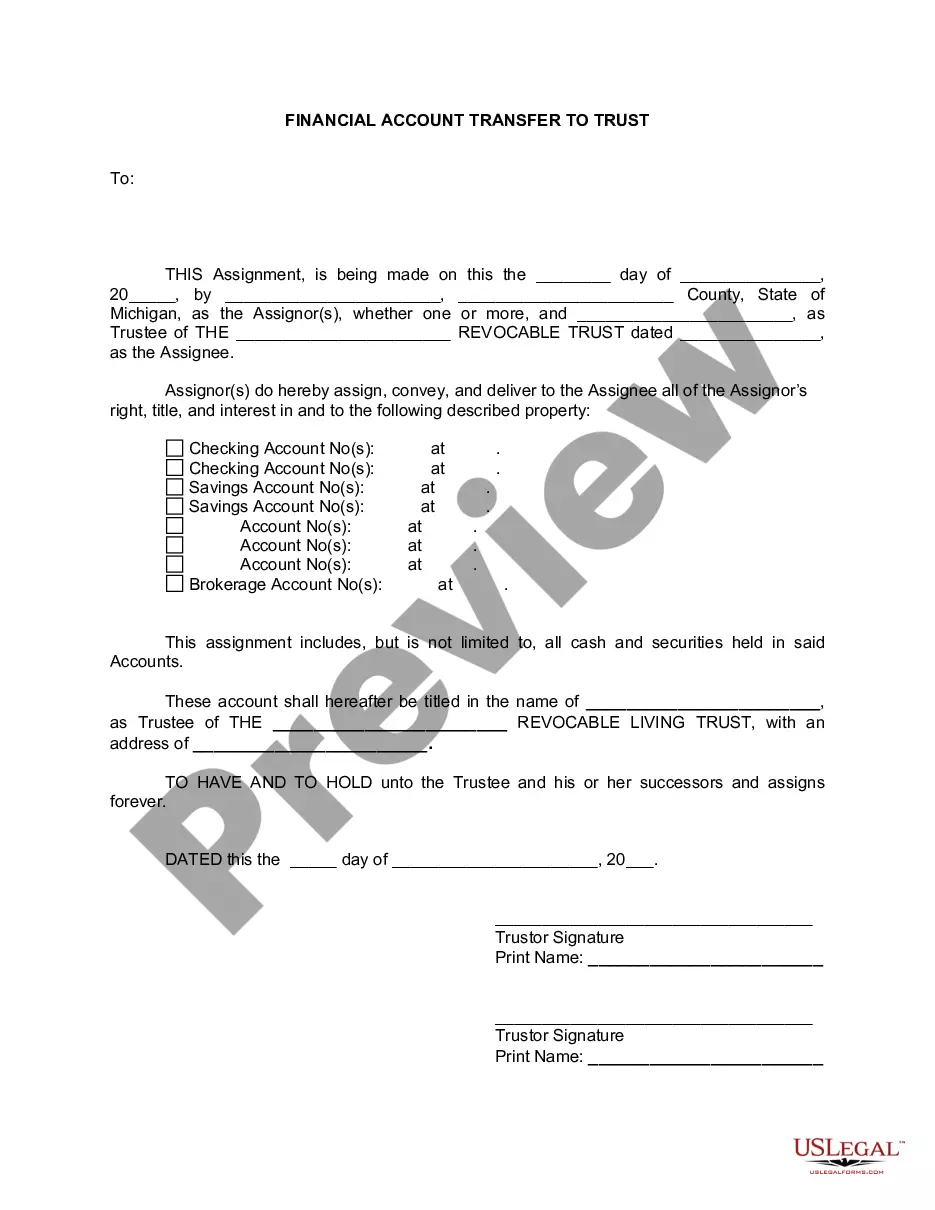

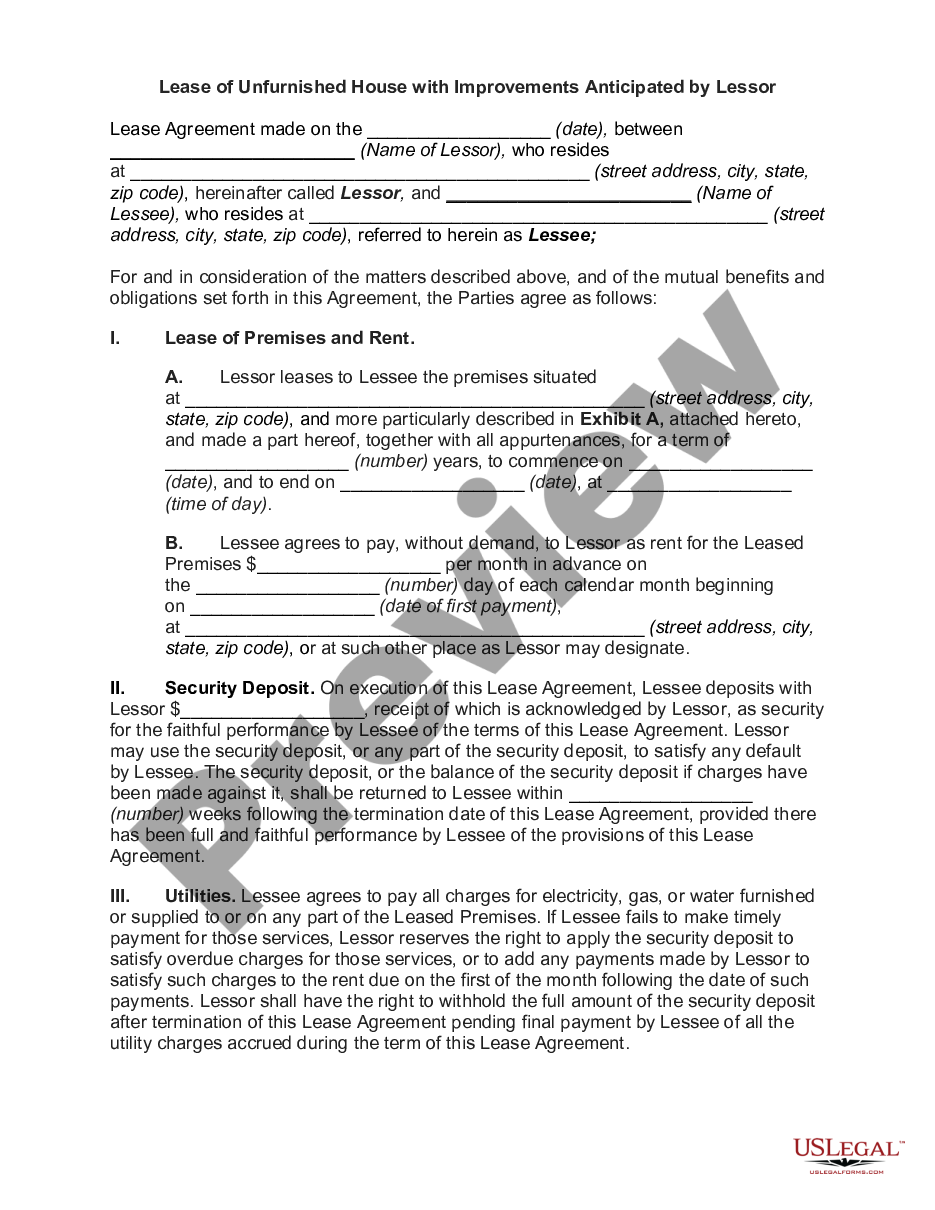

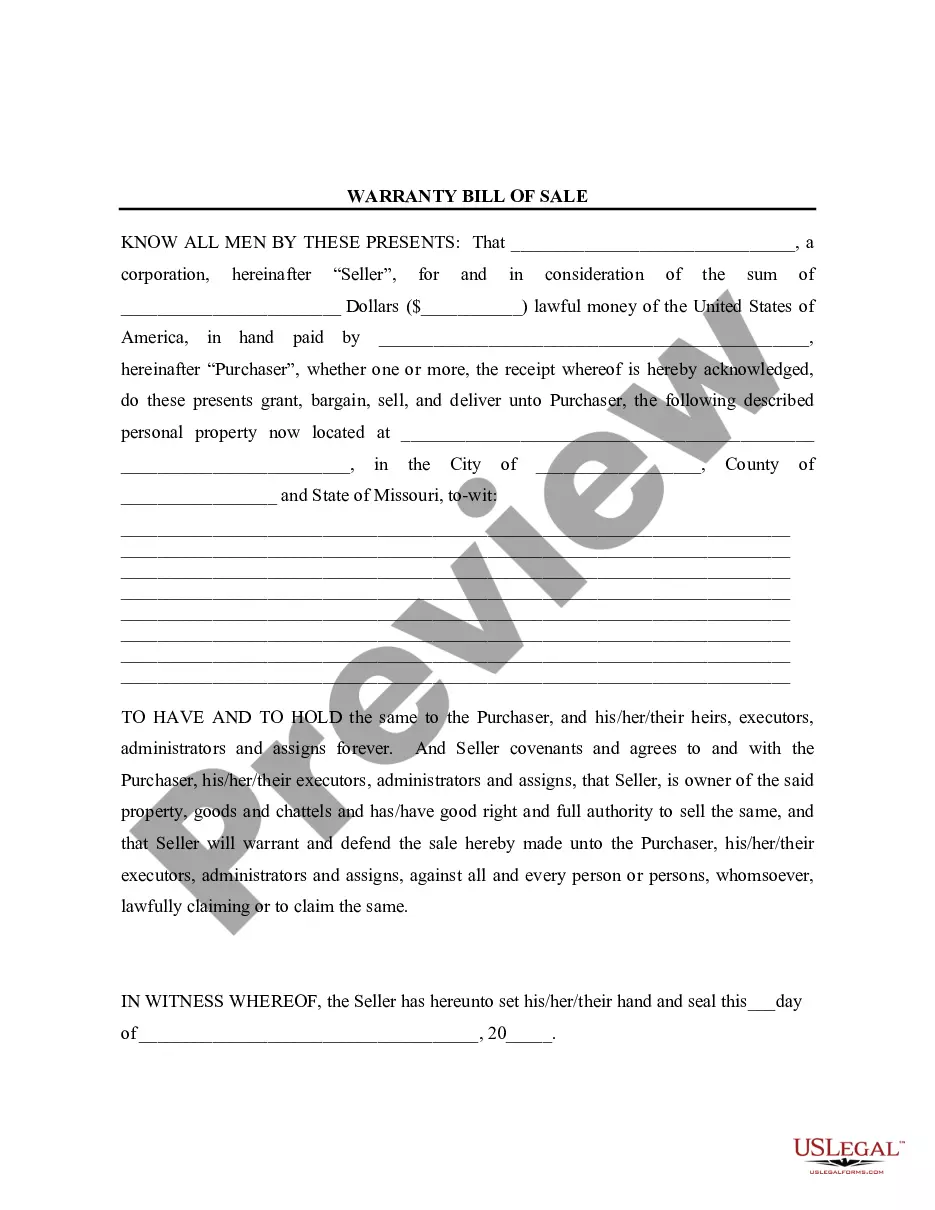

Oakland Michigan Financial Account Transfer to Living Trust: A Comprehensive Guide In Oakland County, Michigan, individuals have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. A living trust is a legal entity that holds assets, including financial accounts, on behalf of the trust creator (also known as the granter or settler) and distributes them according to predetermined instructions upon the granter's death or incapacitation. This allows for the seamless transfer of financial assets to designated beneficiaries, avoiding the often lengthy and costly probate process. There are several types of financial accounts that can be transferred to a living trust in Oakland, Michigan. These include: 1. Bank Accounts: This encompasses checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By re-titling these accounts in the name of the living trust, the granter ensures that the funds are managed according to the trust's terms while maintaining control during their lifetime. 2. Investment Accounts: This category includes brokerage accounts, stocks, bonds, mutual funds, and other securities. Transferring these accounts to a living trust provides centralized management and flexibility for the granter to designate how and when the assets are distributed to beneficiaries. 3. Retirement Accounts: Although it is generally not recommended to transfer retirement accounts, such as individual retirement accounts (IRAs) or 401(k) plans, directly into a living trust due to potential tax implications, it is possible to designate the trust as the beneficiary. This allows for the efficient distribution of retirement assets while maintaining the tax advantages associated with these accounts. 4. Real Estate: While not specifically a financial account, real estate can also be transferred to a living trust. This includes residential, commercial, and rental properties located in Oakland County. By placing real estate in a living trust, the granter can ensure seamless management and avoid potential probate issues. To initiate an Oakland, Michigan financial account transfer to a living trust, individuals should follow these steps: 1. Consult with an Estate Planning Attorney: It is crucial to seek guidance from an experienced estate planning attorney who specializes in living trusts and understands the specific laws and regulations in Oakland County. 2. Create the Living Trust: The attorney will assist in drafting a comprehensive living trust document that encompasses the granter's wishes, including the transfer of financial accounts. The trust will detail how these assets are managed and who the designated beneficiaries are. 3. Re-title Accounts: With the assistance of the attorney, the granter will need to re-title the financial accounts, ensuring that they are held in the name of the living trust. This entails contacting each financial institution individually to complete the necessary paperwork. 4. Notify Financial Institutions: It is crucial to inform banks, brokers, and other financial institutions of the account transfer to the living trust. This will ensure effective management and distribution of the assets according to the trust's terms. 5. Regular Review and Updating: It is essential to review the living trust regularly and address any changes in financial accounts or beneficiaries. Life events such as marriage, divorce, birth, or death may necessitate updates to the living trust to reflect the granter's current wishes accurately. By transferring financial accounts to a living trust in Oakland, Michigan, individuals can ensure streamlined management, privacy, and efficient distribution of their assets to their chosen beneficiaries. Consulting with an estate planning attorney is crucial throughout this process to ensure compliance with state laws and to create a living trust that aligns with the granter's specific financial goals and objectives.

Oakland Michigan Financial Account Transfer to Living Trust

Description

How to fill out Oakland Michigan Financial Account Transfer To Living Trust?

If you’ve already used our service before, log in to your account and save the Oakland Michigan Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Oakland Michigan Financial Account Transfer to Living Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Most banks prefer that you and your spouse come to a local branch of the bank and complete their trust transfer form. Typically this is a one or two page document that will ask you to list the name of your trust, the date of the trust and who the current trustees are.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A trust account is a legal arrangement through which funds or assets are held by a third party (the trustee) for the benefit of another party (the beneficiary). The beneficiary may be an individual or a group. The creator of the trust is known as a grantor or settlor.

Gifting Property To Family Trust The first option you can choose when transferring the property title is to gift it to the trustee. The trustee and the trust will have to sign a ?gift deed?, which establishes that the ownership of the property is being transferred without payment.

Having a separate account makes it easier to move funds into the accounts and keep track of related expenses. Being able to disperse funds quickly and easily is important, especially if the trust was created to handle immediate needs, like the death of a parent or guardian, or urgent medical expenses.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

Recommended for you To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. A Trust-Based Estate Plan is the most secure way to make your last wishes known while protecting your assets and loved ones.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

A trust can hold a variety of different assets, including stocks, mutual funds, ETFs (exchange-traded funds), REITs (real estate investment trusts), cash, real estate, and other property.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.