document templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can set up an account with great ease, but before proceeding, ensure to do the following.

Now you can create your account. Then select the subscription plan and go ahead with the payment. Once the payment is complete, download the Detroit Michigan Financial Account Transfer to Living Trust in the available format. You can return to the site anytime and redownload the document without any additional charges.

Obtaining the latest legal forms has never been simpler. Try US Legal Forms today, and eliminate the frustration of spending hours researching legal documentation online once and for all.

- Verify if the Detroit Michigan Financial Account Transfer to Living Trust aligns with your state and local laws.

- Examine the form’s specifics (if available) to understand who and what the document is suitable for.

- Restart the search if the form is not applicable to your legal situation.

Form popularity

FAQ

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Transfers to an irrevocable trust are generally subject to gift tax. This means that even though assets transferred to an irrevocable trust will not be subject to estate tax, they will generally be subject to gift tax.

The trust itself must report income to the IRS and pay capital gains taxes on earnings. It must distribute income earned on trust assets to beneficiaries annually. If you receive assets from a simple trust, it is considered taxable income and you must report it as such and pay the appropriate taxes.

Non-Grantor Trusts Beneficiaries must report and pay taxes on income distributed to them. In return, the trust claims a tax deduction for the amount distributed. Non-grantor trusts are either simple or complex. All earned income in a simple trust must be distributed to a beneficiary or beneficiaries annually.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

If the trust is revocable, for tax purposes you are considered to be the owner. This means that a transfer has no tax effect. You would not incur capital gains and the property's tax basis would not be adjusted. This is also true of a transfer of the property to a nominee trust of which you are the beneficiary.

Revocable Trusts Any income generated by a revocable trust is taxable to the trust's creator (who is often also referred to as a settlor, trustor, or grantor) during the trust creator's lifetime. This is because the trust's creator retains full control over the terms of the trust and the assets contained within it.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

The cost of forming a living trust in Michigan will depend on how you go about creating it. One option is to make it yourself using an online service. You could pay less than $100 or as much as $300 if you opt for this method. The other option is to draw up the trust document with the help an attorney.