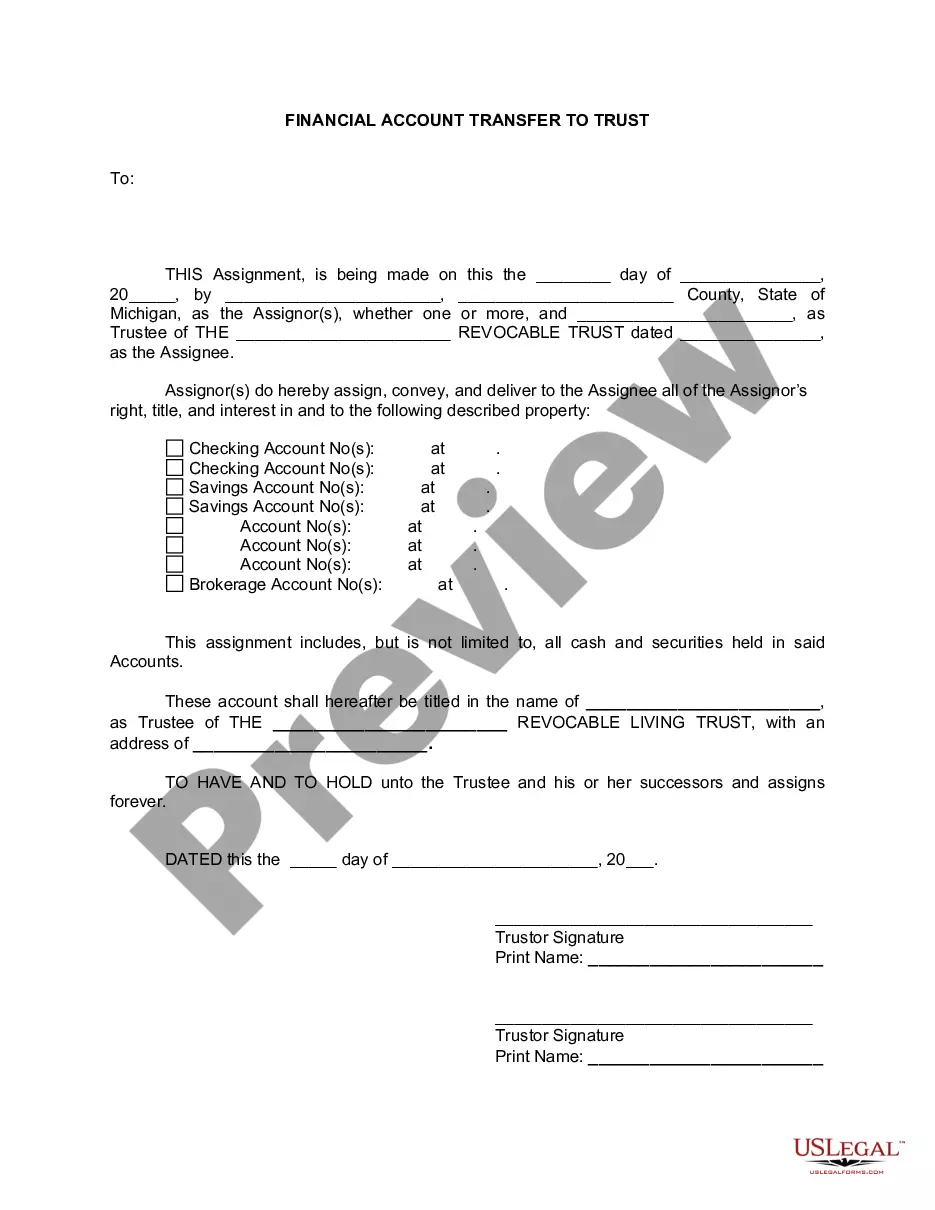

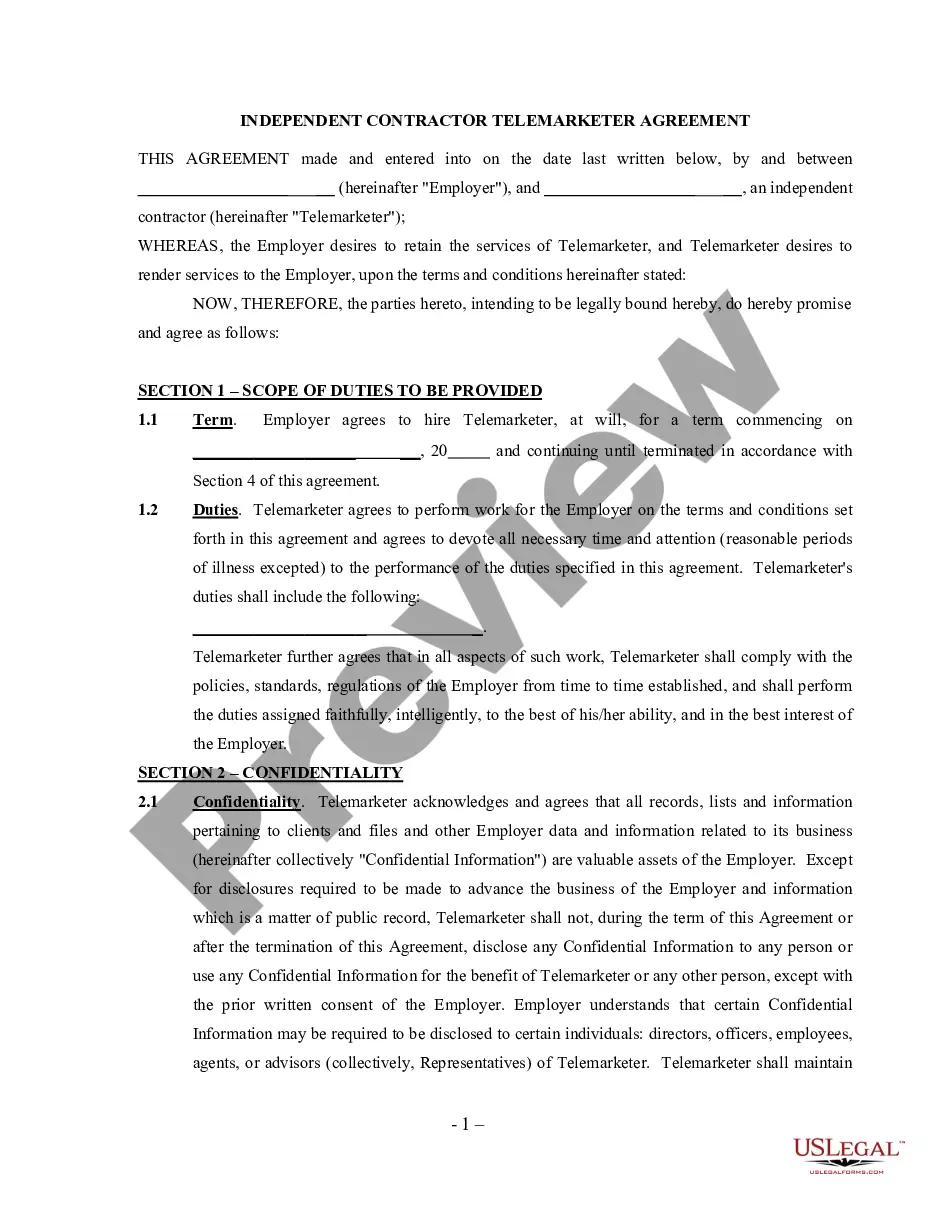

Sterling Heights Michigan Financial Account Transfer to Living Trust: A Comprehensive Guide In Sterling Heights, Michigan, individuals seeking to secure their financial assets for the future often opt for a financial account transfer to a living trust. This strategic planning tool allows them to transfer ownership of their accounts to a revocable living trust, ensuring a smooth transition of assets while avoiding probate court proceedings and potentially reducing estate taxes. Benefits of Financial Account Transfer to Living Trust in Sterling Heights, MI: 1. Avoiding Probate: By transferring financial accounts to a living trust, individuals can bypass the lengthy and expensive probate process. Unlike wills, which are subject to probate, trust assets are privately managed by a trustee, saving valuable time and money for beneficiaries. 2. Privacy and Flexibility: Living trusts offer a higher level of privacy compared to wills. Probate records are public, whereas trust administration occurs privately. Moreover, living trusts in Sterling Heights provide flexibility, allowing the granter to retain control over the assets during their lifetime and modify the trust as desired. Types of Sterling Heights Michigan Financial Account Transfer to Living Trust: 1. Bank Accounts: By transferring bank accounts such as checking, savings, money market, or certificates of deposit (CDs) to a living trust, individuals ensure seamless management of these assets both during their lifetime and after their passing. 2. Investment Accounts: Sterling Heights residents can transfer various investment accounts, including stocks, bonds, mutual funds, brokerage accounts, and retirement accounts (IRAs or 401(k)s) to a living trust. Doing so ensures their careful management and distribution according to their wishes, avoiding potential delays or conflicts. 3. Real Estate: In Sterling Heights, property owners often transfer real estate holdings such as homes, apartments, rental properties, or vacant lands to a living trust. In the event of their incapacity or death, this transfer ensures a smooth transition of these valuable assets to the designated beneficiaries without going through probate. 4. Life Insurance Policies: Transferring ownership of life insurance policies to a living trust allows individuals to maintain control over policy benefits, while ensuring a seamless transfer to their loved ones after death. This strategy helps avoid potential delays and minimizes estate taxes. Process of Sterling Heights Michigan Financial Account Transfer to Living Trust: 1. Consultation: Individuals interested in a financial account transfer to a living trust in Sterling Heights should seek advice from an experienced estate planning attorney. The attorney will assess their specific needs, assets, and goals, ensuring the trust meets all legal requirements. 2. Property Valuation: The attorney will help individuals determine the value of the financial accounts or assets to be transferred into the living trust, ensuring accurate documentation within the trust. 3. Drafting Trust Agreement: The estate planning attorney will draft the living trust agreement, detailing the transfer of financial accounts to the trust and appointing a trustee to manage the assets should the granter become incapacitated or upon their passing. 4. Account Transfers: With the guidance of the attorney, individuals will contact their financial institutions, life insurance providers, and other relevant parties to complete the necessary paperwork required for transferring ownership. 5. Funding the Trust: Once the accounts are successfully transferred to the living trust, individuals must ensure ongoing management of the trust's assets, including updating the trust as necessary when acquiring new accounts or assets. By understanding the process and types of financial account transfers to a living trust available in Sterling Heights, Michigan, individuals can make informed decisions to protect their assets and secure the financial well-being of their loved ones. Seeking professional guidance from estate planning attorneys in Sterling Heights ensures personalized strategies tailored to their specific needs.

Sterling Heights Michigan Financial Account Transfer to Living Trust

Description

How to fill out Sterling Heights Michigan Financial Account Transfer To Living Trust?

Take advantage of the US Legal Forms and have instant access to any form sample you want. Our beneficial platform with a large number of document templates allows you to find and get almost any document sample you require. You are able to save, fill, and sign the Sterling Heights Michigan Financial Account Transfer to Living Trust in just a few minutes instead of surfing the Net for hours trying to find the right template.

Using our catalog is an excellent strategy to increase the safety of your record submissions. Our professional legal professionals on a regular basis check all the records to make certain that the templates are relevant for a particular region and compliant with new laws and regulations.

How can you obtain the Sterling Heights Michigan Financial Account Transfer to Living Trust? If you have a profile, just log in to the account. The Download option will appear on all the documents you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instruction below:

- Open the page with the template you need. Ensure that it is the template you were hoping to find: check its name and description, and take take advantage of the Preview option if it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Save the document. Indicate the format to get the Sterling Heights Michigan Financial Account Transfer to Living Trust and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Sterling Heights Michigan Financial Account Transfer to Living Trust.

Feel free to benefit from our platform and make your document experience as straightforward as possible!