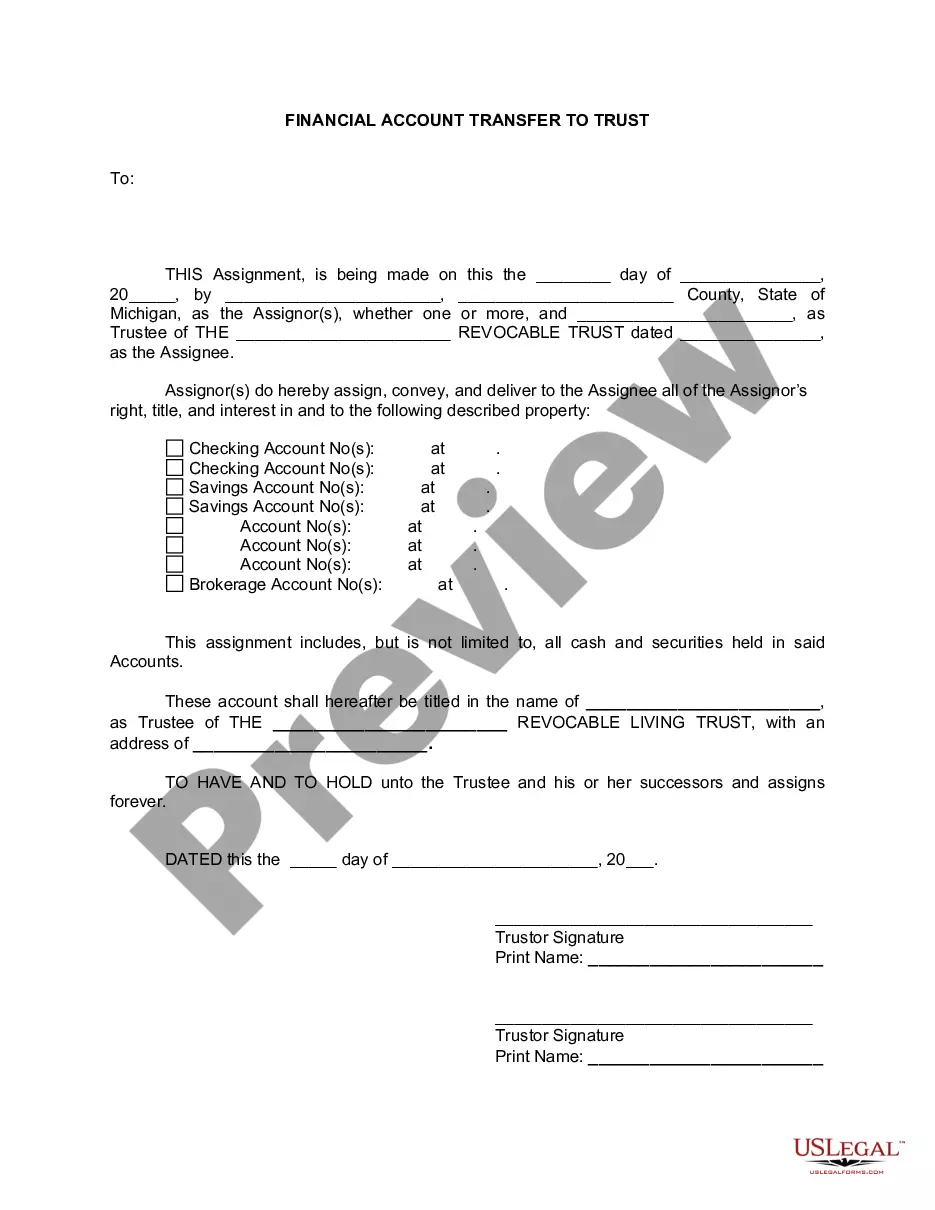

A Grand Rapids Michigan Financial Account Transfer to Living Trust allows individuals in the Grand Rapids area to transfer their financial accounts to a living trust for more efficient management and distribution of assets. This process ensures that the individual's finances are properly accounted for and distributed according to their wishes. There are several types of Grand Rapids Michigan Financial Account Transfer to Living Trust, including: 1. Grand Rapids Michigan Revocable Living Trust: This type of living trust allows individuals to transfer their financial accounts to a trust that they can amend or revoke at any time. It provides flexibility and control over assets while avoiding probate. 2. Grand Rapids Michigan Irrevocable Living Trust: An irrevocable living trust ensures that the transferred financial accounts cannot be modified or revoked without the consent of the beneficiaries. This trust is often established to minimize estate taxes or protect assets from creditors. 3. Grand Rapids Michigan Testamentary Trust: This type of living trust becomes effective upon the individual's death and allows for the transfer of financial accounts to beneficiaries named in the trust document. Testamentary trusts are commonly created to provide ongoing financial support for minor children or individuals with special needs. 4. Grand Rapids Michigan Special Needs Trust: A special needs trust is designed to protect the financial accounts of individuals with disabilities while allowing them to retain eligibility for government assistance programs. This trust provides for their specific needs without jeopardizing their access to public benefits. The Grand Rapids Michigan Financial Account Transfer to Living Trust process involves several steps: 1. Evaluation and Planning: Individuals consider their financial goals, beneficiaries, and estate planning objectives. They assess their financial accounts and determine which assets to transfer to the living trust. 2. Creation of Living Trust: An attorney assists in drafting a comprehensive living trust document that outlines the transfer of financial accounts to the trust. The document includes provisions for asset management, distribution, and any specific instructions. 3. Transfer of Financial Accounts: The individual then contacts their financial institutions to initiate the transfer process. They provide the necessary documentation, such as the living trust document and account information. 4. Updating Account Beneficiary Designations: It is important to update beneficiary designations on financial accounts to align with the living trust. This step ensures assets are distributed per the trust's instructions, overriding any previous designations. 5. Ongoing Account Management: After the transfer, the individual, or their designated trustee, assumes responsibility for managing the financial accounts within the living trust. They must ensure proper record-keeping, tax filings, and adherence to trust provisions. Overall, a Grand Rapids Michigan Financial Account Transfer to Living Trust allows individuals in the area to streamline their estate planning efforts, safeguard assets, minimize probate, and ensure a smooth distribution of their financial accounts to intended beneficiaries. Seeking professional legal advice is crucial for a proper understanding and implementation of this process.

Grand Rapids Michigan Financial Account Transfer to Living Trust

Description

How to fill out Grand Rapids Michigan Financial Account Transfer To Living Trust?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Grand Rapids Michigan Financial Account Transfer to Living Trust or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Grand Rapids Michigan Financial Account Transfer to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Grand Rapids Michigan Financial Account Transfer to Living Trust would work for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!